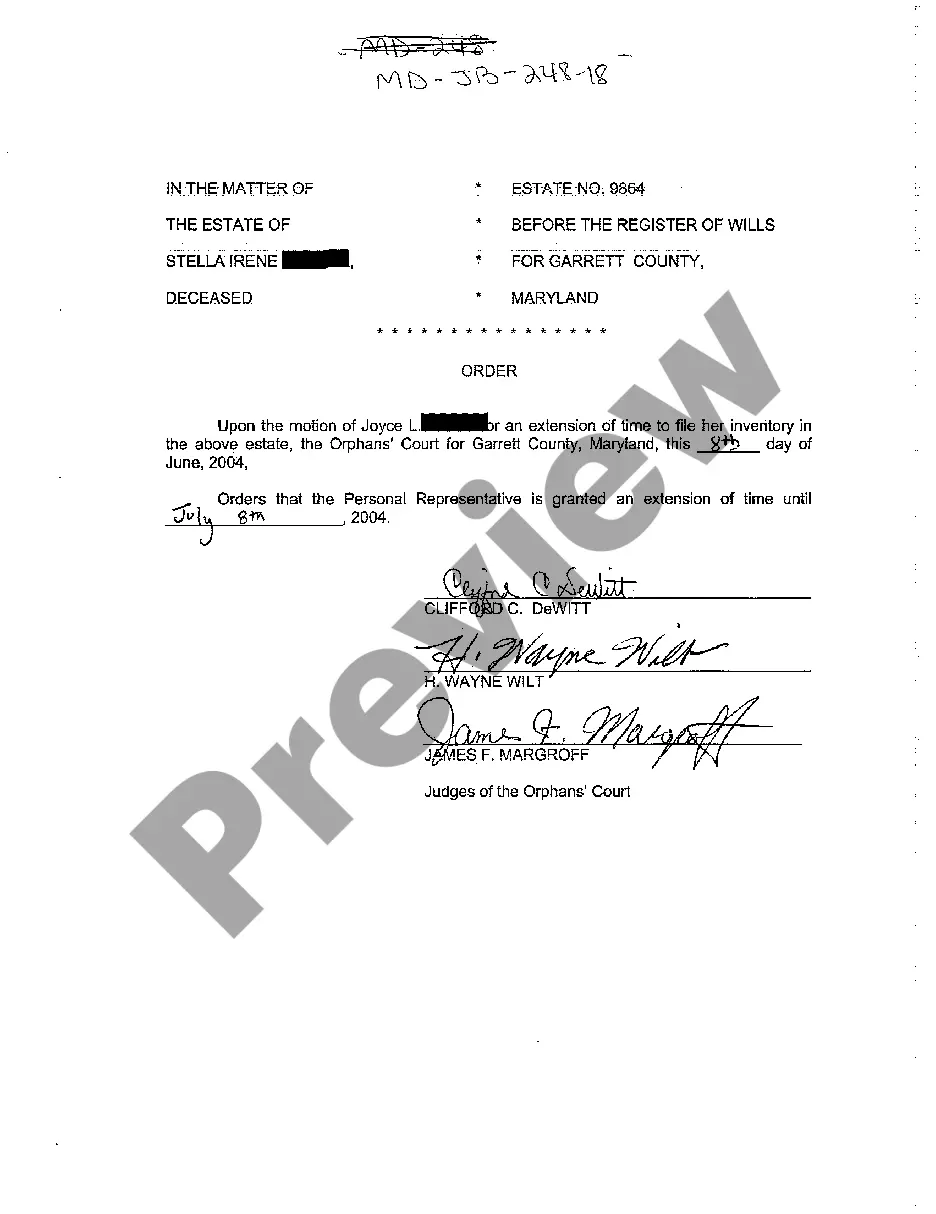

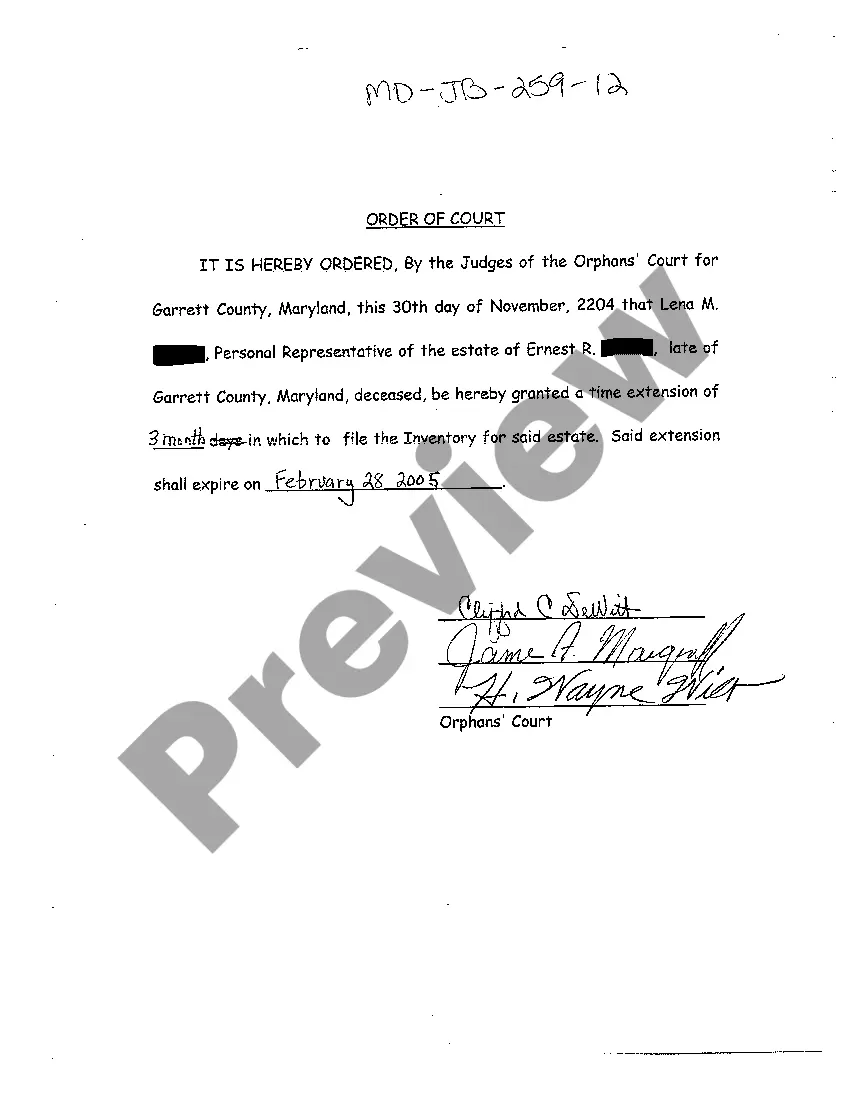

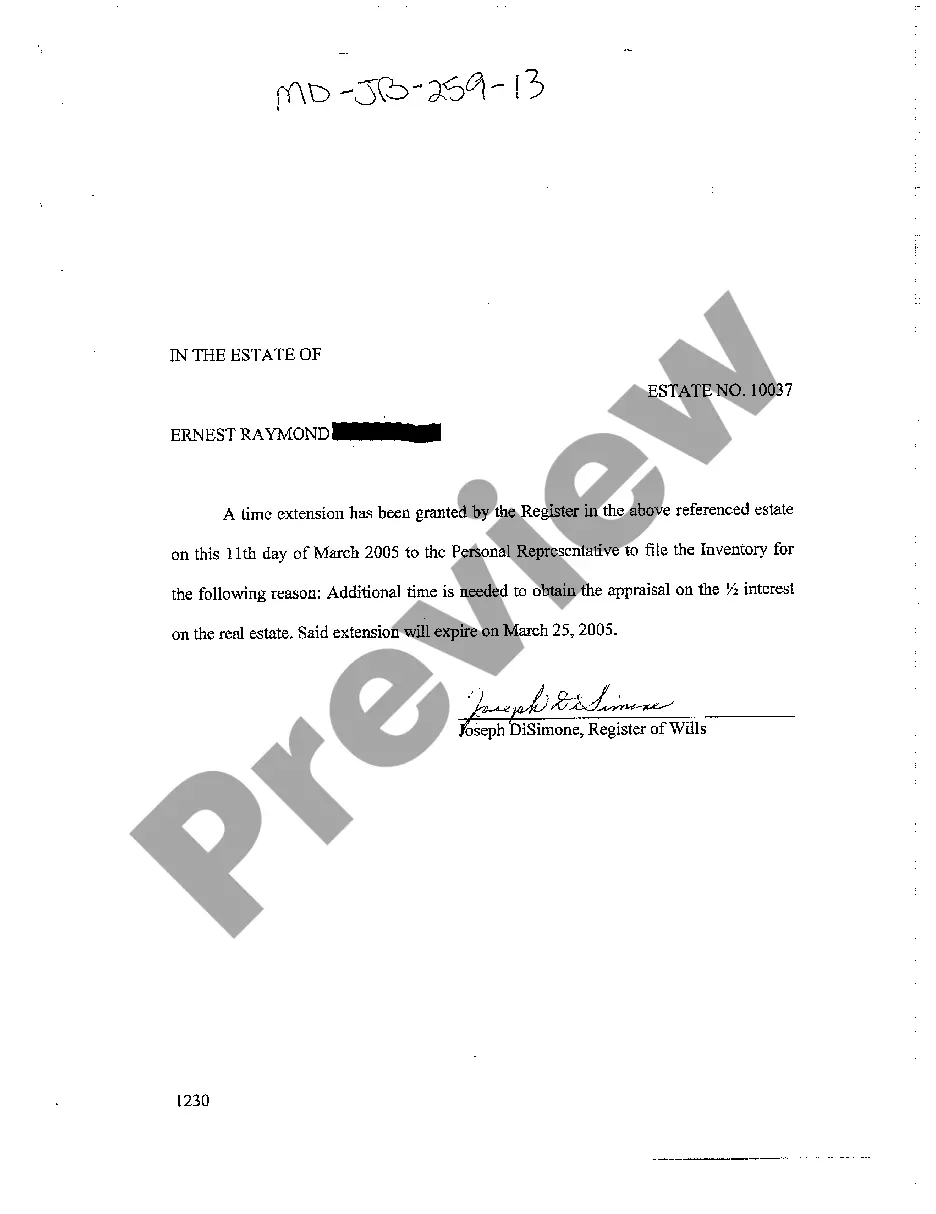

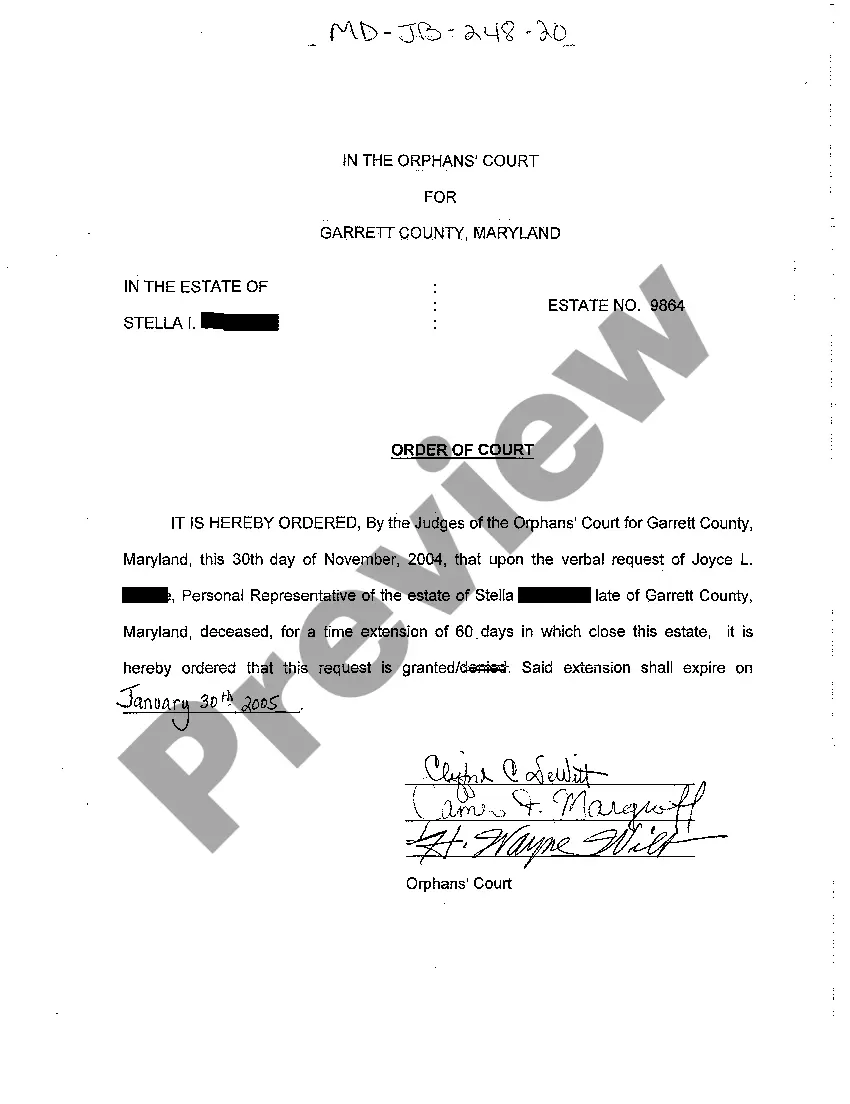

Maryland Order of Court to Extend Time Before Closing of the Estate

Description

How to fill out Maryland Order Of Court To Extend Time Before Closing Of The Estate?

You are invited to the largest legal document repository, US Legal Forms. Right here you will discover any template such as Maryland Order of Court to Extend Time Before Closing of the Estate examples and retain them (as many of them as you desire/require to possess). Create official documents in a few hours, instead of days or even weeks, without costing a fortune on a lawyer.

Obtain the state-specific form in a few clicks and feel assured knowing that it was crafted by our licensed legal experts.

If you’re already a registered user, just Log In to your account and select Download next to the Maryland Order of Court to Extend Time Before Closing of the Estate you wish. Because US Legal Forms is internet-based, you will always have access to your downloaded templates, regardless of the device you’re using. View them within the My documents section.

Print the document and fill it with your/your business’s information. Once you’ve completed the Maryland Order of Court to Extend Time Before Closing of the Estate, send it to your lawyer for verification. It’s an additional step but a vital one for ensuring you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If you don't have an account yet, what are you waiting for? Explore our instructions listed below to get started.

- If this is a state-specific example, verify its validity in the state where you reside.

- Review the description (if available) to determine if it’s the correct example.

- Explore more content with the Preview feature.

- If the example meets all of your requirements, click Buy Now.

- To create an account, choose a pricing plan.

- Use a card or PayPal account to sign up.

- Download the template in the format you require (Word or PDF).

Form popularity

FAQ

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

Under Maryland law, Estates & Trusts, the approved Information Report, as submitted to the Register of Wills, typically closes the small estate. If there are any creditors who filed with the Register of Wills any unpaid valid claims could cause the small estate to remain open.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

How to Close an Estate in Maryland Probate. Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.