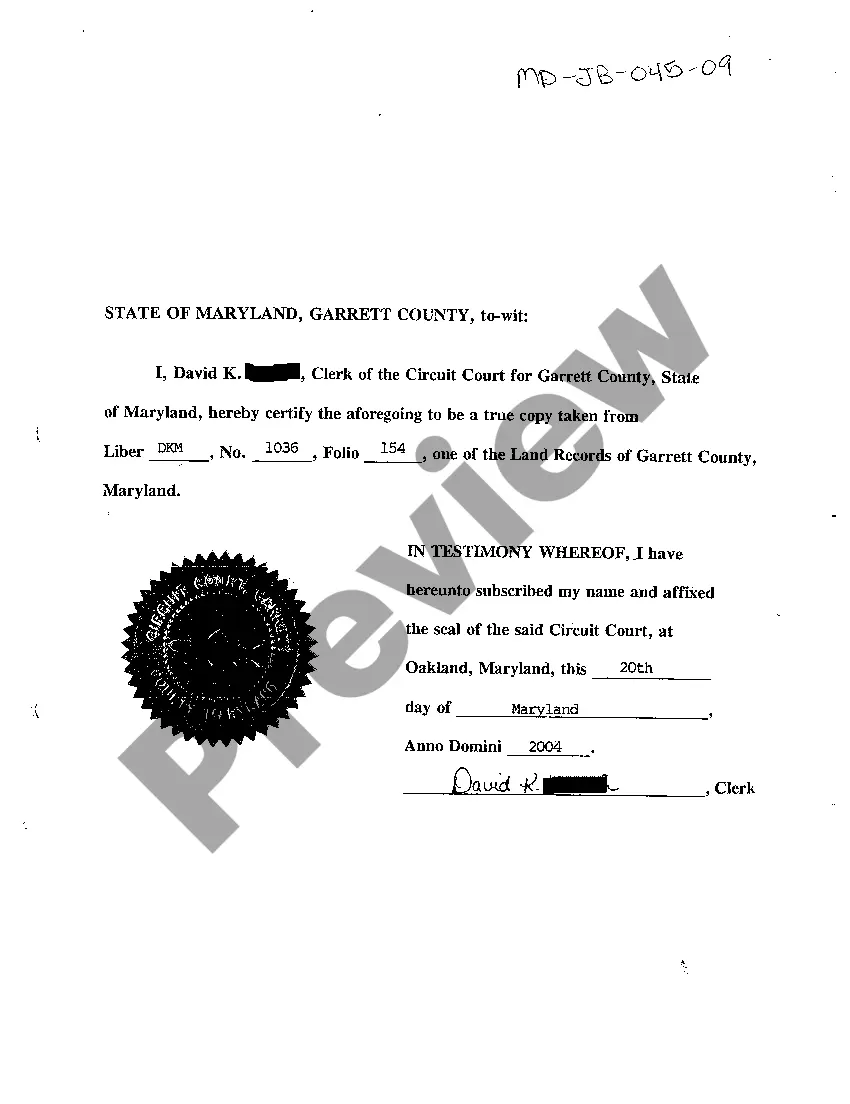

Maryland Certificate of Land Record

Description

How to fill out Maryland Certificate Of Land Record?

You are invited to the premier legal documents library, US Legal Forms. Here you can obtain any template such as Maryland Certificate of Land Record forms and save them (as many copies as you desire/need). Prepare formal documents within a few hours, rather than days or weeks, without having to spend a fortune with an attorney. Acquire the state-specific form in just a few clicks and be assured knowing that it was created by our state-licensed lawyers.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Certificate of Land Record you require. Since US Legal Forms is online, you’ll typically have access to your downloaded forms, no matter the device you’re using. View them within the My documents section.

If you don't have an account yet, what are you waiting for? Follow our instructions outlined below to get started.

Once you’ve completed the Maryland Certificate of Land Record, forward it to your attorney for approval. It’s an additional step but a crucial one for ensuring you’re completely safeguarded. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific form, confirm its relevance in the state where you reside.

- Review the description (if available) to determine if it’s the correct template.

- Explore additional details with the Preview feature.

- If the template satisfies all your criteria, click Buy Now.

- To create your account, select a subscription plan.

- Utilize a credit card or PayPal account to sign up.

- Download the template in the format you prefer (Word or PDF).

- Print the document and fill it out with your/your company's details.

Form popularity

FAQ

Bhoomi is the project for the online delivery and management of land records in Karnataka.

Deeds can be viewed for free online through mdlandrec.net. You must create an account with the Maryland State Archives to view deeds on mdlandrec.net. Many courthouses also have computer terminals you can use to search or review deeds.

When the Land Records clerk is satisfied that the correct documents have been submitted, the clerk will accept the documents for filing. After your documents are recorded, the original deed will be mailed to you, which often takes 4-6 weeks.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

Liens against property can be recorded at the Department of Land Records alongside deeds. Search for liens online using Maryland Land Records (mdlandrec.net). Some liens come from court judgments. Unpaid taxes on the property may result in a lien.

If you default on your property taxes in Maryland, you could lose your home to a tax sale.If you don't pay your Maryland property taxes, the tax collector can sell your home at a tax sale to pay off the delinquent amounts.

Preliminary Title Report- California case law is clear that a preliminary title report cannot be relied upon as a true and reliable condition of title to real property.No duties or liabilities arise with a preliminary title report. Therefore, there is no liability to a title company if any recorded document is missed.

1ask neighbours or adjoining landowners if they know who the owner(s) might be;2ask local residents if they have any ideas about who might own it, as they may have lived in the area for a number of years and have 'local knowledge';3ask in the local pub, post office or shop;Searching for the owner of unregistered land - HM Land Registry\nhmlandregistry.blog.gov.uk > 2018/02/05 > search-owner-unregistered-land