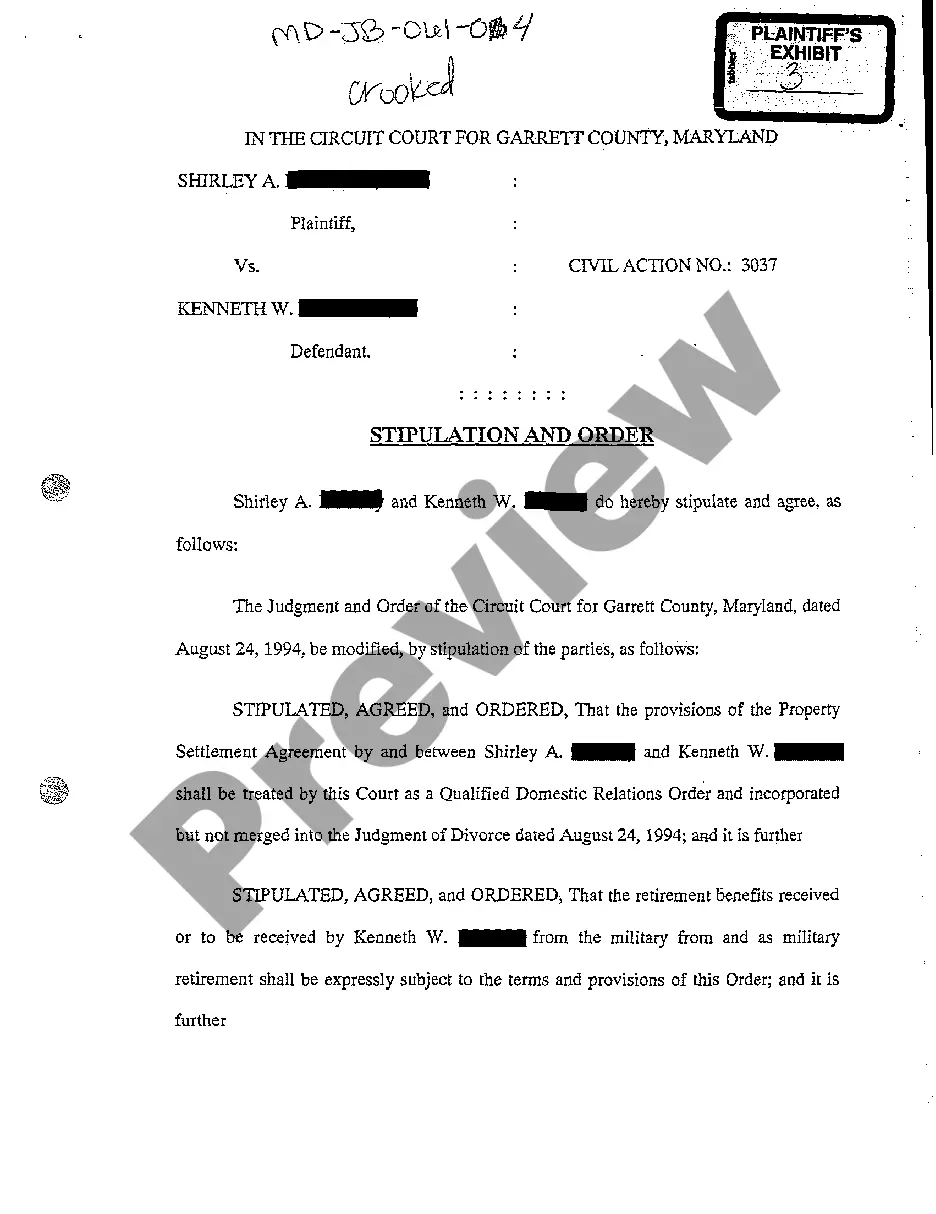

Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree

Description Qdro Services Maryland

How to fill out Maryland Stipulation And Order That Retirement Benefits Be Paid Out In Accordance With Divorce Decree?

You are welcome to the biggest legal files library, US Legal Forms. Here you will find any sample including Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree forms and save them (as many of them as you wish/require). Prepare official documents in a few hours, rather than days or weeks, without spending an arm and a leg on an lawyer or attorney. Get the state-specific sample in clicks and feel confident knowing that it was drafted by our accredited legal professionals.

If you’re already a subscribed user, just log in to your account and then click Download near the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree you want. Because US Legal Forms is web-based, you’ll generally have access to your saved templates, no matter the device you’re using. See them in the My Forms tab.

If you don't have an account yet, what exactly are you awaiting? Check our guidelines listed below to start:

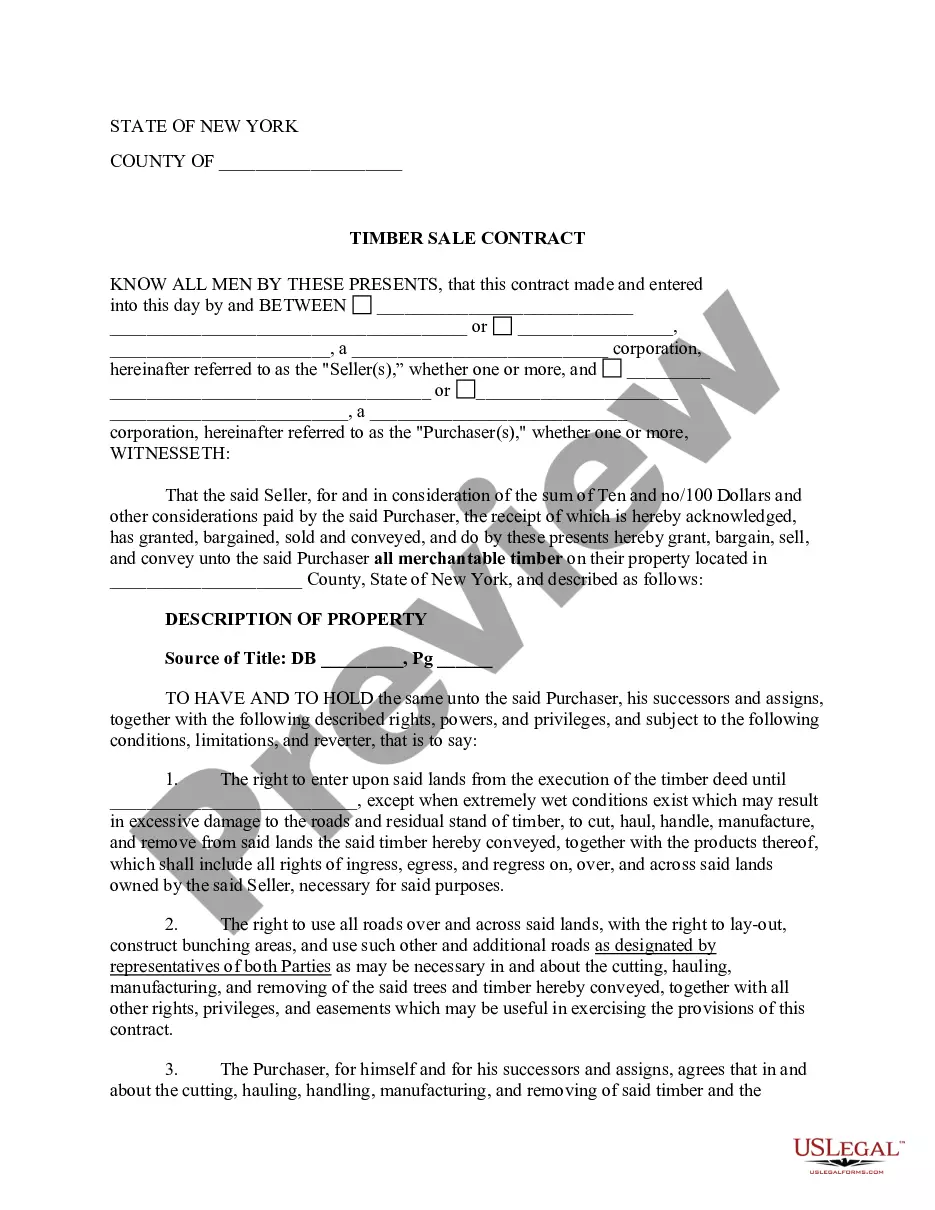

- If this is a state-specific document, check its validity in the state where you live.

- View the description (if readily available) to learn if it’s the proper template.

- See more content with the Preview option.

- If the document meets all your requirements, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a card or PayPal account to sign up.

- Save the document in the format you require (Word or PDF).

- Print the document and complete it with your/your business’s information.

As soon as you’ve filled out the Maryland Stipulation and Order that Retirement Benefits be Paid Out in Accordance with Divorce Decree, send it to your lawyer for confirmation. It’s an extra step but a necessary one for making confident you’re totally covered. Become a member of US Legal Forms now and access thousands of reusable examples.

Form popularity

FAQ

A QDRO will instruct the plan administrator on how to pay the non-employee spouse's share of the plan benefits. A QDRO allows the funds in a retirement account to be separated and withdrawn without penalty and deposited into the non-employee spouse's retirement account (typically an IRA).

The answer to this question depends on what type of retirement plan is being divided. If it is a defined contribution plan (a 401(k), 457, 403(b) or similar plan), or an IRA, the funds are typically transferred into an account in the alternate payee's name within two to five weeks.

Any funds contributed to the 401(k) account during the marriage are marital property and subject to division during the divorce, unless there is a valid prenuptial agreement in place.For example, if your spouse also has a retirement account worth a similar amount, you may each decide to keep your own accounts.

In terms of how much either spouse is entitled to, the rule of thumb is to divide pension benefits earned during the course of the marriage right down the middle. While that means your spouse would be able to lay claim to half, they would be limited to what was earned during the course of the marriage.

The answer to this question depends on what type of retirement plan is being divided. If it is a defined contribution plan (a 401(k), 457, 403(b) or similar plan), or an IRA, the funds are typically transferred into an account in the alternate payee's name within two to five weeks.

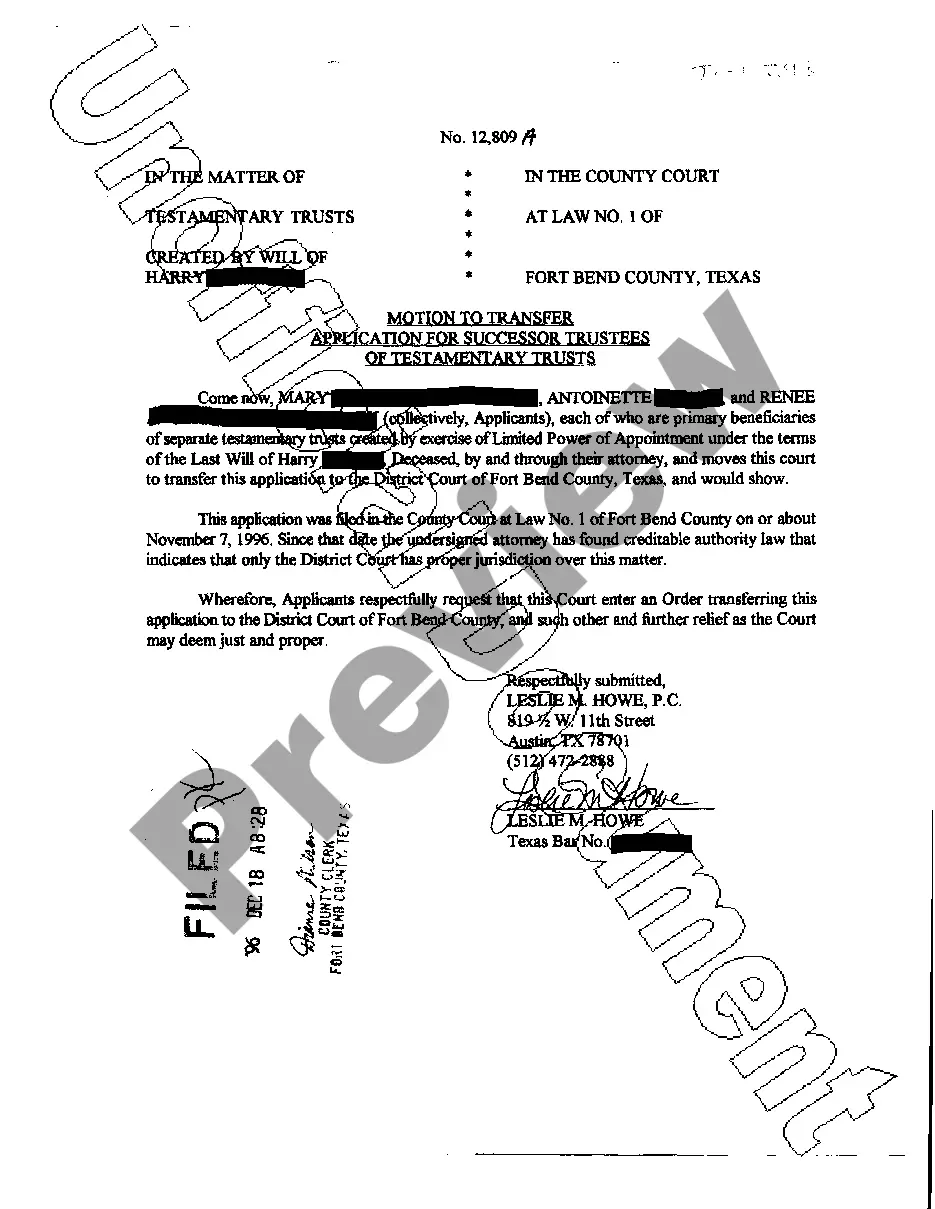

May a QDRO be part of the divorce decree or property settlement? Yes. There is nothing in ERISA or the Code that requires that a QDRO (that is, the provisions that create or recognize an alternate payee's interest in a participant's retirement benefits) be issued as a separate judgment, decree, or order.

If one spouse has a 401(k) worth $200,000, the divorcing couple could agree in the QDRO to split the account equally. In that case, $100,000 of the 401(k) balance can be transferred directly to the other spouse's IRA without incurring any federal income taxes or penalties.

You can receive up to 50% of your spouse's Social Security benefit. You can apply for benefits if you have been married for at least one year. If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years. Starting benefits early may lead to a reduction in payments.

Under California law, your marital assets will be split 50/50. That, unfortunately, will likely include your 401(k).