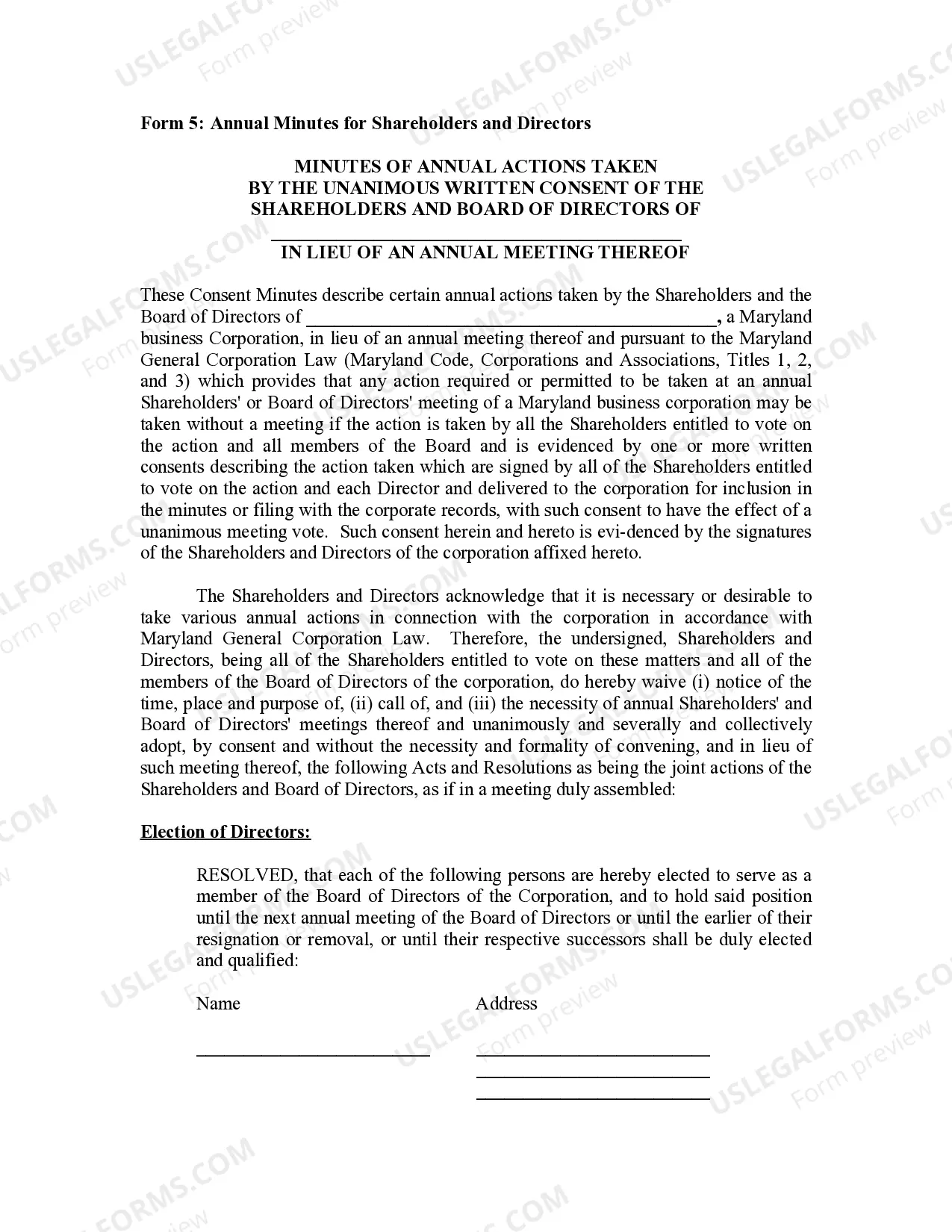

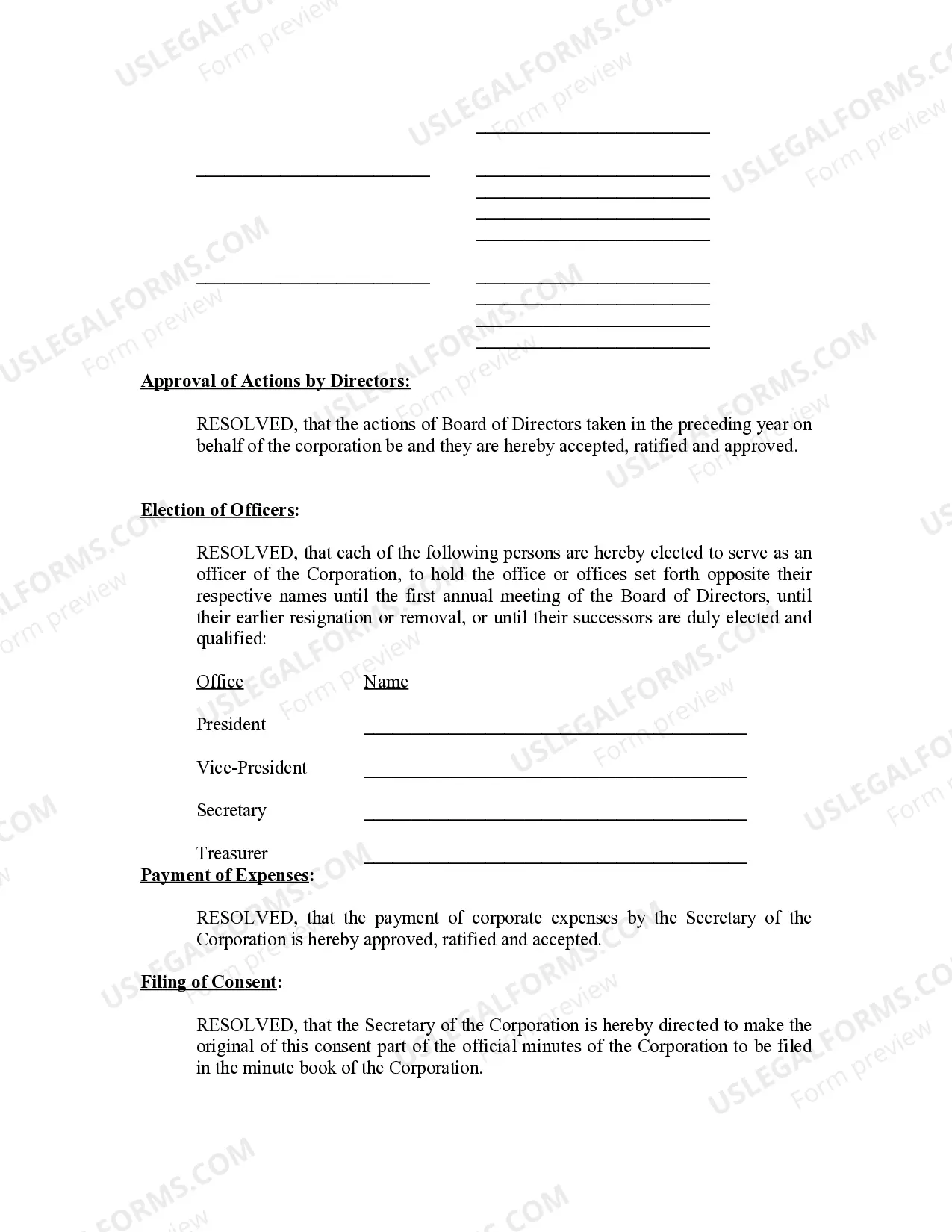

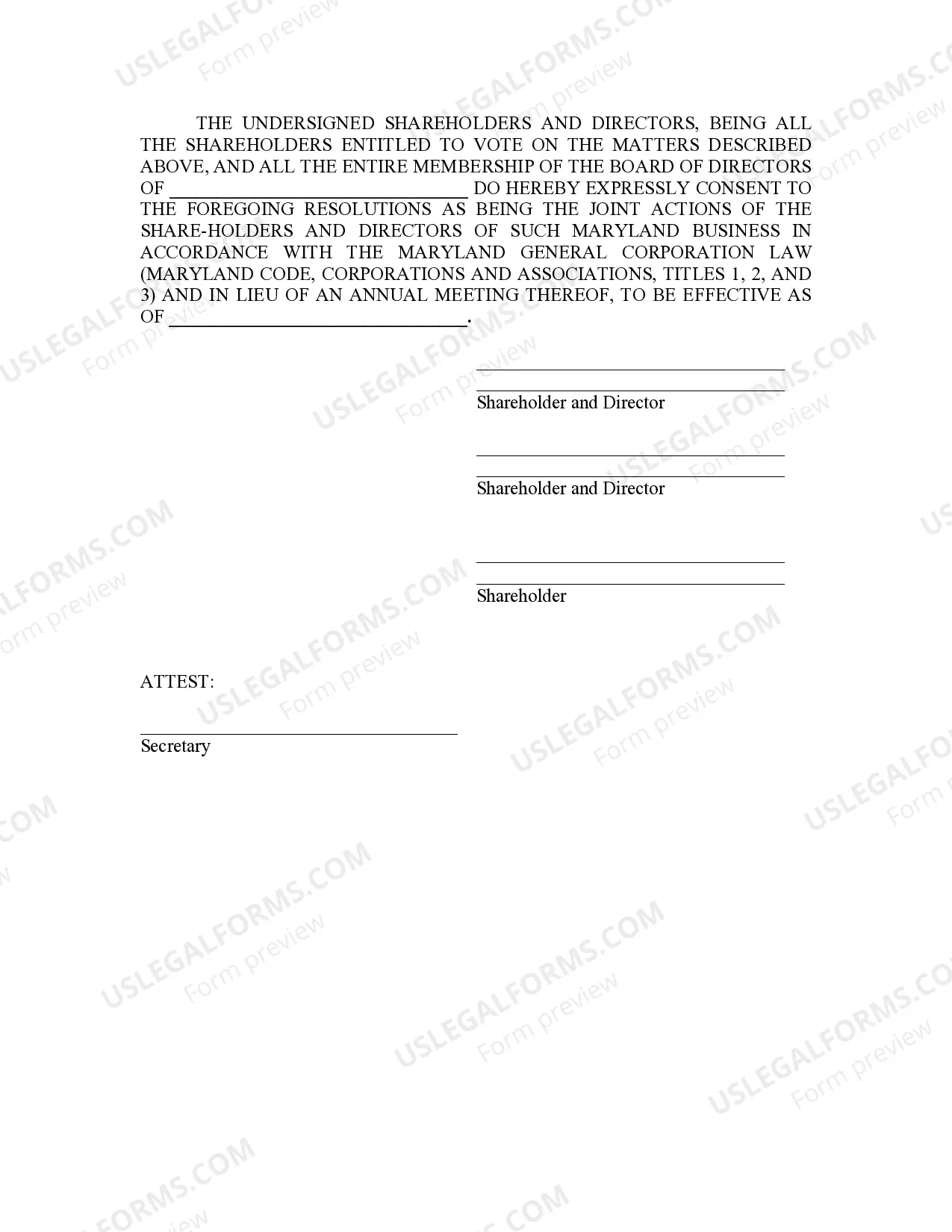

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Maryland Annual Minutes

Description

How to fill out Maryland Annual Minutes?

You are welcome to the largest legal documents library, US Legal Forms. Here you can get any template such as Annual Minutes - Maryland templates and download them (as many of them as you wish/require). Prepare official files with a several hours, rather than days or weeks, without having to spend an arm and a leg on an lawyer. Get your state-specific example in clicks and feel assured understanding that it was drafted by our state-certified attorneys.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Annual Minutes - Maryland you want. Because US Legal Forms is web-based, you’ll generally get access to your saved files, regardless of the device you’re using. Find them within the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our guidelines below to start:

- If this is a state-specific sample, check out its applicability in your state.

- View the description (if offered) to understand if it’s the correct example.

- See a lot more content with the Preview function.

- If the example meets all of your requirements, just click Buy Now.

- To make your account, select a pricing plan.

- Use a card or PayPal account to join.

- Download the document in the format you require (Word or PDF).

- Print the file and fill it with your/your business’s info.

As soon as you’ve filled out the Annual Minutes - Maryland, send away it to your legal professional for verification. It’s an additional step but an essential one for being certain you’re totally covered. Become a member of US Legal Forms now and access thousands of reusable examples.

Form popularity

FAQ

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

If you're looking to incorporate in Maryland, you're in the right place. This guide will help you file formation documents, get tax identification numbers, and set up your company records. Incorporation: $120 filing fee + optional $5 returned mail fee + optional $50 expedited service fee.

You must file the Articles of Incorporation with the California Secretary of State, along with a filing fee of $100. Note that your corporation will also be responsible for an annual tax of $800 to the California Franchise Tax Board.

The great state of Maryland requires all corporations to draft and complete a corporate bylaws- a document that, in general, will delineate the financial and organizational structure of the corporation in question for the benefit of both the government and the relevant partners in the corporation.

Form 2553 S Corporation Election. Form 1120S S Corporation Tax Return. Schedule B Other Return Information. Schedule K Summary of Shareholder Information. Schedule K-1 Individual Shareholder Information.

For many businesses, filing annual reports is among them. If you operate your business as an LLC or corporation (depending on the state in which your company is registered), you may need to publish an annual report to keep in good standing with the state.

Choose a corporate name. File your Articles of Incorporation. Appoint a registered agent. Start a corporate records book. Prepare corporate bylaws. Appoint initial directors. Hold first Board of Directors meeting. Issue stock to shareholders.

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

Converting your LLC to an S-Corp when filing your tax return for tax purposes can be a complicated process, but it is possible. You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return.