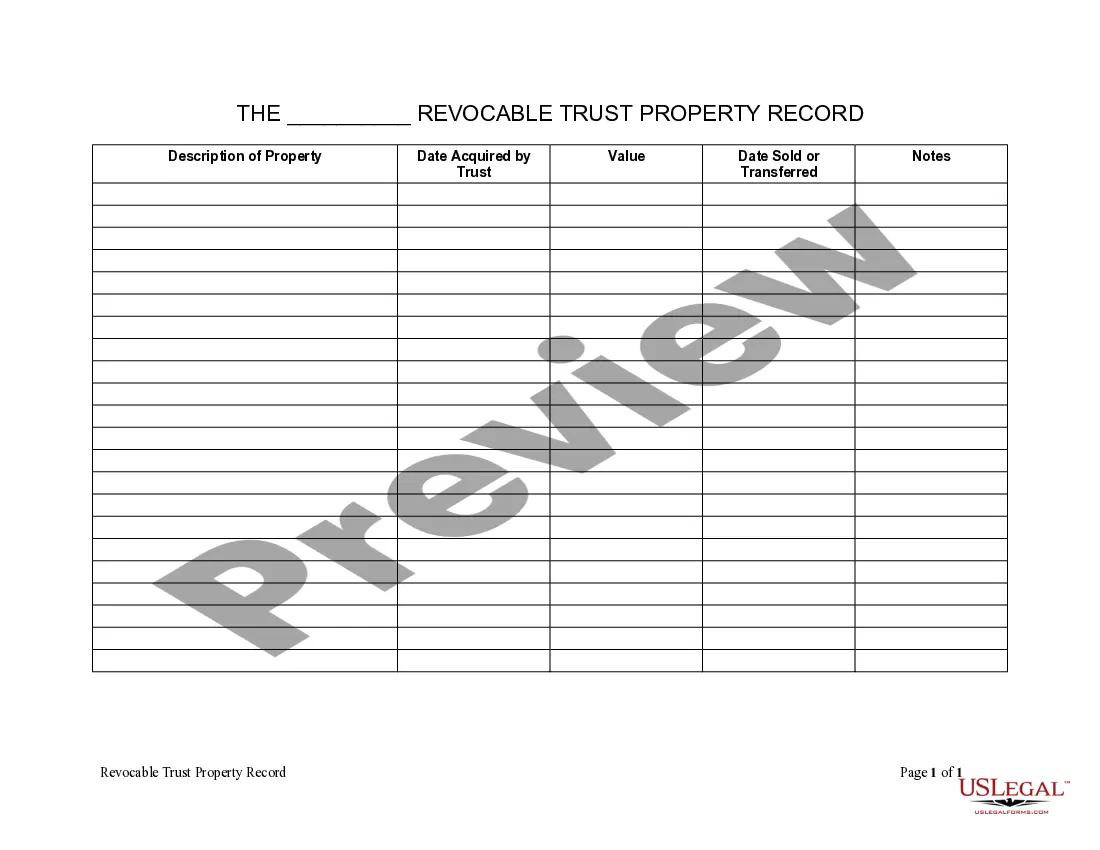

Maryland Living Trust Property Record

Description

How to fill out Maryland Living Trust Property Record?

Welcome to the most significant legal files library, US Legal Forms. Here you can find any example including Maryland Living Trust Property Record forms and download them (as many of them as you wish/need to have). Prepare official files with a couple of hours, instead of days or weeks, without having to spend an arm and a leg on an lawyer or attorney. Get your state-specific example in clicks and be confident knowing that it was drafted by our qualified attorneys.

If you’re already a subscribed consumer, just log in to your account and click Download next to the Maryland Living Trust Property Record you want. Due to the fact US Legal Forms is online solution, you’ll generally have access to your saved files, no matter what device you’re using. See them in the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check out our guidelines listed below to get started:

- If this is a state-specific form, check out its applicability in the state where you live.

- View the description (if accessible) to learn if it’s the right template.

- See a lot more content with the Preview feature.

- If the document meets all your requirements, click Buy Now.

- To create an account, choose a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Download the file in the format you want (Word or PDF).

- Print out the file and fill it with your/your business’s information.

After you’ve completed the Maryland Living Trust Property Record, send away it to your attorney for confirmation. It’s an additional step but a necessary one for making confident you’re entirely covered. Become a member of US Legal Forms now and access a large number of reusable examples.

Form popularity

FAQ

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

A living trust does not protect your assets from a lawsuit. Living trusts are revocable, meaning you remain in control of the assets and you are the legal owner until your death.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

With a revocable trust, your assets will not be protected from creditors looking to sue. That's because you maintain ownership of the trust while you're alive. Therefore if you lose a lawsuit and a judgment is awarded to the creditor, the trust may have to be closed and the money handed over.

Irrevocable trusts safeguard assets from creditors.Creditors can't claim assets in an irrevocable trust. The reason being that you don't control the assets, can't revoke the Trust, and therefore can't be considered the owner of the assets.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Trusts may be revocable or irrevocable. Each trust is different, and the creator of each trust generally determines whether the trust is revocable.Therefore, if a judgment debtor is also the creator of a revocable trust, the judgment creditor can generally garnish the money or property held by that trust.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

With an irrevocable trust, the assets that fund the trust become the property of the trust, and the terms of the trust direct that the trustor no longer controls the assets.Because the assets within the trust are no longer the property of the trustor, a creditor cannot come after them to satisfy debts of the trustor.