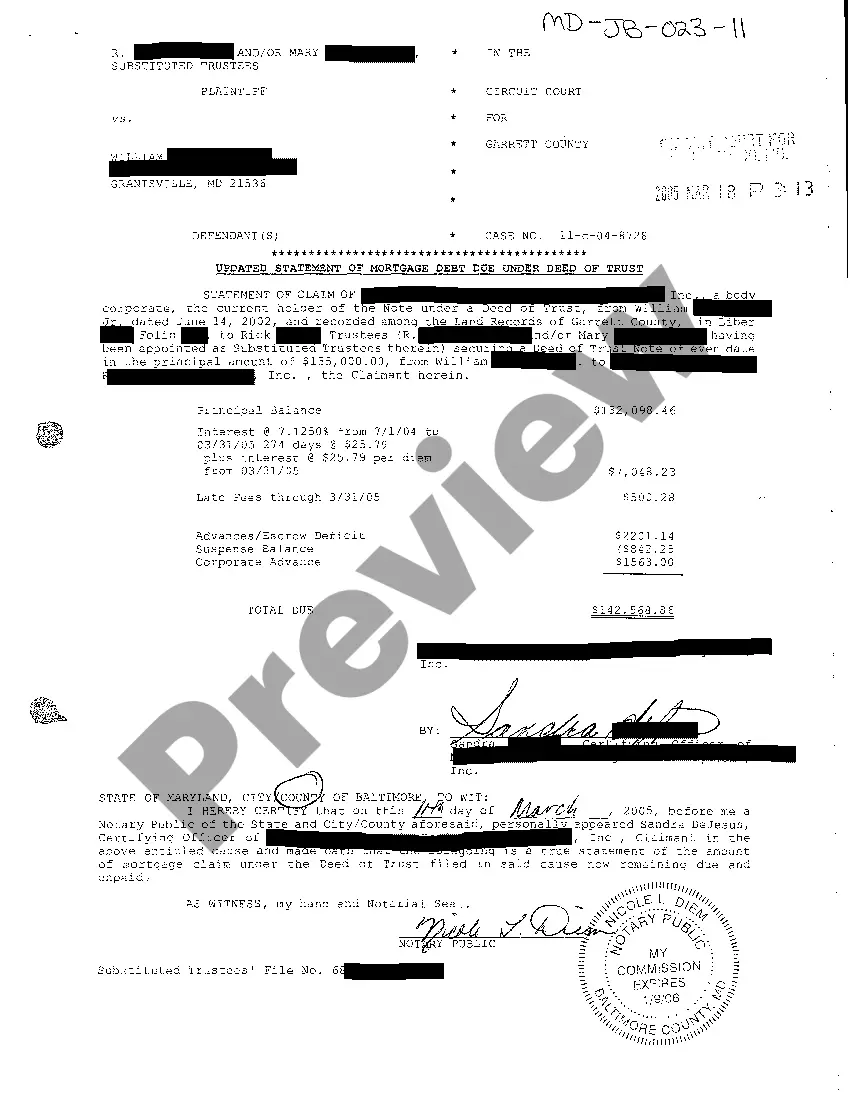

Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust

Description

How to fill out Maryland Updated Statement Of Mortgage Debt Due Under Deed Of Trust?

Welcome to the most significant legal files library, US Legal Forms. Right here you can get any template such as Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust forms and download them (as many of them as you wish/require). Get ready official documents in a couple of hours, instead of days or weeks, without having to spend an arm and a leg on an legal professional. Get your state-specific sample in clicks and feel confident with the knowledge that it was drafted by our qualified lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download near the Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust you want. Due to the fact US Legal Forms is web-based, you’ll always get access to your saved forms, regardless of the device you’re utilizing. Locate them within the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check our instructions listed below to get started:

- If this is a state-specific form, check out its applicability in the state where you live.

- Look at the description (if readily available) to understand if it’s the proper template.

- See far more content with the Preview option.

- If the sample fulfills all your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to join.

- Download the file in the format you need (Word or PDF).

- Print out the file and complete it with your/your business’s information.

After you’ve completed the Maryland Updated Statement of Mortgage Debt Due Under Deed of Trust, send it to your attorney for confirmation. It’s an extra step but an essential one for being sure you’re fully covered. Join US Legal Forms now and get a mass amount of reusable examples.

Form popularity

FAQ

(Md. Code Ann., Tax-Prop. § 14-833). These six months are called a "redemption period." (In Baltimore City, the redemption period is nine months from the date of sale for owner-occupied residential properties.

Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.

Maryland is a recourse (deficiency) state. The lender can pursue you for the deficiency. If you can't afford it, you can file bankruptcy to discharge it, or try to work out a deal for a deed in lieu, to surrender the property in satisfaction of the debt.

The Maryland deed of trust is a type of deed conveying an interest to a bank demonstrating that a mortgage interest exists in the property. This is filed with the Land Records department of the circuit court in the county in which the property is located like any other deed.

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.