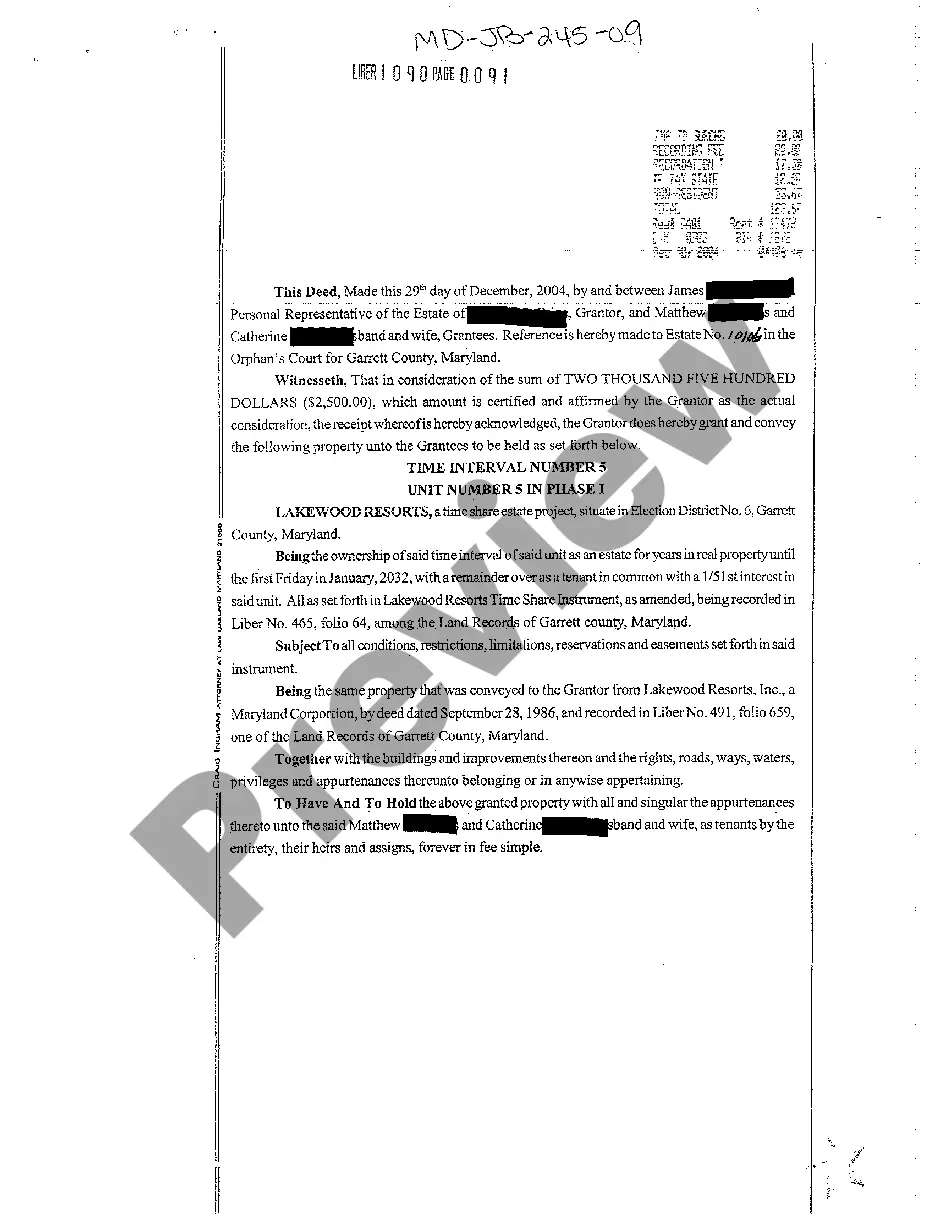

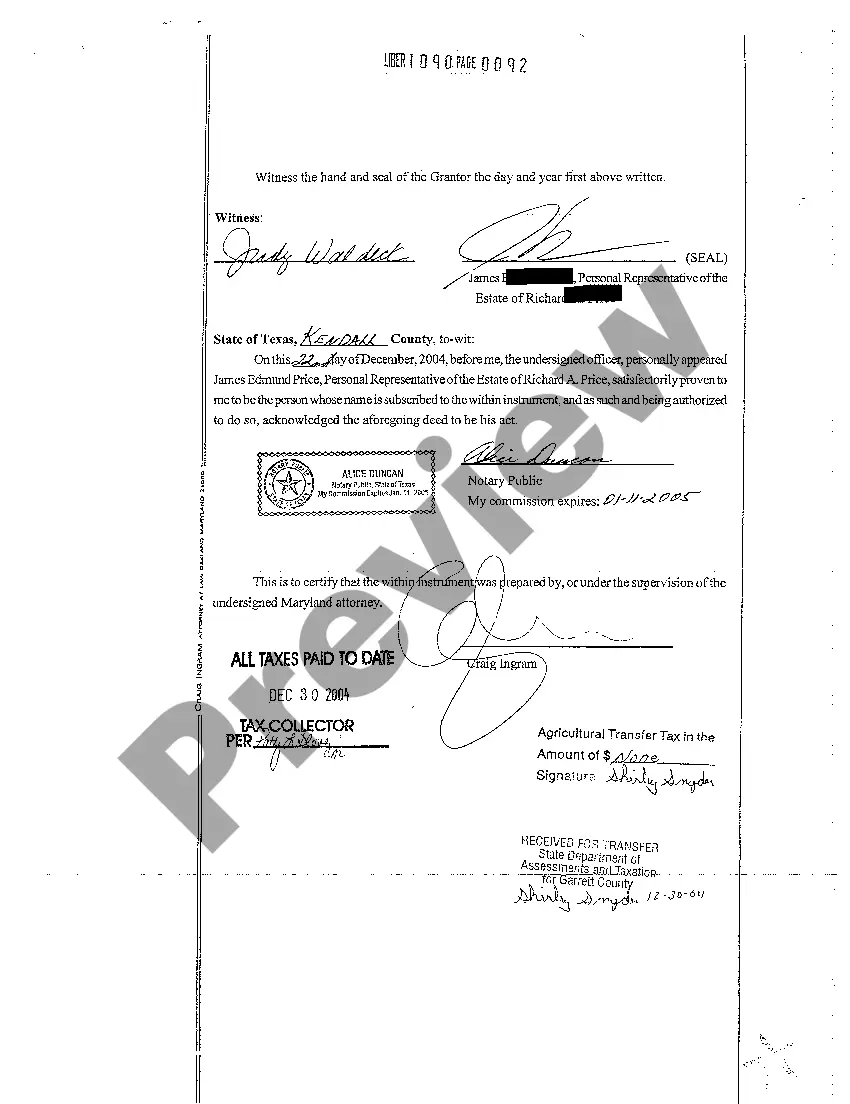

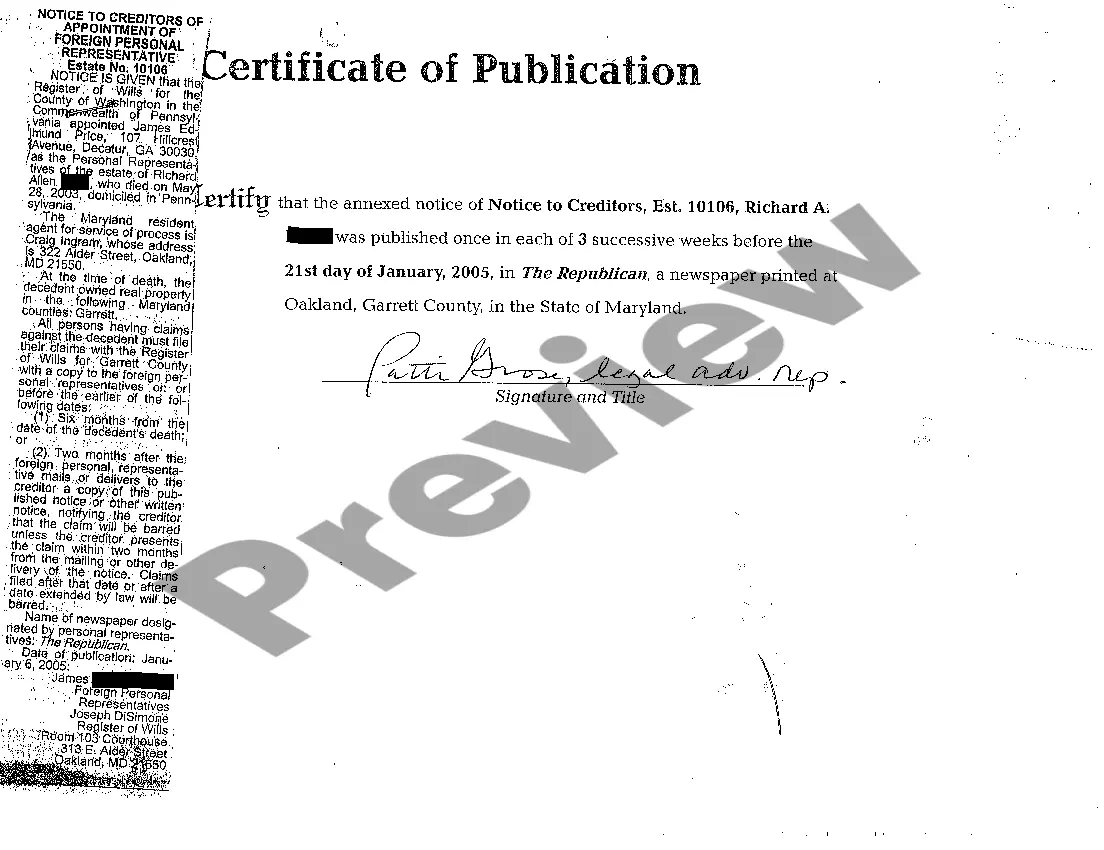

Maryland Deed Conveying Decedent's Property to Beneficiary

Description Mva Transfer On Death Form

How to fill out Transfer Deed On Death Form?

You are welcome to the biggest legal files library, US Legal Forms. Here you will find any sample such as Maryland Deed Conveying Decedent's Property to Beneficiary templates and save them (as many of them as you wish/require). Make official papers within a few hours, instead of days or weeks, without having to spend an arm and a leg on an lawyer or attorney. Get the state-specific form in a couple of clicks and feel confident with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed user, just log in to your account and then click Download near the Maryland Deed Conveying Decedent's Property to Beneficiary you want. Because US Legal Forms is web-based, you’ll always get access to your downloaded files, no matter what device you’re utilizing. See them inside the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our guidelines below to start:

- If this is a state-specific document, check out its validity in the state where you live.

- Look at the description (if readily available) to understand if it’s the right example.

- See a lot more content with the Preview option.

- If the sample fulfills all of your requirements, just click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to join.

- Download the file in the format you want (Word or PDF).

- Print out the file and fill it with your/your business’s info.

When you’ve filled out the Maryland Deed Conveying Decedent's Property to Beneficiary, send away it to your attorney for verification. It’s an extra step but an essential one for making confident you’re entirely covered. Become a member of US Legal Forms now and access a large number of reusable examples.

Transfer On Death Instrument Form popularity

Example Of Transfer On Death Deed Other Form Names

Transfer On Death Form FAQ

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

A transfer on death deed (TOD) lets a property owner pass land or real estate to a designated beneficiary outside of the probate process.While you can use a last will and testament to transfer your property to someone when you die, it must be proven during probate, which takes time.

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

Many will assume responsibility, believing it is the right thing to do, but they are not legally required to do so. Creditors can open an estate. Holding the assets of the decedent in an effort to prevent creditors from reclaiming their debt is a risky proposition.

200bAlaska. Arizona. Arkansas. California. Colorado. District of Columbia. Hawaii. Illinois.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.