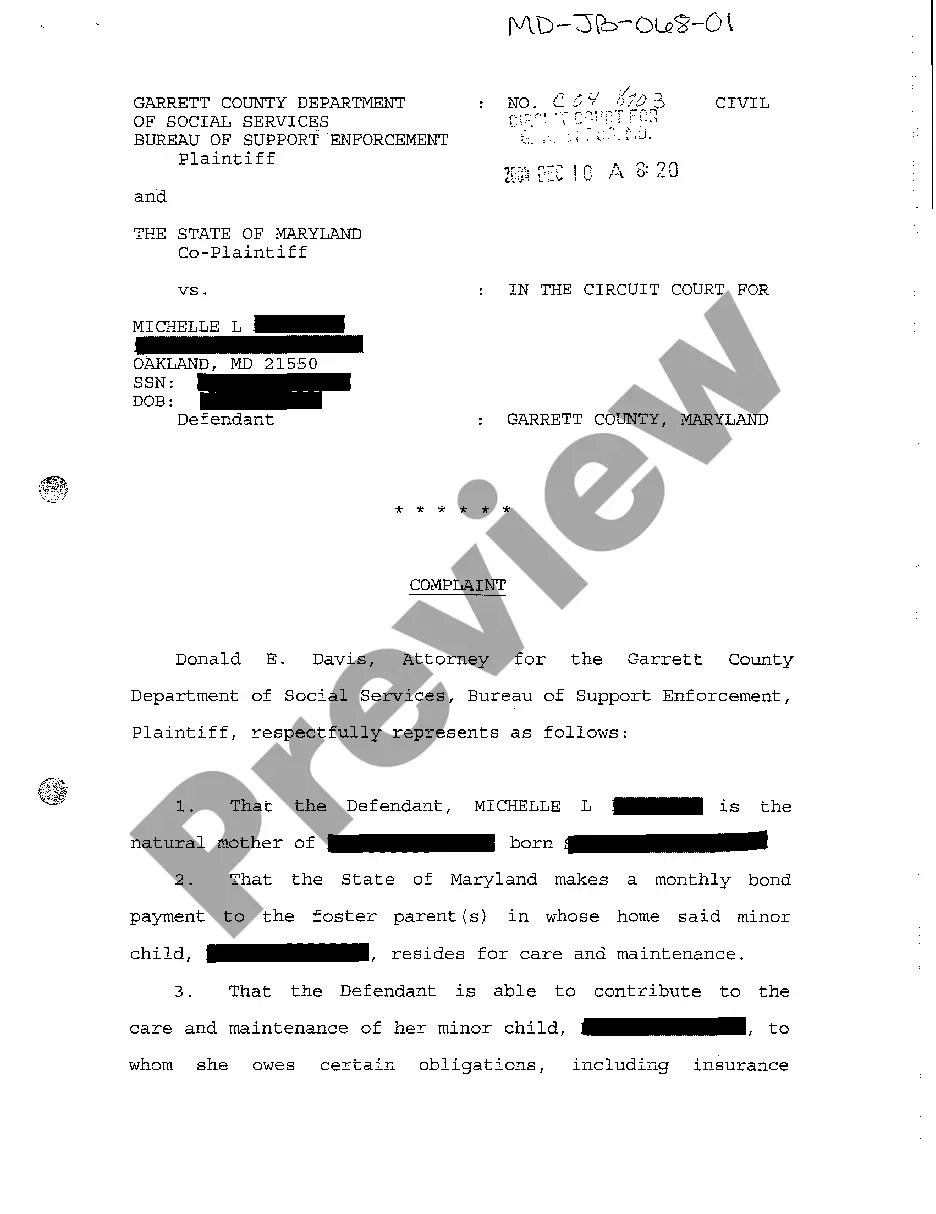

Maryland Complaint Withholding of Earnings for Purpose of Child Support

Description

How to fill out Maryland Complaint Withholding Of Earnings For Purpose Of Child Support?

You are welcome to the largest legal files library, US Legal Forms. Right here you can get any template including Maryland Complaint Withholding of Earnings for Purpose of Child Support templates and save them (as many of them as you wish/need to have). Get ready official papers within a several hours, rather than days or even weeks, without spending an arm and a leg on an legal professional. Get your state-specific example in a couple of clicks and be confident understanding that it was drafted by our accredited attorneys.

If you’re already a subscribed user, just log in to your account and click Download next to the Maryland Complaint Withholding of Earnings for Purpose of Child Support you require. Because US Legal Forms is online solution, you’ll always get access to your downloaded forms, no matter the device you’re utilizing. Locate them inside the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check our instructions below to start:

- If this is a state-specific document, check its validity in your state.

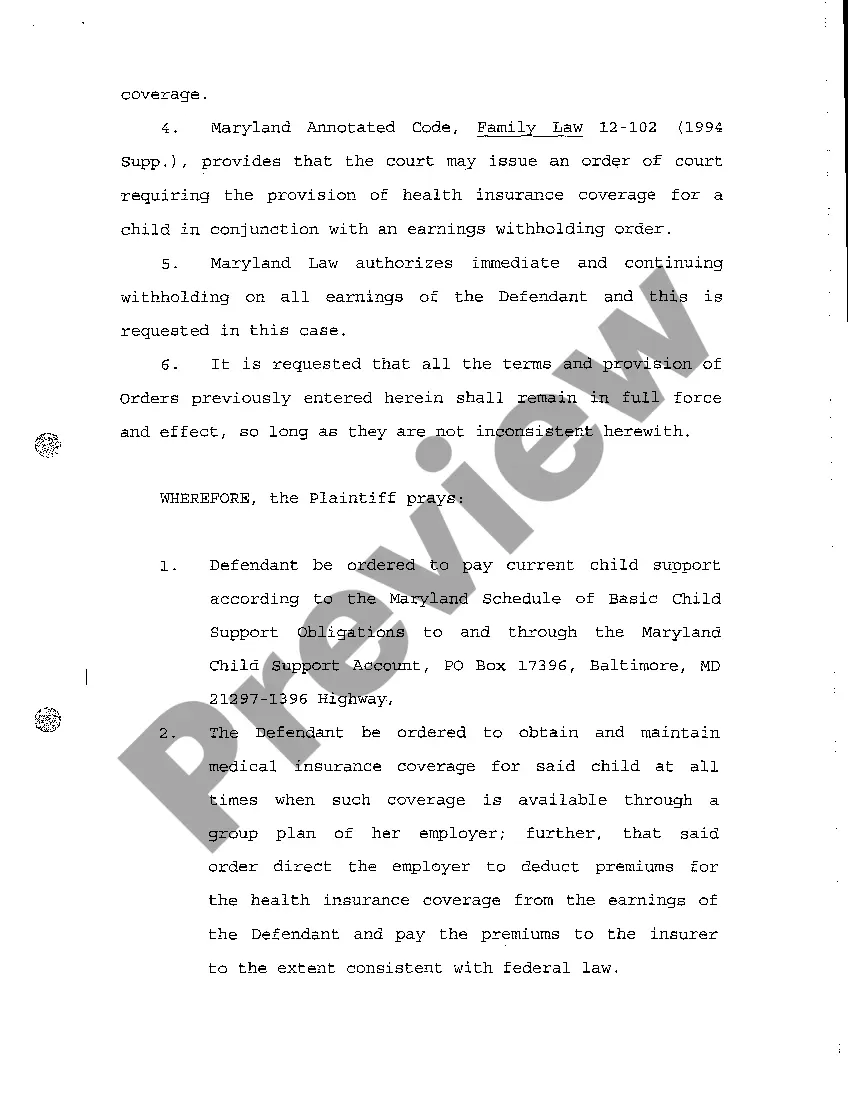

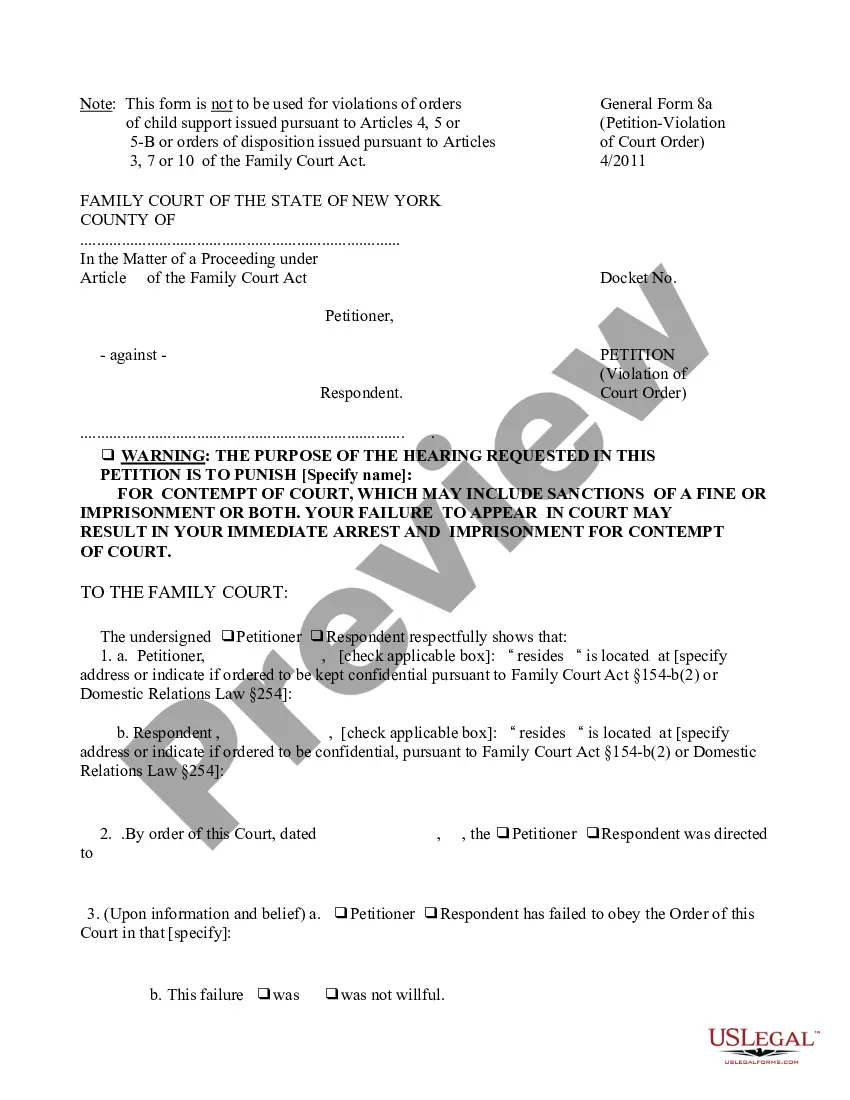

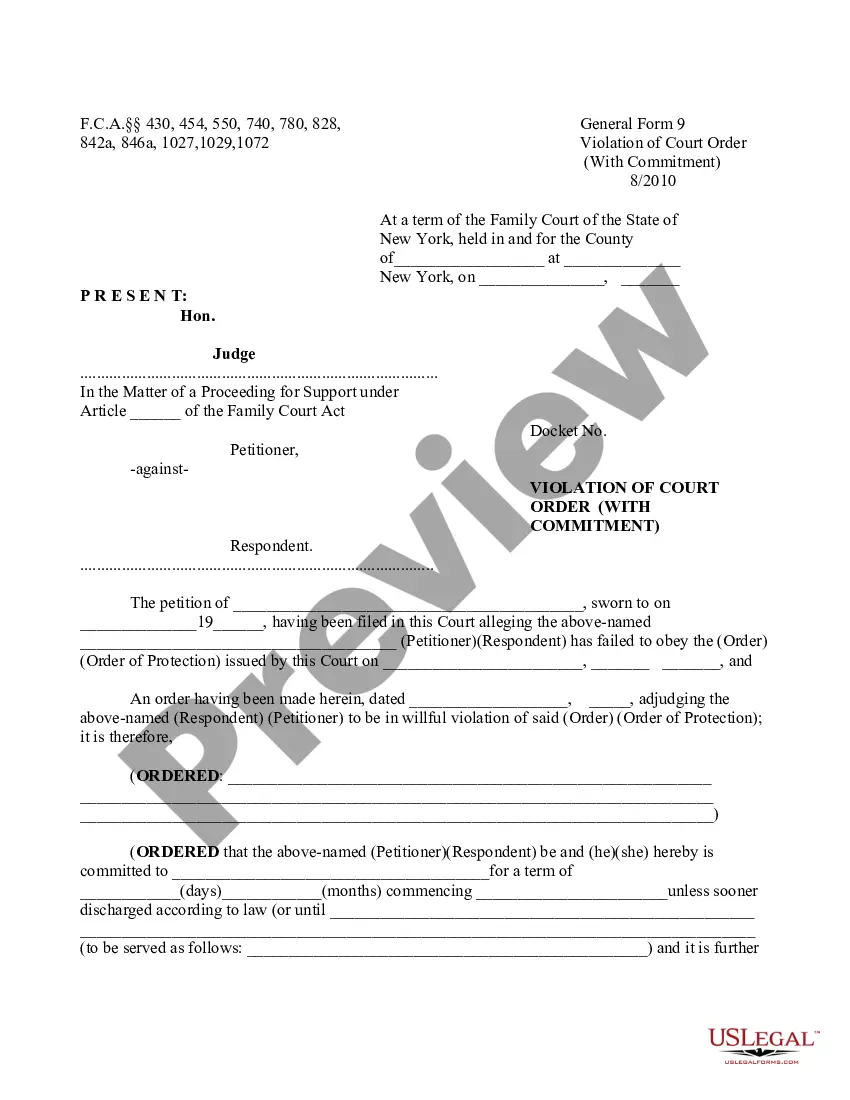

- See the description (if available) to learn if it’s the proper example.

- See much more content with the Preview function.

- If the example fulfills your needs, just click Buy Now.

- To make an account, choose a pricing plan.

- Use a card or PayPal account to sign up.

- Download the file in the format you want (Word or PDF).

- Print out the file and fill it out with your/your business’s info.

As soon as you’ve filled out the Maryland Complaint Withholding of Earnings for Purpose of Child Support, send it to your lawyer for verification. It’s an additional step but an essential one for making certain you’re fully covered. Sign up for US Legal Forms now and get thousands of reusable examples.

Form popularity

FAQ

Under Maryland law, child support continues until the minor child reaches the age of 18. It may be extended to age 19 if the child is still enrolled in high school.

The new MD child support guidelines provide for $2,847 per month in basic child support for an aggregate monthly income of $15,000. As with the old guidelines, the Court will have discretion in setting the support level for parties and individuals with income above the maximum under the guidelines of $15,000 per month.

No, child support is not a pre-tax deduction. You must withhold child support after you withhold taxes. Because most child support orders are based on disposable net income, you need to know how to calculate the employee's disposable income.

Under Maryland law, a person cannot agree with a spouse in order to avoid a court-ordered obligation to pay child support. Rather, there is a worksheet provided by the State of Maryland that allows you to input your own unique factors in order to estimate the amount the court will order you to pay.