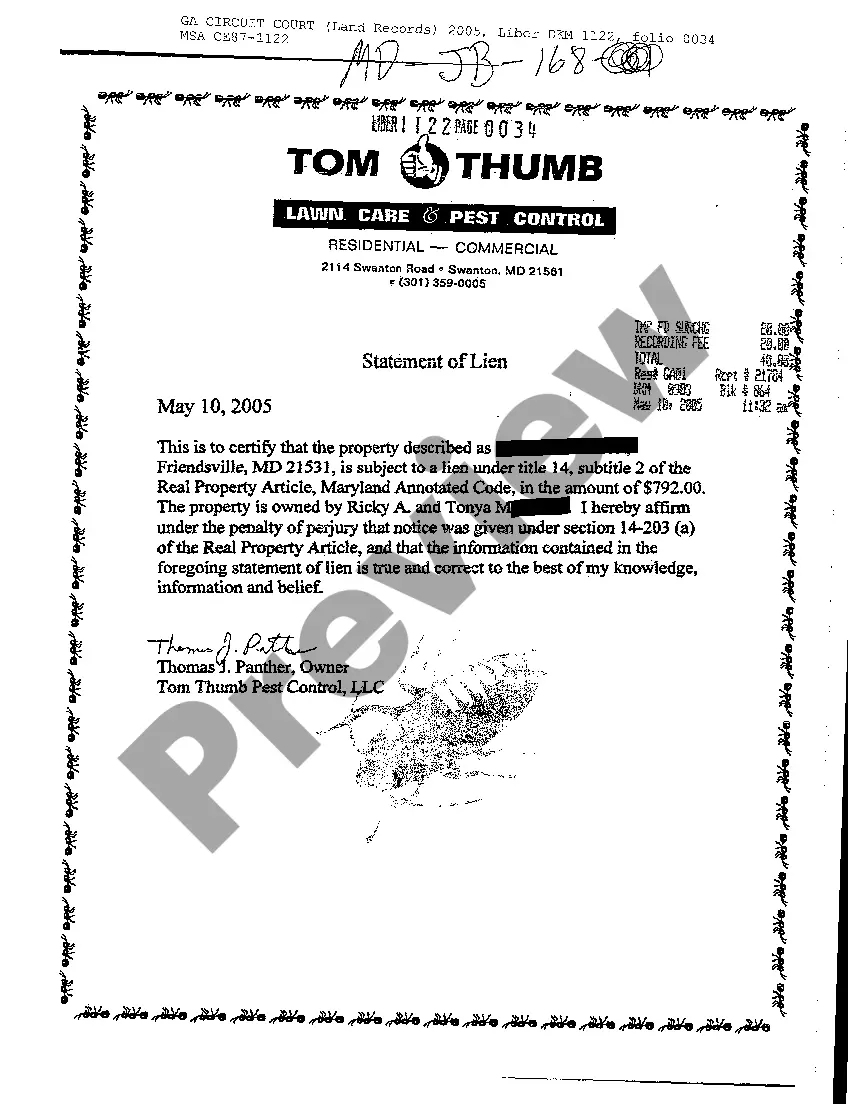

Maryland Statement of Lien to Real Property by Lawn Care Business

Description

How to fill out Maryland Statement Of Lien To Real Property By Lawn Care Business?

You are welcome to the largest legal documents library, US Legal Forms. Right here you can get any template including Maryland Statement of Lien to Real Property by Lawn Care Business forms and download them (as many of them as you wish/need). Make official papers within a few hours, rather than days or even weeks, without spending an arm and a leg with an lawyer or attorney. Get the state-specific form in a couple of clicks and be assured understanding that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maryland Statement of Lien to Real Property by Lawn Care Business you require. Because US Legal Forms is online solution, you’ll generally get access to your downloaded forms, no matter the device you’re utilizing. Locate them in the My Forms tab.

If you don't have an account yet, what are you awaiting? Check our guidelines below to get started:

- If this is a state-specific sample, check out its applicability in the state where you live.

- View the description (if available) to learn if it’s the right template.

- See more content with the Preview feature.

- If the sample fulfills your requirements, click Buy Now.

- To create your account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Download the file in the format you need (Word or PDF).

- Print out the file and fill it with your/your business’s info.

When you’ve completed the Maryland Statement of Lien to Real Property by Lawn Care Business, give it to your lawyer for verification. It’s an additional step but a necessary one for making certain you’re fully covered. Join US Legal Forms now and access thousands of reusable samples.

Form popularity

FAQ

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date.

A mechanic's lien is a guarantee of payment to builders, contractors, and construction firms that build or repair structures. Mechanic's liens also extend to suppliers of materials and subcontractors and cover building repairs as well.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.After all, contractors would rather work out a deal than go through the hassle of filing a lien against your property.

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

A type of lien that gives workers a security interest in personal property until they have been paid for their work on that property.