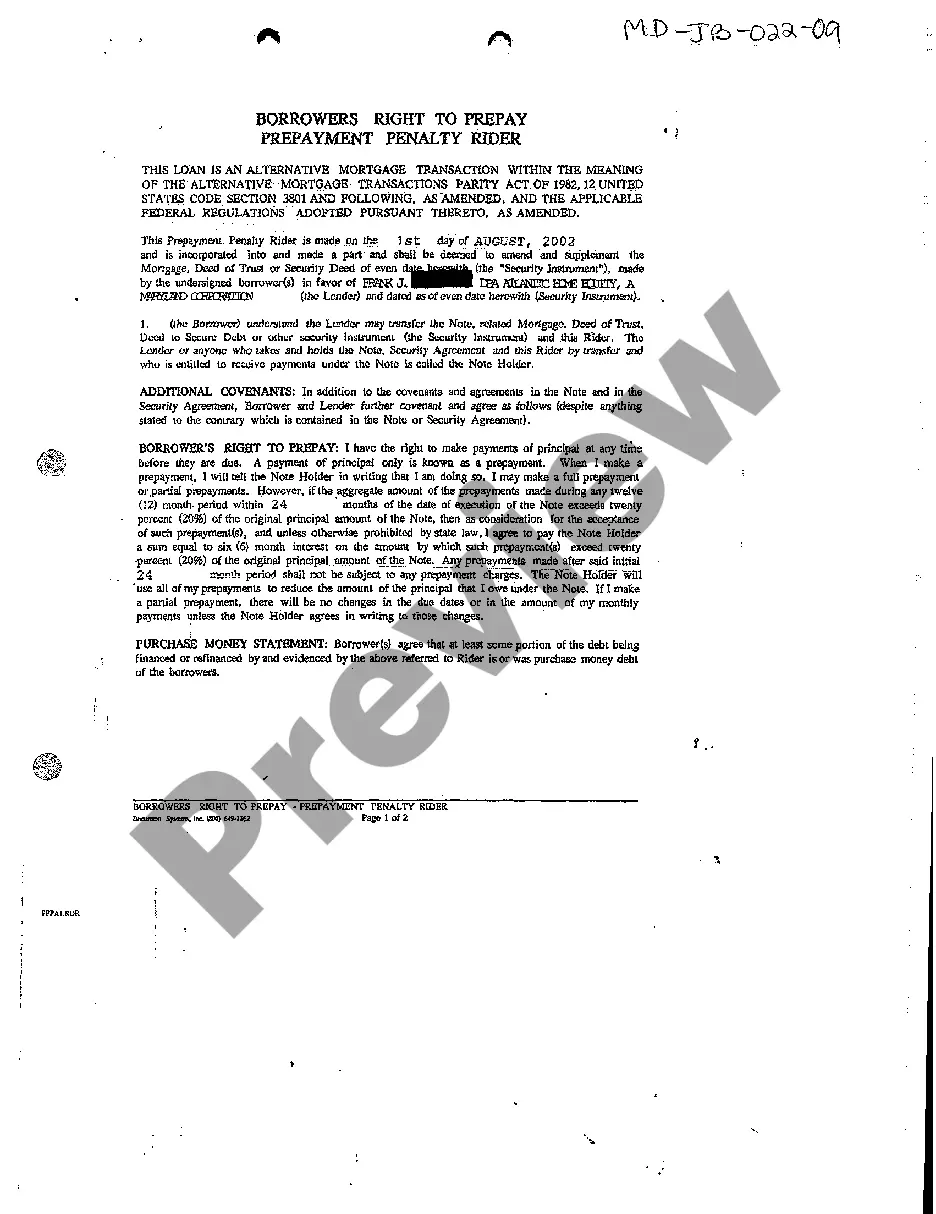

Maryland Borrowers Right to Prepay Prepayment Penalty Rider

Description Maryland Prepayment Penalty Law

How to fill out Maryland Borrowers Right To Prepay Prepayment Penalty Rider?

Welcome to the biggest legal documents library, US Legal Forms. Here you can find any example such as Maryland Borrowers Right to Prepay Prepayment Penalty Rider forms and download them (as many of them as you want/require). Make official files with a couple of hours, rather than days or even weeks, without having to spend an arm and a leg with an attorney. Get your state-specific form in clicks and feel assured with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed user, just log in to your account and then click Download near the Maryland Borrowers Right to Prepay Prepayment Penalty Rider you need. Because US Legal Forms is online solution, you’ll always have access to your saved templates, no matter the device you’re using. Locate them in the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our instructions below to begin:

- If this is a state-specific form, check its validity in the state where you live.

- See the description (if accessible) to understand if it’s the right template.

- See a lot more content with the Preview function.

- If the example meets all your needs, just click Buy Now.

- To make an account, choose a pricing plan.

- Use a credit card or PayPal account to register.

- Download the template in the format you want (Word or PDF).

- Print the file and fill it out with your/your business’s details.

As soon as you’ve completed the Maryland Borrowers Right to Prepay Prepayment Penalty Rider, give it to your legal professional for verification. It’s an additional step but an essential one for making sure you’re entirely covered. Sign up for US Legal Forms now and get access to thousands of reusable examples.

Prepayment Penalty Rider Form popularity

FAQ

Loan prepayment penalties are fees lenders might include in their terms to ensure you pay a certain amount of interest on your loan before paying it off. It might sound crazy, but making extra payments or paying your loan off early can actually cost you more because of loan prepayment penalties.

Federal law prohibits prepayment penalties for many types of home loans, including FHA and USDA loans, as well as student loans. In other cases, the early payoff penalties that lenders can charge are permitted but include both time and financial restrictions under federal law.

Yes, you can try negotiating it down, but the best way to avoid the fee altogether is to switch to a different loan or a different lender. Since not all lenders charge the same prepayment penalty, make sure to get quotes from different lenders to find the best loan for you.

Function: noun. The Prepayment Rider discusses the borrower's right to prepay their loan. Sometimes there are penalties for prepaying a loan during the life of the loan, or during the first several years of the loan. Some borrowers like to pay a little bit more than the monthly payments to pay off their loan sooner.

(ii) May not exceed an amount equal to 2 months' advance interest on the aggregate amount of all prepayments made in any 12-month period in excess of one-third of the amount of the original loan. (d) Prepayment penalty prohibited.

Federal law prohibits some mortgages from having prepayment penalties, which are charges for paying off the loan early.If your lender can charge a prepayment penalty, it can only do so for the first three years of your loan and the amount of the penalty is capped. These protections come thanks to federal law.

Are prepayment penalties illegal in Maryland? Not exactly. Prepayment penalties may be permissible under certain Maryland law and are subject to certain limitations. However, many Maryland laws do not permit prepayment penalties.