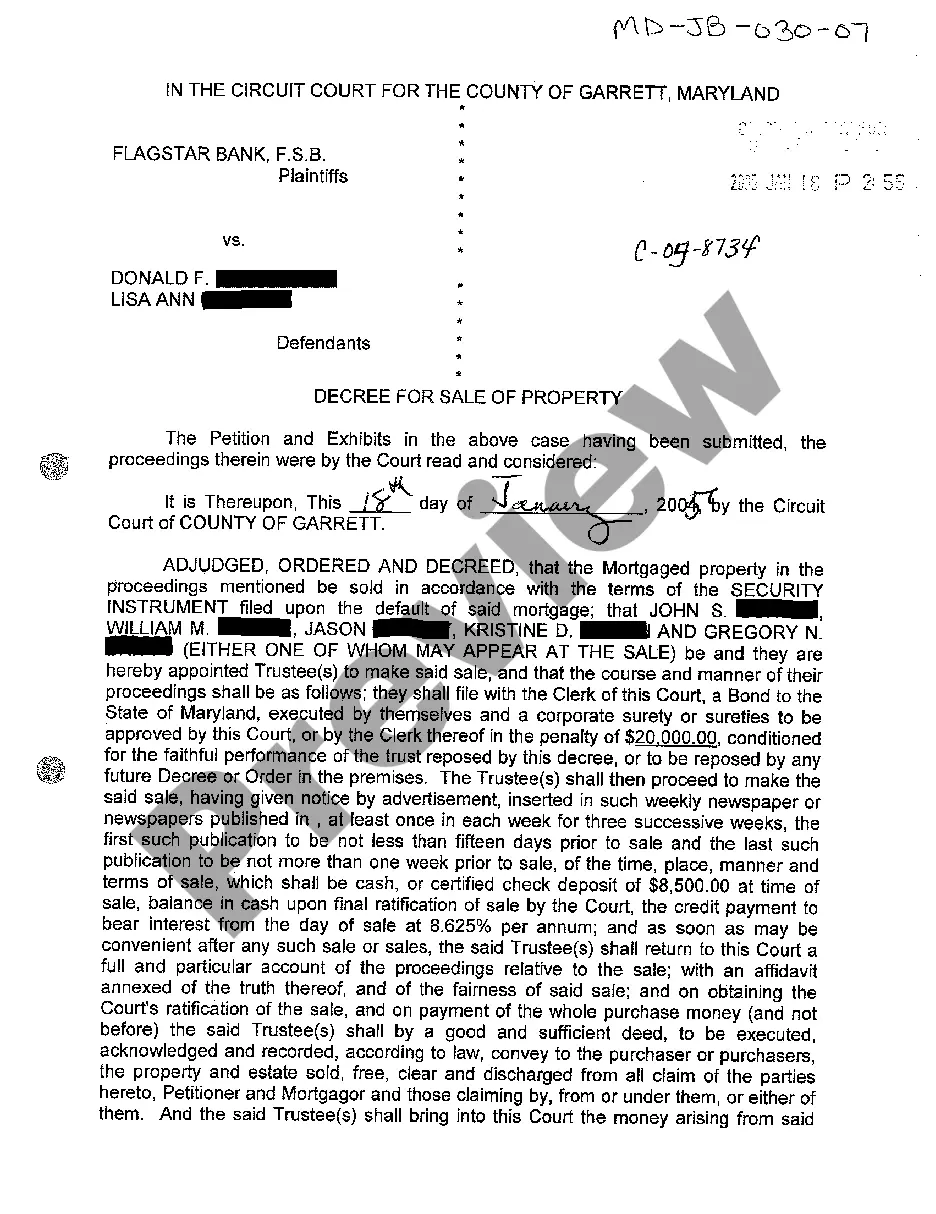

Maryland Decree for Sale of Property

Description

How to fill out Maryland Decree For Sale Of Property?

Welcome to the biggest legal files library, US Legal Forms. Right here you can find any sample such as Maryland Decree for Sale of Property forms and save them (as many of them as you want/need to have). Get ready official files in just a few hours, rather than days or weeks, without spending an arm and a leg with an legal professional. Get your state-specific form in a few clicks and be assured with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and then click Download near the Maryland Decree for Sale of Property you need. Because US Legal Forms is online solution, you’ll always get access to your downloaded forms, regardless of the device you’re using. Locate them within the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check out our instructions below to get started:

- If this is a state-specific form, check its validity in your state.

- See the description (if offered) to understand if it’s the proper template.

- See a lot more content with the Preview function.

- If the sample matches your needs, just click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to sign up.

- Download the document in the format you want (Word or PDF).

- Print the document and fill it with your/your business’s info.

When you’ve filled out the Maryland Decree for Sale of Property, send out it to your legal professional for confirmation. It’s an additional step but an essential one for making certain you’re fully covered. Sign up for US Legal Forms now and access a large number of reusable examples.

Form popularity

FAQ

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

At the tax sale, which is a public auction, your property will be sold to the highest bidder who is willing to pay at least the total amount of all taxes due, together with interest, penalties, and expenses related to the sale.The winning bidder then gets a certificate of sale. (Md. Code Ann., Tax-Prop.

The unpaid taxes are auctioned off at a tax lien sale. The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.

States such as Maryland are withholding a portion of real estate proceeds from out-of-state residents, to ensure sellers pay capital gains tax to Maryland on top of the seller's home state and the federal government.

Before adding your spouse to the deed, speak with your attorney. The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

In most states you can file a disclaimer or deed of disclaimer that says specifically you were placed in title without your knowledge or consent and disclaim the deed.

If you are adding your spouse or other party to the deed, put your name in the "Transferred From" line and place both your name and the other person's name in the "Transferred To" section. Failure to put your name in the "Transferred To" section will make the new person the sole owner of the house.

The law doesn't forbid adding people to a deed on a home with an outstanding mortgage. Mortgage lenders are familiar and frequently work with deed changes and transfers.When you "deed" your home to someone, you've effectively transferred part ownership, which could activate the "due-on-sale" clause.