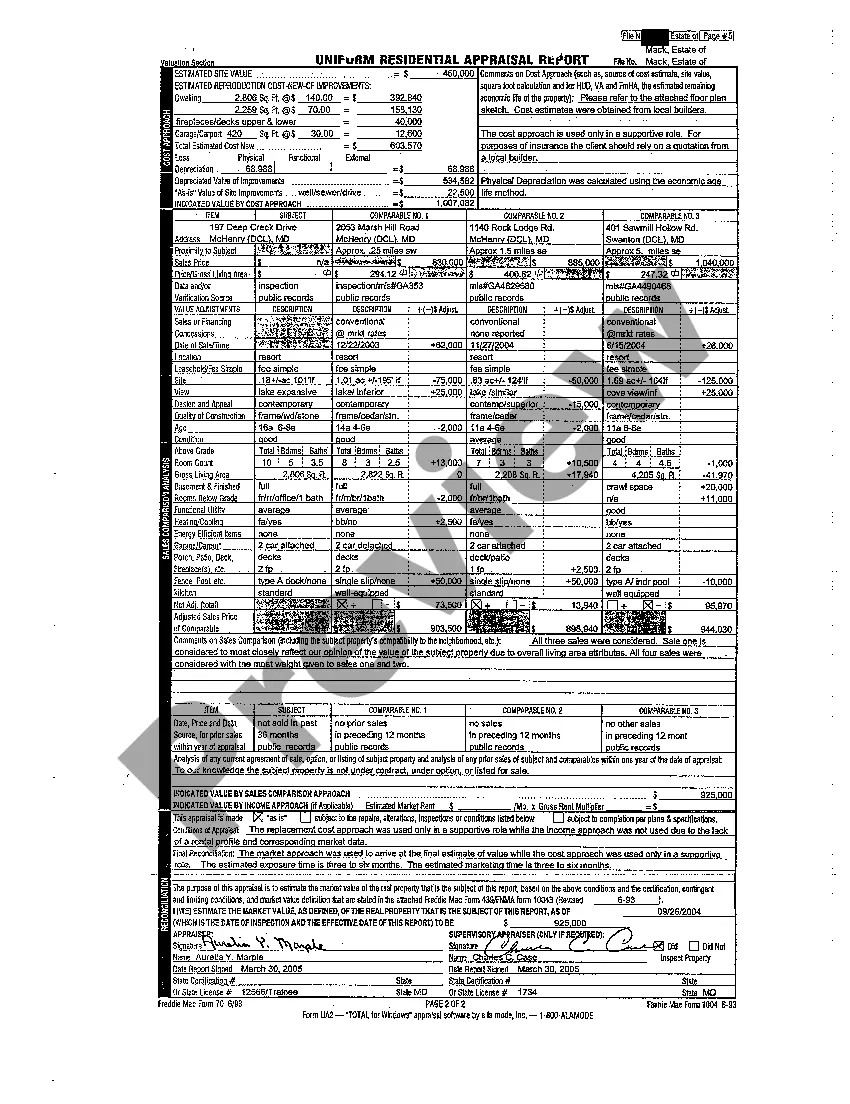

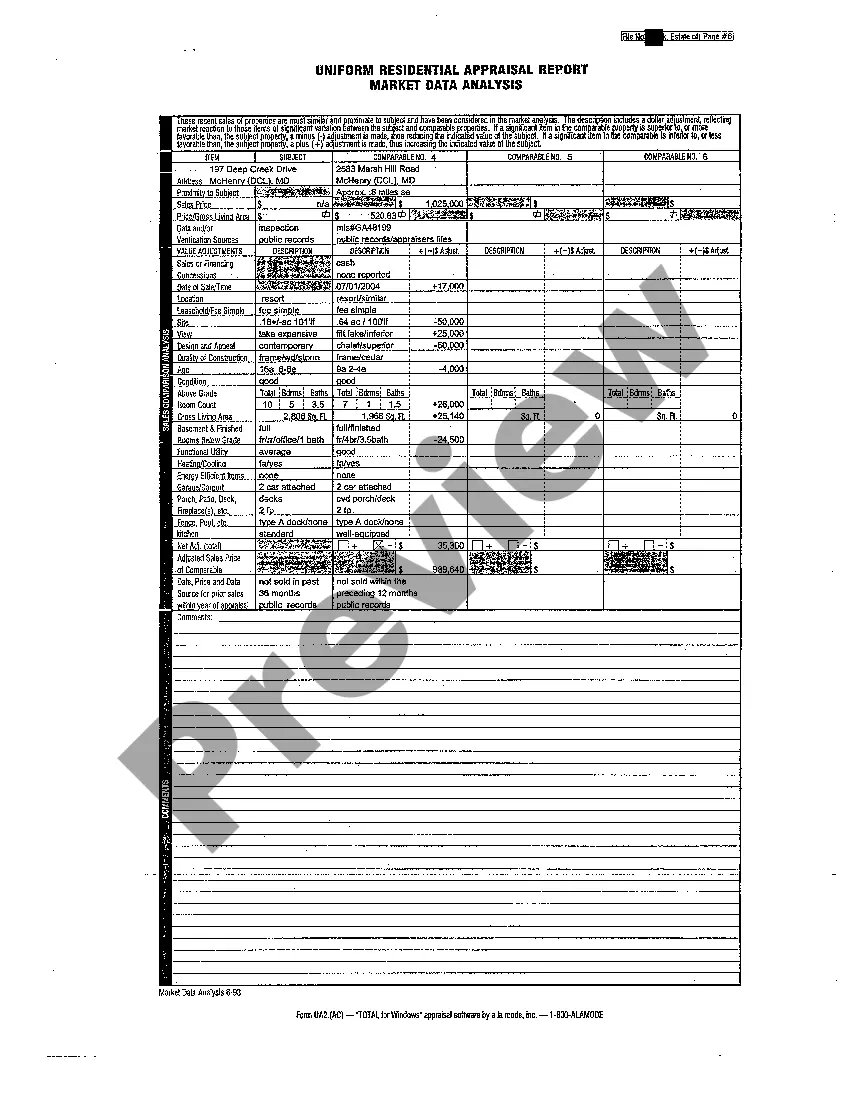

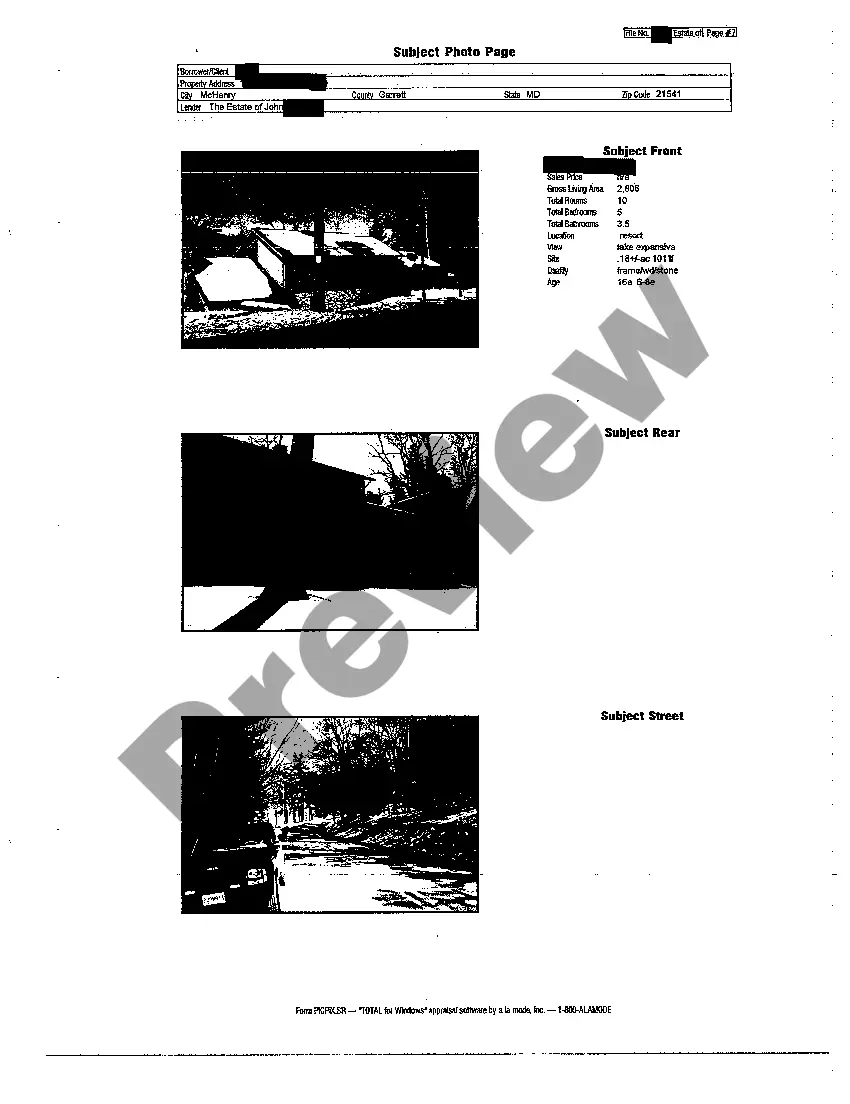

Maryland Appraisal of Decedent's Real Property

Description

How to fill out Maryland Appraisal Of Decedent's Real Property?

Welcome to the largest legal files library, US Legal Forms. Right here you can get any example such as Maryland Appraisal of Decedent's Real Property templates and download them (as many of them as you want/require). Get ready official files with a couple of hours, rather than days or weeks, without spending an arm and a leg on an lawyer or attorney. Get the state-specific form in a few clicks and feel assured knowing that it was drafted by our state-certified lawyers.

If you’re already a subscribed customer, just log in to your account and click Download near the Maryland Appraisal of Decedent's Real Property you require. Because US Legal Forms is online solution, you’ll generally have access to your saved templates, regardless of the device you’re utilizing. See them in the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check our instructions below to start:

- If this is a state-specific document, check its applicability in the state where you live.

- View the description (if available) to understand if it’s the correct template.

- See more content with the Preview function.

- If the document fulfills all of your requirements, click Buy Now.

- To make your account, pick a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Download the document in the format you want (Word or PDF).

- Print the file and fill it with your/your business’s information.

As soon as you’ve filled out the Maryland Appraisal of Decedent's Real Property, send out it to your attorney for verification. It’s an extra step but an essential one for making sure you’re entirely covered. Sign up for US Legal Forms now and access a mass amount of reusable examples.

Form popularity

FAQ

The laws are different in every state, but if you're married and die without a will, your estate will probably go to your spouse if you both own it. Legally, it's called community property. If you have separate property, it would likely be split among your surviving spouse, children, siblings and parents.

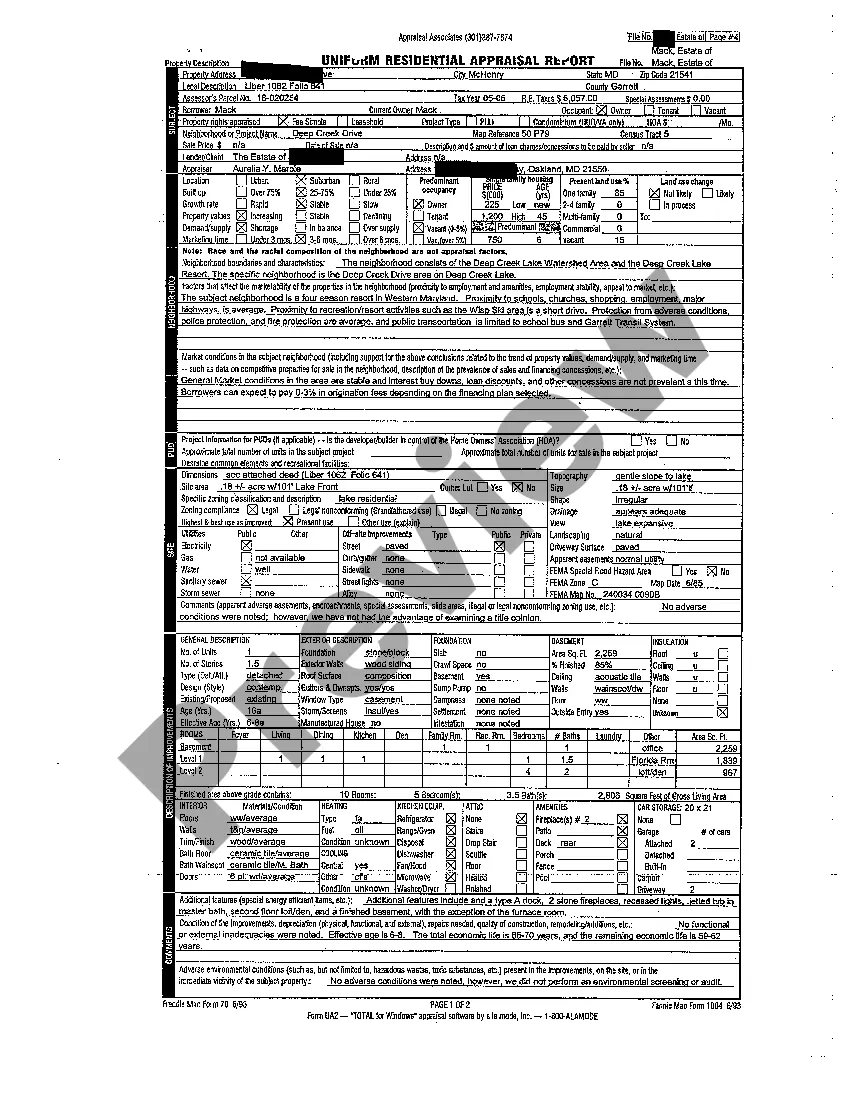

The DOD assesses how much value the heirs actually got for tax purposes. To do that, an appraisal must be performed to determine what the property was worth on that date, even if it was months ago, using historical sales and market data from that date of death.It may also set a new income tax basis for the inheritors.

Fair market value. It is the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts. If you put a restriction on the use of property you donate, the FMV must reflect that restriction.

The basis of an inherited home is generally the Fair Market Value (FMV) of the property at the date of the individual's death. If no appraisal was done at that time, you will need to engage the help of a real estate professional to provide the FMV for you. There is no other way to determine your basis for the property.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

If a person owns assets in his or her individual name and dies without a Will, assets remaining after payment of administration expenses, debts and taxes (if any) are distributed to the person's heirs as provided under Maryland Intestacy Laws (the person is said to have died intestate).

Estate or probate appraisals are commonly ordered between 2-6 months of the death of a loved one (or inheritance of property). Sometimes the appraisal is ordered right away within two weeks, while other times there is a much more substantial time period.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.