Maryland Exhibit 3 Second Amendment to Promissory Note

Description

Key Concepts & Definitions

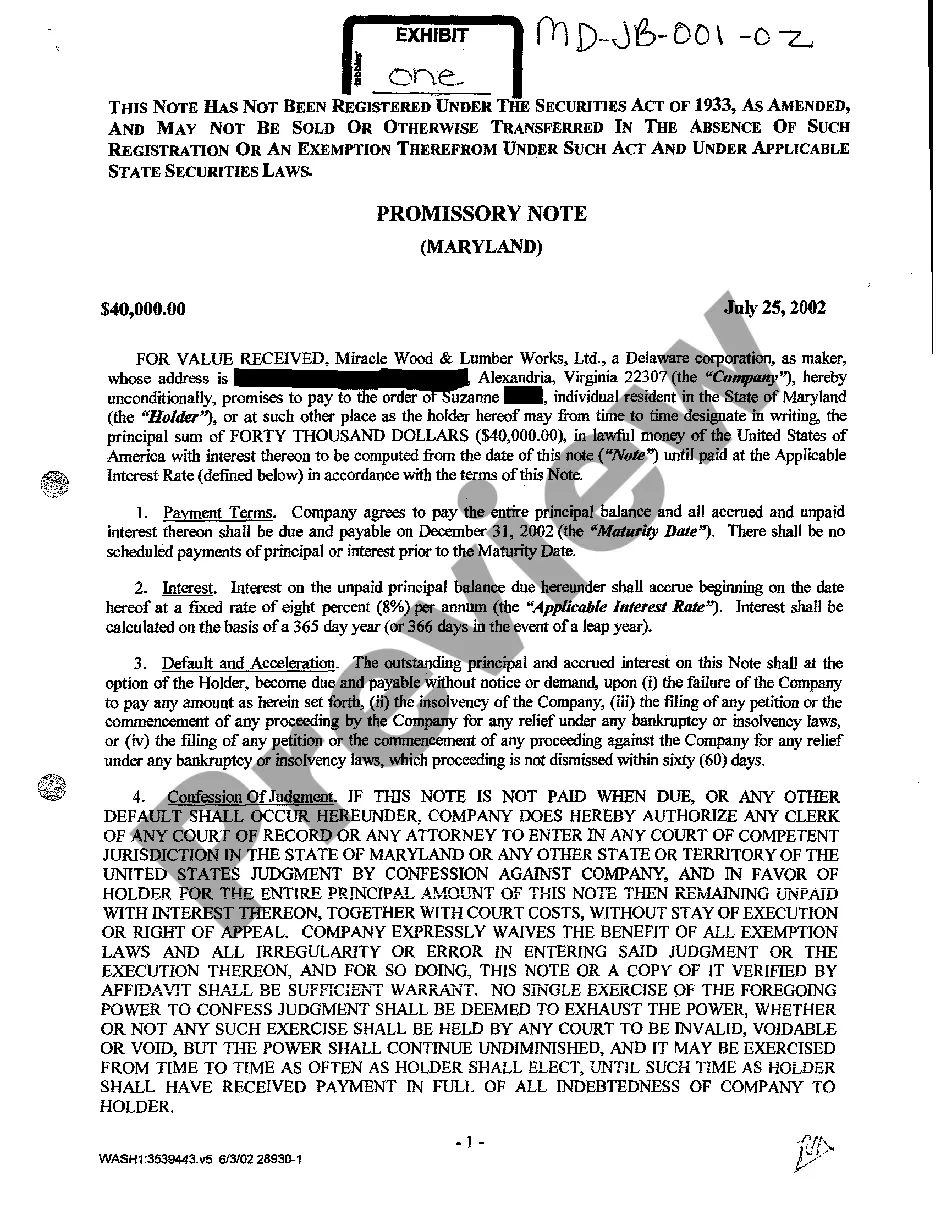

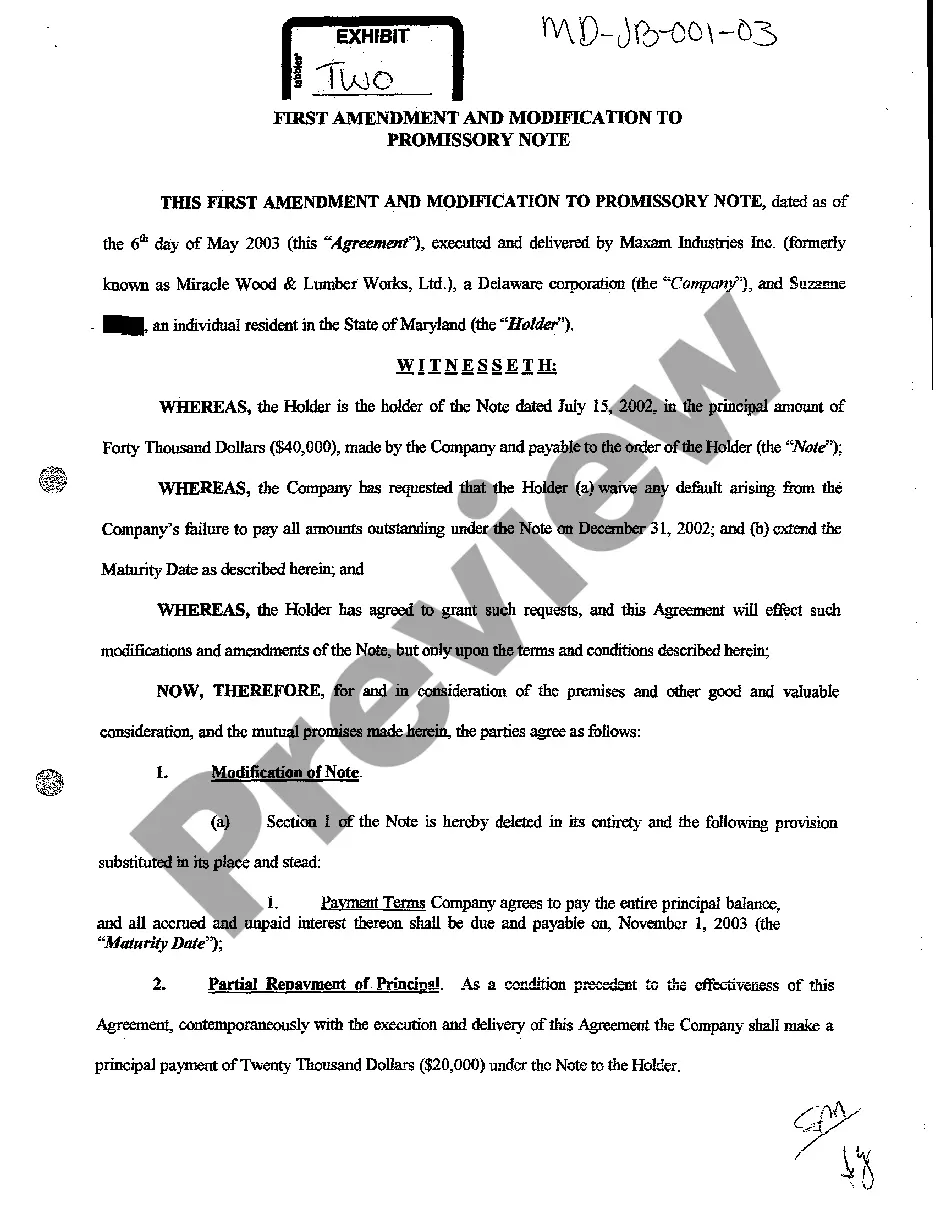

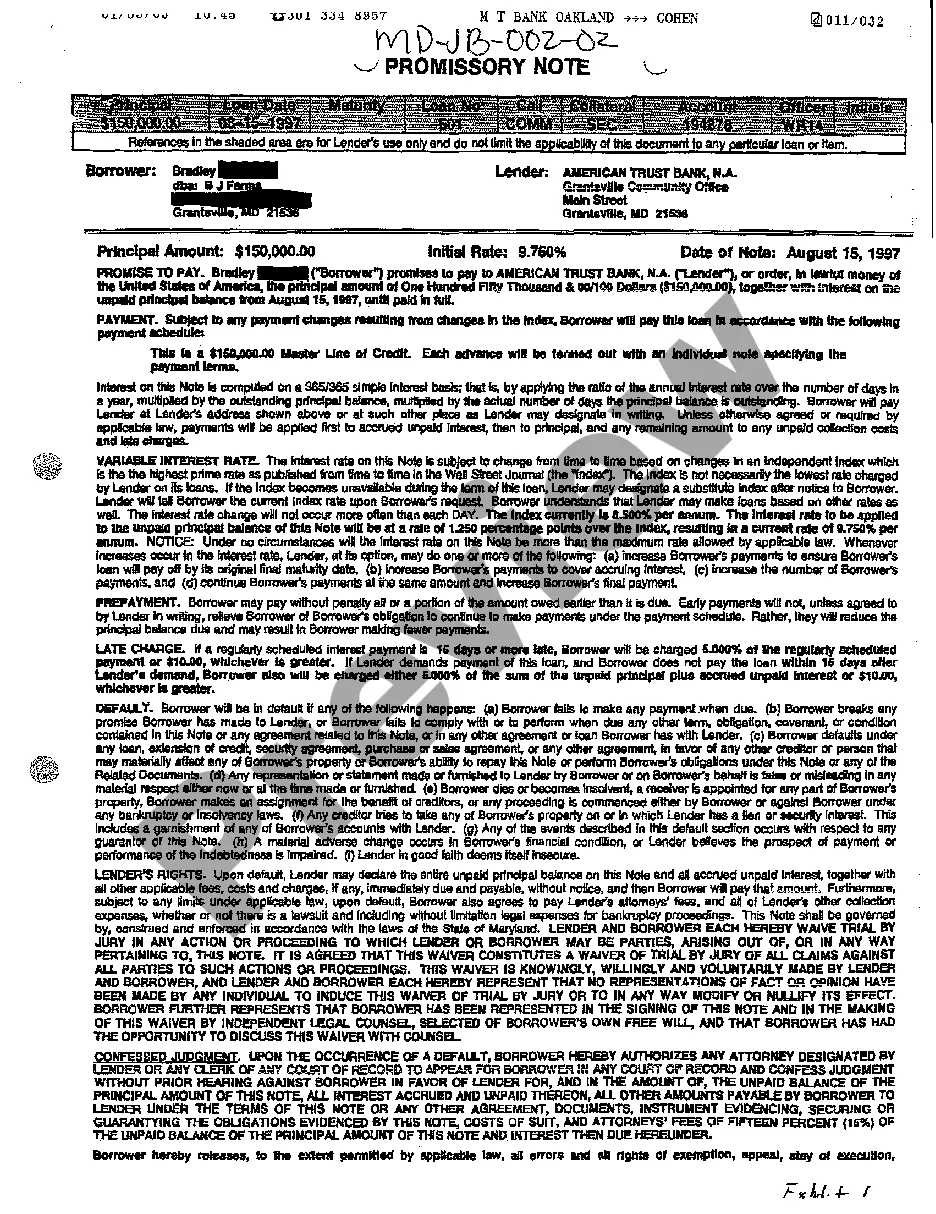

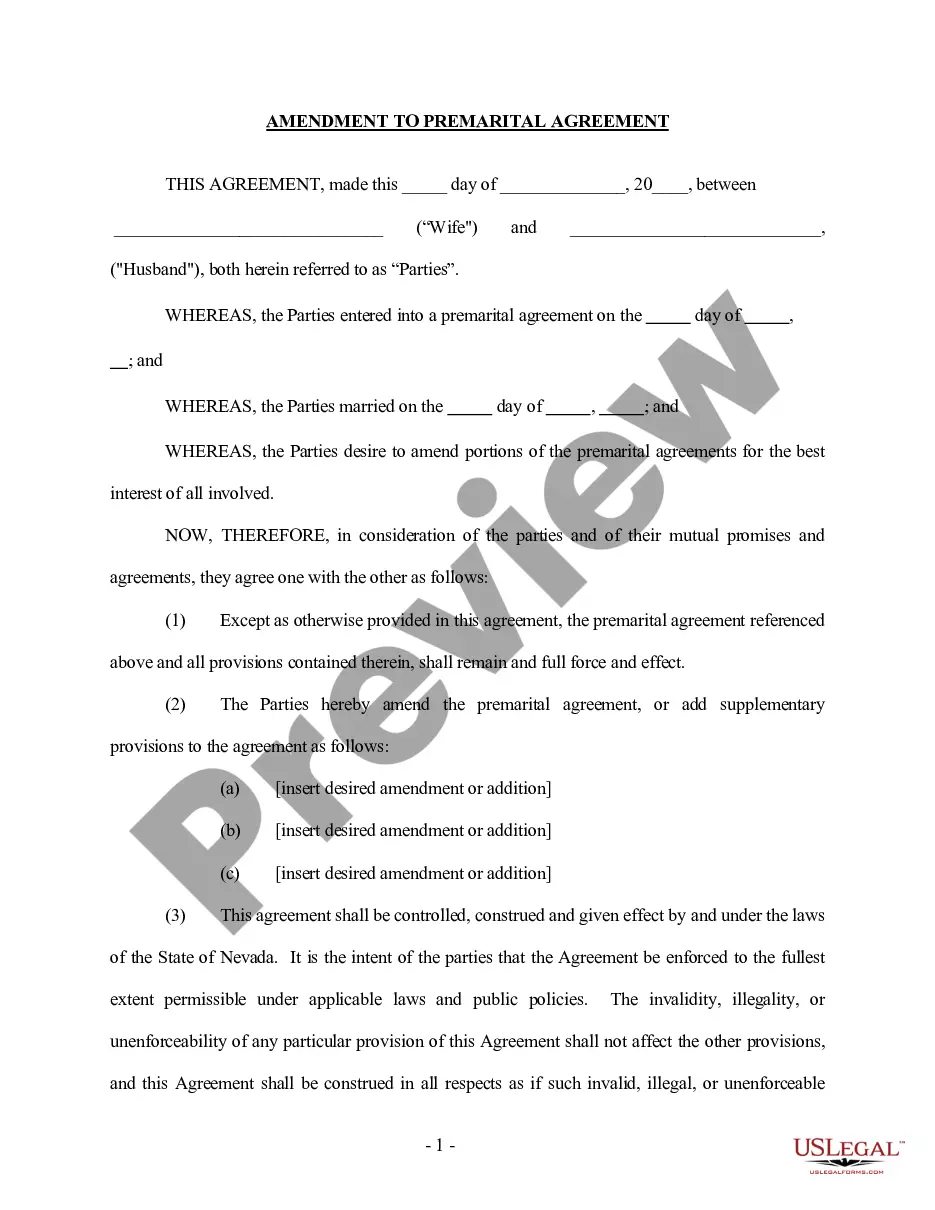

A04 Exhibit 3 Second Amendment to Promissory Note refers to a specific legal document amendment associated with a promissory note. A promissory note is a financial instrument where the issuer commits in writing to pay a specified sum of money to a specified person at a predetermined date or on demand. An amendment to a promissory note involves modifications to the original terms agreed upon by all parties.

Step-by-Step Guide to Drafting and Managing the Amendment

- Review the Original Agreement: Begin by thoroughly reviewing the original promissory note to understand the initial terms and conditions.

- Identify Needed Changes: Clearly identify what changes need to be made in the amendment, such as adjustments to payment schedules, interest rates, or the principal amount.

- Consult Legal Counsel: It's advisable to consult with legal counsel to ensure compliance with local and federal laws and to get assistance in drafting the amendment.

- Draft the Amendment: Prepare the amendment document, ensuring all new terms are clearly stated and the document references the original promissory note accurately.

- Execution of the Amendment: All parties involved must sign the amendment for it to be valid. Verification through witnesses or a notary can also be required, depending on state laws.

- Record the Amendment: Keep the amended document with the original promissory note and ensure both are stored securely. Additionally, depending on the type of promissory note, registration of the amendment might be necessary.

Risk Analysis

- Legal Risks: If not properly amended, the changes might not be legally binding, exposing parties to disputes or financial losses.

- Financial Risks: Incorrect amendments might lead to unintended financial obligations. For example, a poorly structured amendment regarding interest rates could result in a higher pay-back amount.

- Compliance Risks: Failing to adhere to state and federal regulations when amending a promissory note could lead to legal penalties.

Pros & Cons

Pros:- Flexibility in modifying terms as per the current financial situation or in response to other changes.

- Legal transparency and clarity between involved parties preventing future disagreements.

- Potential for misunderstanding or errors during the amendment process if not handled carefully.

- Legal fees involved in the consultation and documentation process.

Best Practices

- Clear Language: Use clear and concise language in the amendment to avoid ambiguities.

- Comprehensive Review: Both parties should review the terms thoroughly before signing.

- Legal Guidance: Always engage legal professionals to ensure that all adjustments are permissible and correctly documented.

How to fill out Maryland Exhibit 3 Second Amendment To Promissory Note?

Greetings to the most extensive legal documents repository, US Legal Forms. Here you can discover any template such as Maryland Exhibit 3 Second Amendment to Promissory Note forms and obtain them (as many versions as you desire/need). Prepare official documentation in a few hours, instead of days or even weeks, without having to pay a fortune to a legal expert. Acquire the state-specific template in just a few clicks and rest assured knowing it was created by our licensed attorneys.

If you’re already a registered user, just Log Into your account and click Download next to the Maryland Exhibit 3 Second Amendment to Promissory Note you require. As US Legal Forms is online-based, you will always have access to your downloaded templates, no matter which device you are using. Find them in the My documents section.

If you don't have an account yet, what are you waiting for? Follow our instructions below to begin.

Once you’ve completed the Maryland Exhibit 3 Second Amendment to Promissory Note, send it to your attorney for validation. It’s an extra step but an essential one to ensure you are fully protected. Join US Legal Forms now and gain access to a vast array of reusable templates.

- If this is a state-specific document, verify its legitimacy in the state where you reside.

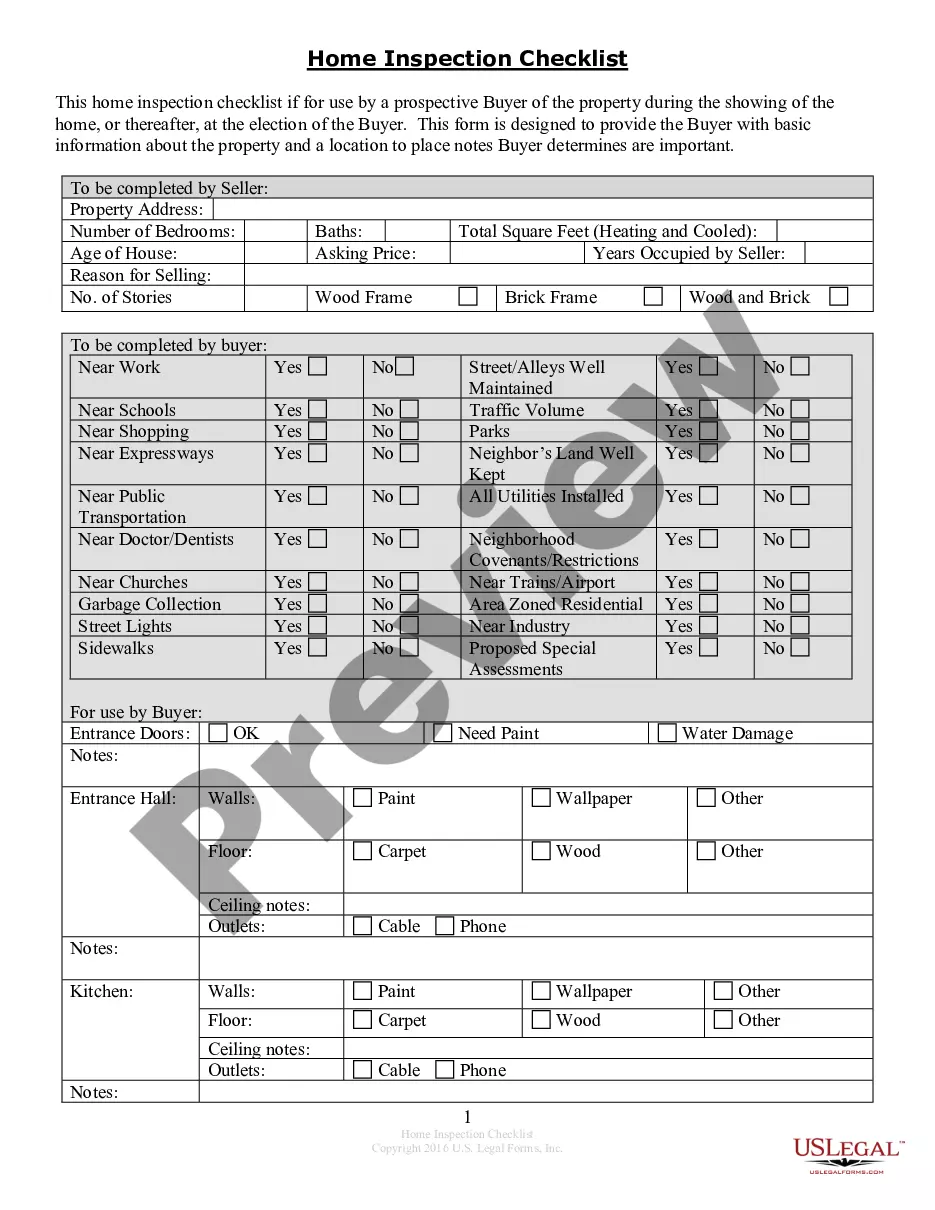

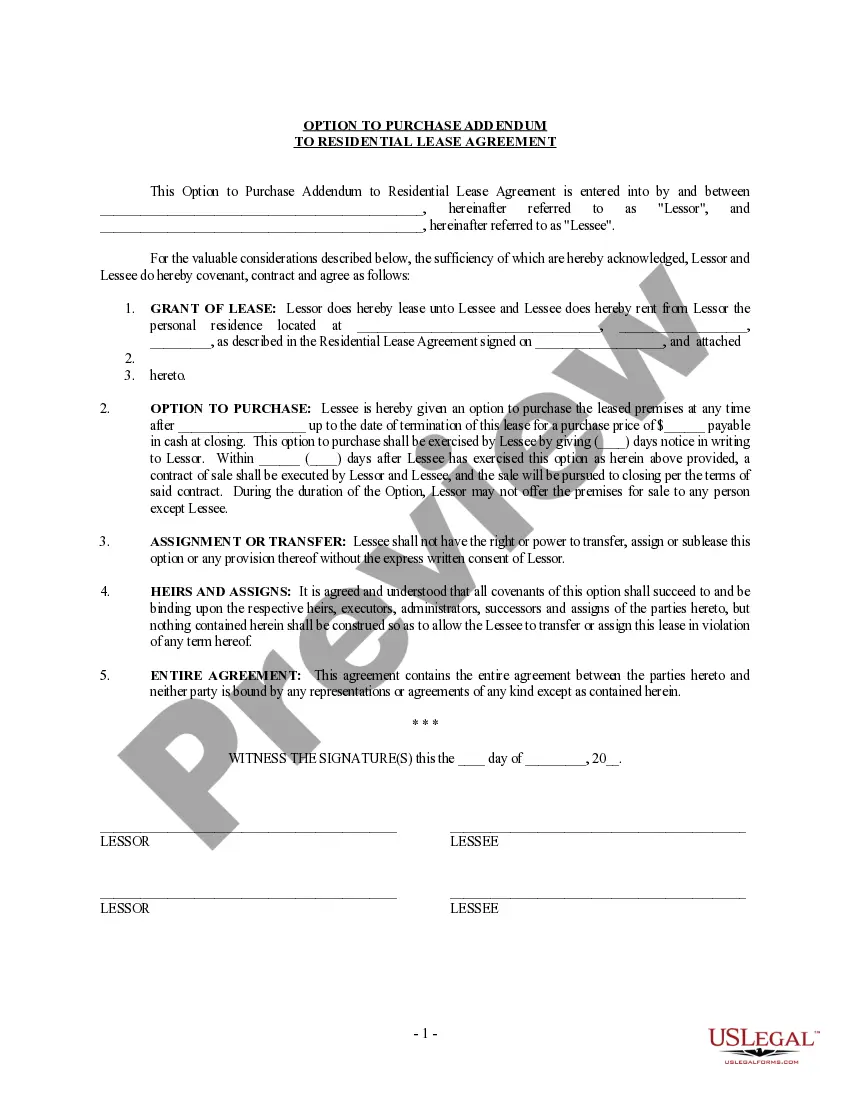

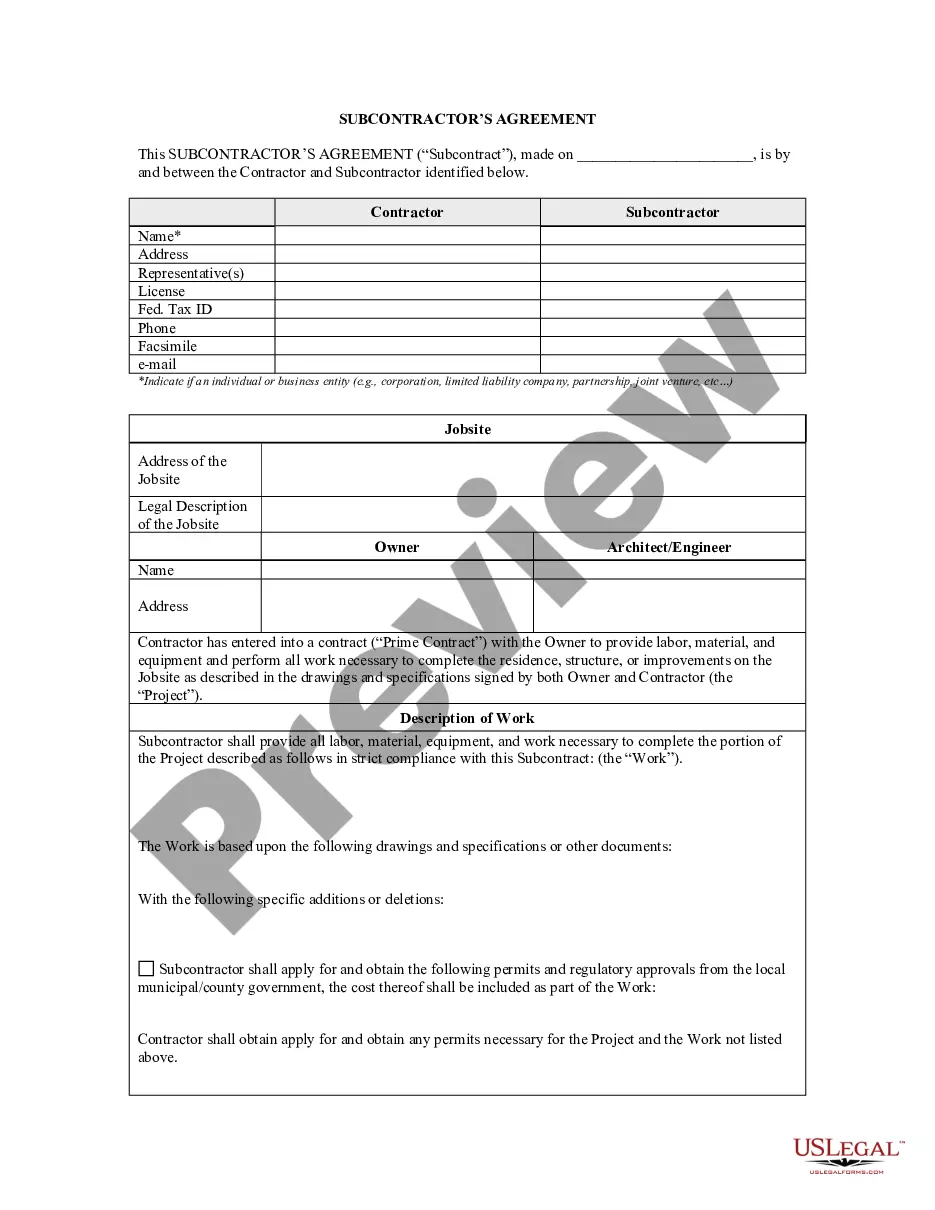

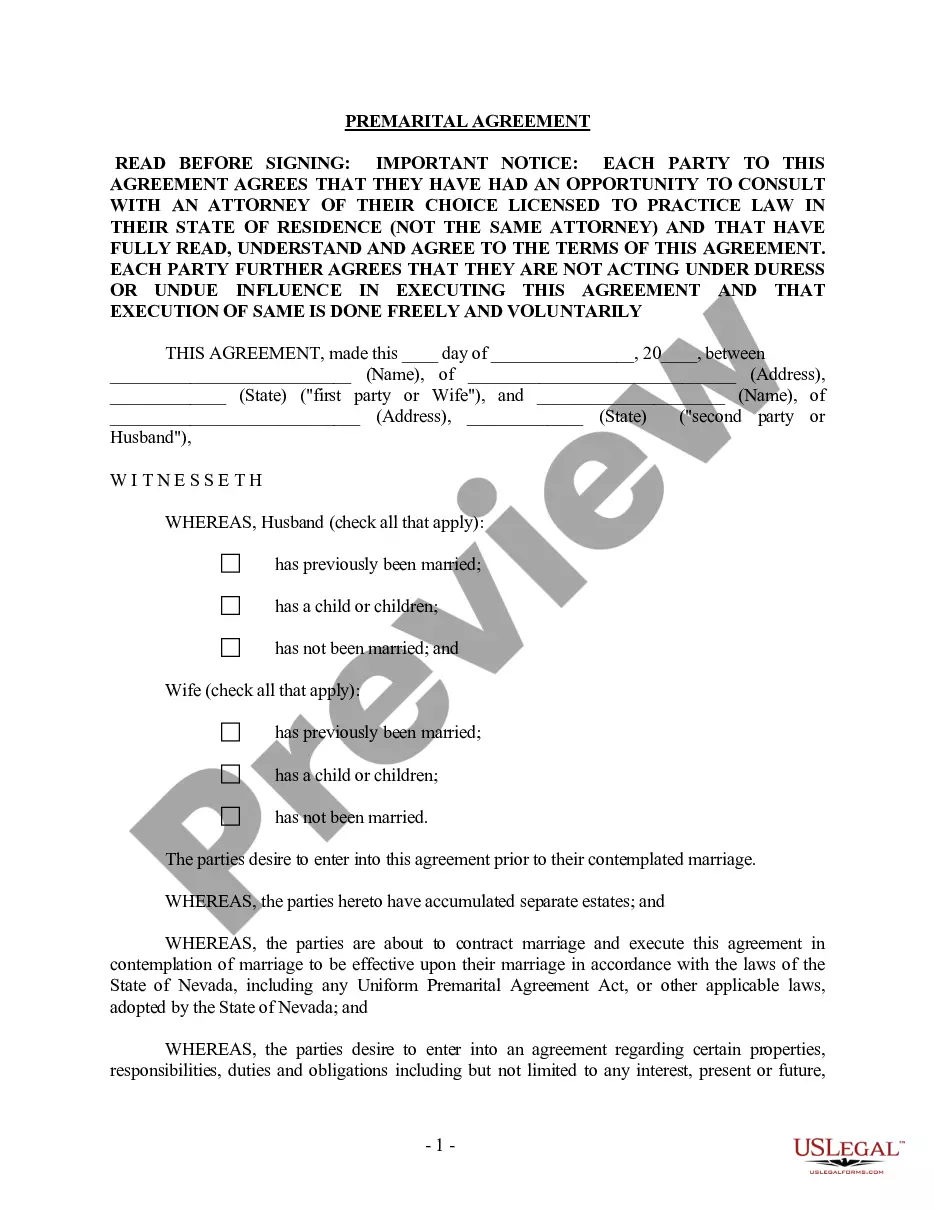

- Review the description (if available) to determine if it’s the appropriate template.

- Examine more details with the Preview feature.

- If the template satisfies your needs, click Buy Now.

- To create an account, choose a subscription plan.

- Utilize a credit card or PayPal to register.

- Download the form in your preferred format (Word or PDF).

- Print the document and fill it in with your/your business’s information.

Form popularity

FAQ

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

The Loan shall be evidenced and governed by a new promissory note (the New Note) which amends and restates in its entirety, but does not extinguish, the Note. Anything to the contrary notwithstanding, if any inconsistency exists between the Loan Agreement and the New Note, the New Note shall control.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

The Promissory Note is hereby modified and amended by deleting the last sentence of the first paragraph of the Promissory Note in its entirety, and replacing it with the following: All outstanding principal and interest shall be due and payable on June 3, 2012 (the Due Date).

Identify the terms of the note that are creating difficulty in repayment. Communicate your need to modify the terms of the note to the note holder. Have the holder of the note draft modifications to the original note. Tip.

In the unlikely event a borrower defaults on a promissory note, it is the lender's responsibility to execute the collection action necessary to claim the item(s) used as collateral. These actions may include: Foreclosure (for real estate investments) Repossession.