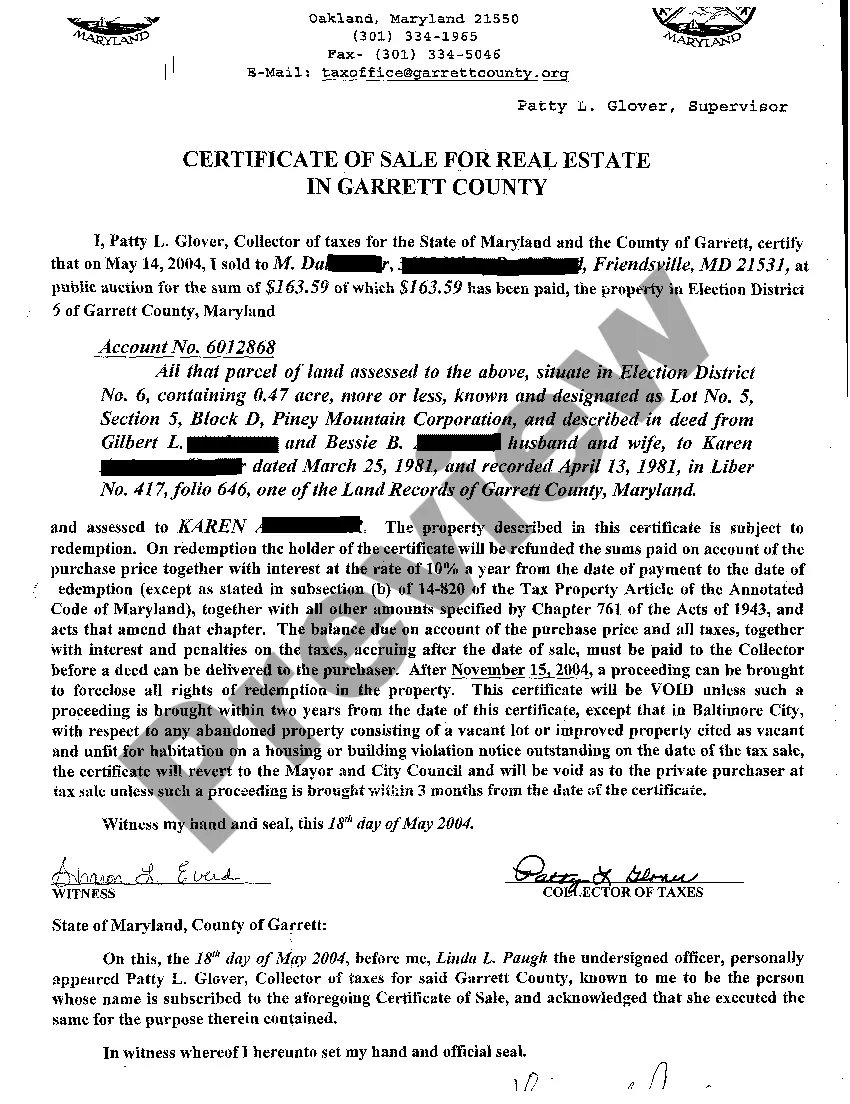

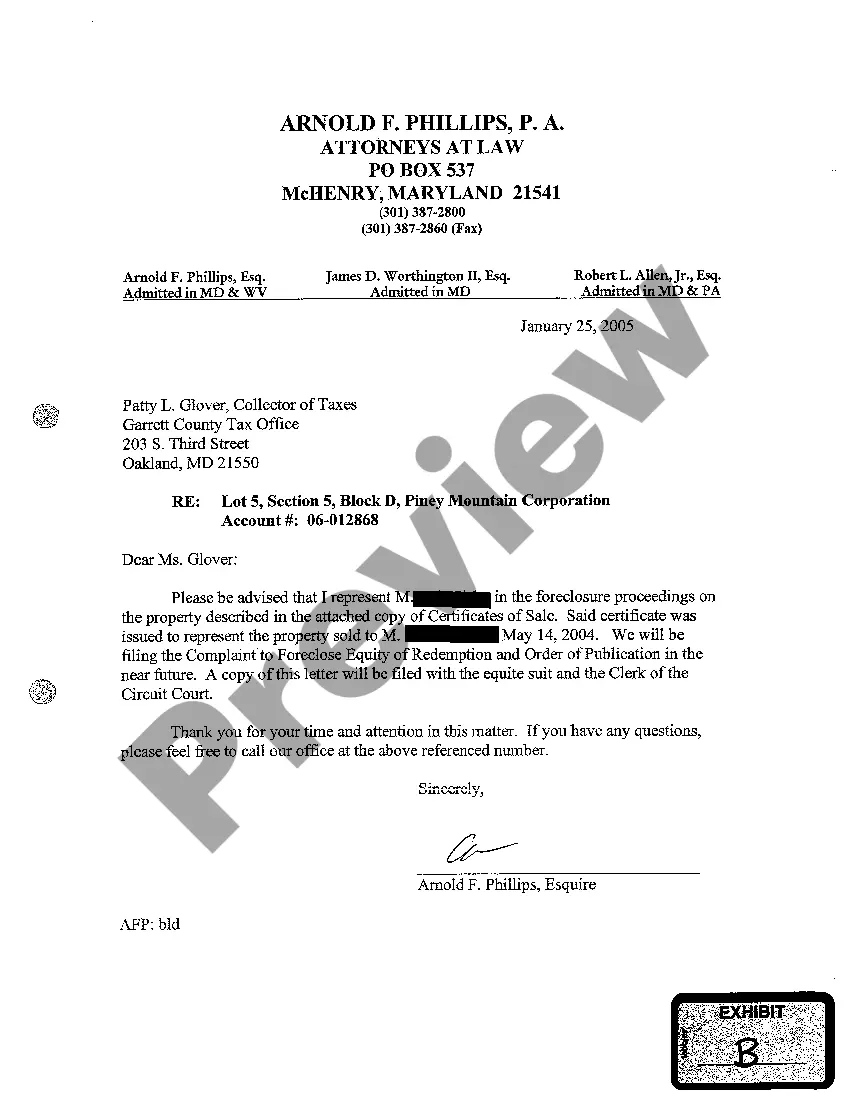

Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes

Description

How to fill out Maryland Complaint To Foreclosure Equity Of Redemption Property Sold For Nonpayment Of Taxes?

Welcome to the biggest legal documents library, US Legal Forms. Here you can get any sample such as Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes templates and download them (as many of them as you wish/need). Get ready official files in just a several hours, instead of days or even weeks, without spending an arm and a leg on an lawyer. Get the state-specific example in clicks and be assured with the knowledge that it was drafted by our accredited legal professionals.

If you’re already a subscribed user, just log in to your account and click Download near the Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes you require. Because US Legal Forms is web-based, you’ll always get access to your downloaded files, no matter the device you’re utilizing. See them inside the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check our guidelines below to get started:

- If this is a state-specific document, check its applicability in the state where you live.

- Look at the description (if readily available) to learn if it’s the proper example.

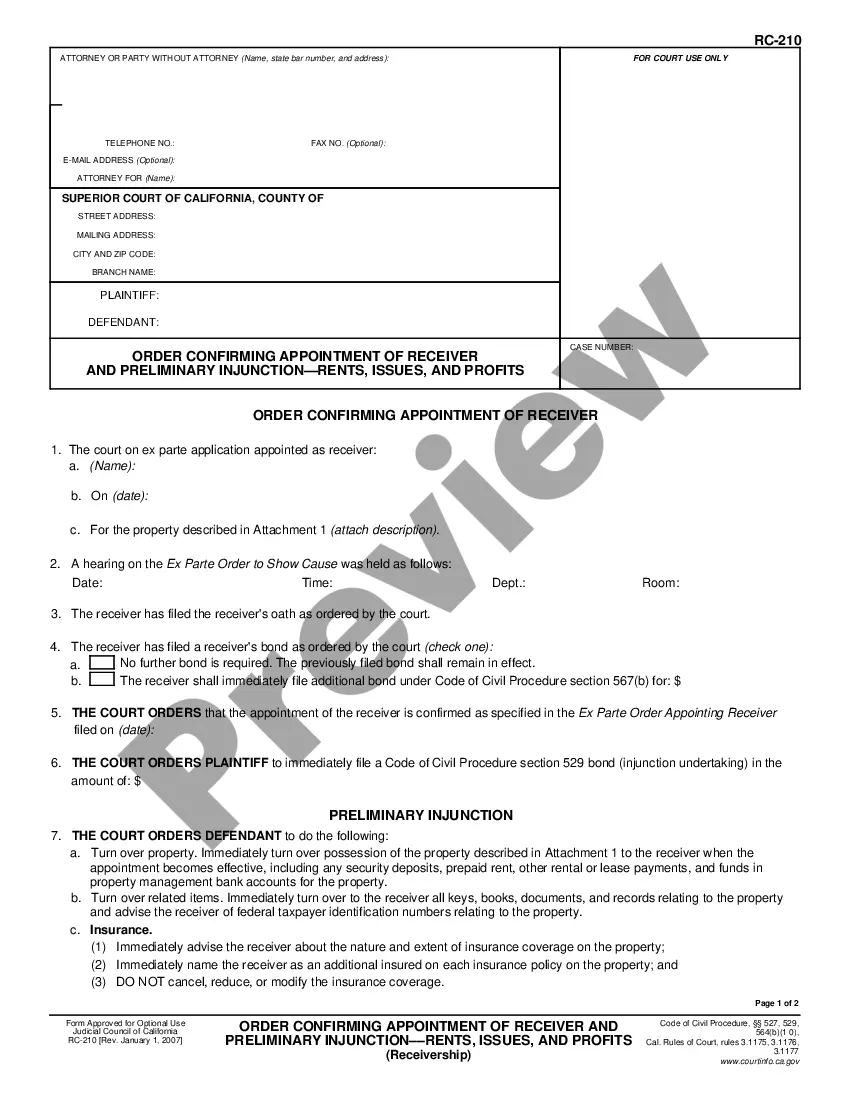

- See a lot more content with the Preview option.

- If the document matches all of your needs, click Buy Now.

- To create your account, select a pricing plan.

- Use a card or PayPal account to sign up.

- Save the document in the format you require (Word or PDF).

- Print the file and fill it with your/your business’s info.

After you’ve completed the Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes, send it to your legal professional for confirmation. It’s an additional step but a necessary one for being sure you’re totally covered. Sign up for US Legal Forms now and get access to a mass amount of reusable samples.

Form popularity

FAQ

The "right of redemption" is the right of a homeowner to either: stop a foreclosure sale from taking place by paying off the mortgage debt or. repurchase the property after a foreclosure sale by paying a specific sum of money within a limited period of time.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

You may want to pay off your mortgage before the end of your term to sell your property or remortgage to a better deal elsewhere. Paying off your loan early in this way is called 'redeeming' your mortgage.

When available, the redemption period generally ranges from thirty days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.