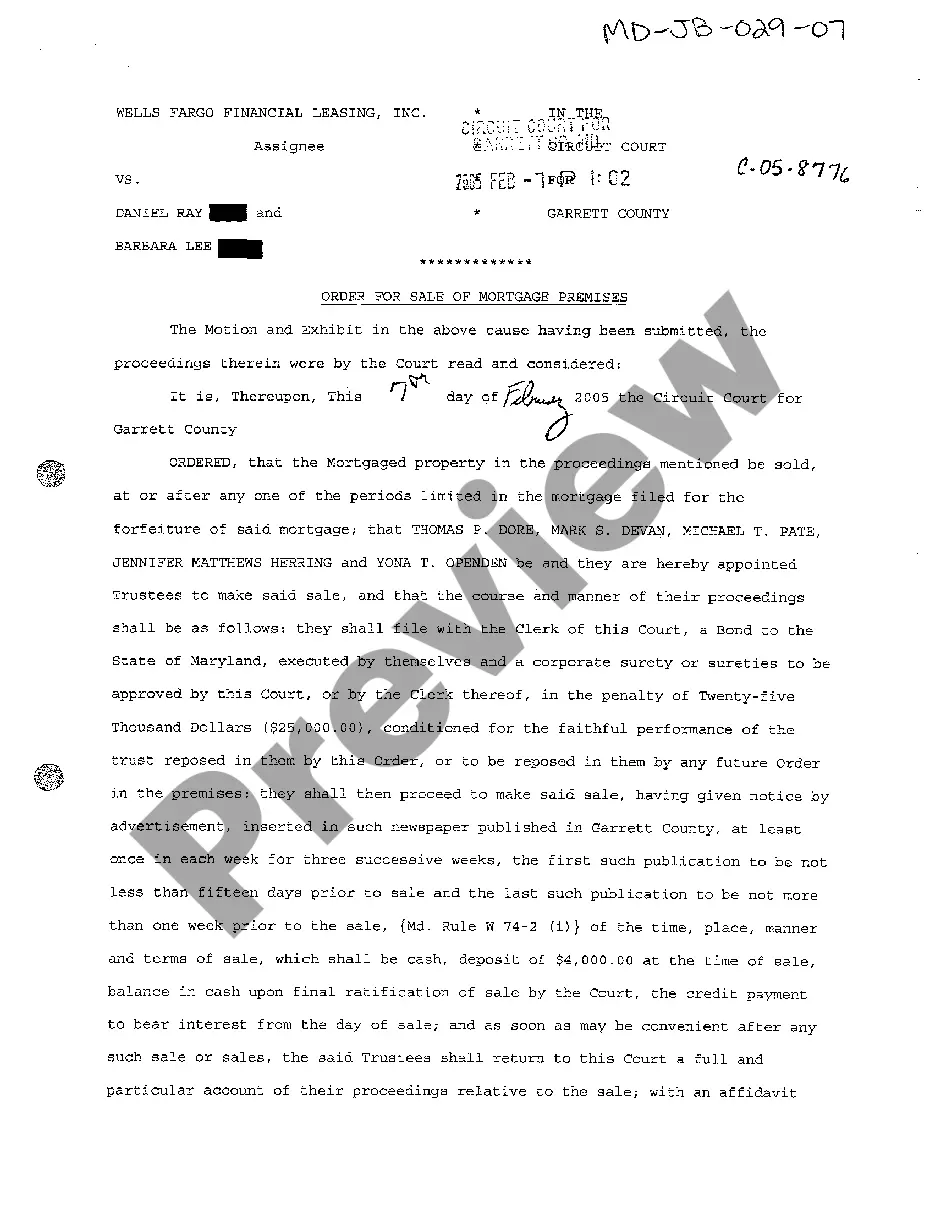

Maryland Order for Sale of Mortgage Premises

Description

How to fill out Maryland Order For Sale Of Mortgage Premises?

You are welcome to the greatest legal files library, US Legal Forms. Here you can get any template including Maryland Order for Sale of Mortgage Premises forms and download them (as many of them as you want/need). Prepare official documents in a few hours, rather than days or even weeks, without having to spend an arm and a leg on an lawyer or attorney. Get your state-specific form in a couple of clicks and be assured with the knowledge that it was drafted by our accredited lawyers.

If you’re already a subscribed consumer, just log in to your account and then click Download next to the Maryland Order for Sale of Mortgage Premises you require. Due to the fact US Legal Forms is online solution, you’ll generally get access to your saved templates, regardless of the device you’re utilizing. See them in the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check our guidelines listed below to begin:

- If this is a state-specific form, check out its validity in the state where you live.

- See the description (if available) to learn if it’s the correct template.

- See far more content with the Preview function.

- If the sample fulfills all of your requirements, just click Buy Now.

- To make an account, choose a pricing plan.

- Use a card or PayPal account to join.

- Save the template in the format you need (Word or PDF).

- Print the document and fill it out with your/your business’s details.

After you’ve completed the Maryland Order for Sale of Mortgage Premises, send it to your lawyer for confirmation. It’s an additional step but an essential one for making confident you’re totally covered. Become a member of US Legal Forms now and get access to a large number of reusable samples.

Form popularity

FAQ

Maryland Foreclosures: A Quasi-Judicial Process. Most foreclosures in Maryland are what's called nonjudicial or quasi-judicial. With a nonjudicial foreclosure, the lender must complete specific out-of-court steps detailed in state law before selling the property.

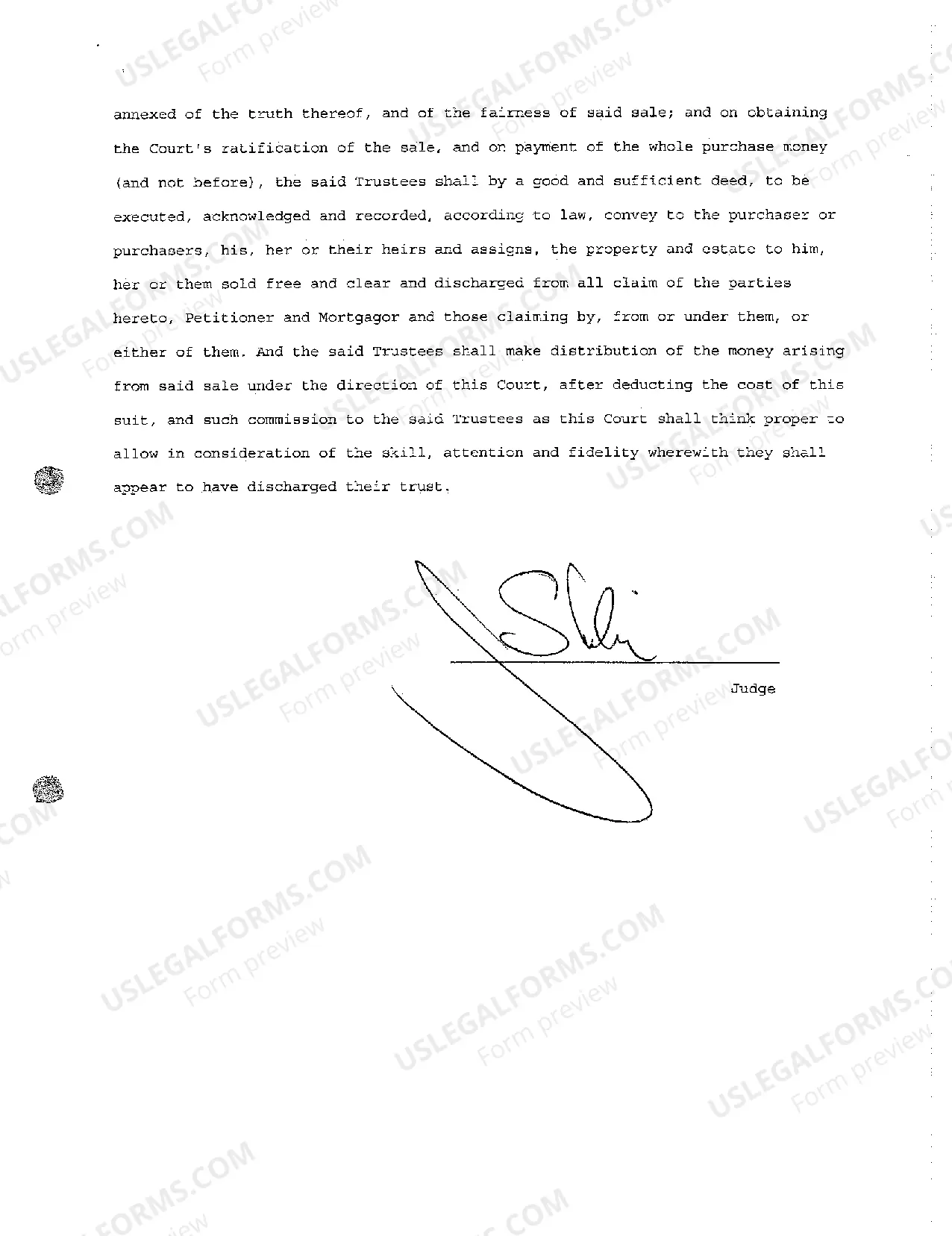

While you can't redeem your home after the foreclosure sale in Maryland, you do get what is called an "equitable right of redemption" before the sale is finalized.Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.

States that allow for statutory redemption include California, Illinois, Florida, and Texas.

Maryland is a recourse (deficiency) state. The lender can pursue you for the deficiency. If you can't afford it, you can file bankruptcy to discharge it, or try to work out a deal for a deed in lieu, to surrender the property in satisfaction of the debt.

(Md. Code Ann., Tax-Prop. § 14-833). These six months are called a "redemption period." (In Baltimore City, the redemption period is nine months from the date of sale for owner-occupied residential properties.

Foreclosure auctions are usually held at the courthouse in the county where the property is located. After a sale has taken place, it usually takes approximately 30-45 days for the sale to be ratified, however the ratification time can vary significantly from county to county.

Some states allow foreclosed homeowners to repurchase their property after the foreclosure sale during a post-sale redemption period, but Maryland isn't one of them.

Maryland is a recourse (deficiency) state. The lender can pursue you for the deficiency. If you can't afford it, you can file bankruptcy to discharge it, or try to work out a deal for a deed in lieu, to surrender the property in satisfaction of the debt.