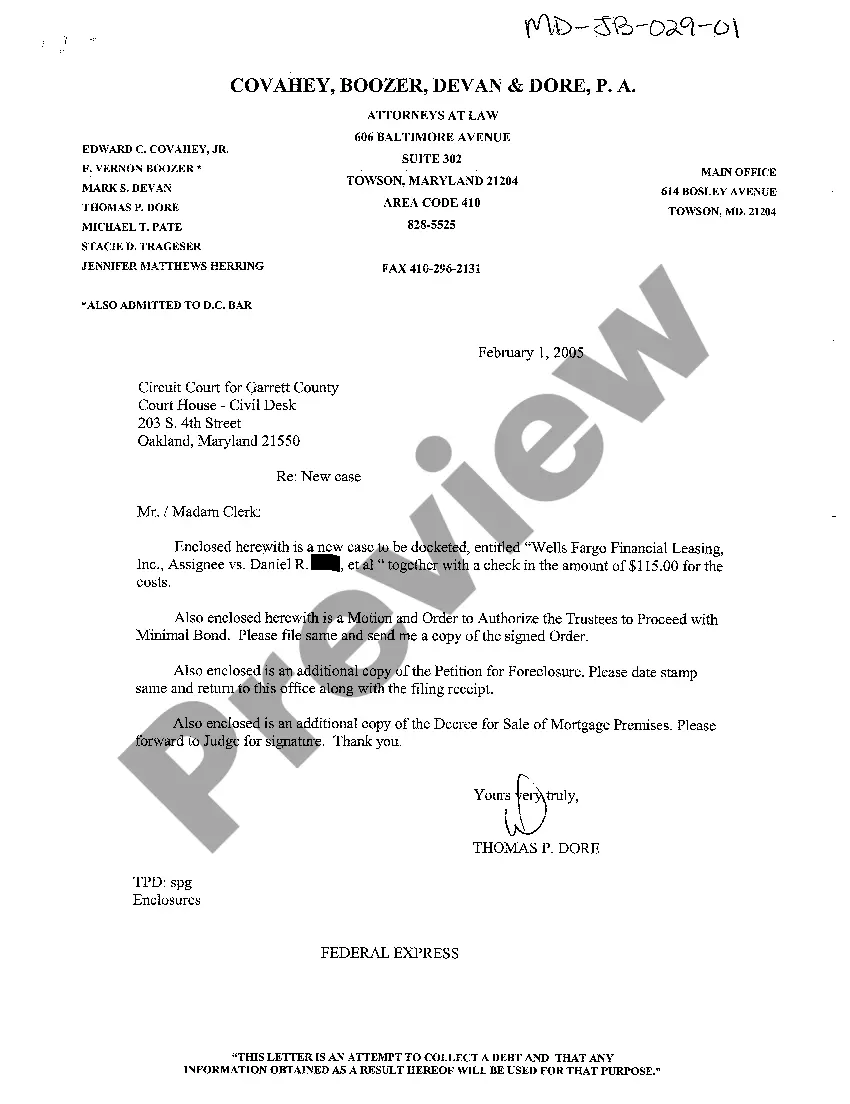

Maryland Letter to Collect Debt

Description

How to fill out Maryland Letter To Collect Debt?

You are welcome to the greatest legal files library, US Legal Forms. Here you can find any example such as Maryland Letter to Collect Debt forms and download them (as many of them as you wish/need). Get ready official files in just a several hours, instead of days or even weeks, without spending an arm and a leg with an lawyer. Get your state-specific sample in a few clicks and be assured with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and click Download near the Maryland Letter to Collect Debt you need. Due to the fact US Legal Forms is web-based, you’ll always have access to your downloaded files, no matter what device you’re utilizing. Find them inside the My Forms tab.

If you don't have an account yet, what are you awaiting? Check our guidelines listed below to begin:

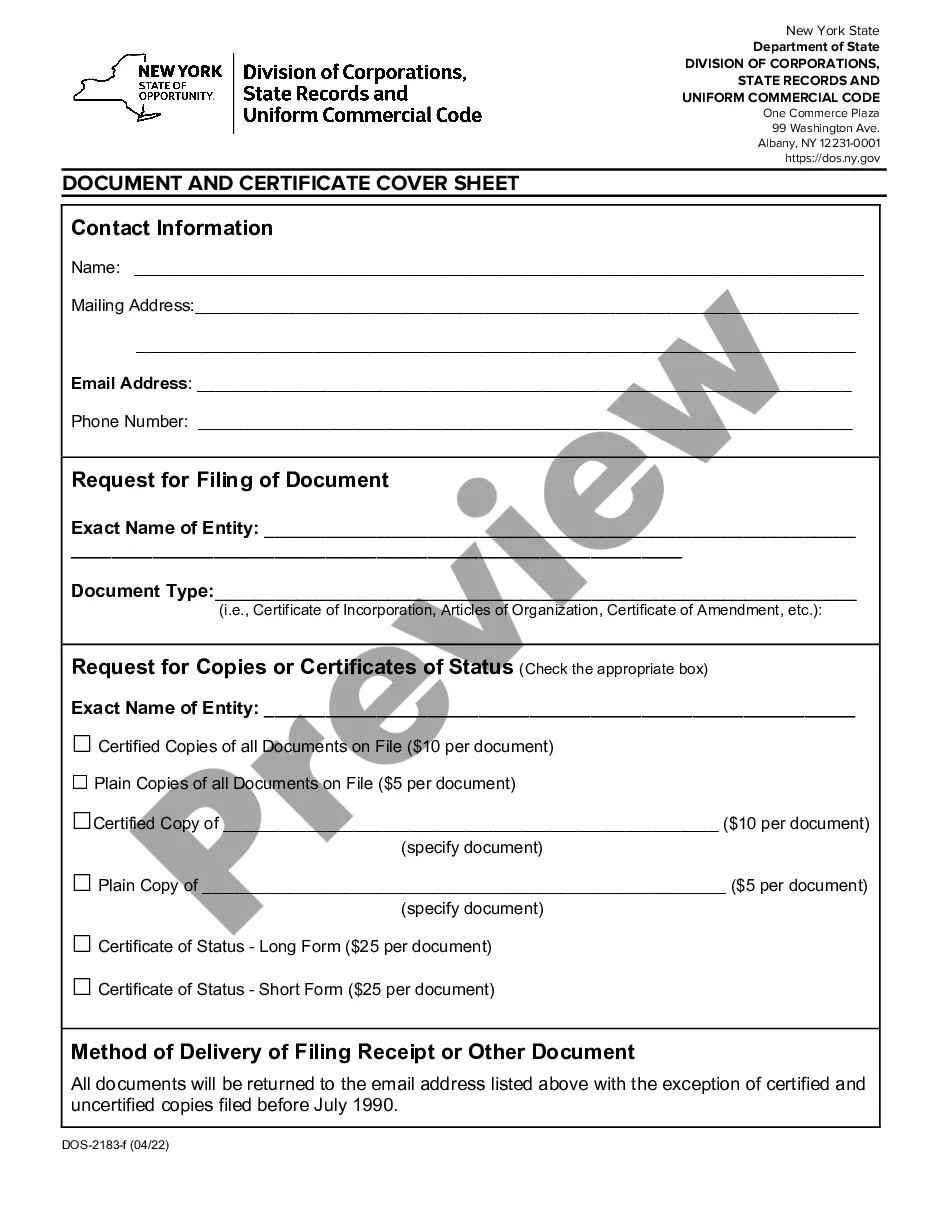

- If this is a state-specific document, check its validity in your state.

- Look at the description (if readily available) to learn if it’s the proper example.

- See a lot more content with the Preview option.

- If the sample meets your requirements, click Buy Now.

- To create your account, pick a pricing plan.

- Use a card or PayPal account to sign up.

- Download the document in the format you want (Word or PDF).

- Print the file and complete it with your/your business’s details.

As soon as you’ve filled out the Maryland Letter to Collect Debt, give it to your legal professional for confirmation. It’s an additional step but an essential one for being sure you’re totally covered. Sign up for US Legal Forms now and access thousands of reusable examples.

Form popularity

FAQ

In general, the statute of limitations in Maryland for debt collection is three or four years after you stopped making payments, although it can be as long as 12 years in limited cases.

Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not in the next 7 business days as this can be vauge.

Unpaid credit card debt will drop off an individual's credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person's credit score.After that, a creditor can still sue, but the case will be thrown out if you indicate that the debt is time-barred.

No. The court will not put you in jail for not paying a consumer debt like a credit card bill, medical bill, or rent payment.If a creditor has a judgment against you, it may be able to garnish your wages or ask the court for the money in your bank account.

You might get sued. The debt collector may file a lawsuit against you if you ignore the calls and letters. If you then ignore the lawsuit, this could lead to a judgment and the collection agency may be able to garnish your wages or go after the funds in your bank account. (Learn more about Creditor Lawsuits.)

Here's some basic information you should write down anytime you speak with a debt collector: date and time of the phone call, the name of the collector you spoke to, name and address of collection agency, the amount you allegedly owe, the name of the original creditor, and everything discussed in the phone call.

Know What to Include A demand letter should include the name of the creditor, the amount owed, action required, debt reference, deadline, and the consequences. Ensure you include all these details so your letter is not only compliant with the FDCPA, but also practical.

For the name and contact information of the original creditor. why the collector believes you own the debt in the first place. for a record of all owners of the debt. the amount and age of the debt (including an account number if you're able). under what authority the collector has to collect.