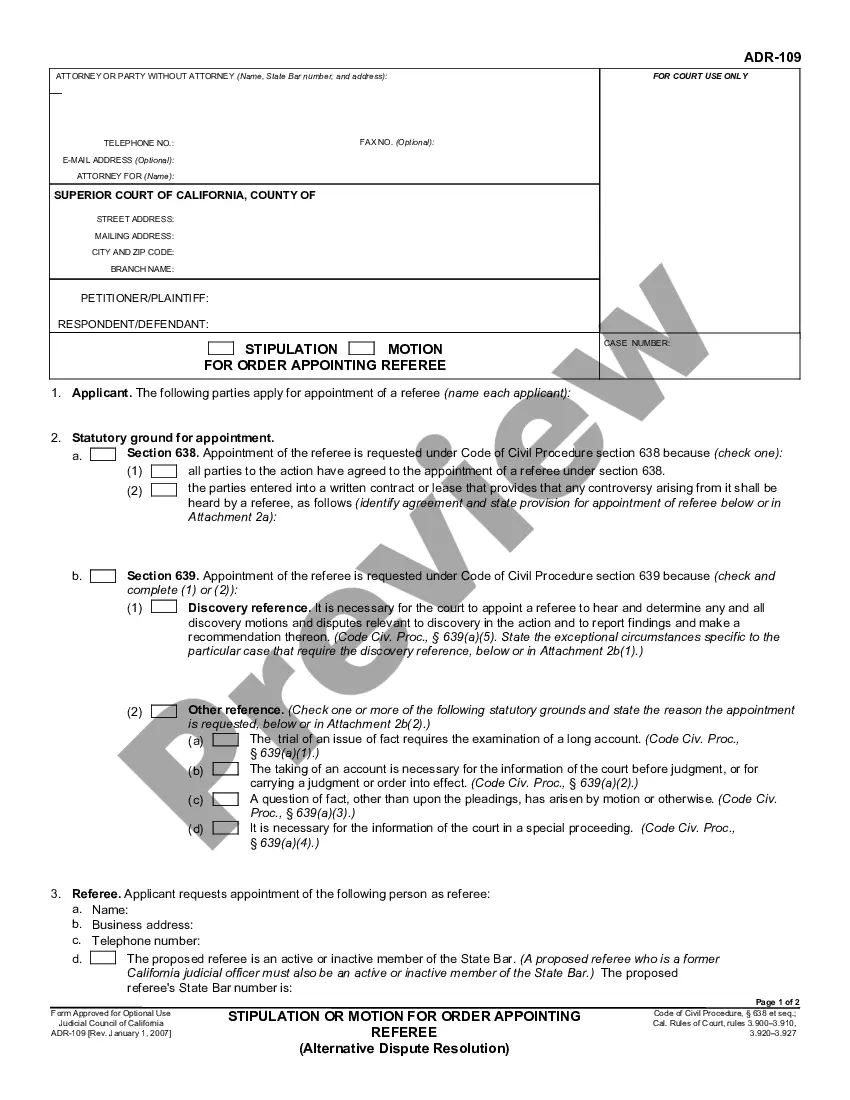

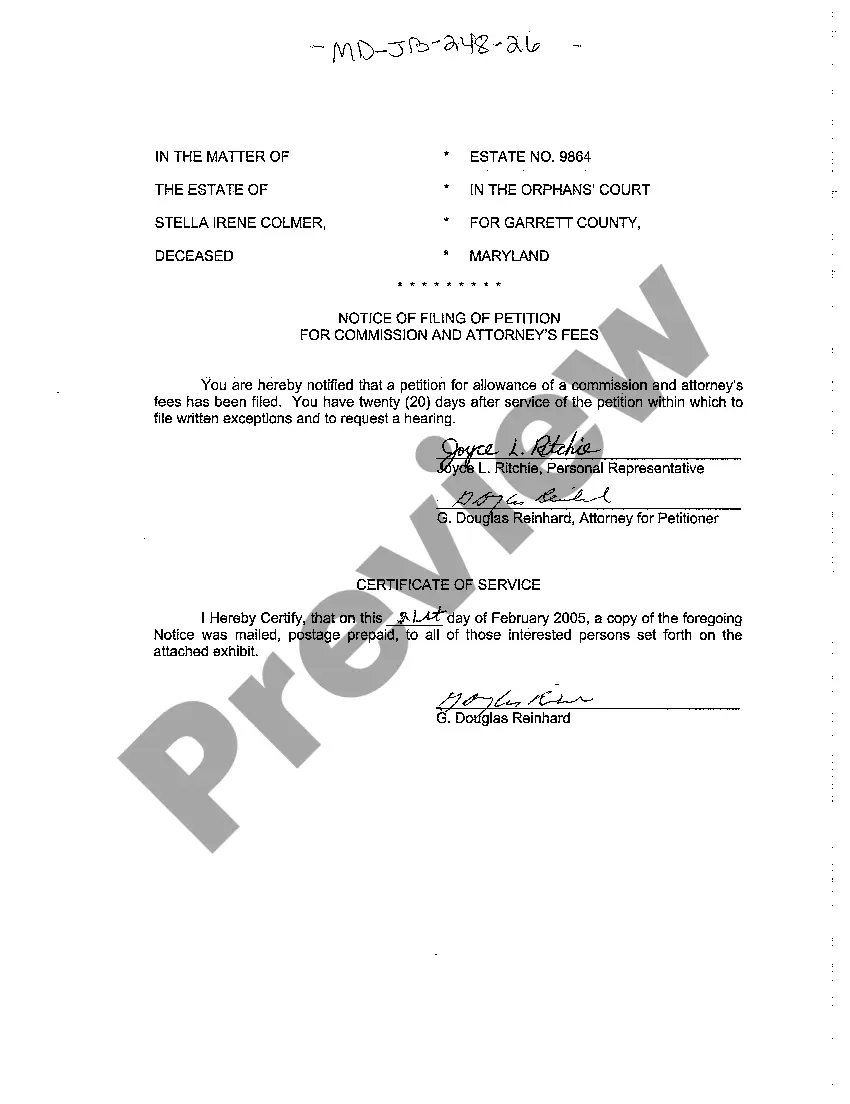

Maryland Notice of Filing of Petition for Commission and Attorney's Fees

Description

How to fill out Maryland Notice Of Filing Of Petition For Commission And Attorney's Fees?

Welcome to the greatest legal documents library, US Legal Forms. Right here you can get any sample such as Maryland Notice of Filing of Petition for Commission and Attorney's Fees templates and save them (as many of them as you want/need to have). Get ready official files with a several hours, rather than days or weeks, without spending an arm and a leg on an attorney. Get your state-specific sample in a few clicks and be assured with the knowledge that it was drafted by our state-certified lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maryland Notice of Filing of Petition for Commission and Attorney's Fees you want. Because US Legal Forms is web-based, you’ll always have access to your downloaded files, regardless of the device you’re using. See them inside the My Forms tab.

If you don't have an account yet, what exactly are you waiting for? Check out our instructions below to start:

- If this is a state-specific document, check its applicability in your state.

- Look at the description (if available) to understand if it’s the proper template.

- See much more content with the Preview function.

- If the sample fulfills all of your needs, click Buy Now.

- To make an account, choose a pricing plan.

- Use a card or PayPal account to join.

- Save the template in the format you want (Word or PDF).

- Print the file and complete it with your/your business’s info.

As soon as you’ve filled out the Maryland Notice of Filing of Petition for Commission and Attorney's Fees, send out it to your attorney for verification. It’s an extra step but an essential one for making sure you’re fully covered. Sign up for US Legal Forms now and get access to a large number of reusable examples.

Form popularity

FAQ

How to Close an Estate in Maryland Probate. Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.

The Will must be filed in the Orphan's Court in the county where the decedent lived. The Will must be filed within a reasonable amount of time at the Register of Wills.

The simple answer is that once you have a grant of probate or letter of administration in hand, it usually takes between six and twelve months to transfer all the funds, assets and property in an estate.The Department for Work and Pensions needs to investigate the estate. The estate is bankrupt.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.