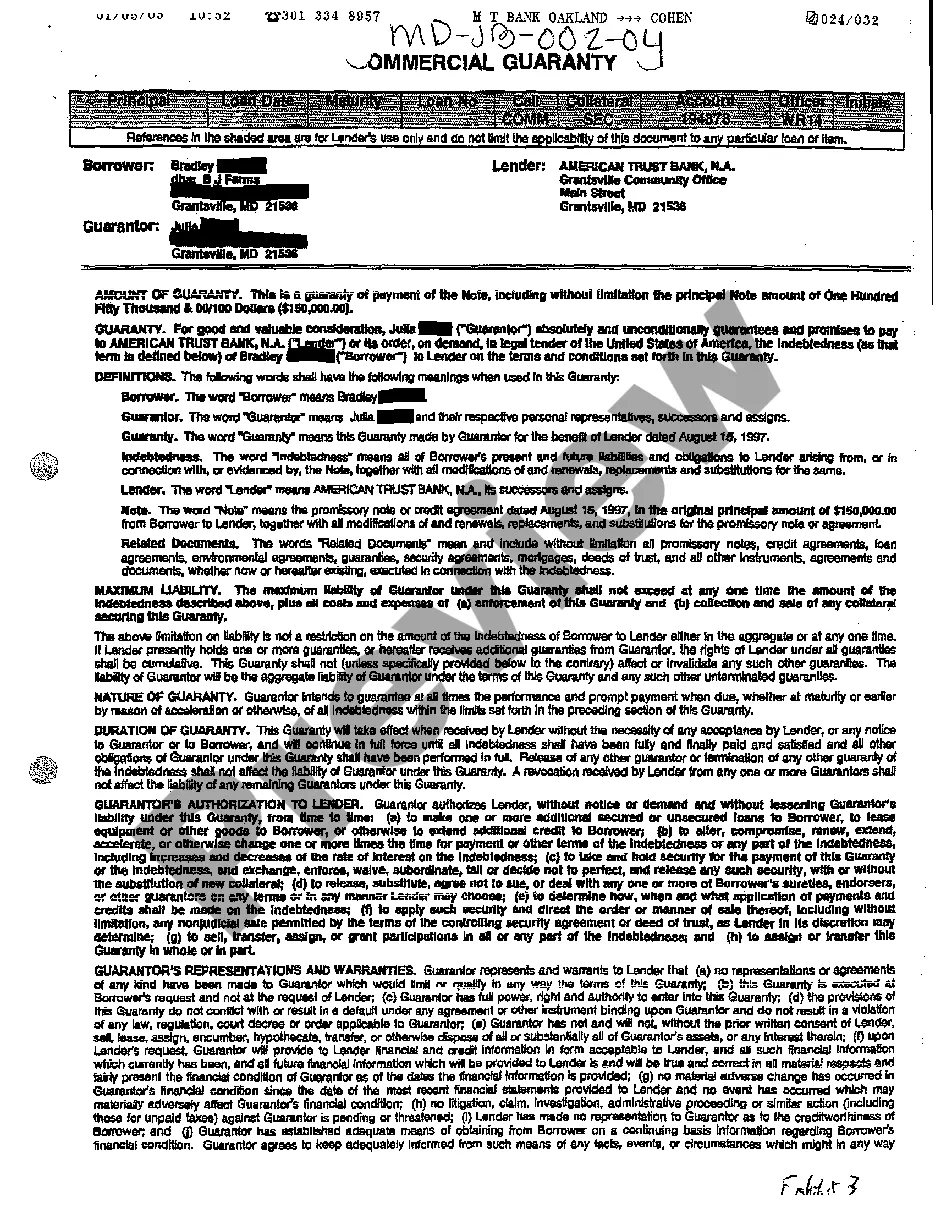

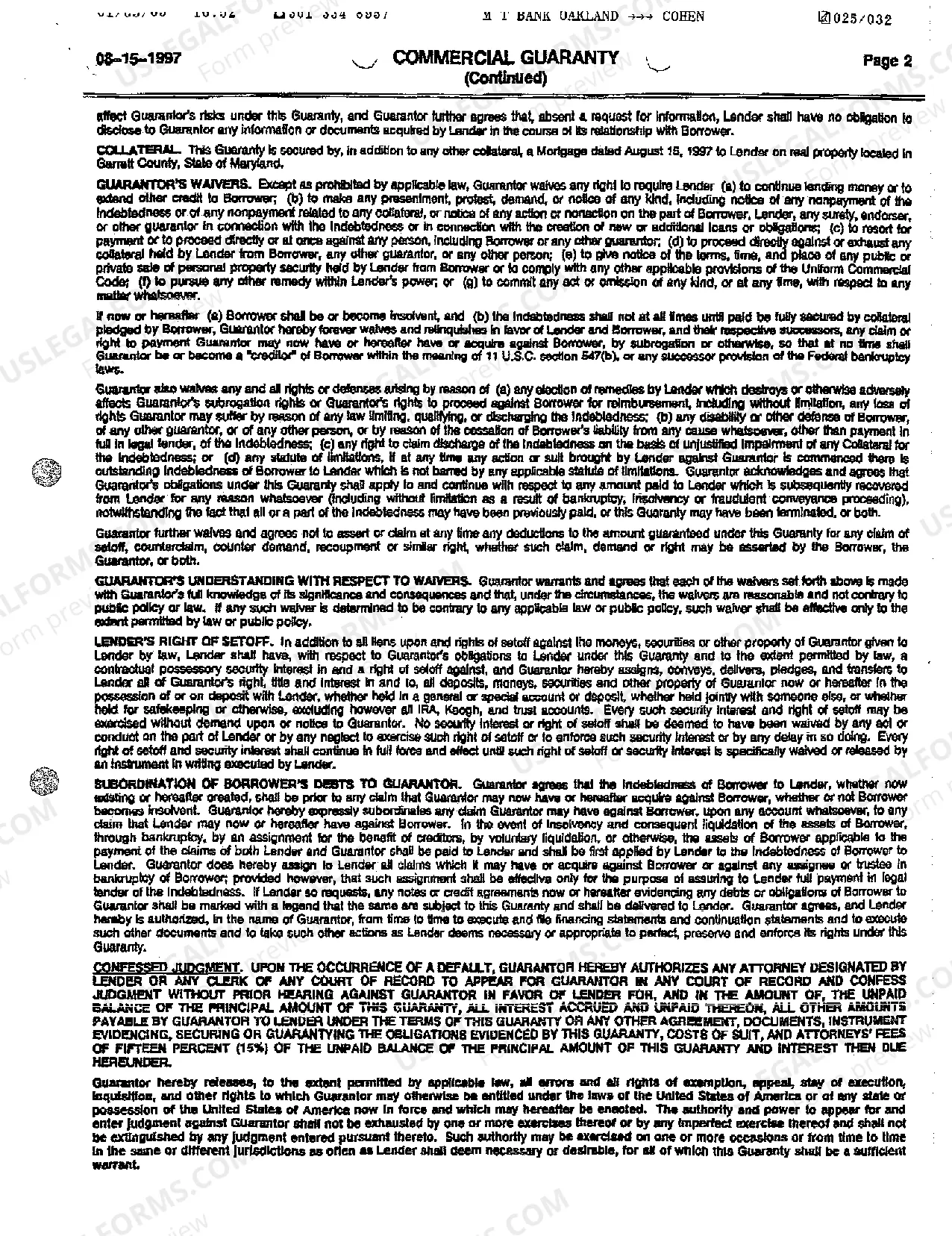

Maryland Exhibit 3 Commercial Guaranty

Description

How to fill out Maryland Exhibit 3 Commercial Guaranty?

You are welcome to the largest legal documents library, US Legal Forms. Right here you can get any template including Maryland Exhibit 3 Commercial Guaranty templates and save them (as many of them as you wish/need). Prepare official files in a few hours, rather than days or even weeks, without having to spend an arm and a leg on an lawyer. Get the state-specific form in clicks and feel assured understanding that it was drafted by our state-certified lawyers.

If you’re already a subscribed customer, just log in to your account and click Download next to the Maryland Exhibit 3 Commercial Guaranty you need. Because US Legal Forms is online solution, you’ll generally have access to your saved forms, regardless of the device you’re utilizing. Find them within the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check out our instructions below to begin:

- If this is a state-specific form, check its validity in your state.

- See the description (if available) to understand if it’s the right example.

- See much more content with the Preview option.

- If the sample fulfills all your requirements, click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to sign up.

- Save the template in the format you want (Word or PDF).

- Print out the document and fill it with your/your business’s info.

When you’ve completed the Maryland Exhibit 3 Commercial Guaranty, give it to your legal professional for confirmation. It’s an extra step but an essential one for making confident you’re entirely covered. Join US Legal Forms now and get access to a mass amount of reusable samples.

Form popularity

FAQ

One reason could be the need to take a loan yourself. However, a bank may not allow a guarantor to withdraw from the role unless the borrower gets another guarantor or brings in additional collateral.

Lenders have their own rules and guidelines, but usually guarantors will: be over 21 years old. have a good credit history. have a separate bank account to the borrower you may be able to guarantee a loan for a spouse or partner, but only if you have separate bank accounts.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

At law, the giver of a guarantee is called the surety or the "guarantor". The person to whom the guarantee is given is the creditor or the "obligee"; while the person whose payment or performance is secured thereby is termed "the obligor", "the principal debtor", or simply "the principal".

As nouns the difference between guarantee and guarantor is that guarantee is anything that assures a certain outcome while guarantor is a person, or company, that gives a guarantee.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform.A guaranty contract provides the obligee with an alternative to a surety agreement to guarantee or ensure the successful performance of a promise.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

A guarantor for a commercial loan or apartment loan is: An individual or other that signs the loan note stating that in the event of default by the borrower, the guarantor will step up and make good on the borrower's obligation to repay the commercial loan note.

A surety is an insurer of the debt, whereas a guarantor is an insurer of the solvency of the debtor. A suretyship is an undertaking that the debt shall be paid; a guaranty, an undertaking that the debtor shall pay.A surety binds himself to perform if the principal does not, without regard to his ability to do so.