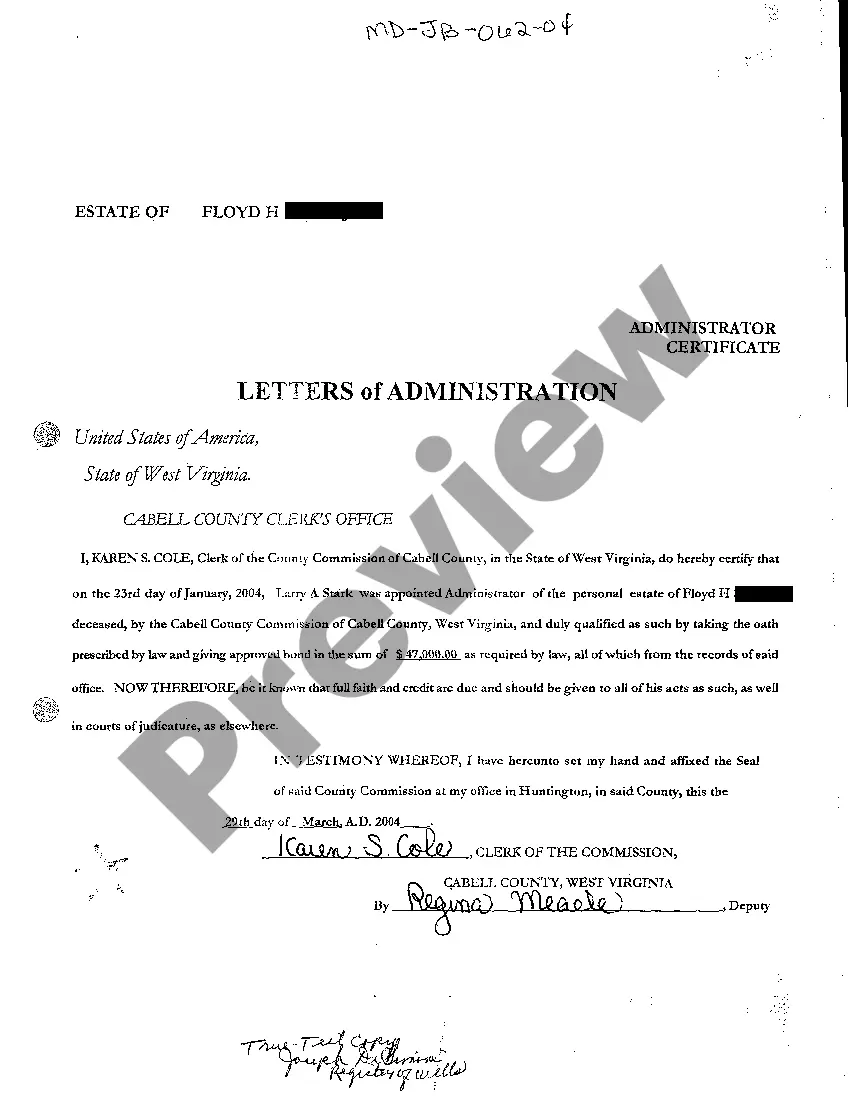

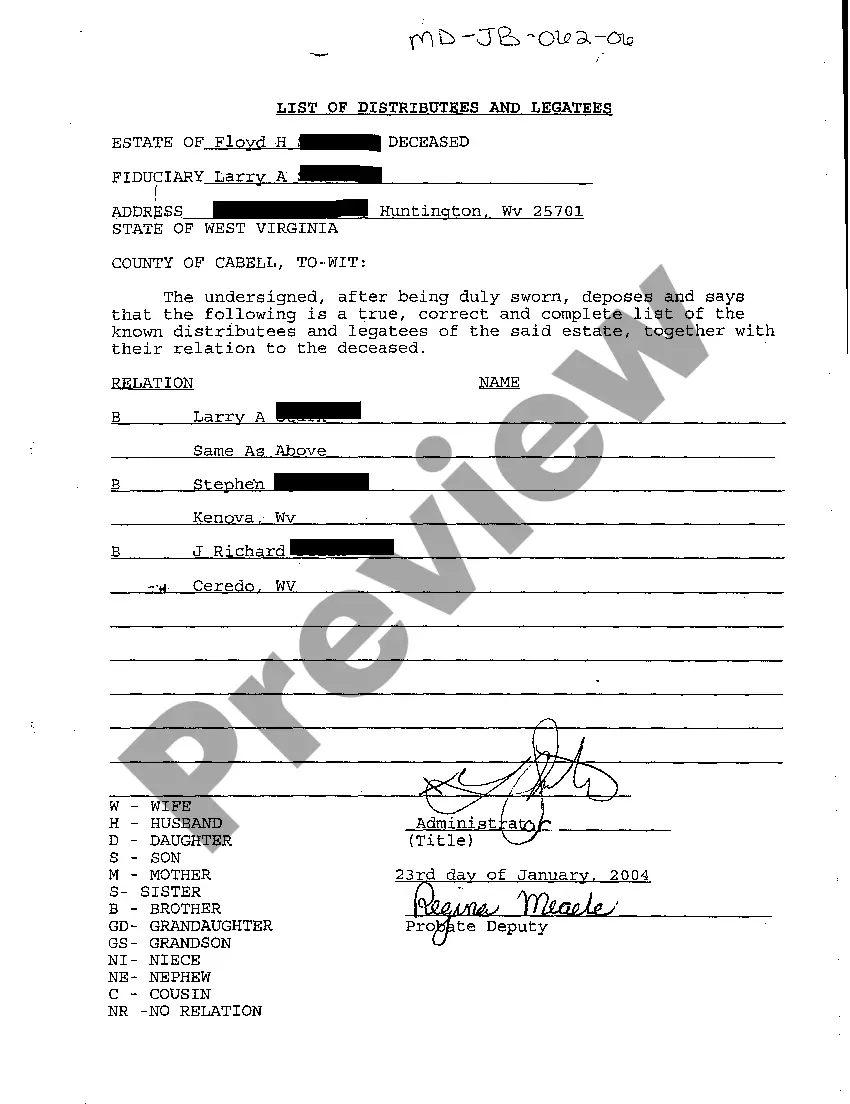

Maryland List of Distributees and Legatees

Description

How to fill out Maryland List Of Distributees And Legatees?

You are invited to the most important legal documents repository, US Legal Forms.

Here you can obtain any template such as Maryland List of Distributees and Legatees forms and retrieve them (as many of them as you require).

Prepare official papers within a few hours, rather than days or even weeks, without spending a fortune on an attorney.

If the example suits your requirements, click Buy Now. To establish an account, choose a pricing plan. Use a credit card or PayPal account to register. Download the document in the desired format (Word or PDF). Print the document and complete it with your or your business’s information. After finalizing the Maryland List of Distributees and Legatees, submit it to your lawyer for validation. It’s an additional measure but a crucial one for ensuring complete coverage. Sign up for US Legal Forms today and gain access to a vast array of reusable templates.

- Acquire your state-specific sample in just a few clicks and feel assured knowing that it was prepared by our experienced legal experts.

- If you are already a registered user, simply Log In to your account and then click Download next to the Maryland List of Distributees and Legatees you need.

- Since US Legal Forms is an online service, you will always have access to your saved files, regardless of the device you are using.

- View them in the My documents section.

- If you do not possess an account yet, what are you waiting for.

- Follow our guidelines below to get started.

- If this is a form specific to your state, verify its validity in your residing state.

- Review the description (if accessible) to see if it is the appropriate example.

Form popularity

FAQ

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

The Personal Representative is responsible for identifying probate assets (assets in the sole name of the decedent), filing the necessary forms and tax returns required by Law, paying from the estate assets administration expenses, valid creditor claims (including funeral expenses) and taxes (if there are any), and

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

In Maryland, a decedent cannot entirely disinherit a surviving spouse. If a Maryland decedent dies with a will, a surviving spouse has the right to renounce the will and elect to take an elective share.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Maryland Law requires that any one holding an original Will and/or Codicil(s) must file that document with the Register of Wills promptly after a decedent's death even if there are no assets. However, although the Will and/or Codicil are kept on file, no probate proceedings are required to be opened.

While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.