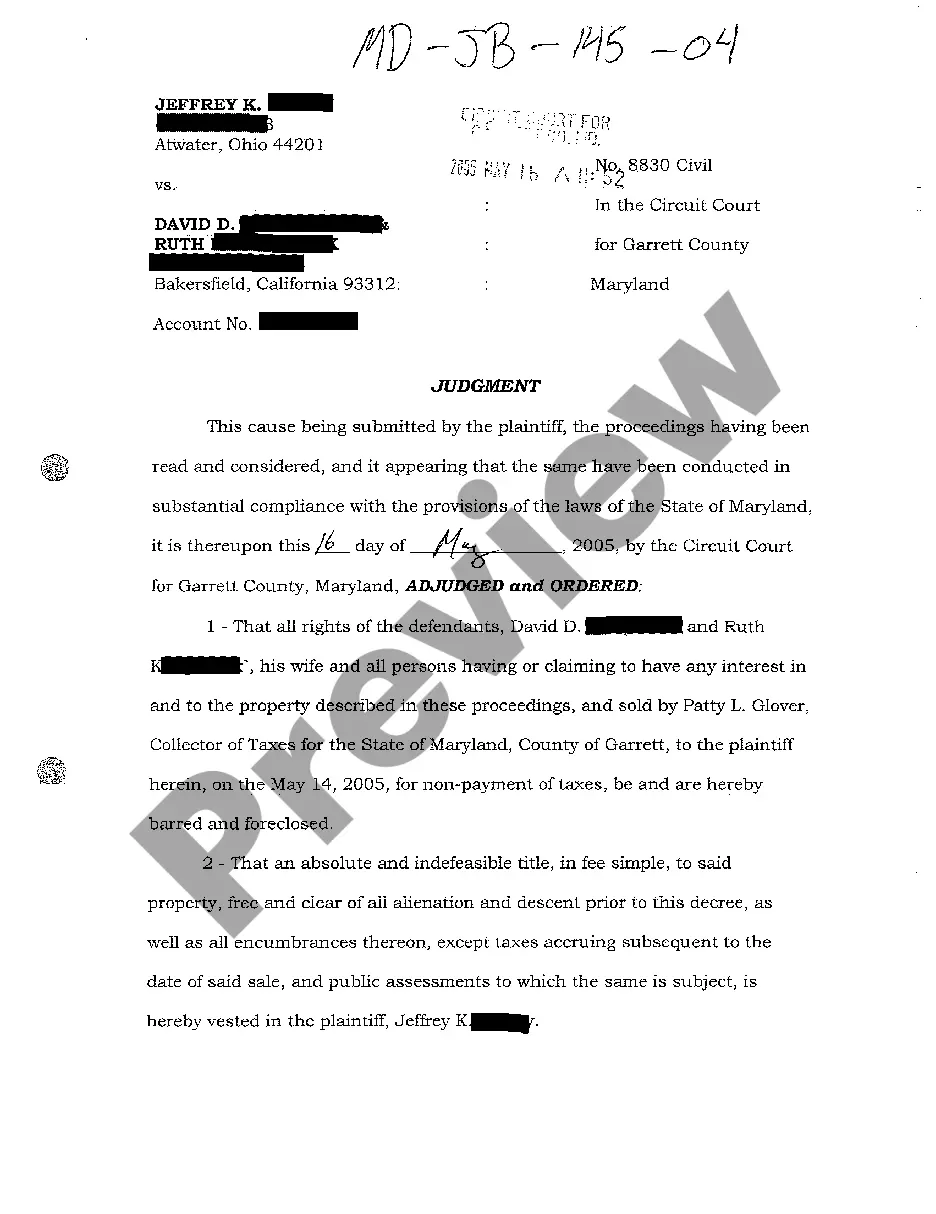

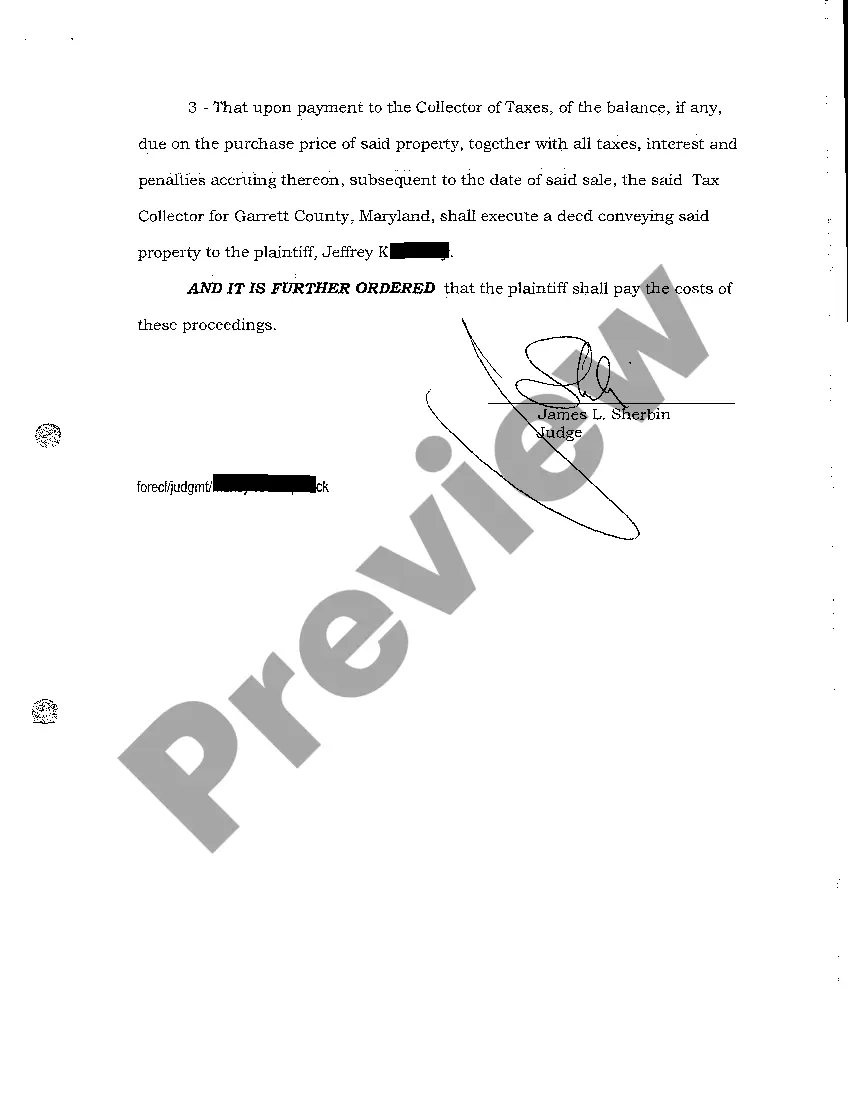

Maryland Judgment

Description

How to fill out Maryland Judgment?

Welcome to the biggest legal files library, US Legal Forms. Right here you can find any template such as Maryland Judgment forms and download them (as many of them as you wish/need to have). Prepare official papers with a few hours, rather than days or even weeks, without having to spend an arm and a leg on an lawyer or attorney. Get your state-specific example in a couple of clicks and feel confident knowing that it was drafted by our state-certified lawyers.

If you’re already a subscribed user, just log in to your account and click Download next to the Maryland Judgment you need. Due to the fact US Legal Forms is web-based, you’ll always get access to your downloaded files, no matter the device you’re utilizing. Find them inside the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check our guidelines listed below to start:

- If this is a state-specific document, check its applicability in the state where you live.

- Look at the description (if available) to understand if it’s the right example.

- See far more content with the Preview option.

- If the example fulfills all of your requirements, just click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to subscribe.

- Save the document in the format you need (Word or PDF).

- Print out the document and fill it out with your/your business’s info.

As soon as you’ve filled out the Maryland Judgment, send it to your attorney for verification. It’s an extra step but an essential one for making certain you’re entirely covered. Become a member of US Legal Forms now and get access to a large number of reusable examples.

Form popularity

FAQ

Garnishing the other person's wages; Garnishing the other person's bank account; or. Seizing the other person's personal property or real estate.

In California, a judgment lien can be attached to the debtor's real estate -- meaning a house, condo, land, or similar kind of property interest -- or to the debtor's personal property -- things like jewelry, art, antiques, and other valuables. (In some states, judgment liens can be attached to personal property only.)

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.

A lien is a right that prohibits the debtor from transferring their interest in a property until a debt is satisfied. The lien may be attached to any property or properties located within Maryland. Once filed, a lien will remain in force for 12 years unless removed by you after receiving payment from the debtor.

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts.