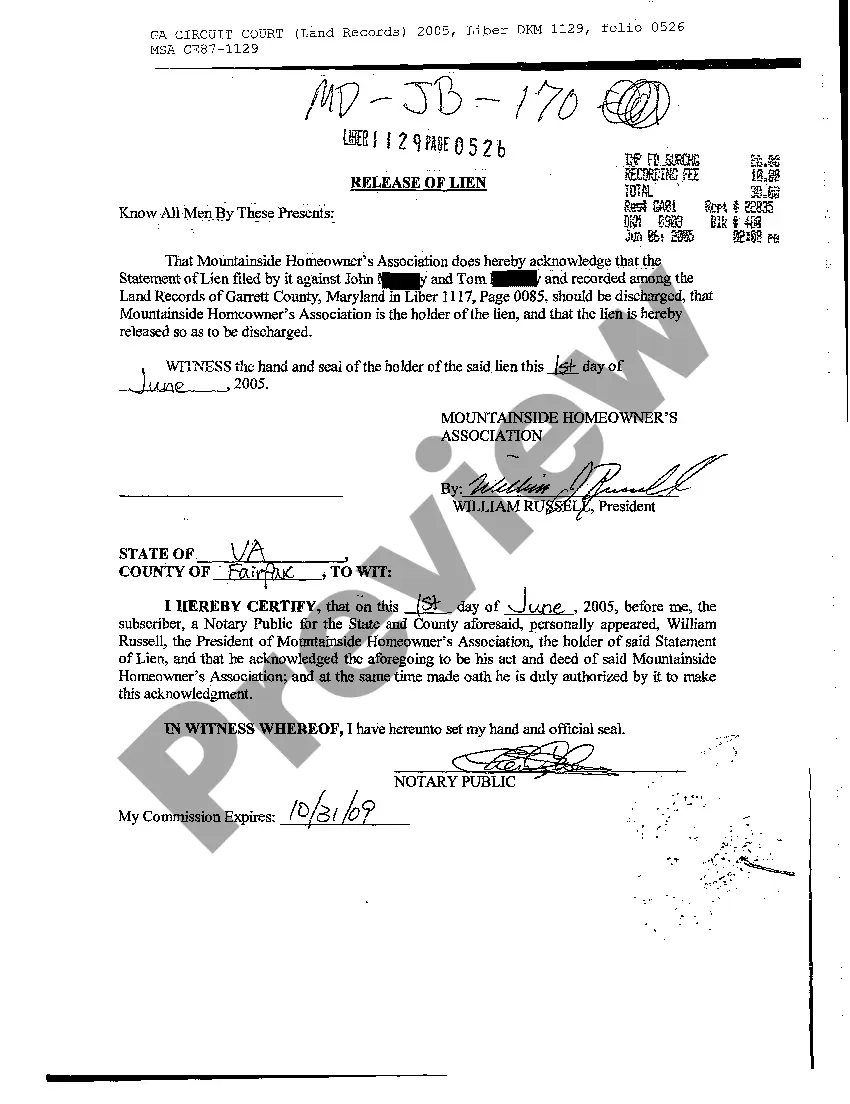

Maryland Release of Lien by Homeowner's Association

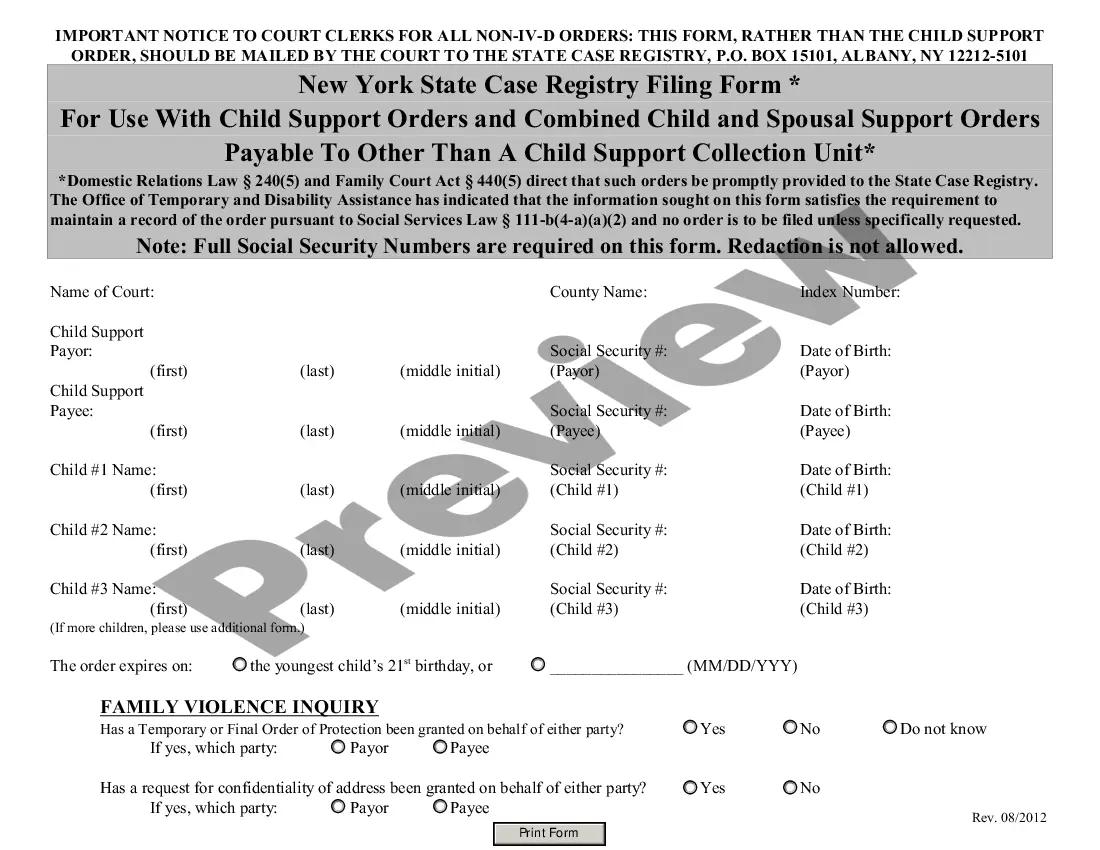

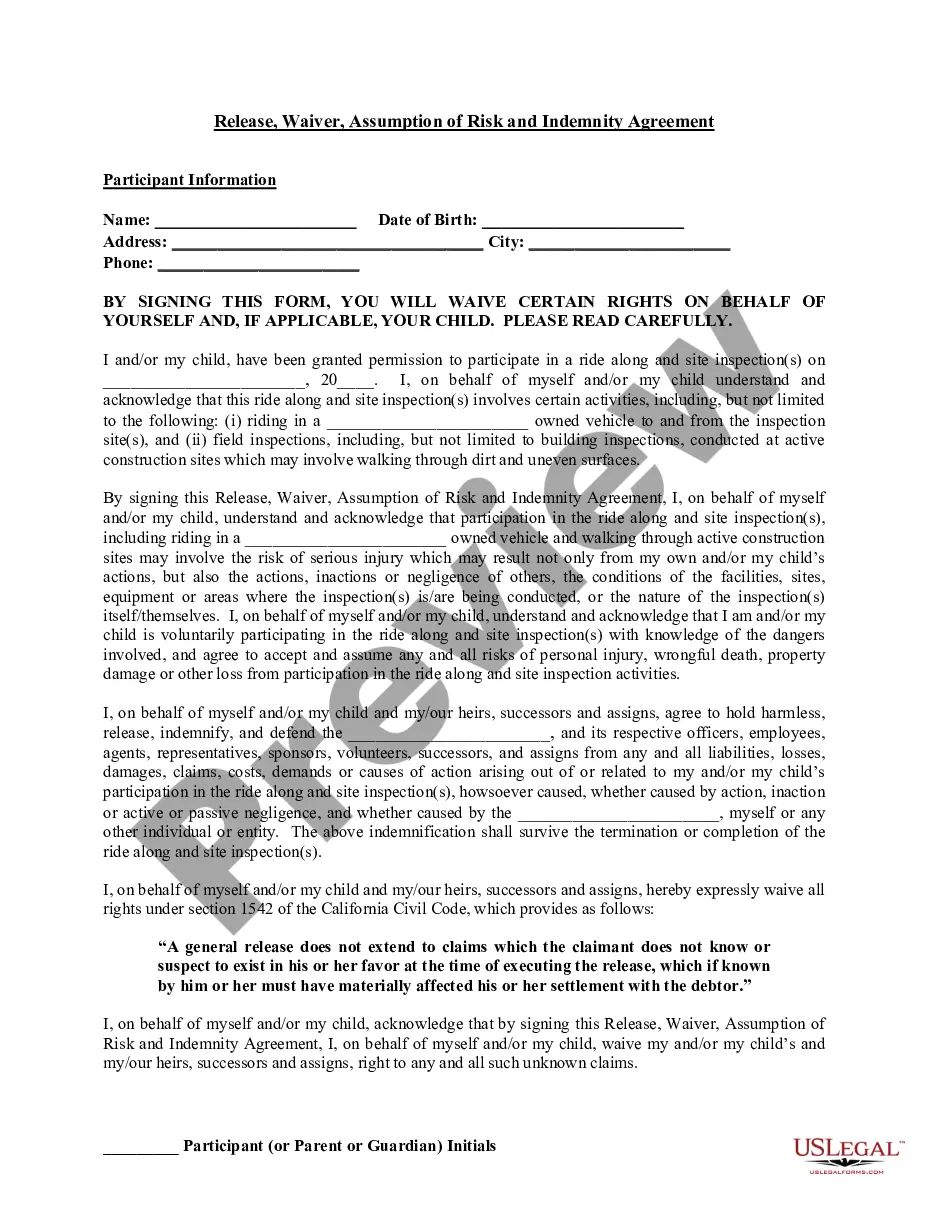

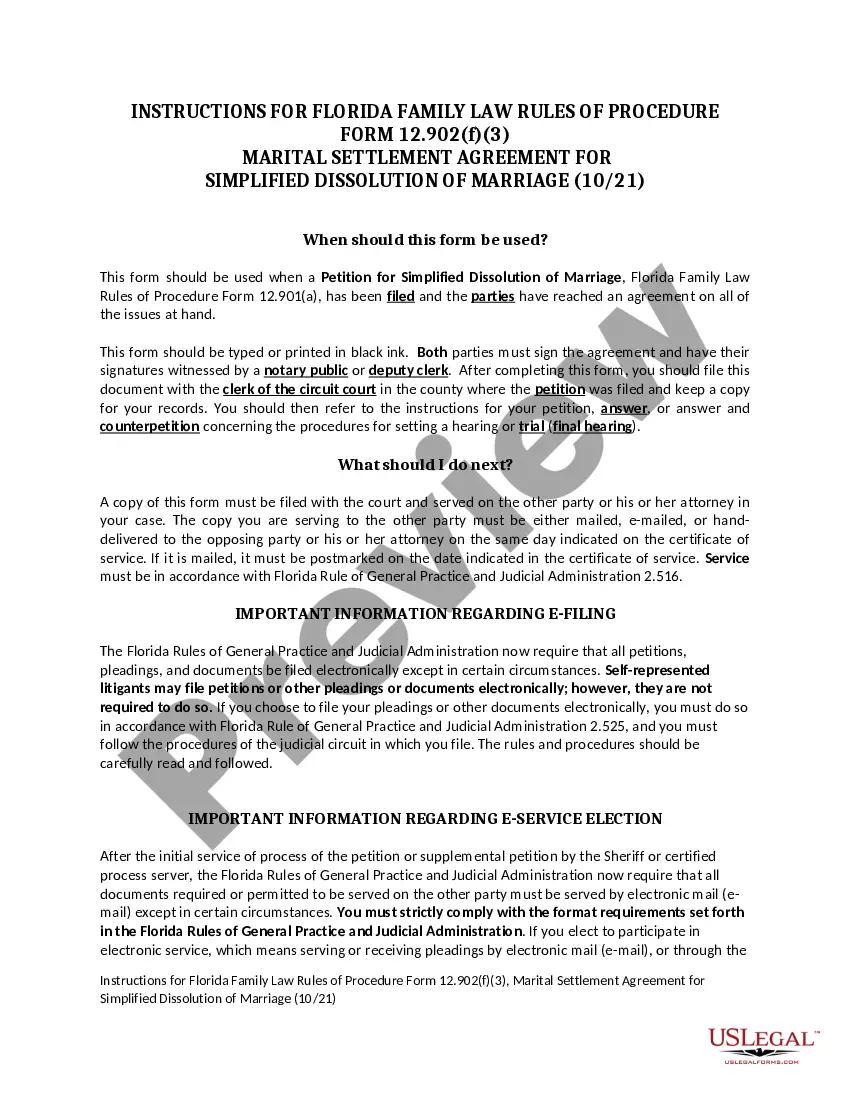

Description

How to fill out Maryland Release Of Lien By Homeowner's Association?

You are welcome to the greatest legal files library, US Legal Forms. Right here you can get any example including Maryland Release of Lien by Homeowner's Association forms and download them (as many of them as you wish/need to have). Make official files within a several hours, instead of days or even weeks, without having to spend an arm and a leg on an lawyer. Get the state-specific sample in clicks and feel confident with the knowledge that it was drafted by our state-certified legal professionals.

If you’re already a subscribed user, just log in to your account and click Download near the Maryland Release of Lien by Homeowner's Association you require. Because US Legal Forms is online solution, you’ll generally have access to your downloaded files, no matter the device you’re using. See them within the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check out our guidelines below to get started:

- If this is a state-specific document, check its applicability in the state where you live.

- See the description (if accessible) to understand if it’s the proper example.

- See much more content with the Preview option.

- If the document fulfills your needs, click Buy Now.

- To make your account, select a pricing plan.

- Use a card or PayPal account to sign up.

- Save the file in the format you need (Word or PDF).

- Print out the document and fill it out with your/your business’s info.

When you’ve filled out the Maryland Release of Lien by Homeowner's Association, send away it to your attorney for confirmation. It’s an extra step but a necessary one for being sure you’re totally covered. Become a member of US Legal Forms now and get access to thousands of reusable examples.

Form popularity

FAQ

Super Liens in Maryland Under Maryland law, if a mortgage or deed of trust was recorded on or after October 1, 2011 and the holder forecloses, lien priority is given to any HOA or COA that holds a lien on the property for four months' worth of unpaid expenses or $1,200, whichever is less.

Some people use HOA rules and HOA covenants interchangeably. You can find HOA covenants within your association's Covenants, Conditions, & Restrictions (CC&Rs). These dictate the association's and the members' obligations and rights.Both HOA covenants and rules are legally binding and enforceable.

When it comes to HOA liens, a super lien refers to that portion of a homeowners' association lien that is given higher priority than even the first-mortgage holder, placing the HOA's interest in front of the first mortgage.

Majority of Members Must Consent to Dissolution of HOA. Third-Party Rights and Agreements Must Be Honored. Local Government Permitting Conditions Must Be Honored. Internal HOA Dissolution Procedures Must Be Followed. New Deeds Might Be Required. Someone Must Take Over the HOA's Assets.

Connecticut. Massachusetts. Maine. New Hampshire. New Jersey. Tennessee.

Generally speaking, yes. Both HOA covenants and rules are legally binding and enforceable. There are some exceptions to this statement, though. Some rules can be unenforceable.

Liens Wiped Out, Not Debt The HOA first sends you a notice of the delinquent fees and ways to resolve the debt.Foreclosure by a mortgage lender wipes out the HOA lien, but doesn't resolve the debt itself.