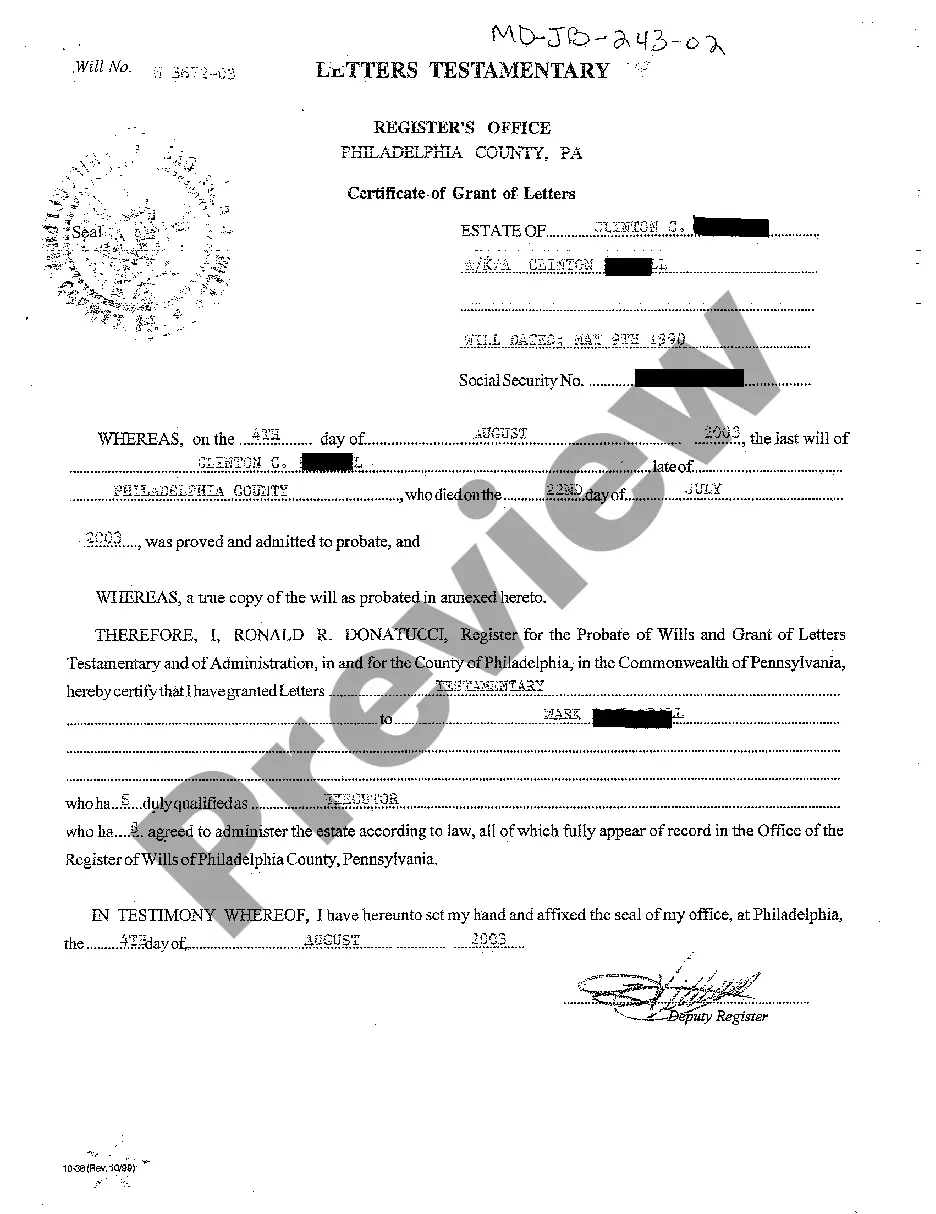

Maryland Letters Testamentary

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Letters Testamentary?

You are invited to the most important legal documents repository, US Legal Forms. Here you will discover any example such as Maryland Letters Testamentary templates and save them (as many as you desire or require). Prepare formal documents in a few hours, rather than days or even weeks, without having to spend a fortune on an attorney.

Obtain the state-specific form in clicks and feel confident with the assurance that it was created by our state-certified legal experts.

If you’re already a subscribed member, just Log In to your account and then click Download next to the Maryland Letters Testamentary you need. Since US Legal Forms is web-based, you’ll always have access to your saved forms, regardless of the device you’re using. Find them in the My documents section.

Print the document and complete it with your or your business’s details. After you’ve filled out the Maryland Letters Testamentary, send it to your attorney for confirmation. It’s an additional step, but a crucial one to ensure you’re completely covered. Join US Legal Forms today and gain access to thousands of reusable templates.

- If you don't have an account yet, what exactly are you waiting for.

- Follow our guidelines below to get started.

- If this is a state-specific document, check its validity in your residing state.

- Review the description (if present) to determine if it’s the correct template.

- Explore more content with the Preview feature.

- If the document satisfies all of your requirements, click Buy Now.

- To create your account, choose a subscription plan.

- Use a card or PayPal account to sign up.

- Download the document in your preferred format (Word or PDF).

Form popularity

FAQ

There are two components of letter of testamentary cost: the court fee and the attorney's fees. The court fee ranges from $45 to $1,250, depending on the gross value of the estate. The attorney's fees start at about $2,500 and can go up depending on the complexity of the case.

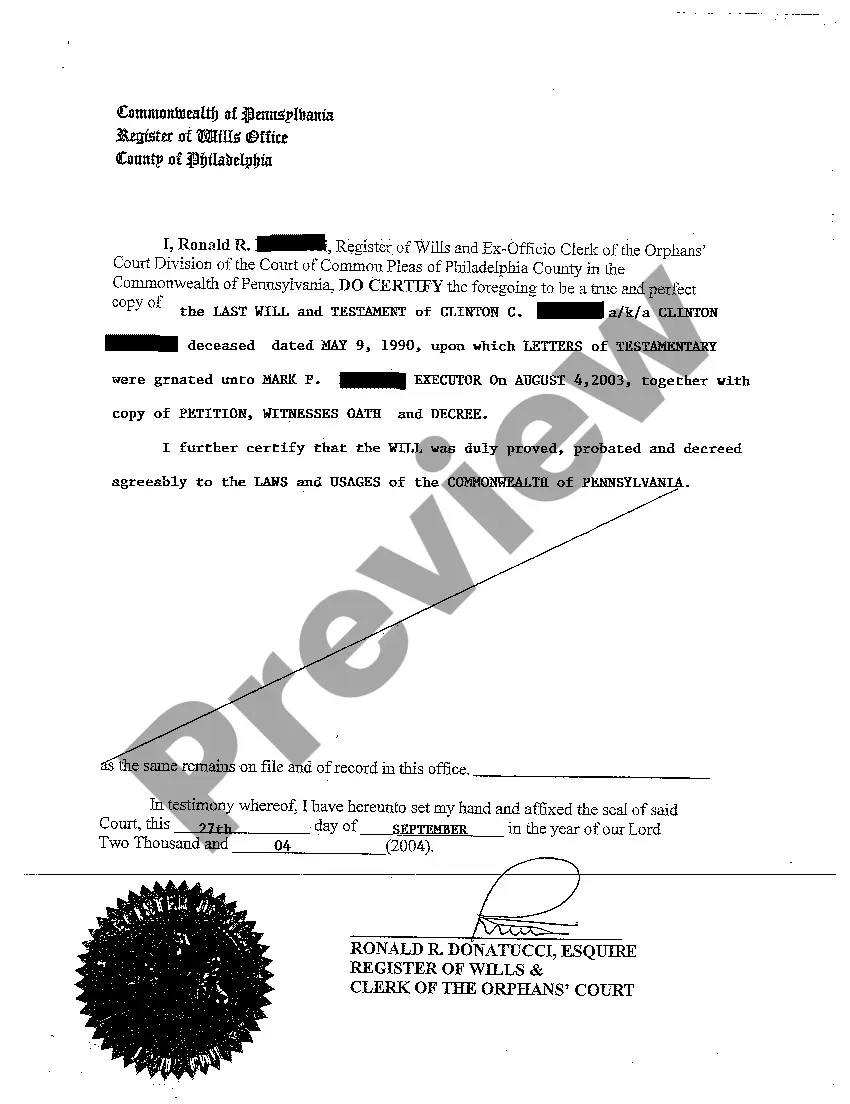

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

The purpose of a letter of testamentary is to show you have the legal right to act as an executor of a particular person's estate. This letter gives you permission to pay an estate's debts, take inventory of the estate's assets and distribute those assets on behalf of the decedent.

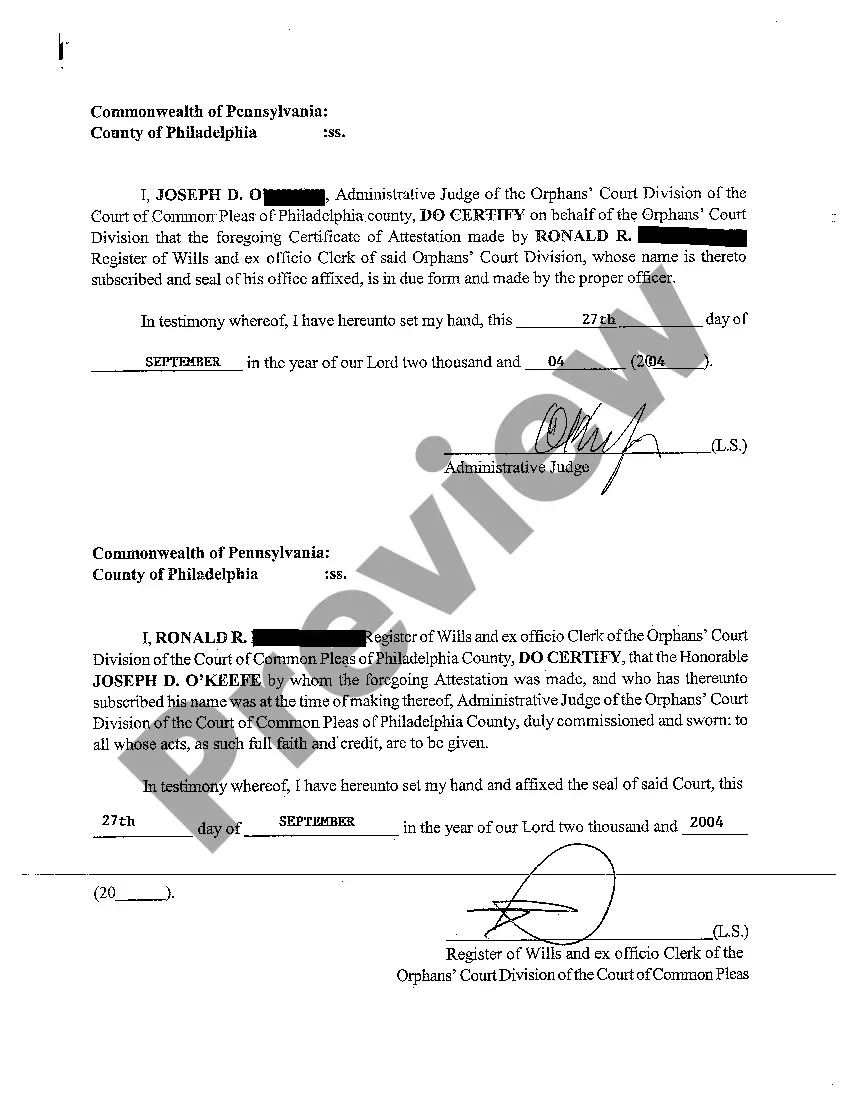

Find the local probate court or surrogate's court, as it's sometimes called. File the will and a certified copy of the testator's death certificate . Fill out the necessary paperwork , like a petition form, and provide any additional documents.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

Step 1, Determine whether You are the Personal Representative. Step 2, Petition to Probate the Estate. Step 3, Make an Inventory of the Estate. Step 4, Assess any projected Inheritance Taxes. Step 5, Consolidate the Estate and Manage Expenses.

Most likely you will need an attorney to obtain letters testamentary. Many attorneys offer a free consultation. At least meet with an attorney to make sure letters testamentary is what you need.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.