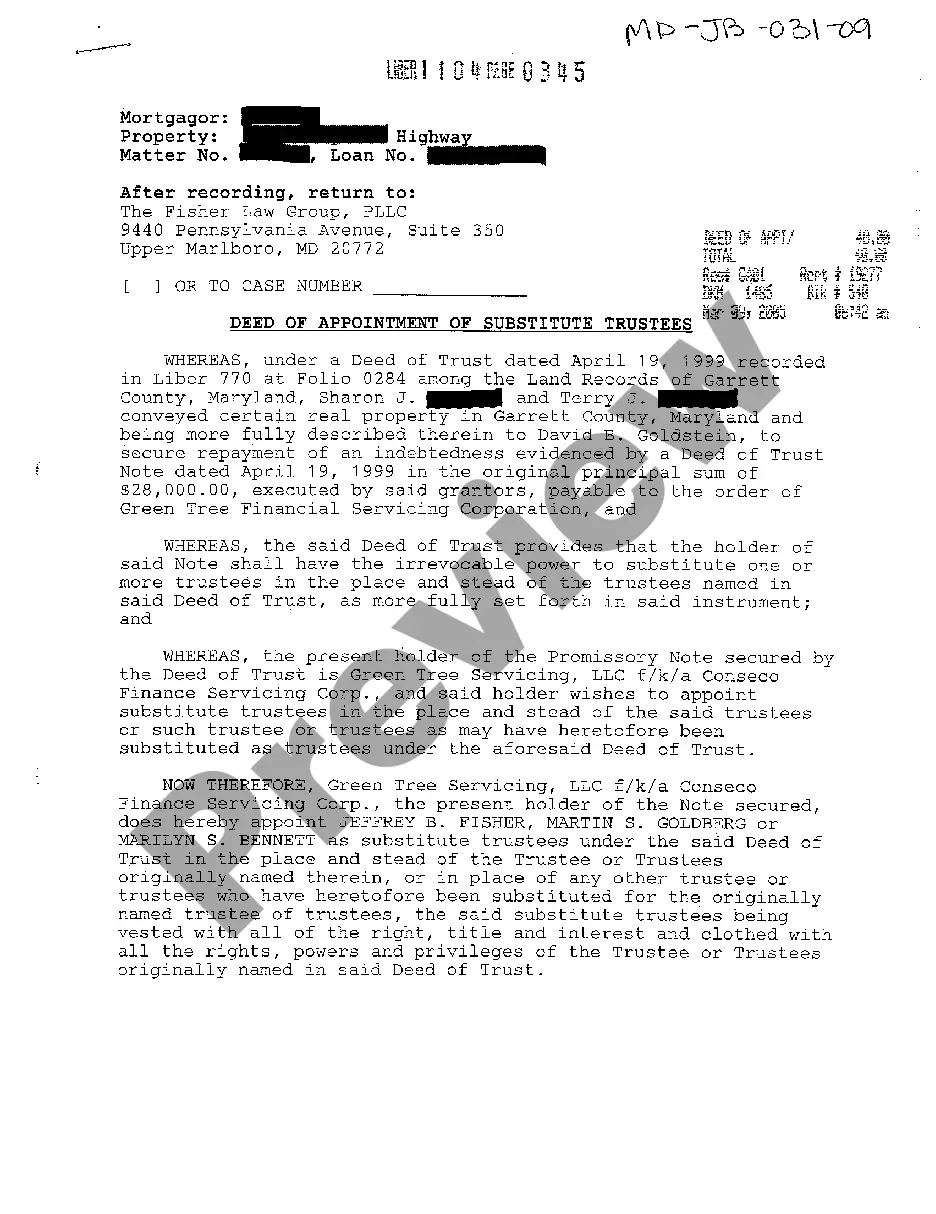

Maryland Deed of Appointment of Substitute Trustees

Description

How to fill out Maryland Deed Of Appointment Of Substitute Trustees?

You are welcome to the greatest legal documents library, US Legal Forms. Here you can get any template such as Maryland Deed of Appointment of Substitute Trustees templates and save them (as many of them as you want/require). Make official papers in a several hours, rather than days or even weeks, without having to spend an arm and a leg on an legal professional. Get your state-specific example in a few clicks and be confident understanding that it was drafted by our qualified attorneys.

If you’re already a subscribed consumer, just log in to your account and click Download next to the Maryland Deed of Appointment of Substitute Trustees you require. Because US Legal Forms is web-based, you’ll always have access to your saved files, no matter what device you’re using. Locate them inside the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check out our instructions below to begin:

- If this is a state-specific form, check out its validity in your state.

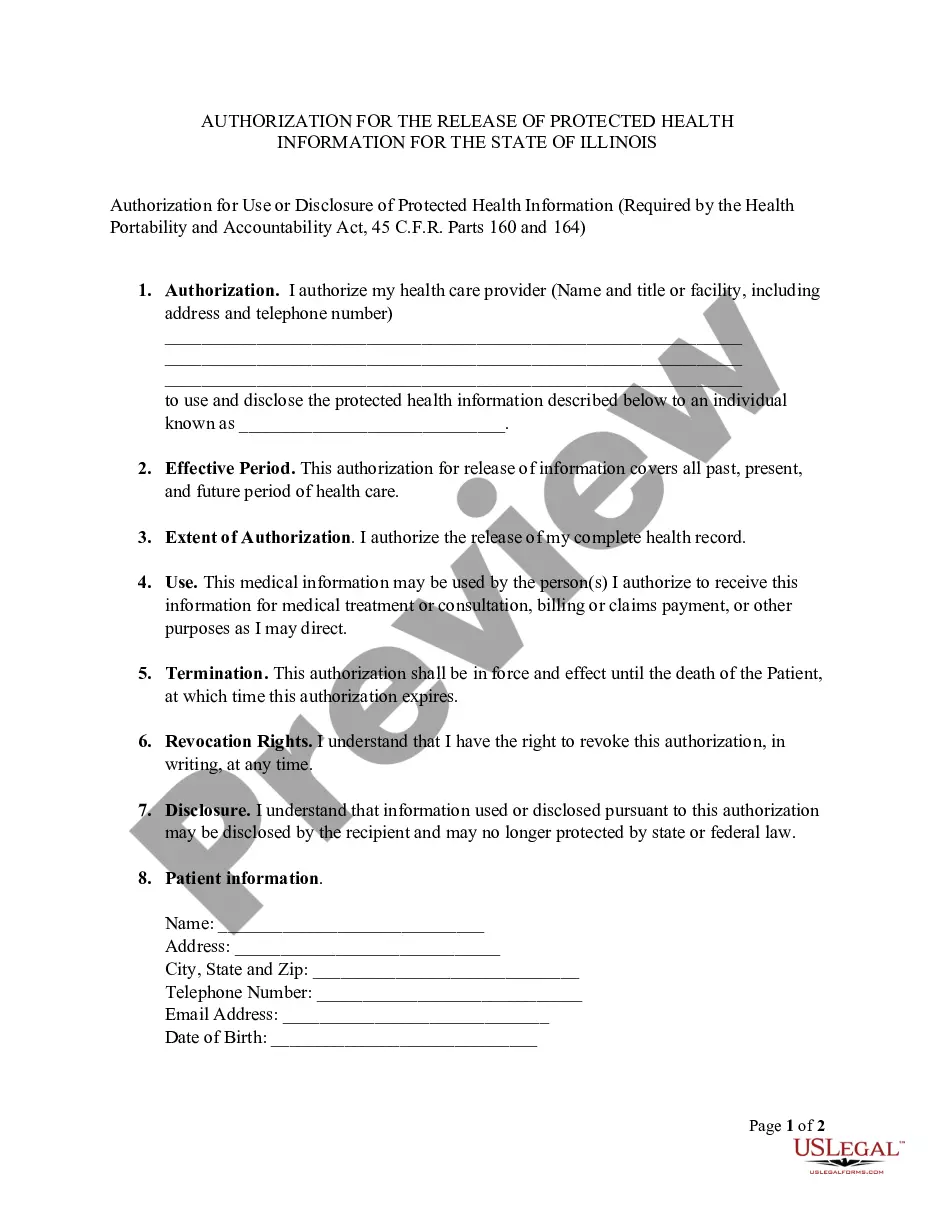

- View the description (if offered) to understand if it’s the correct template.

- See much more content with the Preview feature.

- If the sample fulfills all your needs, just click Buy Now.

- To create your account, select a pricing plan.

- Use a card or PayPal account to register.

- Download the document in the format you want (Word or PDF).

- Print the document and fill it with your/your business’s info.

Once you’ve completed the Maryland Deed of Appointment of Substitute Trustees, give it to your lawyer for verification. It’s an extra step but an essential one for being confident you’re completely covered. Become a member of US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

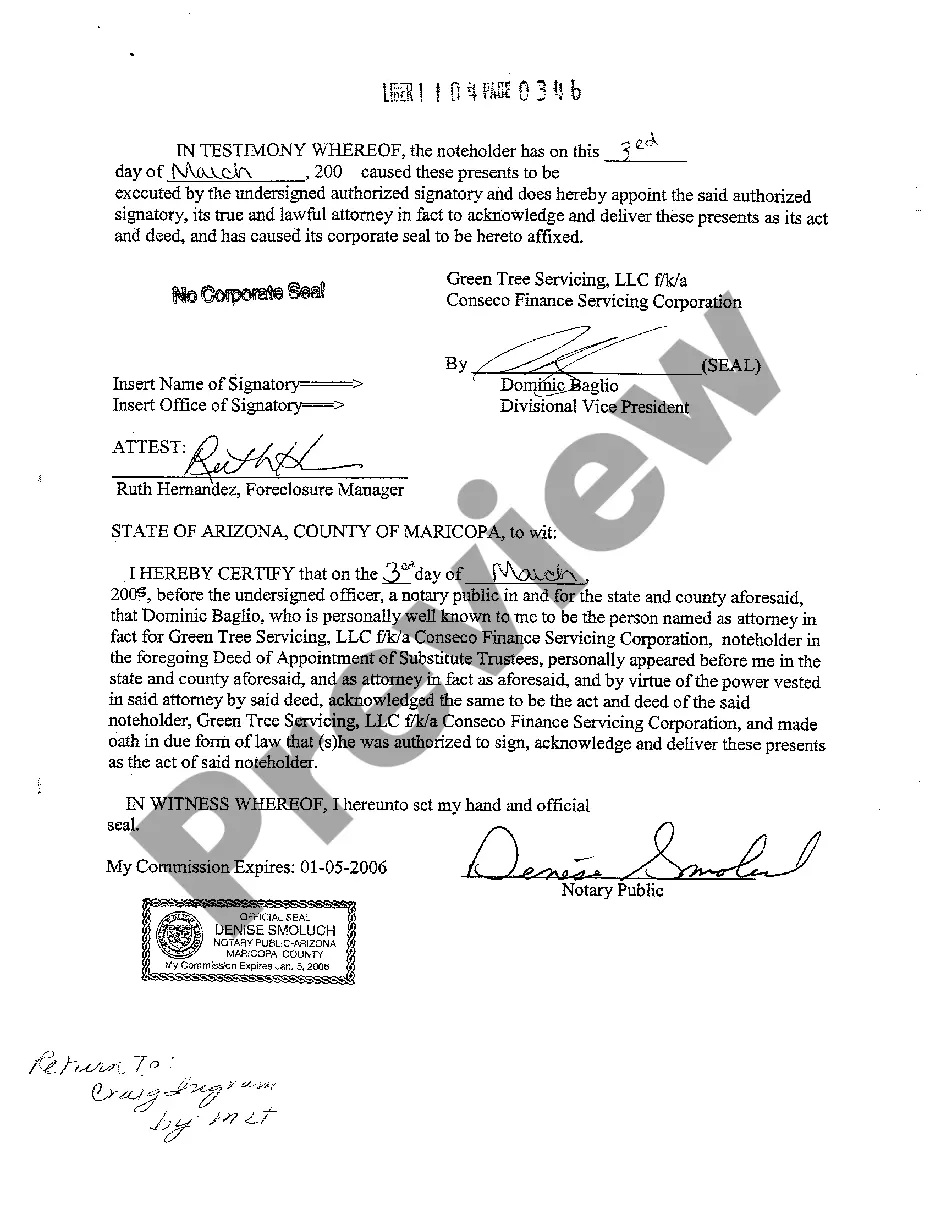

The trustee will then issue a reconveyance deed, which gives the legal title of the property to you.Instead, the original trustee, or sometimes the loan servicing company, will appoint a new Substitute Trustee to handle the foreclosure. To do this, they must file an Appointment of Substitute Trustees.

Under Maryland Real Property §7-105 and Maryland Rule 14-214(b)(2), corporate trustees may not exercise the power of sale. An individual (i.e., a natural person) appointed as trustee in a deed of trust or as a substitute trustee shall conduct the sale of property subject to a deed of trust.

A substitution of trustee is a legal document that provides public notice regarding a foreclosure. California is one of several states that allows for mortgage foreclosure through a private transaction called a trustee's sale.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender.If the bank chooses to appoint a new trustee at the time the loan is paid and/or the obligation is satisfied, they will substitute a new trustee.