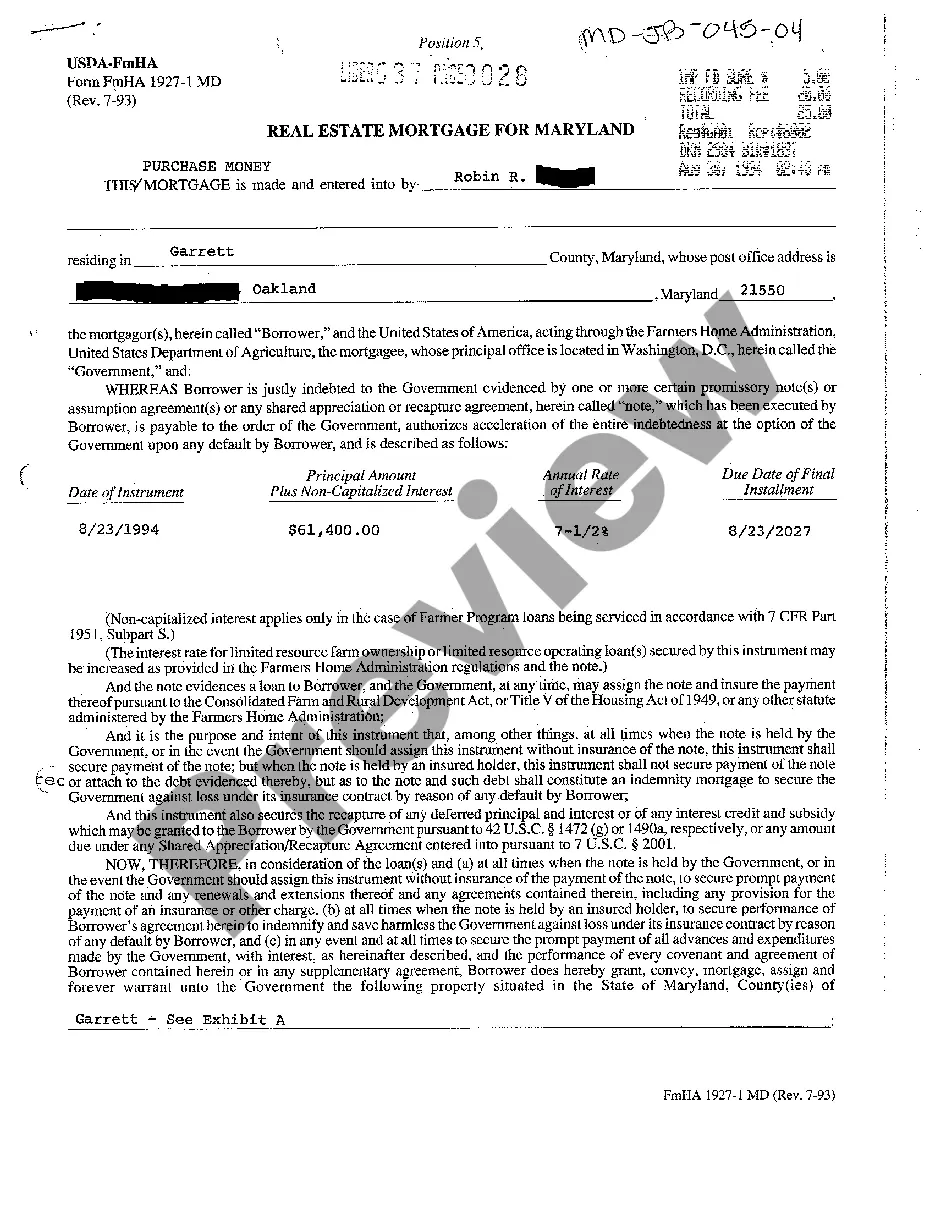

Maryland Real Estate Mortgage

Description

How to fill out Maryland Real Estate Mortgage?

You are welcome to the most significant legal documents library, US Legal Forms. Here you can get any sample including Real Estate Mortgage for Maryland templates and download them (as many of them as you want/require). Prepare official papers with a couple of hours, instead of days or weeks, without having to spend an arm and a leg on an attorney. Get your state-specific form in a couple of clicks and be confident understanding that it was drafted by our accredited legal professionals.

If you’re already a subscribed customer, just log in to your account and then click Download near the Real Estate Mortgage for Maryland you require. Due to the fact US Legal Forms is online solution, you’ll generally have access to your saved forms, no matter the device you’re utilizing. Locate them within the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check out our guidelines below to start:

- If this is a state-specific document, check out its validity in your state.

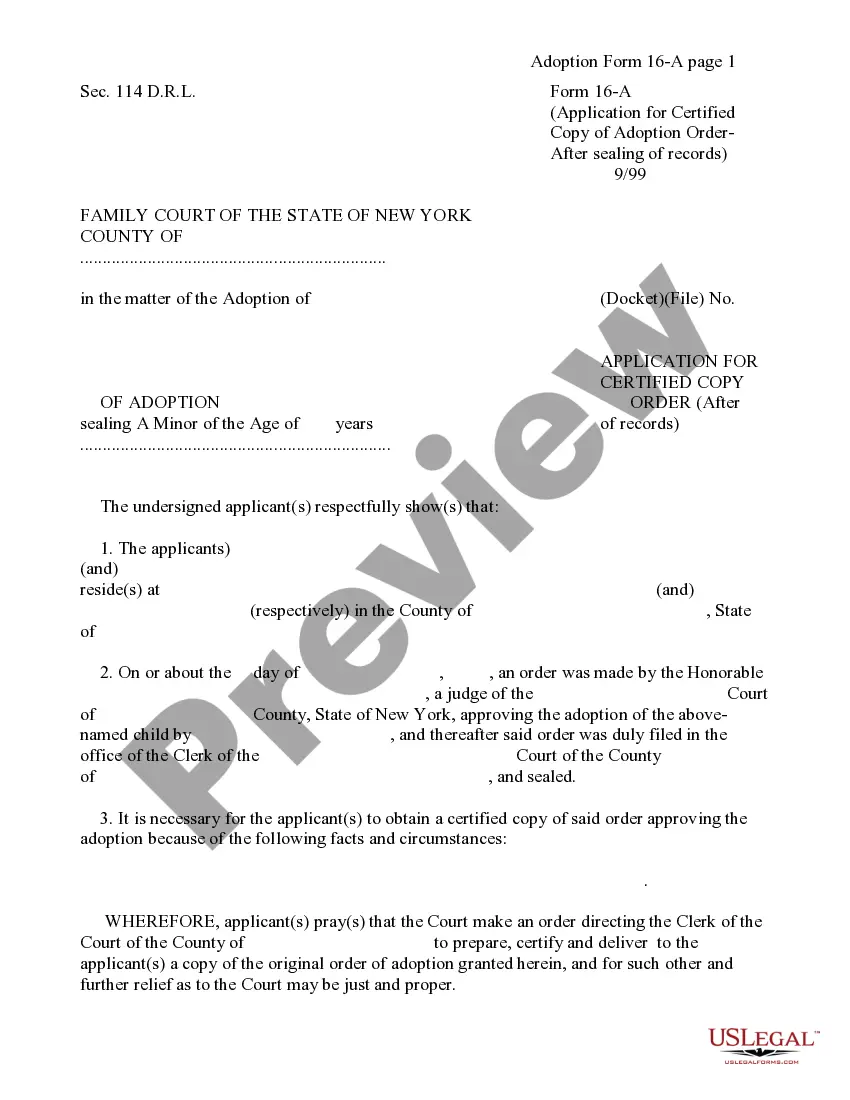

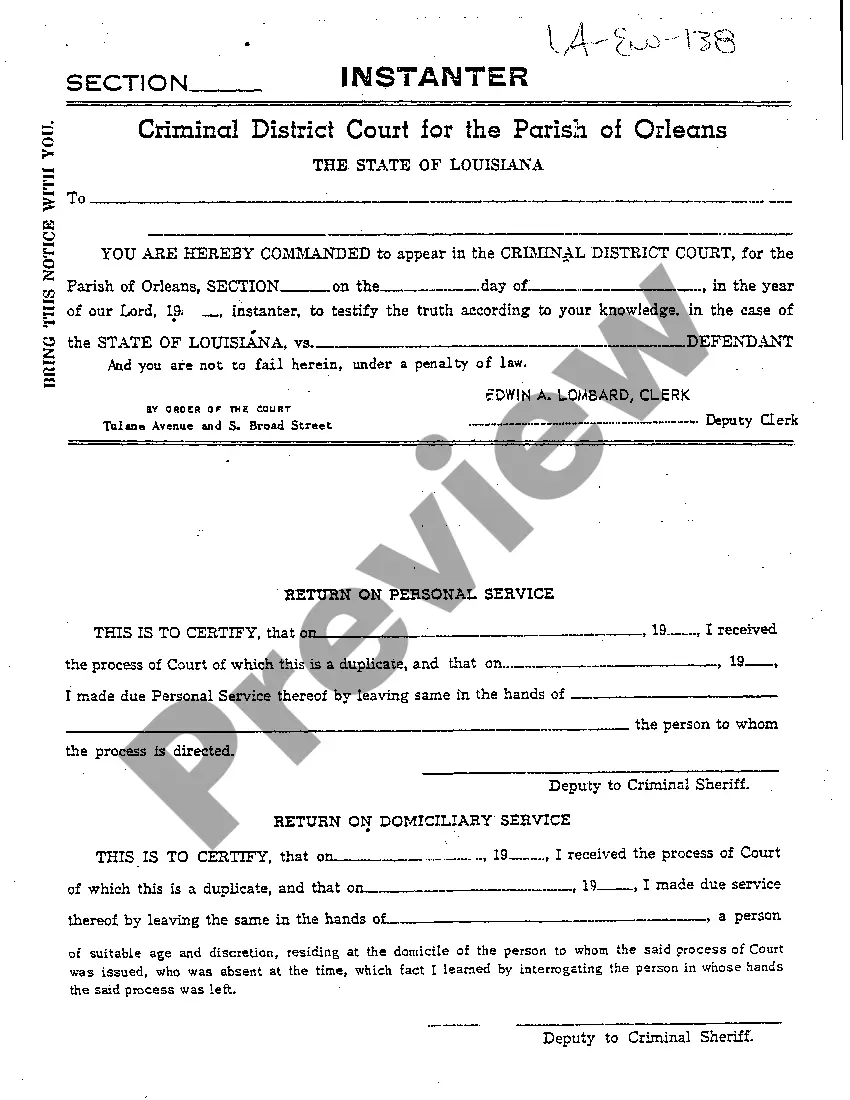

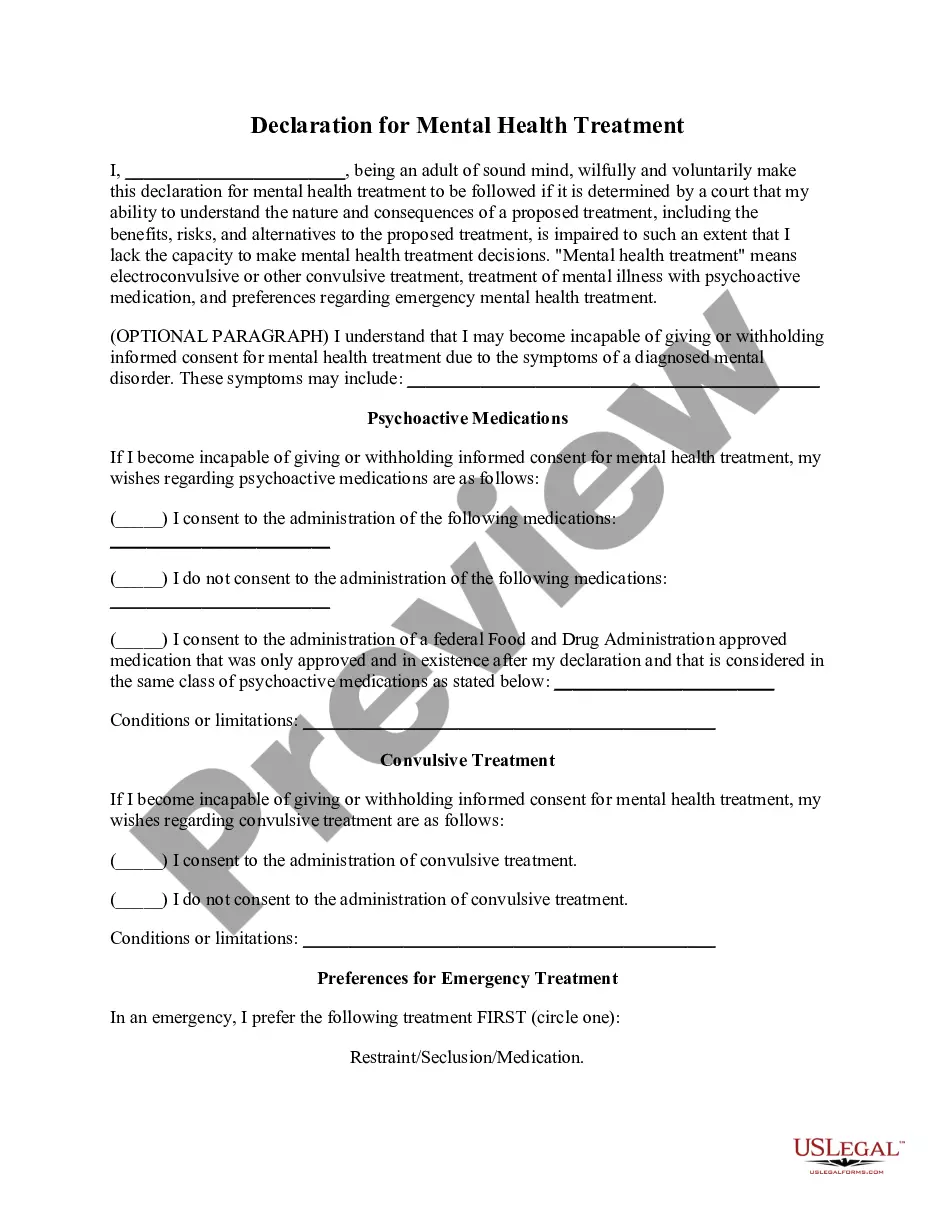

- See the description (if accessible) to learn if it’s the correct template.

- See far more content with the Preview feature.

- If the example fulfills all of your needs, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a credit card or PayPal account to join.

- Download the document in the format you need (Word or PDF).

- Print out the file and complete it with your/your business’s info.

Once you’ve completed the Real Estate Mortgage for Maryland, send it to your legal professional for verification. It’s an additional step but a necessary one for making sure you’re totally covered. Sign up for US Legal Forms now and get access to thousands of reusable examples.

Form popularity

FAQ

The Maryland Mortgage Program, available through the Maryland Department of Housing and Community Development, provides home loans and down payment assistance to Maryland's working families to encourage responsible homeownership and build strong communities, working through a network of Maryland Mortgage Program lender

A Maryland HomeCredit, generically referred to as a mortgage credit certificate, allows eligible homebuyers to claim a federal tax credit of up to $2,000 every year, for the life of the loan.This amount can be claimed as a tax credit each year until the loan is paid off, refinanced, transferred, or the home is sold.

To be eligible for financing programs targeted for first-time homebuyers, most lenders in Maryland follow the U.S. Department of Housing and Urban Development (HUD) definition: a first time homebuyer is an individual who has not had an ownership interest in a principal residence (anywhere) for the previous three (3)

The Maryland Mortgage Program (MMP) helps homebuyers in Maryland achieve their dream of homeownership through a range of programs that make purchasing and owning a home more affordable. MMP home loans are 30-year fixed-rate loans available as either Government or Conventional insured loans.

A 1st time buyer needs to have a 3.5% down payment when using an FHA loan. For example, that is $7,000 on a $200,000 home, $12,250 on a $300,000 home, or $14,000 on a $400,000 home. The seller can pay all of the buyer's closing costs on most purchases in Maryland (up to 6% of the price of the house).

Conventional loans require a 20% down payment, but FHA loans only require you provide 3.5% of your new home's value at the time of purchase. However, to receive the full potential of this perk, you must have a FICO® credit score of 580 or better.