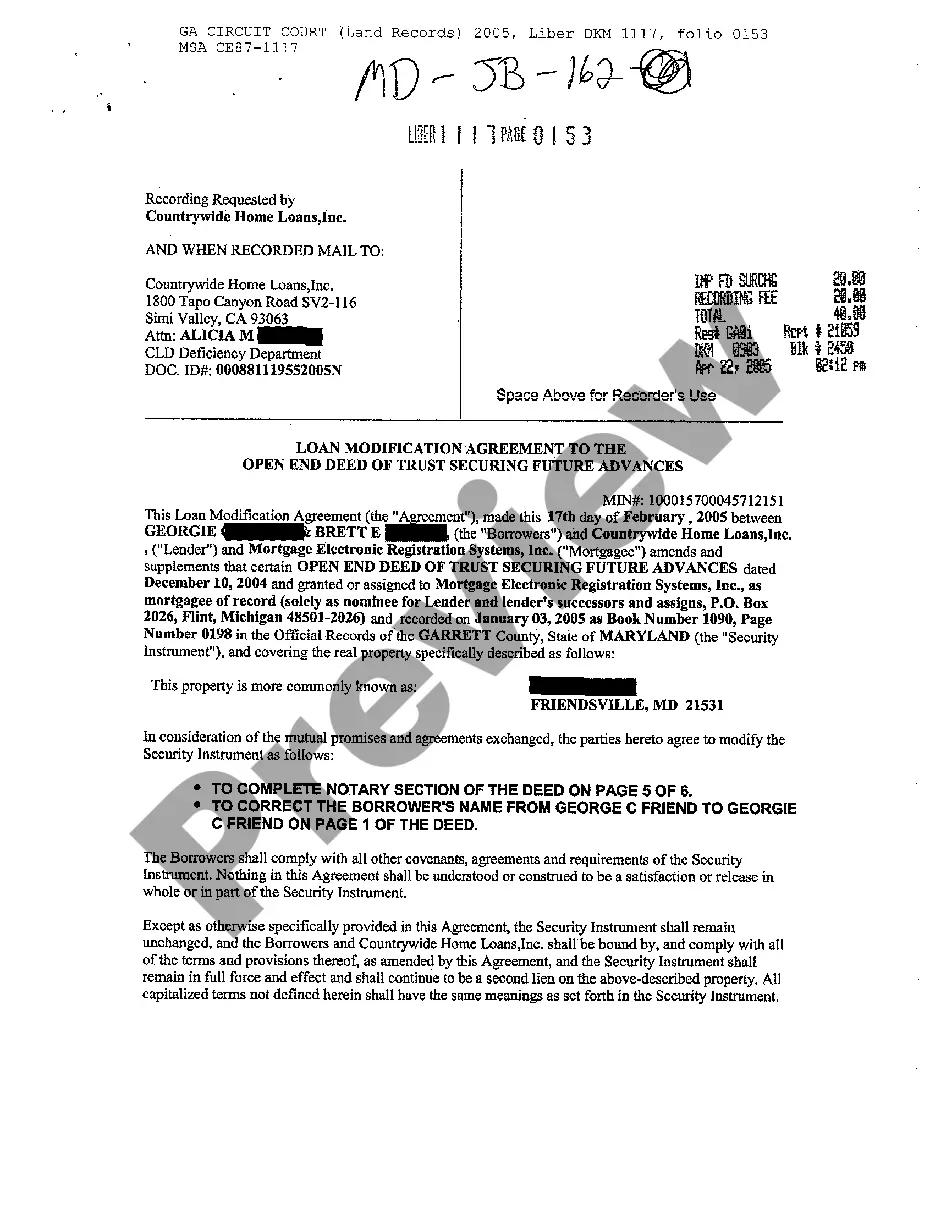

Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances

Description

How to fill out Maryland Loan Modification Agreement To The Open End Of Trust Securing Future Advances?

Welcome to the most significant legal files library, US Legal Forms. Right here you will find any template including Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances forms and save them (as many of them as you want/need to have). Prepare official documents in just a few hours, instead of days or even weeks, without having to spend an arm and a leg on an lawyer. Get your state-specific form in clicks and be assured knowing that it was drafted by our accredited attorneys.

If you’re already a subscribed consumer, just log in to your account and then click Download next to the Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances you want. Due to the fact US Legal Forms is online solution, you’ll always have access to your saved forms, no matter what device you’re using. Find them inside the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check out our guidelines listed below to begin:

- If this is a state-specific document, check its validity in the state where you live.

- Look at the description (if readily available) to learn if it’s the right example.

- See much more content with the Preview function.

- If the example meets your requirements, click Buy Now.

- To make your account, select a pricing plan.

- Use a card or PayPal account to join.

- Download the template in the format you want (Word or PDF).

- Print out the document and complete it with your/your business’s info.

After you’ve filled out the Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances, give it to your attorney for verification. It’s an additional step but an essential one for being certain you’re fully covered. Join US Legal Forms now and access a mass amount of reusable examples.

Form popularity

FAQ

A temporary loan, also called interim financing, bridge loan, swing loan, or gap loan, is used when funds are needed for short periods of time to complete a real estate transaction.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

This may be referred to as the "power of sale" clause. This is the language that legally authorizes the trustee to sell the property outside of court if the buyer does not meet his or her obligations under the deed of trust and promissory note.

Pay off your mortgage fully. Draft a letter to your mortgage lender requesting a deed of reconveyance.

Open-end credit is a pre-approved loan, granted by a financial institution to a borrower, that can be used repeatedly. With open-end loans, like credit cards, once the borrower has started to pay back the balance, they can choose to take out the funds againmeaning it is a revolving loan.

Loans may not be closed in the name of a trust.The first deed will remove title from the trust. The second deed will transfer title back into the trust. Both deeds are provided to the notary to be executed at closing.

A closed-end mortgage (also known as a "closed mortgage") is a restrictive type of mortgage that cannot be prepaid, renegotiated, or refinanced without paying breakage costs or other penalties to the lender.

Future Loan means any loan by Lender to a Future Borrower for the construction of an extended-stay hotel; provided, that, nothing herein is intended to, nor shall it, obligate Lender to provide a commitment for, or agree to fund, any such Future Loan.

A future advance is a clause in a mortgage that provides for additional availability of funds under the loan contract.Future advance clauses may or may not have certain contingencies that make the borrower eligible for future advances.