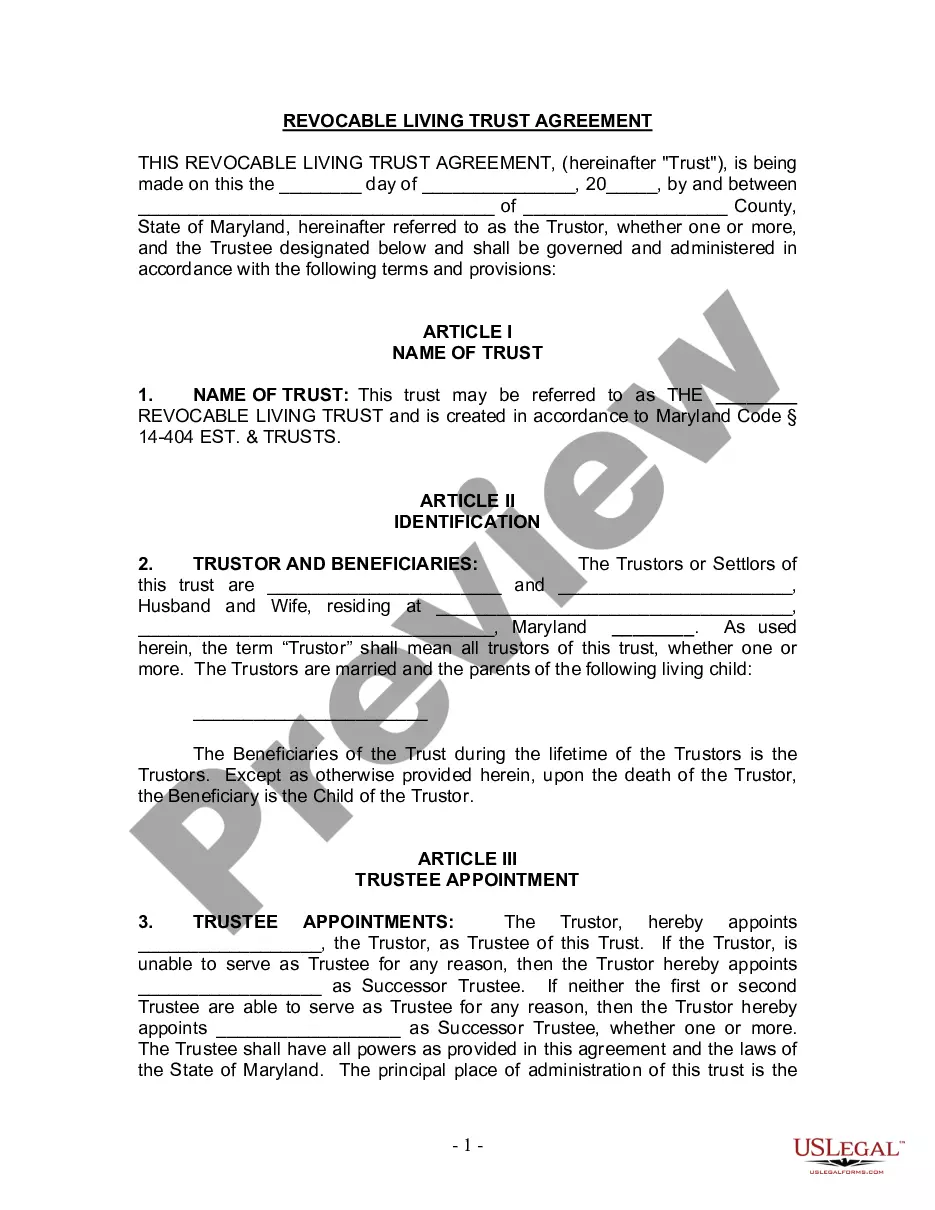

Maryland Living Trust for Husband and Wife with One Child

Description

How to fill out Maryland Living Trust For Husband And Wife With One Child?

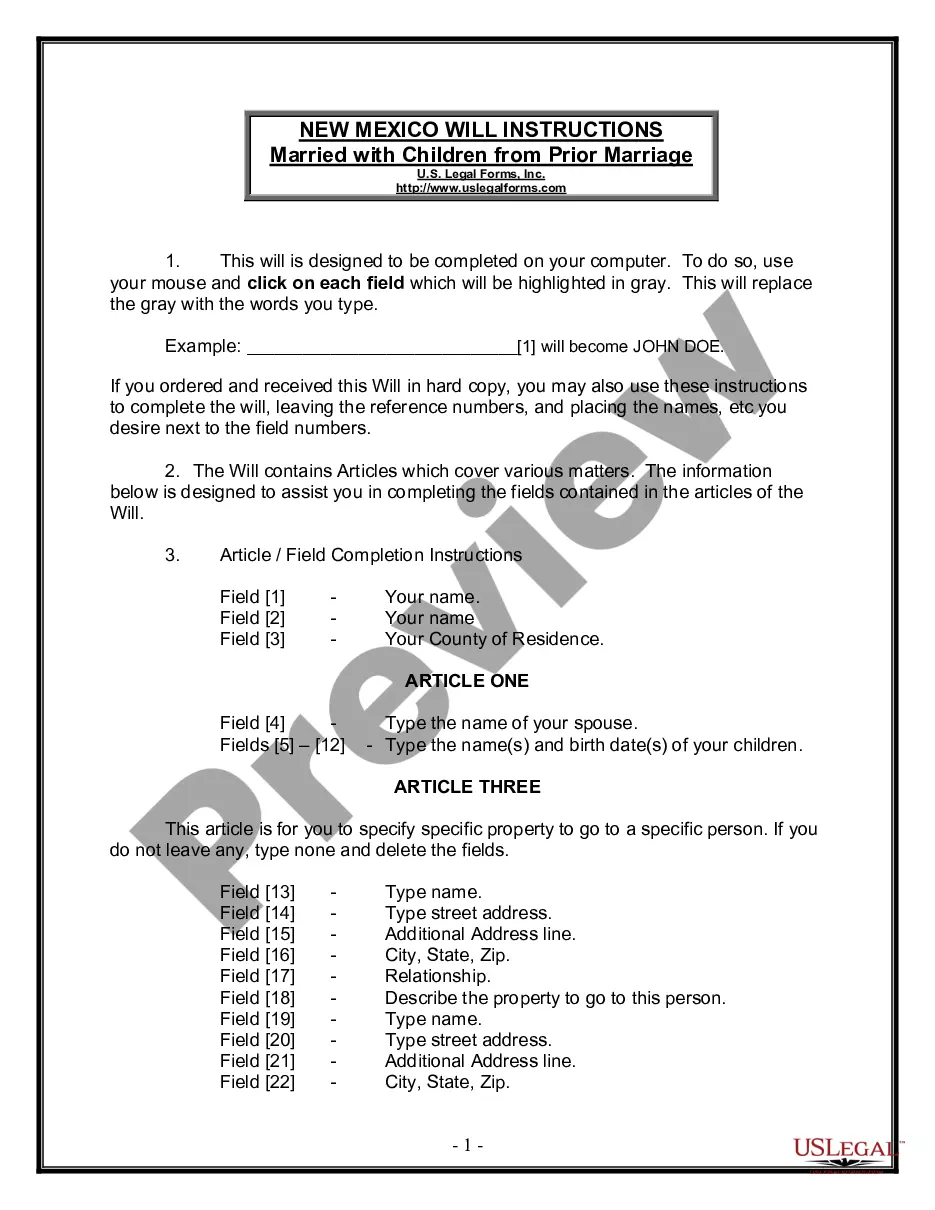

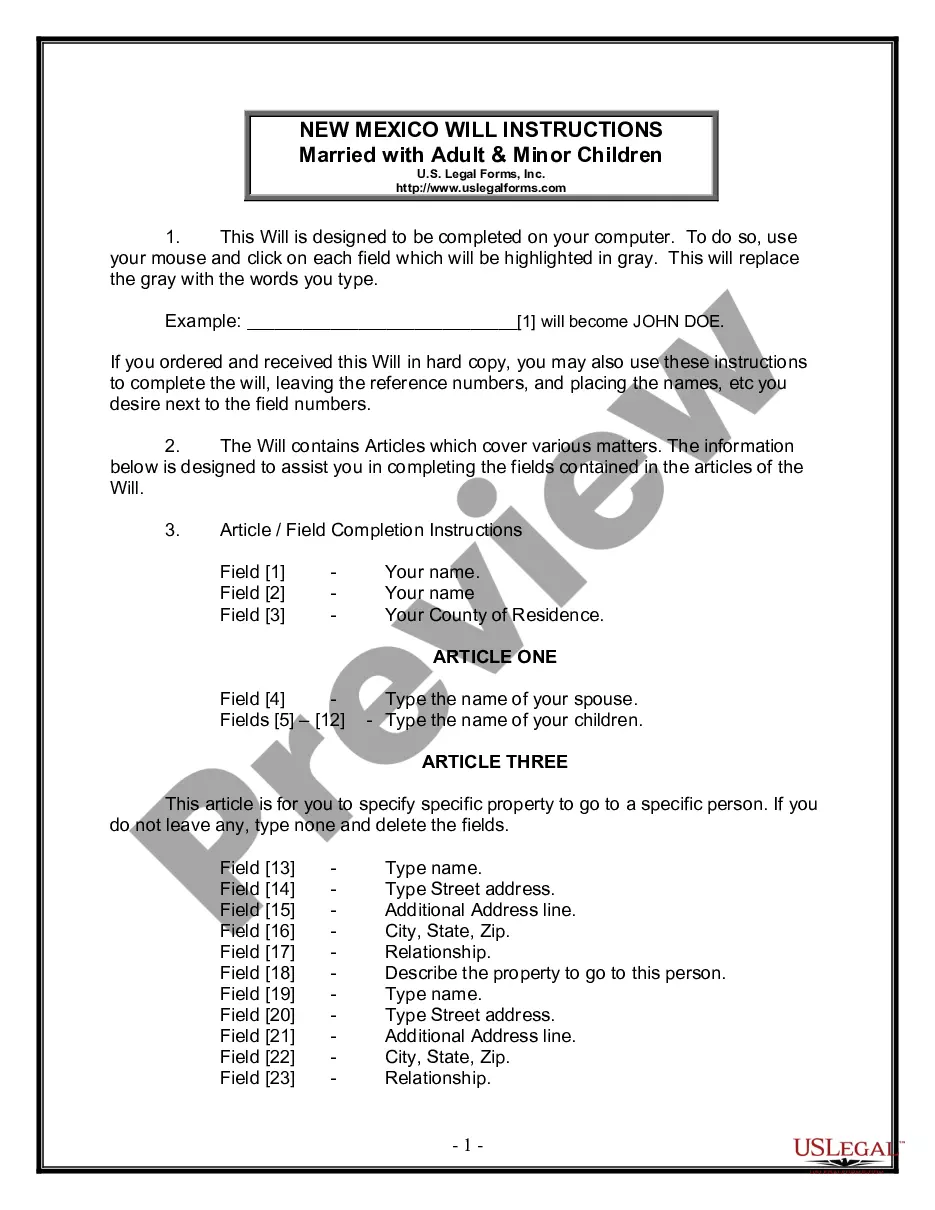

Welcome to the biggest legal files library, US Legal Forms. Here you can find any template including Maryland Living Trust for Husband and Wife with One Child forms and download them (as many of them as you want/require). Prepare official documents in a several hours, instead of days or weeks, without having to spend an arm and a leg with an legal professional. Get the state-specific sample in a couple of clicks and be assured with the knowledge that it was drafted by our qualified attorneys.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Maryland Living Trust for Husband and Wife with One Child you need. Due to the fact US Legal Forms is web-based, you’ll generally have access to your downloaded templates, regardless of the device you’re utilizing. Find them inside the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our instructions below to start:

- If this is a state-specific sample, check out its applicability in your state.

- View the description (if readily available) to understand if it’s the correct example.

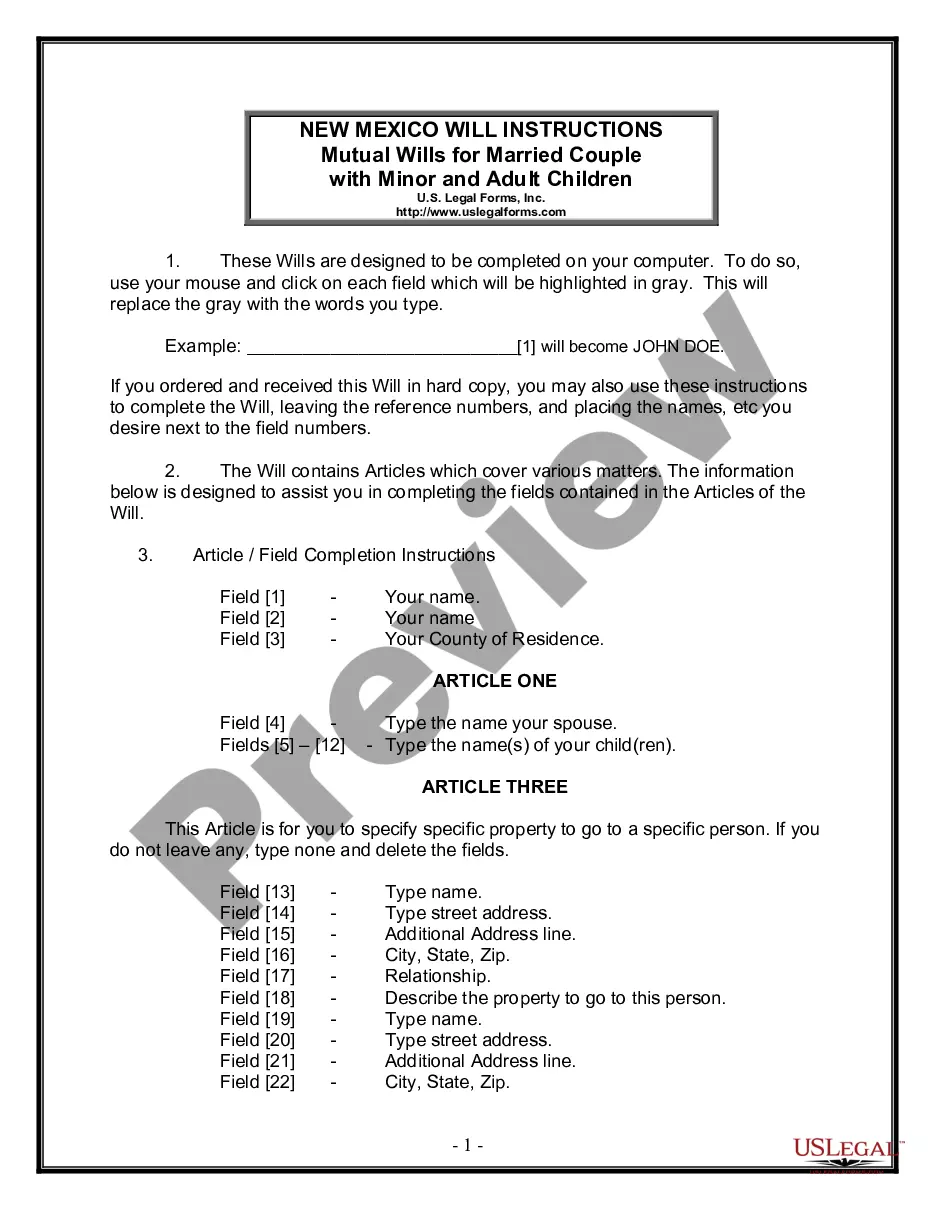

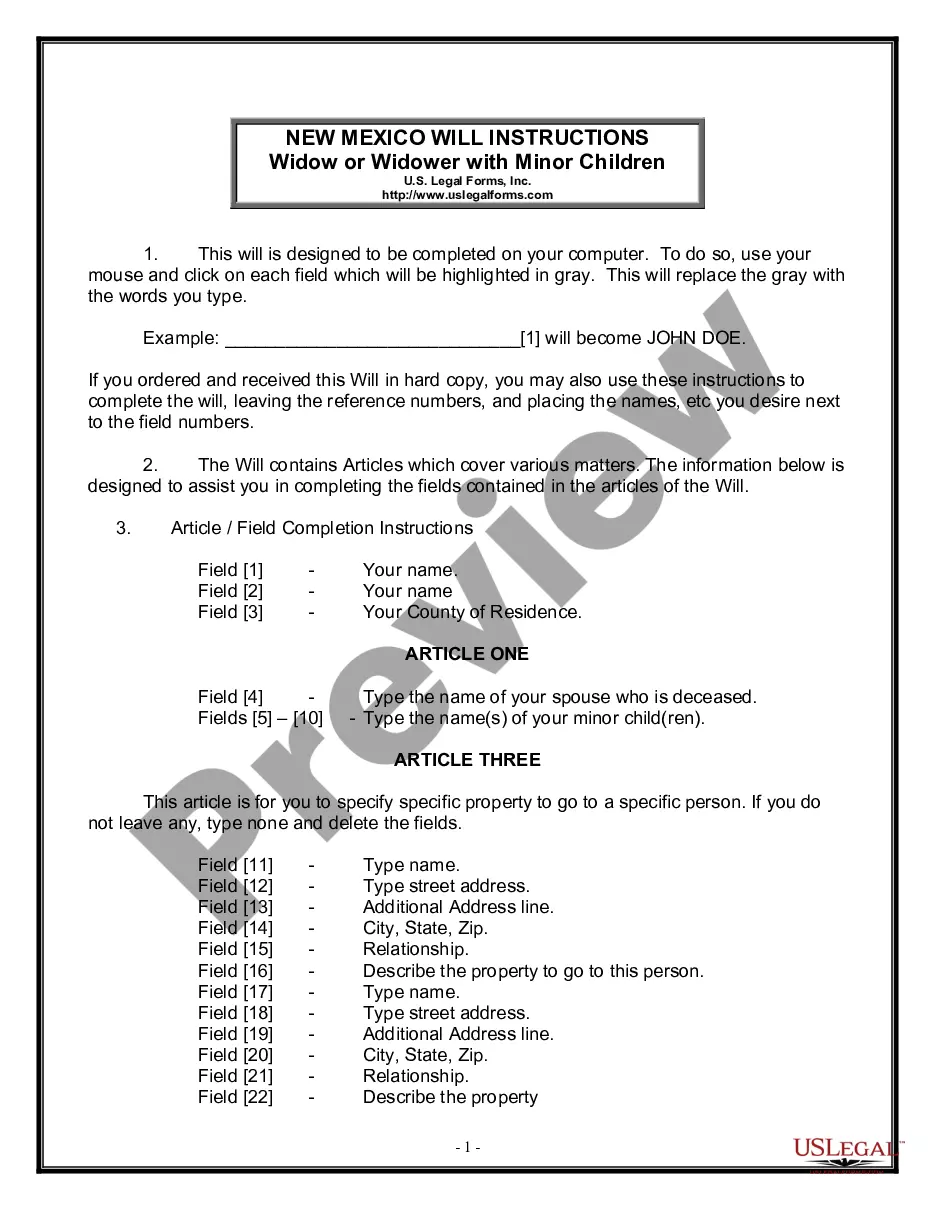

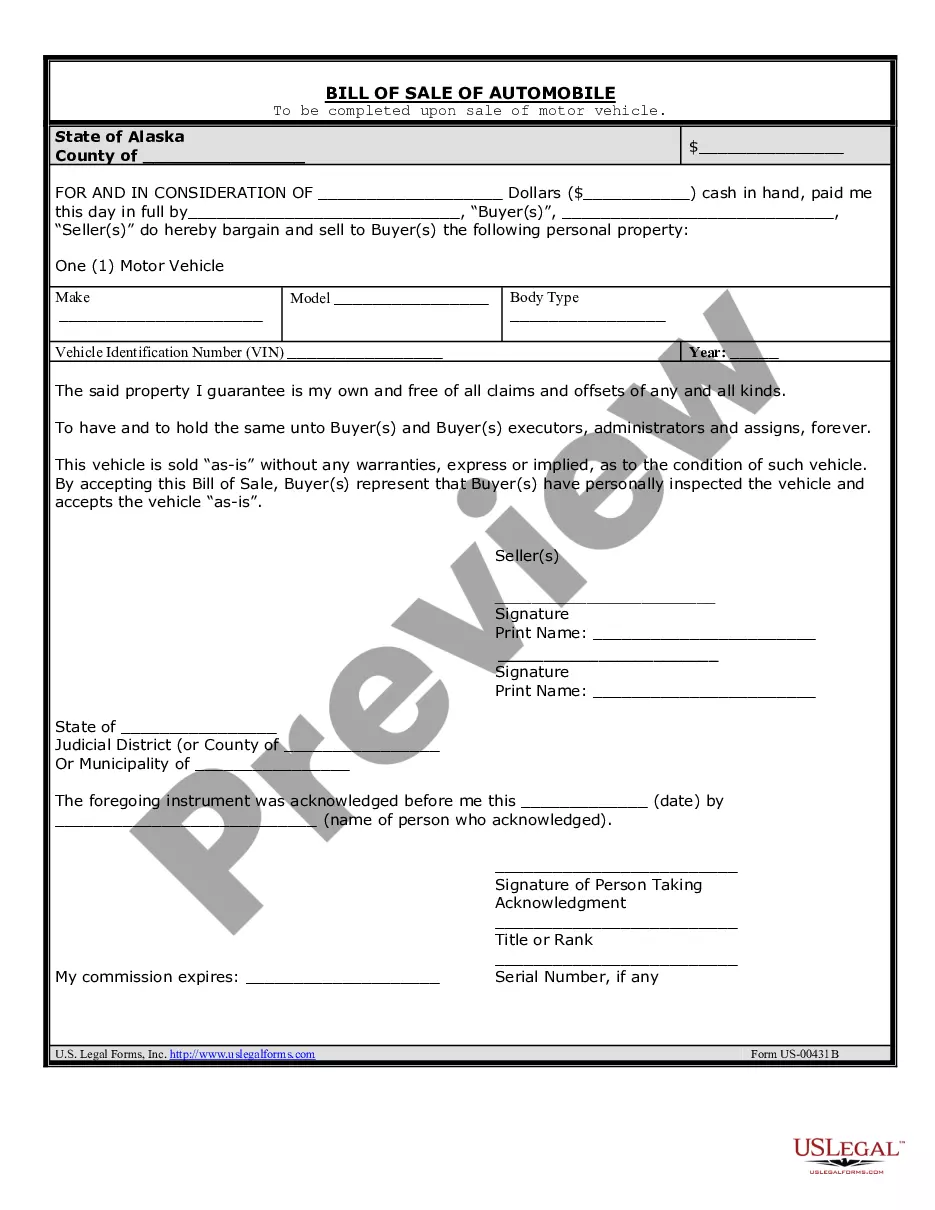

- See far more content with the Preview option.

- If the example meets your needs, just click Buy Now.

- To create an account, pick a pricing plan.

- Use a card or PayPal account to register.

- Save the template in the format you require (Word or PDF).

- Print out the file and fill it out with your/your business’s information.

Once you’ve filled out the Maryland Living Trust for Husband and Wife with One Child, send it to your lawyer for confirmation. It’s an extra step but an essential one for being confident you’re fully covered. Sign up for US Legal Forms now and get access to a large number of reusable samples.

Form popularity

FAQ

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

Choose the type of trust you want. Take inventory of your property. Decide who will be your trustee. Create a trust document, either by yourself using an online program or with the assistance of a lawyer. Sign the trust in front of a notary public. Fund the trust by transferring your property into it.

When one spouse dies, the joint trust will continue to operate for the benefit of the surviving spouse as a Survivor's Trust. Any specific gifts of tangible property from the first spouse to beneficiaries (other than the surviving spouse) will be given to those people.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

In Maryland, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If Probate is needed but you don't apply for it, the beneficiaries won't be able to receive their inheritance. Instead the deceased person's assets will be frozen and held in a state of limbo. No one will have the legal authority to access, sell or transfer them.

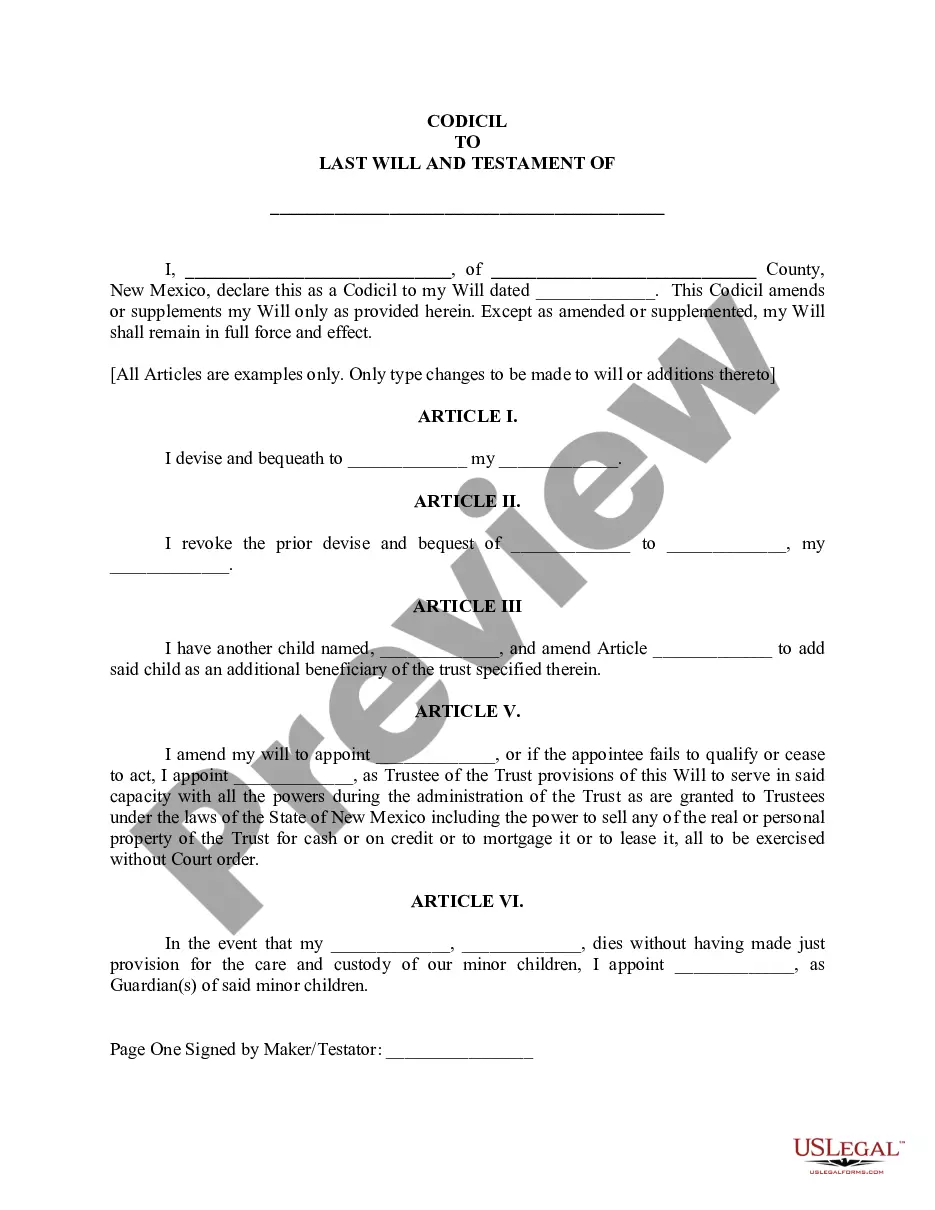

Maryland Law requires that any one holding an original Will and/or Codicil(s) must file that document with the Register of Wills promptly after a decedent's death even if there are no assets. However, although the Will and/or Codicil are kept on file, no probate proceedings are required to be opened.

A living trust in Maryland is an estate planning tool that holds your assets in trust but allows you complete use of them and then passes them to your beneficiaries. A revocable living trust (sometimes referred to as an inter vivos trust) provides a variety of benefits. Living Trusts in Maryland.

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.