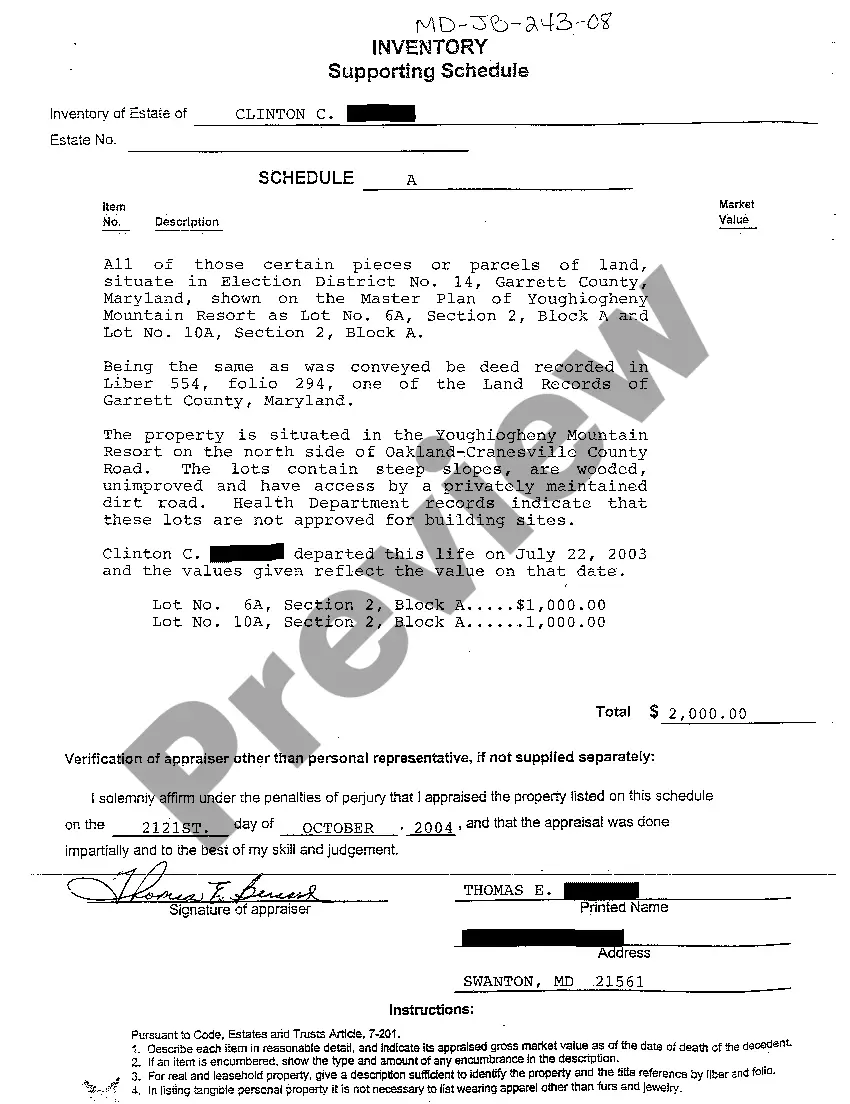

Maryland Inventory Supporting Schedule

Description

How to fill out Maryland Inventory Supporting Schedule?

Welcome to the biggest legal documents library, US Legal Forms. Here you can get any example including Maryland Inventory Supporting Schedule templates and save them (as many of them as you wish/need to have). Get ready official papers in just a few hours, rather than days or even weeks, without spending an arm and a leg on an lawyer. Get your state-specific example in a few clicks and feel confident knowing that it was drafted by our accredited legal professionals.

If you’re already a subscribed user, just log in to your account and click Download near the Maryland Inventory Supporting Schedule you require. Due to the fact US Legal Forms is online solution, you’ll always have access to your saved templates, regardless of the device you’re using. See them in the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our instructions below to start:

- If this is a state-specific document, check out its validity in your state.

- View the description (if accessible) to understand if it’s the proper template.

- See far more content with the Preview feature.

- If the sample fulfills all your requirements, click Buy Now.

- To make your account, select a pricing plan.

- Use a card or PayPal account to register.

- Download the template in the format you require (Word or PDF).

- Print out the document and fill it out with your/your business’s information.

After you’ve completed the Maryland Inventory Supporting Schedule, send it to your attorney for confirmation. It’s an extra step but a necessary one for being sure you’re fully covered. Join US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

The new format of the balance sheet is also called vertical format balance sheet and it lists the equities and liabilities on the top followed by the assets at the bottom.

13. Schedule XIII Income: These includes: (1) Interest Earned: (i) Interest, Discounts on advance and bills; (ii) Income on investment; (iii) Interest on balance with RBI. (2) Others.

In accounting, a schedule is defined as the supporting report or document which constitutes detailed information, explaining the elements of the chief financial report.In other words, accounting schedules provide all the financial accounting in detail which cannot be illustrated within the chief report.

The schedule of accounts receivable is a report that lists all amounts owed by customers. The report lists each outstanding invoice as of the report date, aggregated by customer.The collections team examines the schedule to determine which invoices are overdue, and then makes collection calls to customers. Credit.

The government has decided to revise schedule VI to the Companies Act, which stipulates the manner in which every company prepares and presents its balance sheet and profit and loss account.The draft revised schedule VI requires companies to classify assets and liabilities into current and non-current categories.

The Balance Sheet includes:Equity and Liabilities comprising of Shareholders' Funds , Share Application, money pending allotment, Non-Current Liabilities , and Current Liabilities . Assets comprising of Non-Current Assets and Current Assets .

The fixed asset schedule comprises of the fixed assets listing in detail, which is mentioned in the general ledger.The accumulated depreciation account is an account for the assets which are having a credit balance i.e. it appears as a deduction from the total fixed assets amount reported on the balance sheet.

The fixed asset schedule comprises of the fixed assets listing in detail, which is mentioned in the general ledger.The accumulated depreciation account is an account for the assets which are having a credit balance i.e. it appears as a deduction from the total fixed assets amount reported on the balance sheet.

21 April 2015 Schedule III of the Companies Act, 2013 contains a format for preparation and presentation of financial statements. . Except for addition of general instructions for preparation of Consolidated Financial Statements (CFS), the format of financial statements given in the Companies Act, 2013 is the same as