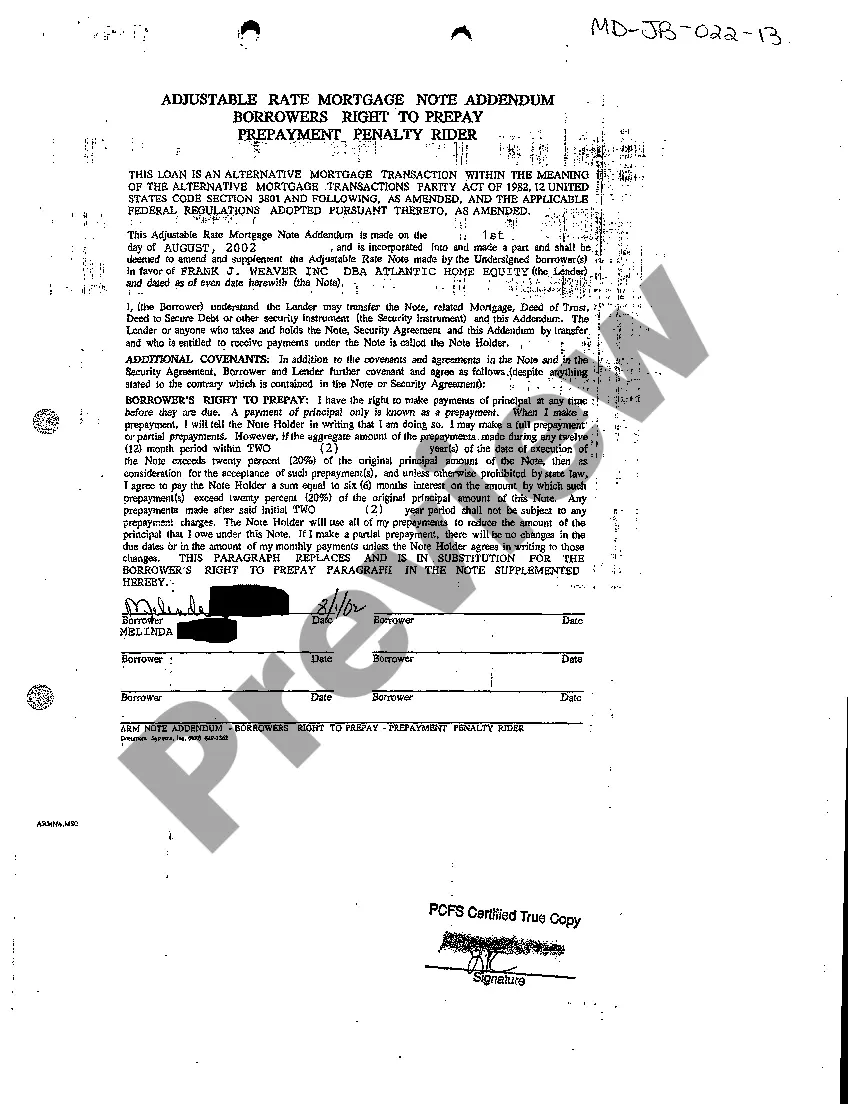

Maryland Adjustable Rate Mortgage Note Addendum Borrowers Right to Prepay Prepayment Penalty Rider

Description

How to fill out Maryland Adjustable Rate Mortgage Note Addendum Borrowers Right To Prepay Prepayment Penalty Rider?

You are welcome to the biggest legal files library, US Legal Forms. Right here you can find any sample including Maryland Adjustable Rate Mortgage Note Addendum Borrowers Right to Prepay Prepayment Penalty Rider forms and download them (as many of them as you wish/need). Get ready official documents in a several hours, rather than days or weeks, without spending an arm and a leg on an lawyer. Get the state-specific form in clicks and be assured understanding that it was drafted by our accredited lawyers.

If you’re already a subscribed consumer, just log in to your account and click Download next to the Maryland Adjustable Rate Mortgage Note Addendum Borrowers Right to Prepay Prepayment Penalty Rider you want. Because US Legal Forms is web-based, you’ll generally have access to your downloaded files, no matter what device you’re using. Locate them within the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check our instructions below to get started:

- If this is a state-specific document, check out its validity in the state where you live.

- Look at the description (if available) to learn if it’s the proper example.

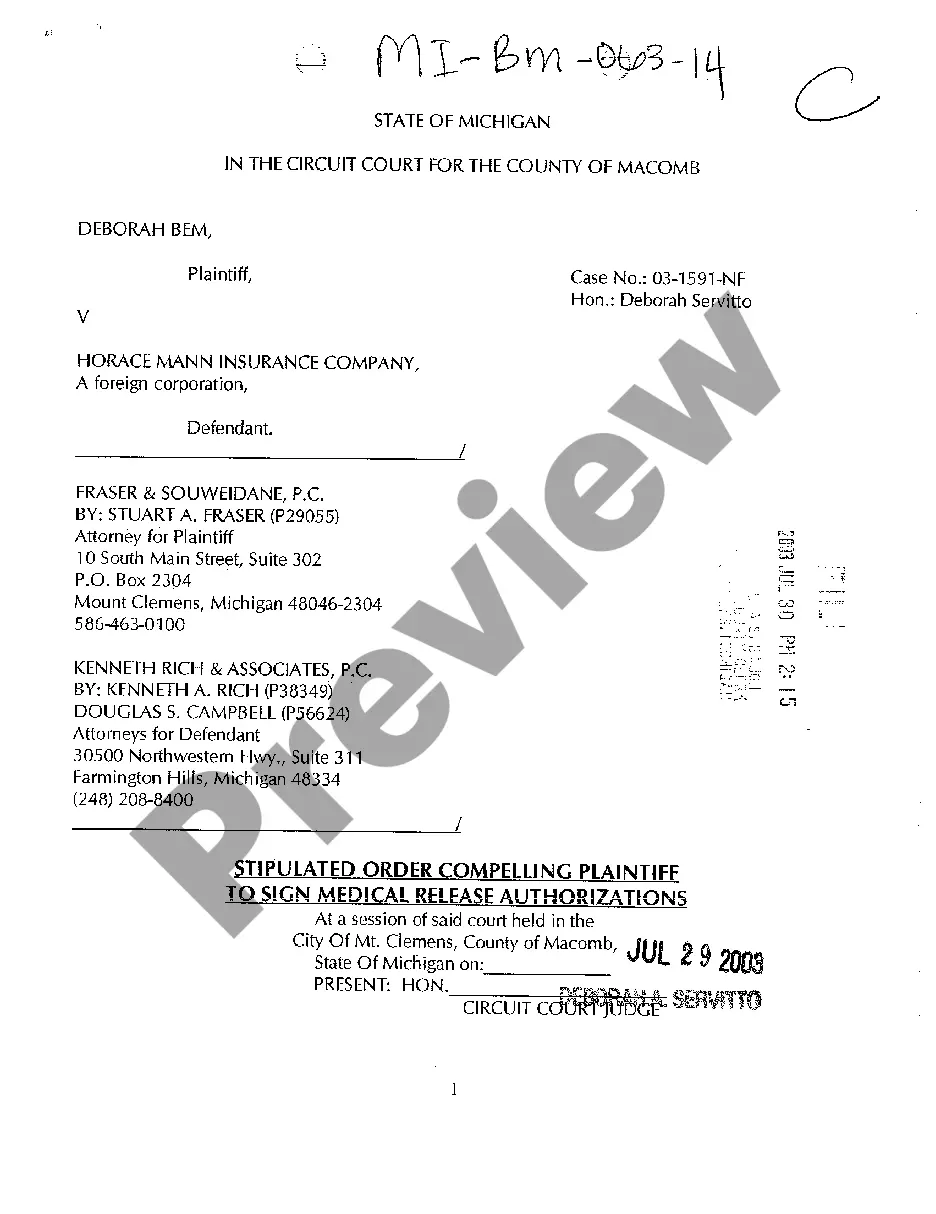

- See much more content with the Preview option.

- If the document meets all of your needs, click Buy Now.

- To make an account, pick a pricing plan.

- Use a card or PayPal account to register.

- Save the template in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s information.

Once you’ve completed the Maryland Adjustable Rate Mortgage Note Addendum Borrowers Right to Prepay Prepayment Penalty Rider, send out it to your legal professional for confirmation. It’s an extra step but an essential one for making certain you’re completely covered. Sign up for US Legal Forms now and get a mass amount of reusable samples.

Form popularity

FAQ

Lenders typically impose a prepayment penalty on all financial products that create a creditor-debtor relationship. As the creditor, the lender relies on the terms of the original loan to predict a return on investment.It is called a "step-down" penalty because the amount gets smaller the longer the loan is in place.

Soft prepayment penalty requires the borrower to pay a penalty amount when a loan is paid off because the loan is refinanced only. What It Means. Prepayment penalty is not charged if the borrower sells the property.

A due-on-sale clause is a provision in a mortgage contract that requires the mortgage to be repaid in full upon a sale or conveyance of partial or full interest in the property that secures the mortgage. This provision as also sometimes referred to as an acceleration clause.

A mortgage prepayment penalty is a fee that some lenders charge when you pay all or part of your mortgage loan term off early. The penalty fee is an incentive for borrowers to pay back their principal slowly over a full term, allowing mortgage lenders to collect interest.

The period between rate changes is called the adjustment period. For example, a loan with an adjustment period of 1 year is called a 1-year ARM, and the interest rate and payment can change once every year; a loan with a 3-year adjustment period is called a 3-year ARM.

In adjustable-rate mortgages, the rate at which changes to a mortgage's interest rate occur. Usually, the interest rate changes once a year, but some mortgages change rates as often as once a month or as seldom as every five years. The higher the adjustment frequency, the higher the financial risk for the homeowner.

A prepayment clause allows the borrower to pay the debt before the due date. A prepayment penalty is a charge imposed on a borrower who pays off the loan early. This clause states that the borrower cannot repay a loan prior to a specified date without paying a fee.

A prepayment penalty clause states that a penalty will be assessed if the borrower significantly pays down or pays off the mortgage, usually within the first five years of the loan.

Payment shock. What is the term used to describe a rate adjustment resulting in a new payment amount? recast.