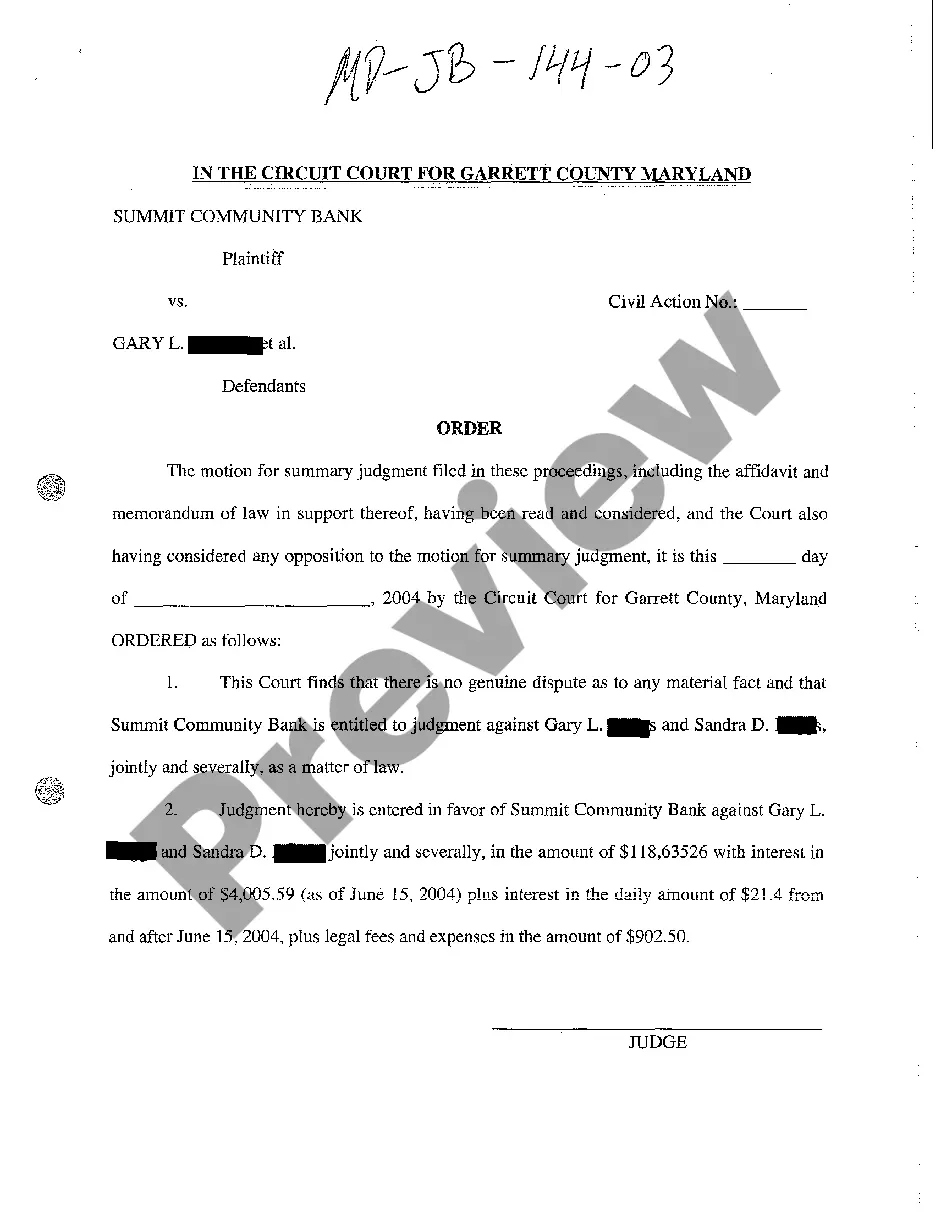

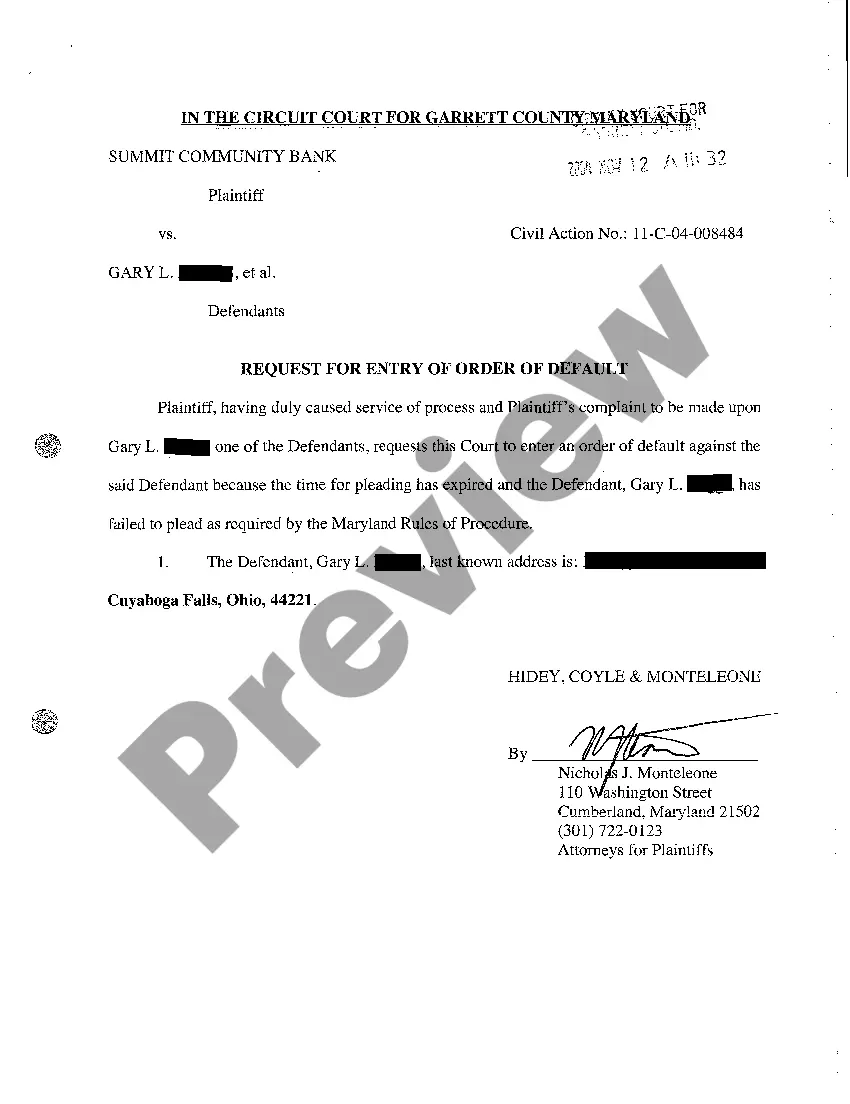

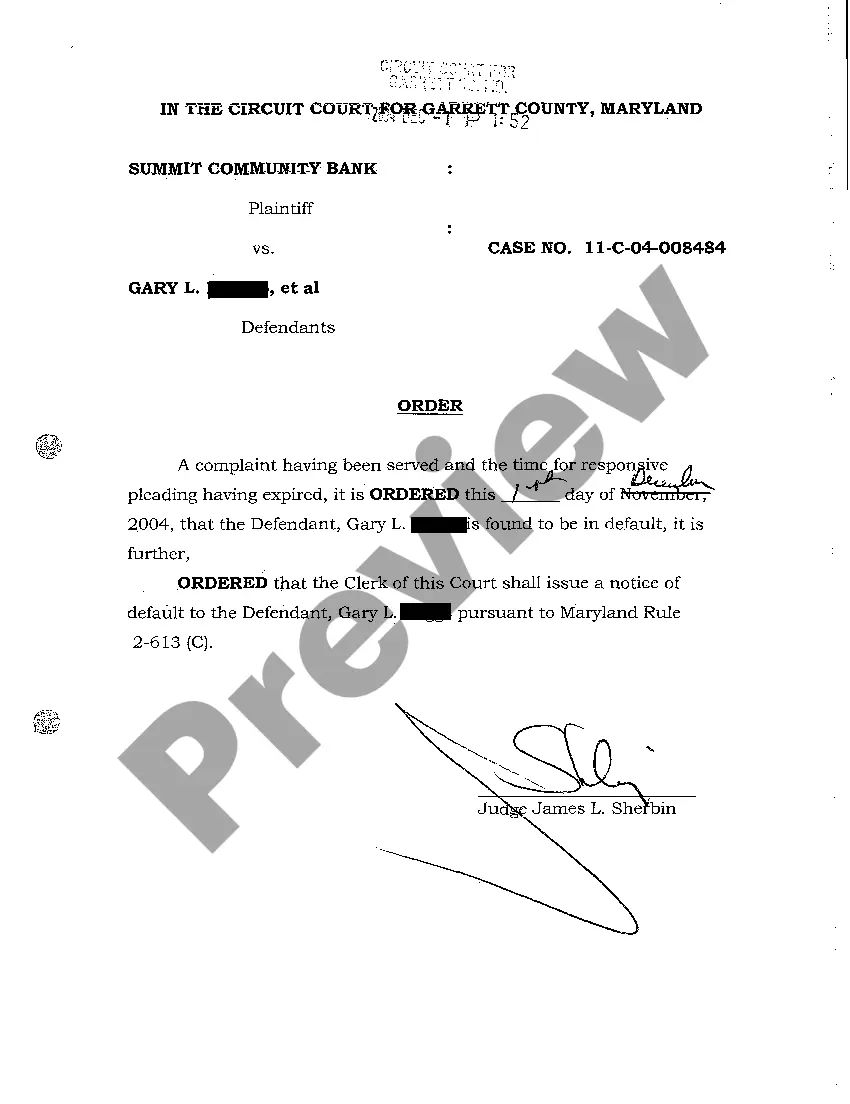

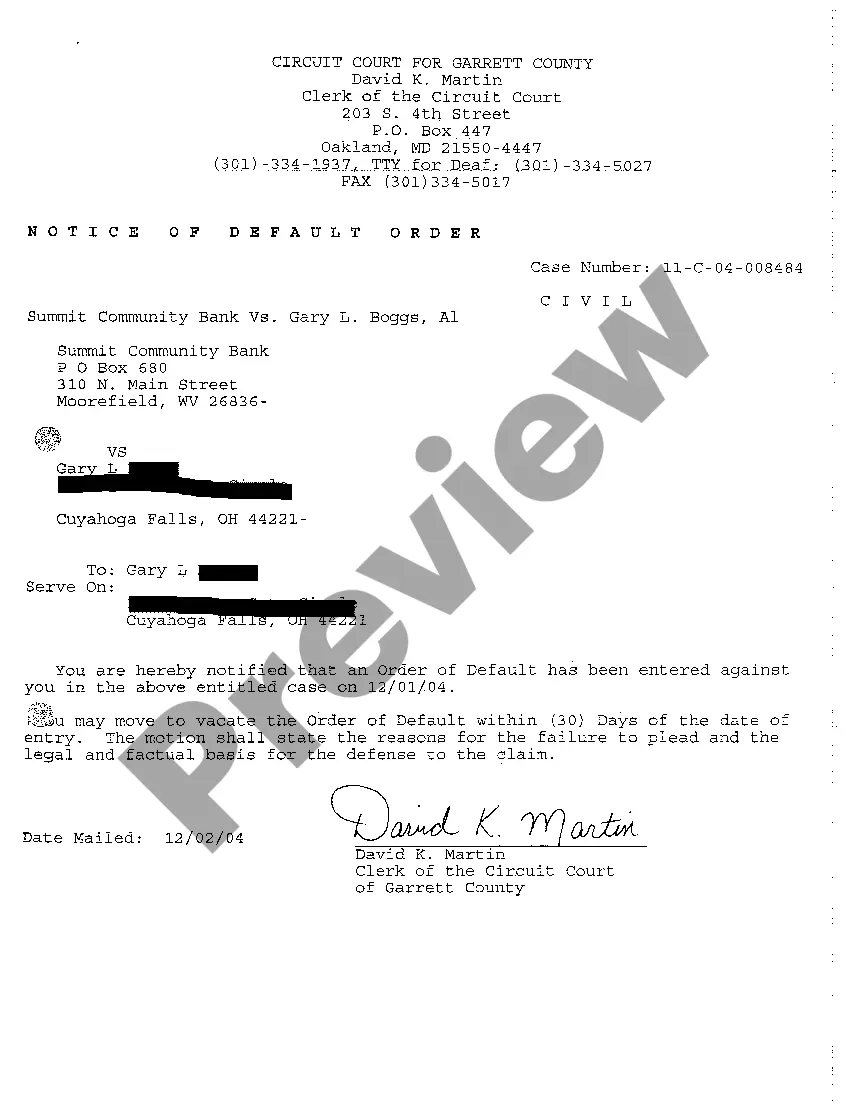

Maryland Order regarding Breach of Promissory Note by Selling Collateral Security

Description

How to fill out Maryland Order Regarding Breach Of Promissory Note By Selling Collateral Security?

You are welcome to the biggest legal files library, US Legal Forms. Here you can get any example such as Maryland Order regarding Breach of Promissory Note by Selling Collateral Security templates and save them (as many of them as you wish/need to have). Prepare official documents in a several hours, rather than days or even weeks, without having to spend an arm and a leg with an lawyer. Get your state-specific sample in a couple of clicks and be confident with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maryland Order regarding Breach of Promissory Note by Selling Collateral Security you want. Due to the fact US Legal Forms is online solution, you’ll generally get access to your downloaded forms, regardless of the device you’re utilizing. Find them within the My Forms tab.

If you don't have an account yet, what are you awaiting? Check out our instructions listed below to start:

- If this is a state-specific document, check out its validity in your state.

- View the description (if available) to understand if it’s the right template.

- See a lot more content with the Preview feature.

- If the document meets your requirements, just click Buy Now.

- To make your account, choose a pricing plan.

- Use a card or PayPal account to register.

- Save the template in the format you require (Word or PDF).

- Print out the document and complete it with your/your business’s information.

After you’ve filled out the Maryland Order regarding Breach of Promissory Note by Selling Collateral Security, send it to your attorney for verification. It’s an additional step but a necessary one for being certain you’re totally covered. Sign up for US Legal Forms now and get thousands of reusable examples.

Form popularity

FAQ

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The lender can then take the promissory note to a financial institution (usually a bank, albeit this could also be a private person, or another company), that will exchange the promissory note for cash; usually, the promissory note is cashed in for the amount established in the promissory note, less a small discount.

Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions. You have a few options if someone who has borrowed money from you does not pay you back. First, you should ask for the repayment in writing.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

The home (or business) serves as the collateral and an agreed upon down payment is the security for the note. As long as the buyer makes the agreed payments, they continue to be owners of the home. Should they default, the seller can take back, or foreclose on, the property.

Selling Mortgage Notes. Mortgage notes, or promissory notes, are financial instruments that define the terms of a loan used to purchase property. People who hold a mortgage note for a home, business or property can sell it for a lump sum of cash to a buyer in the secondary mortgage note industry.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.