Maryland Exhibit B Notice to Collector of Taxes

Description

How to fill out Maryland Exhibit B Notice To Collector Of Taxes?

You are welcome to the most significant legal files library, US Legal Forms. Right here you will find any example such as Maryland Exhibit B Notice to Collector of Taxes forms and download them (as many of them as you want/need to have). Prepare official papers with a few hours, instead of days or weeks, without spending an arm and a leg with an lawyer. Get your state-specific example in clicks and be assured understanding that it was drafted by our state-certified attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download near the Maryland Exhibit B Notice to Collector of Taxes you require. Due to the fact US Legal Forms is online solution, you’ll generally have access to your downloaded templates, no matter what device you’re using. See them within the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check out our guidelines below to begin:

- If this is a state-specific sample, check out its validity in your state.

- Look at the description (if offered) to understand if it’s the proper template.

- See much more content with the Preview option.

- If the sample fulfills all your requirements, just click Buy Now.

- To make an account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Download the file in the format you need (Word or PDF).

- Print out the document and fill it out with your/your business’s details.

After you’ve filled out the Maryland Exhibit B Notice to Collector of Taxes, send it to your lawyer for confirmation. It’s an extra step but a necessary one for being sure you’re totally covered. Sign up for US Legal Forms now and get thousands of reusable samples.

Form popularity

FAQ

Do Maryland State Tax Liens Expire?However, in 2019, Maryland Governor Larry Hogan signed a law that created a statute of limitations for certain tax liens. So, Maryland state tax liens can eventually expire, but the statute of limitations is very long: 20 years.

Arizona, California, Colorado, Kentucky, Michigan, Ohio, and Wisconsin have four years from the date you file your return or the date it is due, whichever is later, to assess additional obligations. Kansas has three years from the date your return was due, the date you file, or the date you pay, whichever is later.

There is no statute of limitations on tax debt in Maryland and unpaid taxes collect interest at a whopping 13% per year. Maryland can and will collect taxes from you that are 10, 15, or 20 years old. You cannot wait out the state of Maryland!

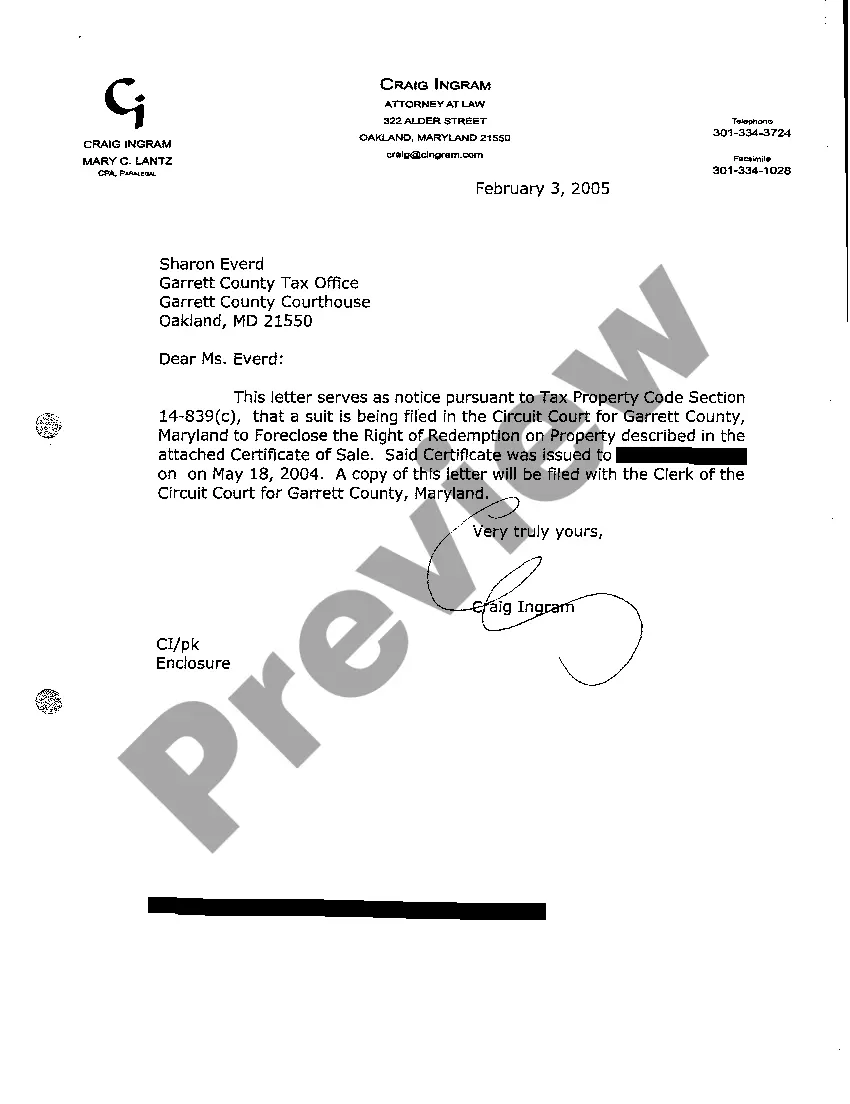

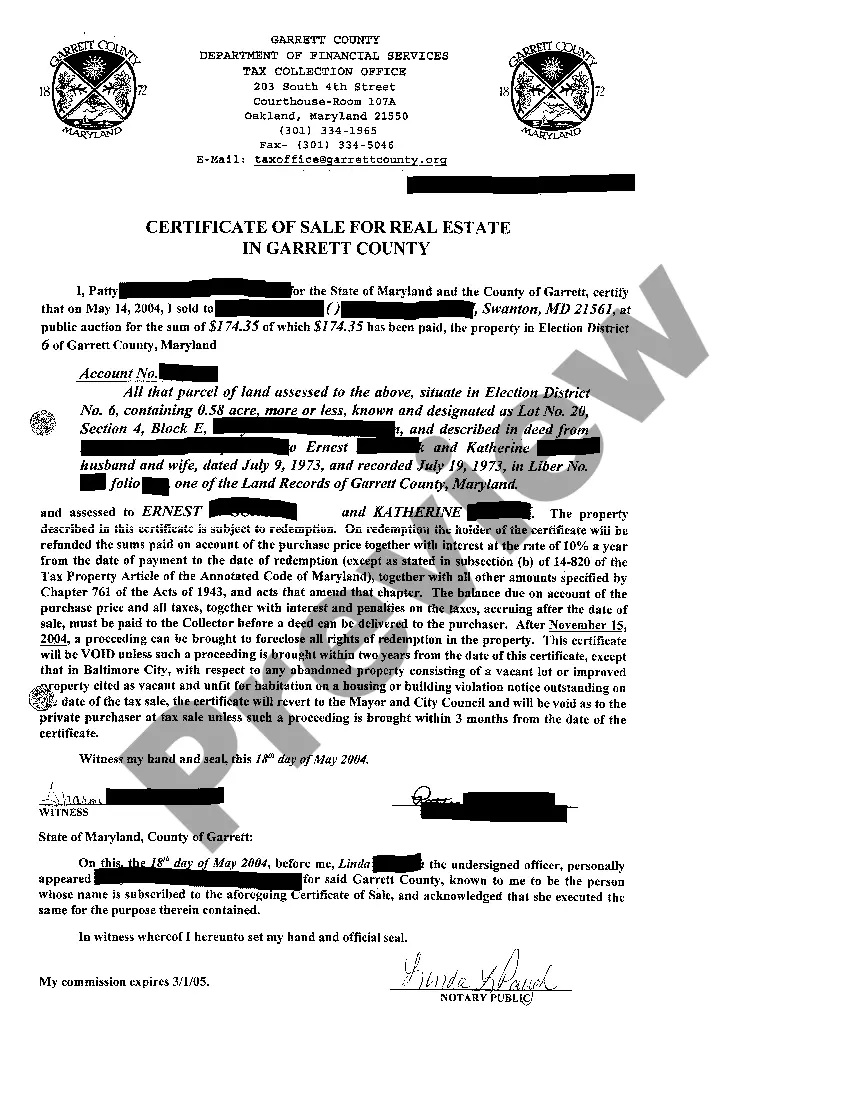

If you default on your property taxes in Maryland, you could lose your home to a tax sale.If you don't pay your Maryland property taxes, the tax collector can sell your home at a tax sale to pay off the delinquent amounts.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,

Legal references herein refer to the Tax Property Article of the Annotated Code of Maryland.Any unpaid State, County and city (municipal) taxes on real property constitute a lien on the real property from the date they become due until paid (Section 14-804).

The only way to get a tax lien released is to pay your Maryland tax balance. After doing so, you can visit the applicable circuit court to obtain a certified copy of the lien release. This can be submitted to the three major credit agencies so your credit report will reflect the lien release.

As a general rule, there is a ten year statute of limitations on IRS collections. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. Subject to some important exceptions, once the ten years are up, the IRS has to stop its collection efforts.

After three years, you can no longer claim a tax refund for that year (but you may still file a tax return). However, if you owe taxes, you'll need to file your return as soon as possible as well as owe back taxes and penalties.> late filing penalties for each month your return is not filed.