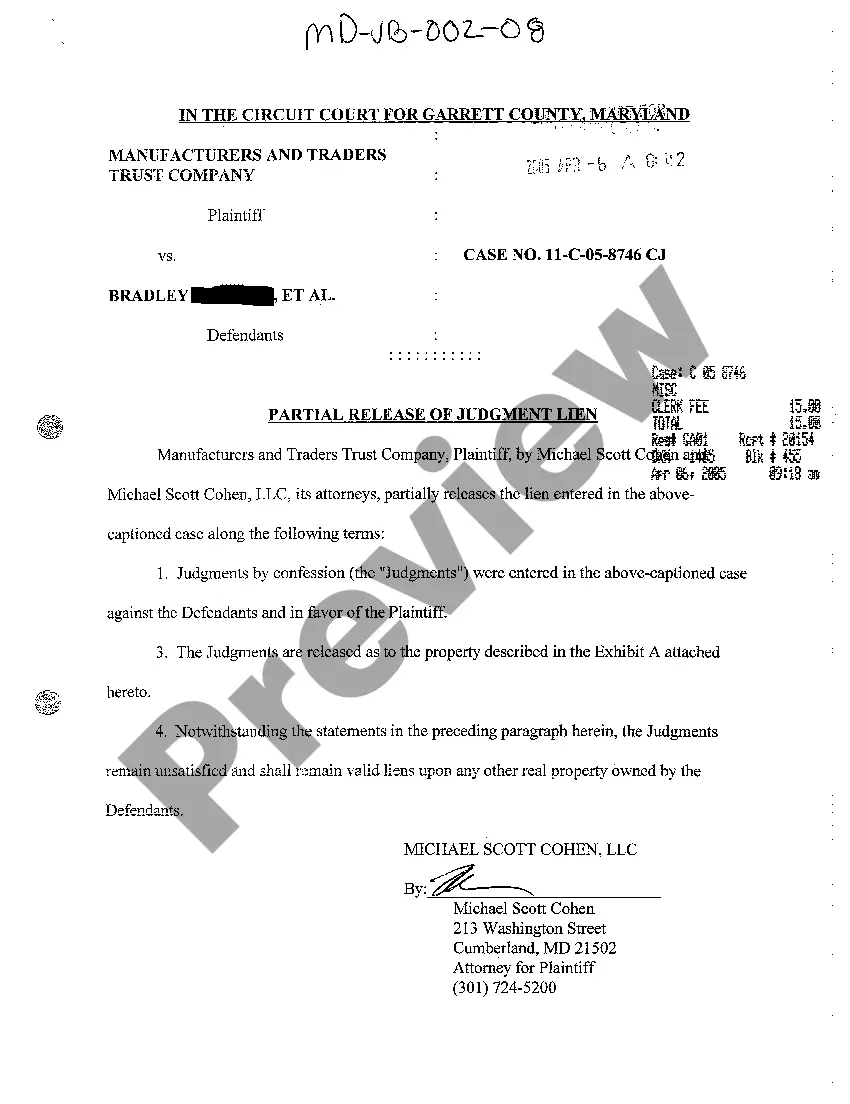

Maryland Partial Release Of Judgment Lien

Description Release Of Judgment Lien

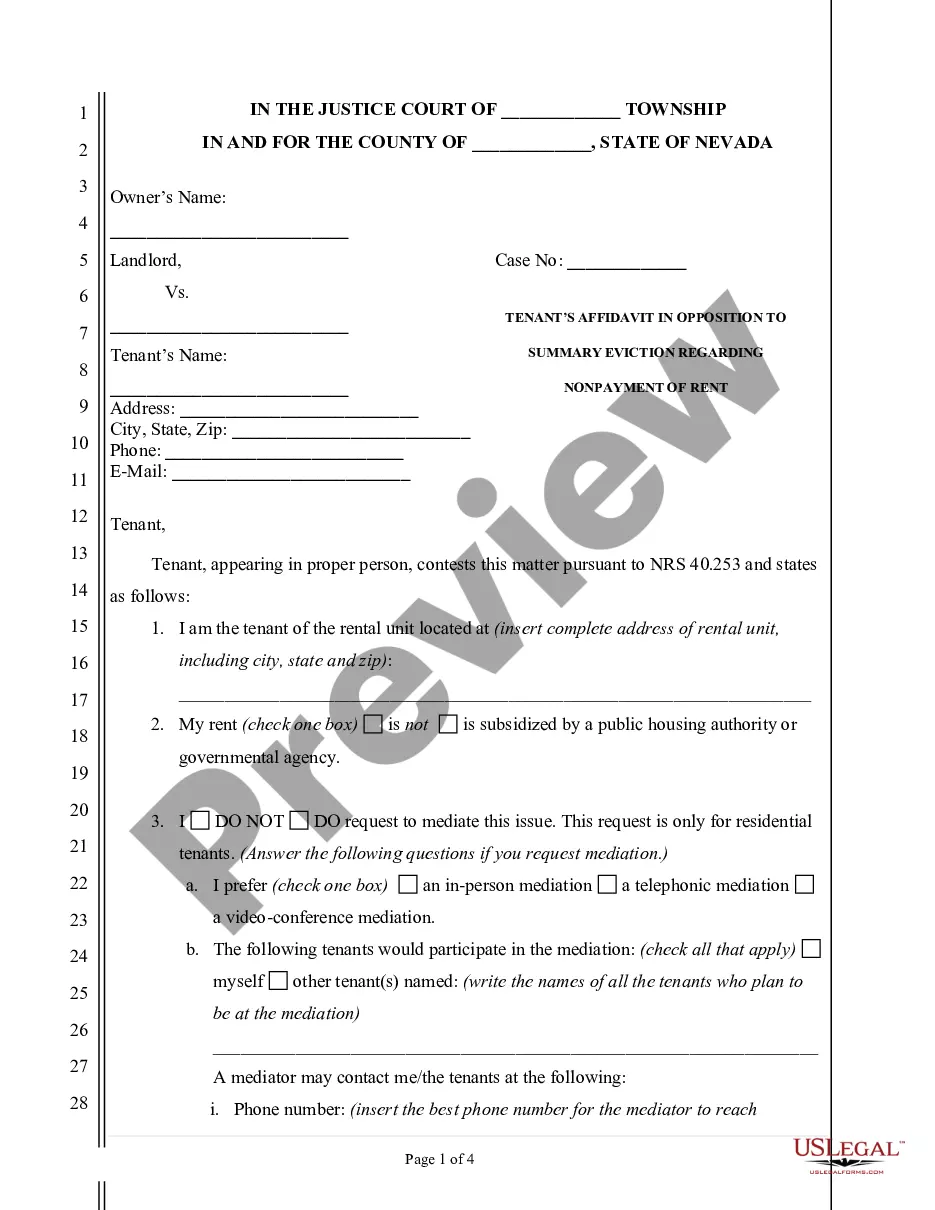

How to fill out Maryland Partial Release Of Judgment Lien?

Welcome to the greatest legal files library, US Legal Forms. Here you can get any example such as Maryland Partial Release Of Judgment Lien forms and save them (as many of them as you wish/require). Make official documents in a couple of hours, rather than days or weeks, without spending an arm and a leg with an attorney. Get your state-specific example in clicks and be assured with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed consumer, just log in to your account and click Download near the Maryland Partial Release Of Judgment Lien you require. Because US Legal Forms is web-based, you’ll generally get access to your downloaded templates, no matter the device you’re using. See them in the My Forms tab.

If you don't have an account yet, what are you waiting for? Check our instructions listed below to start:

- If this is a state-specific form, check its validity in the state where you live.

- See the description (if offered) to learn if it’s the correct template.

- See much more content with the Preview option.

- If the example matches all your requirements, click Buy Now.

- To make your account, choose a pricing plan.

- Use a card or PayPal account to sign up.

- Download the file in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s information.

As soon as you’ve completed the Maryland Partial Release Of Judgment Lien, send away it to your legal professional for confirmation. It’s an extra step but a necessary one for being sure you’re completely covered. Become a member of US Legal Forms now and access a mass amount of reusable examples.

Partial Release Of Lien Form popularity

Partial Release Of Lein Other Form Names

Lost Lien Release Maryland FAQ

Then the creditor has 10 days after they receive a stamp filed copy back to issue it to the judgment debtor. So that whole process could usually take about 30 days.

You must have the Acknowledgment of Satisfaction of Judgment (EJ-100) served on the judgment debtor by someone over 18 who is not a party to the case. Be sure the judgment debtor receives all the original, notarized copies he or she will need to release all of the liens you placed on his or her property.

If the Judgment Debtor, the party who lost during the trial, does not pay you voluntarily, you may contact an enforcement officer.An execution is a court order that allows the enforcement officer to take money or property from the Judgment Debtor in order to have your Judgment paid.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.

The defendant should ask for a letter confirming that the entire amount of the judgment has been paid. He or she may do so by sending a demand letter to the plaintiff. The release and satisfaction form is filed with the court clerk and entered into the case record.

Satisfaction of judgment. n. a document signed by a judgment creditor (the party owed the money judgment) stating that the full amount due on the judgment has been paid.

A Satisfaction of Judgment or Release and Satisfaction is a legal document that shows that the plaintiff has been paid all that he or she is owed, based upon the original judgment against the defendant.

Once a judgment is paid, whether in installments or a lump sum, a judgment creditor (the person who won the case) must acknowledge that the judgment has been paid by filing a Satisfaction of Judgment form with the court clerk.Ask the small claims clerk for more information about how to do this.

Paying off Judgments Will not Improve your Credit Score While the Fair Credit Reporting Act states that a judgment may stay on your credit report for as long as the statute of limitations in your state is in effect, all three bureaus remove judgments at the 7-year mark whether or not they are paid.

Motion for satisfaction by the debtor If the creditor does not file an acknowledgement of satisfaction, the debtor can file a motion for an order declaring that the judgment is satisfied. The debtor must file the motion in the court that entered the original judgment and serve a copy on the creditor.