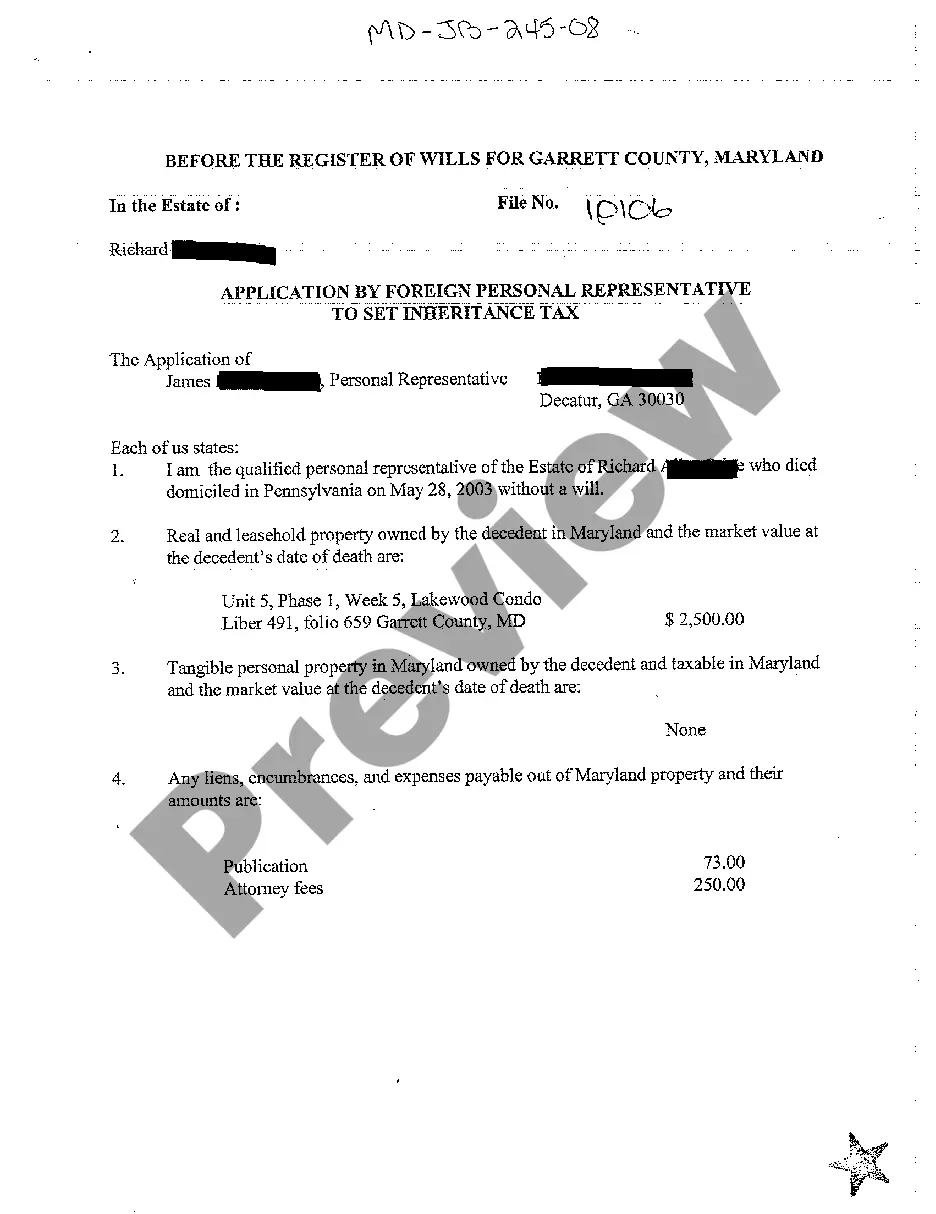

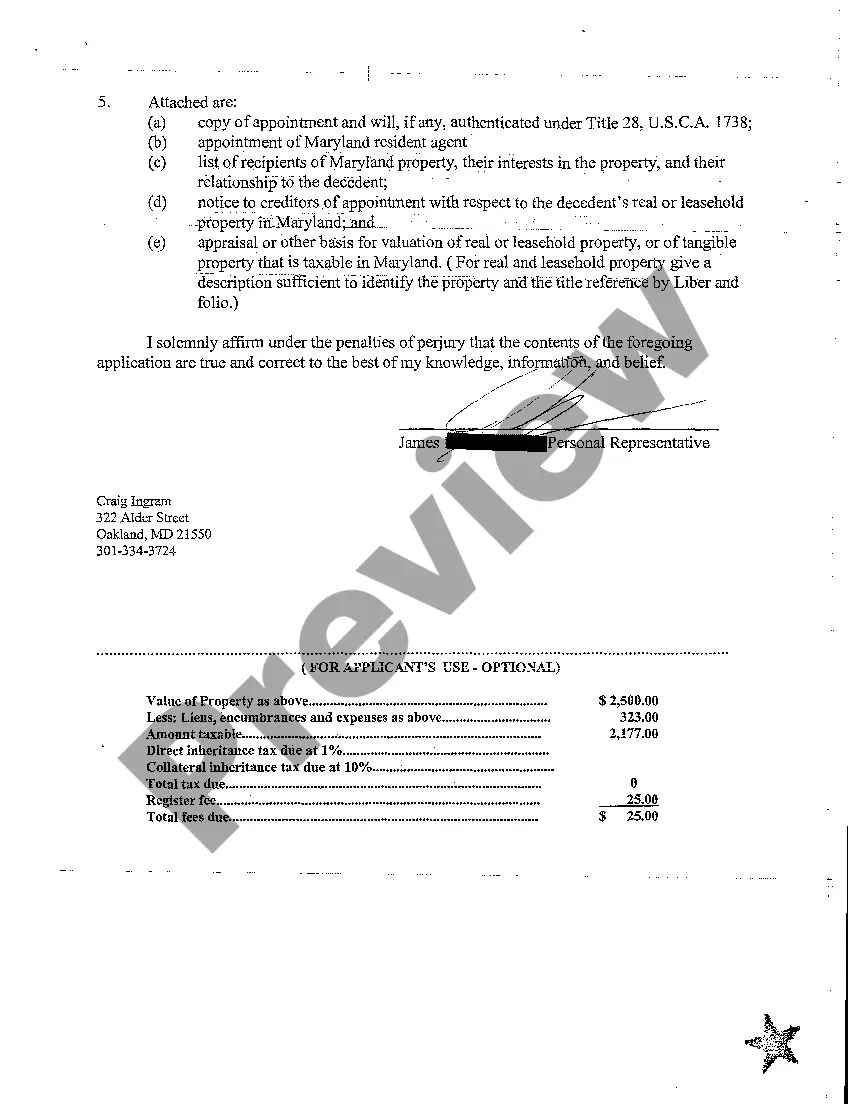

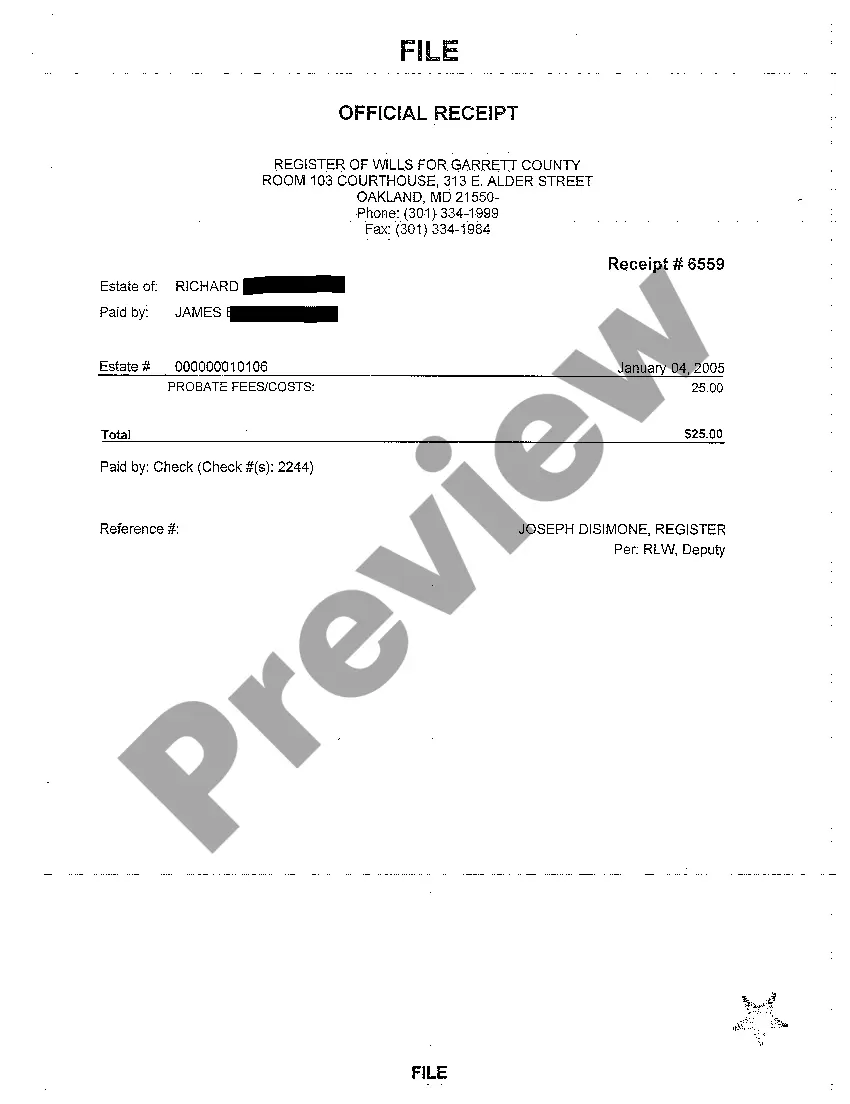

Maryland Application by Foreign Personal Representative to set Inheritance Tax

Description

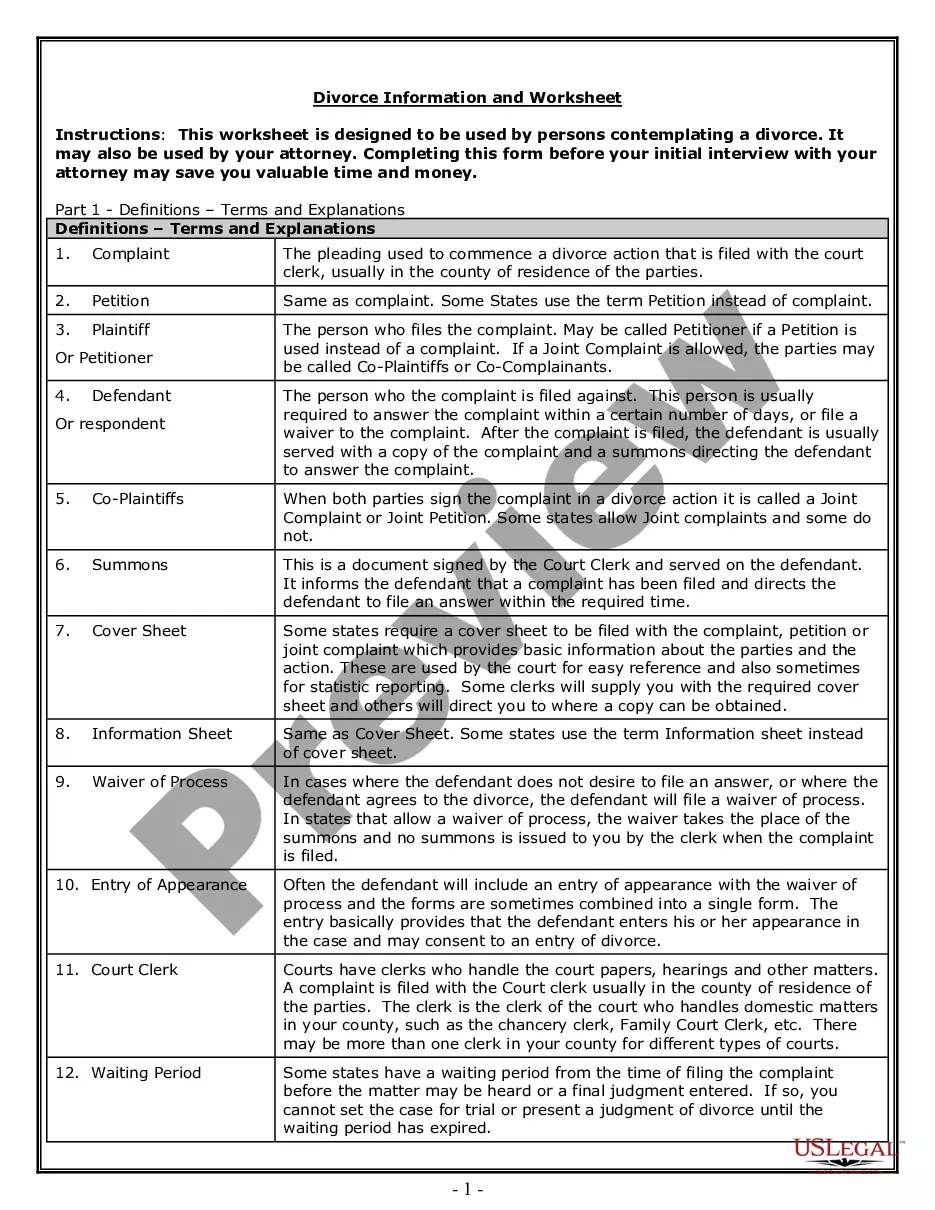

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Welcome to the biggest legal files library, US Legal Forms. Right here you will find any template including Maryland Application by Foreign Personal Representative to set Inheritance Tax forms and download them (as many of them as you want/need). Make official files within a several hours, instead of days or weeks, without having to spend an arm and a leg with an lawyer or attorney. Get the state-specific sample in a few clicks and be confident with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed user, just log in to your account and then click Download next to the Maryland Application by Foreign Personal Representative to set Inheritance Tax you want. Due to the fact US Legal Forms is web-based, you’ll always get access to your saved files, no matter what device you’re using. Find them in the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our guidelines listed below to begin:

- If this is a state-specific document, check out its validity in the state where you live.

- Look at the description (if offered) to learn if it’s the proper example.

- See a lot more content with the Preview option.

- If the example fulfills all your needs, click Buy Now.

- To create your account, pick a pricing plan.

- Use a card or PayPal account to sign up.

- Save the document in the format you require (Word or PDF).

- Print the document and complete it with your/your business’s information.

Once you’ve filled out the Maryland Application by Foreign Personal Representative to set Inheritance Tax, send it to your attorney for verification. It’s an extra step but an essential one for making sure you’re entirely covered. Sign up for US Legal Forms now and get a mass amount of reusable samples.

Form popularity

FAQ

Petition for Administration. List of Assets and Debts. Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs. Bond of Personal Representative Form. List of Interested Persons. Paid Funeral Bill. Copy of Death Certificate - available from Division of Vital Records.

Most relatives who inherit are exempt from Maryland's inheritance tax.Maryland collects an inheritance tax when certain recipients inherit property from someone who lived in Maryland or owned property there. Close relatives and charities are exempt from the tax; other inheritors pay the tax at a 10% rate.

Retirement accounts, unlike almost any other asset that a person can inherit, are subject to income tax. That means that if you inherit an IRA or a 401(k), when you withdraw the money, you'll have to pay income tax on these withdrawals.

In Maryland, state estate tax limits will stay at $5 million. For 2020, the federal estate tax limit will increase to $11.58 million for an individual and $23.16 million for a couple. A deceased person owes federal estate taxes on a taxable estate.

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. Obtain a tax ID number for the estate account. Bring all required documents to the bank. Open the estate account.

Decedent's Last Will and Testament. Death Certificate. Funeral Contract/Bill. Approximate value of assets in the decedent's name alone. Title to decedent's automobiles and/or other motor vehicles.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Determining Maryland Inheritance TaxesMaryland is one of a few states with an inheritance tax. The tax focuses on the privilege of receiving property from a decedent. The Maryland inheritance tax rate is 10% of the value of the gift.