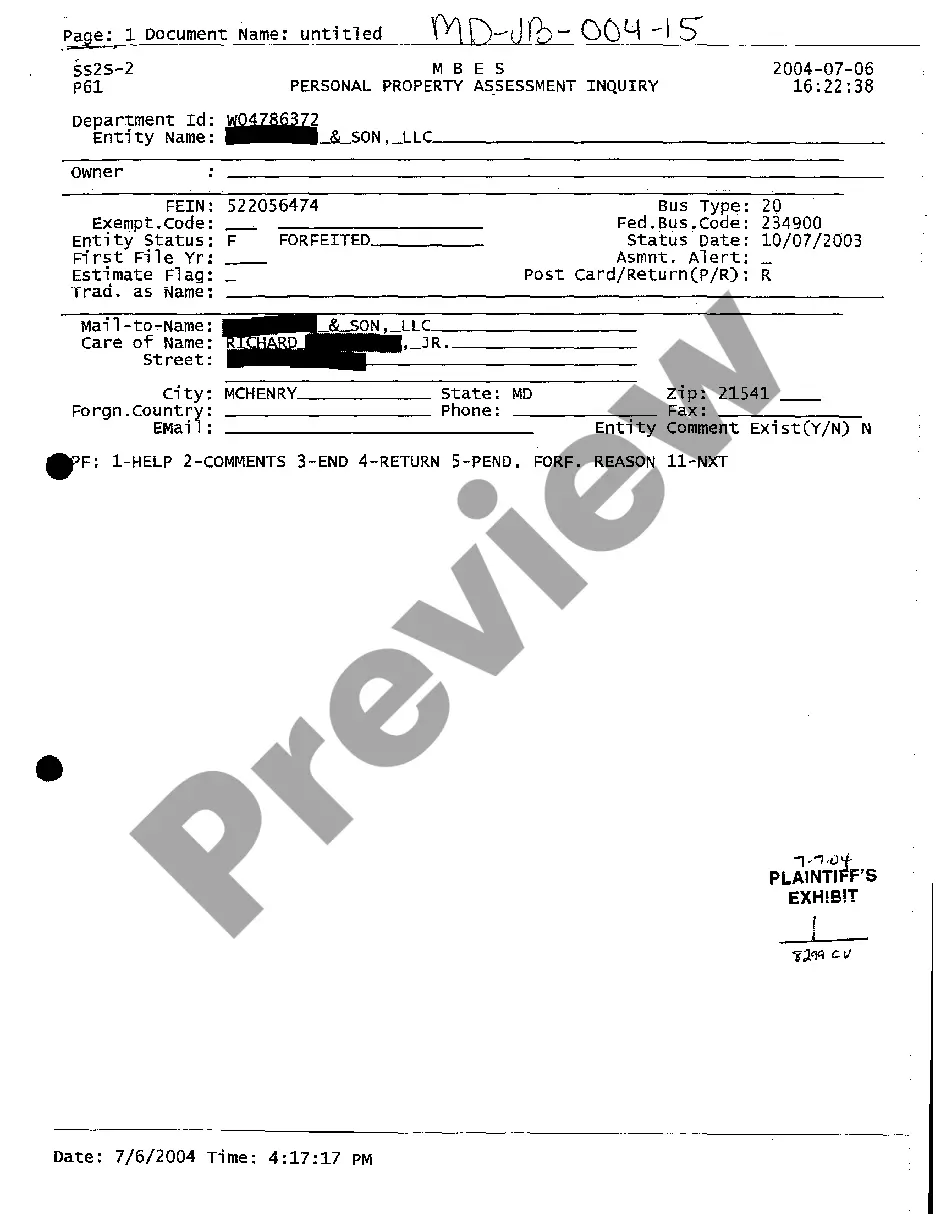

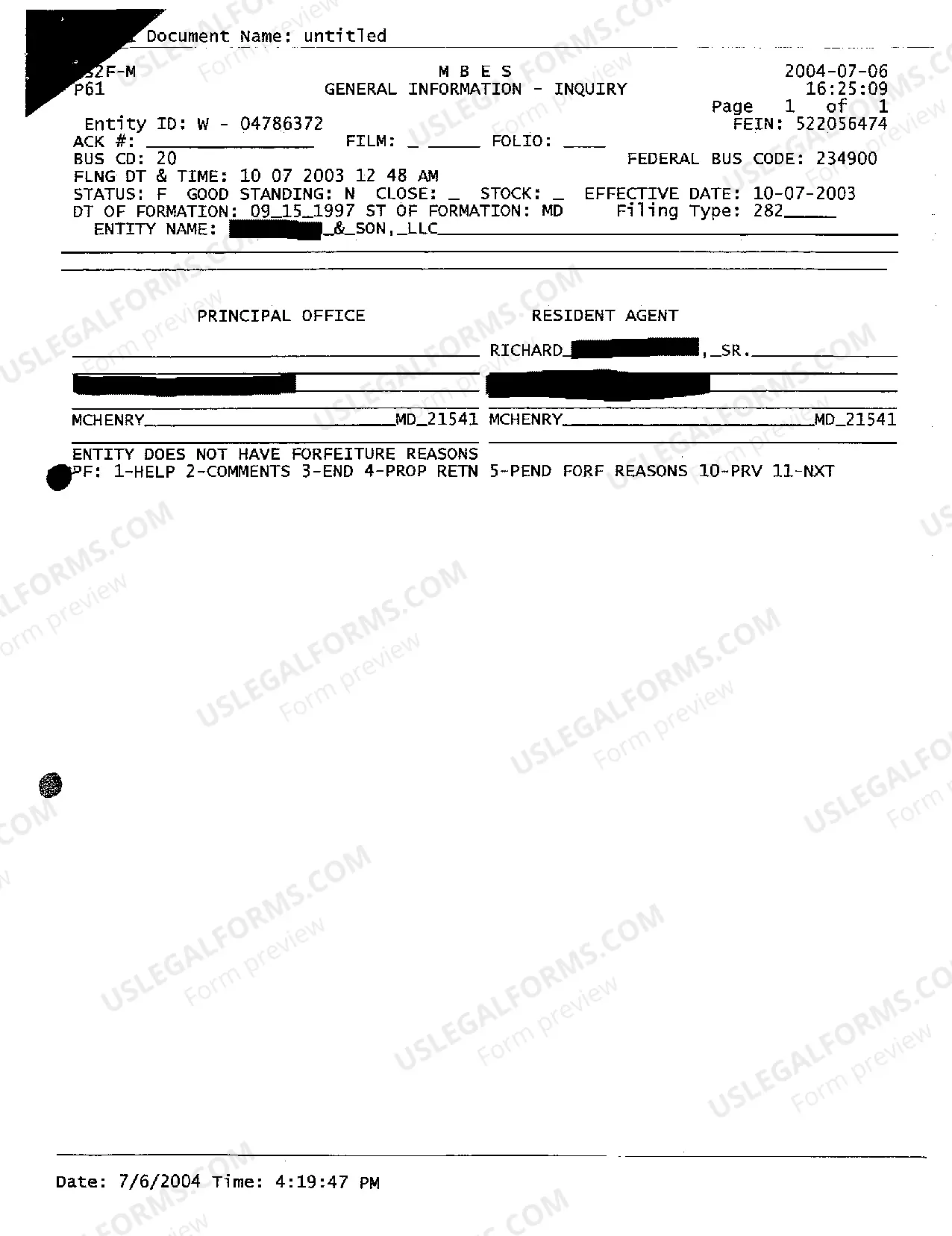

Maryland Exhibit 1 Personal Property Assessment Inquiry

Description

How to fill out Maryland Exhibit 1 Personal Property Assessment Inquiry?

Greetings to the finest collection of legal documentation, US Legal Forms. Here, you will discover various templates such as Maryland Exhibit 1 Personal Property Assessment Inquiry forms and download them (as many as you desire/require). Prepare official paperwork in just a few hours, rather than days or even weeks, without needing to spend a fortune on a legal expert.

Obtain the state-specific template in a few clicks and rest assured knowing that it was crafted by our state-certified legal experts. If you're already a registered user, simply Log In to your account and click Download beside the Maryland Exhibit 1 Personal Property Assessment Inquiry you require. Since US Legal Forms is an online service, you’ll always have access to your saved documents, regardless of which device you’re utilizing. Locate them in the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions provided below to get started: If this is a state-specific document, verify its validity in your state. Review the description (if available) to ensure that it’s the correct template. Explore more content with the Preview feature. If the template fulfills your requirements, click Buy Now. To set up an account, select a pricing plan. Utilize a credit card or PayPal account to register. Download the document in your preferred format (Word or PDF). Print the document and complete it with your or your business’s information.

- After you’ve completed the Maryland Exhibit 1 Personal Property Assessment Inquiry, submit it to your attorney for verification.

- This is an additional step but a vital one for ensuring you’re fully protected.

- Become a member of US Legal Forms today and gain access to thousands of reusable templates.

Form popularity

FAQ

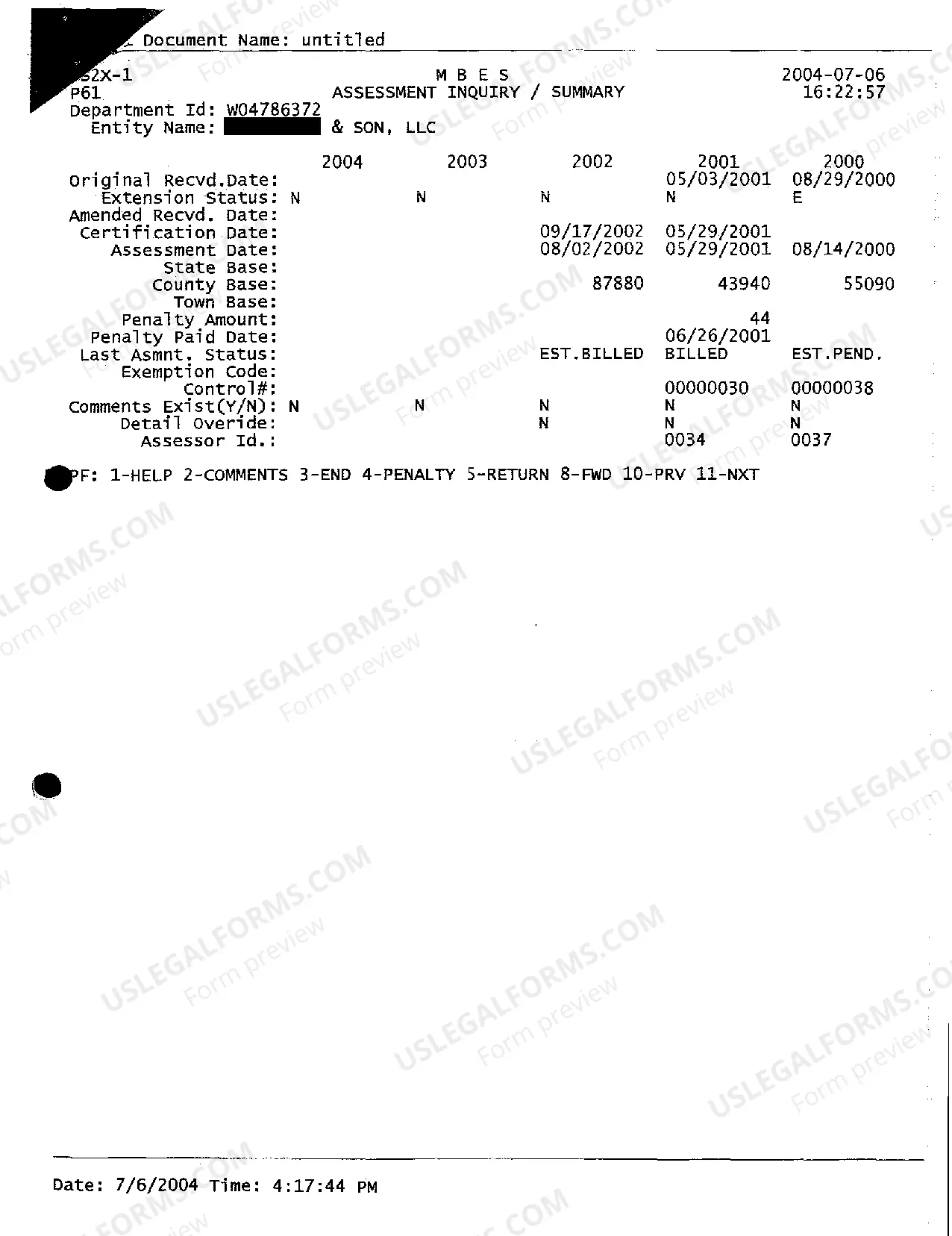

How is my bill calculated? The tax rate is established each fiscal year by the annual budget process. The bill is calculated by multiplying the tax rate by the certified assessment. The rate of interest on delinquencies is 1% of the unpaid principal, per month or portion of a month until paid.

'Real' property encompasses interests in land and fixtures or structures upon the land. 'Personal' property encompasses tangible or 'corporeal' thingschattels or goods.

Personal property taxes, also known as property taxes, are a form of taxation on what is termed personal property. Personal property is defined as any movable property that is not attached to a home or building.Personal property excludes real property, which comprises of real estate, land and buildings.

Personal property is a class of property that can include any asset other than real estate. The distinguishing factor between personal property and real estate, or real property, is that personal property is movable; that is, it isn't fixed permanently to one particular location.

It includes land and buildings, for example. Personal property typically includes furniture, fixtures, tools, vehicles, and machinery and equipment. All of these items can be moved.

Although the state does not have personal property tax rates, there are some counties that do.

To deduct the value-based portion of your registration fee, you must itemize your deductions using IRS Form Schedule A. Car fees go on the line for "state and local personal property taxes."Nevertheless, if the fee is value-based and assessed on a yearly basis, the IRS considers it a deductible personal property tax.

Maryland's average effective property tax rate of 1.06% is just below the national average, which is 1.07%. However, because Maryland generally has high property values, Maryland homeowners pay more in annual property taxes than homeowners in most other states.

Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.