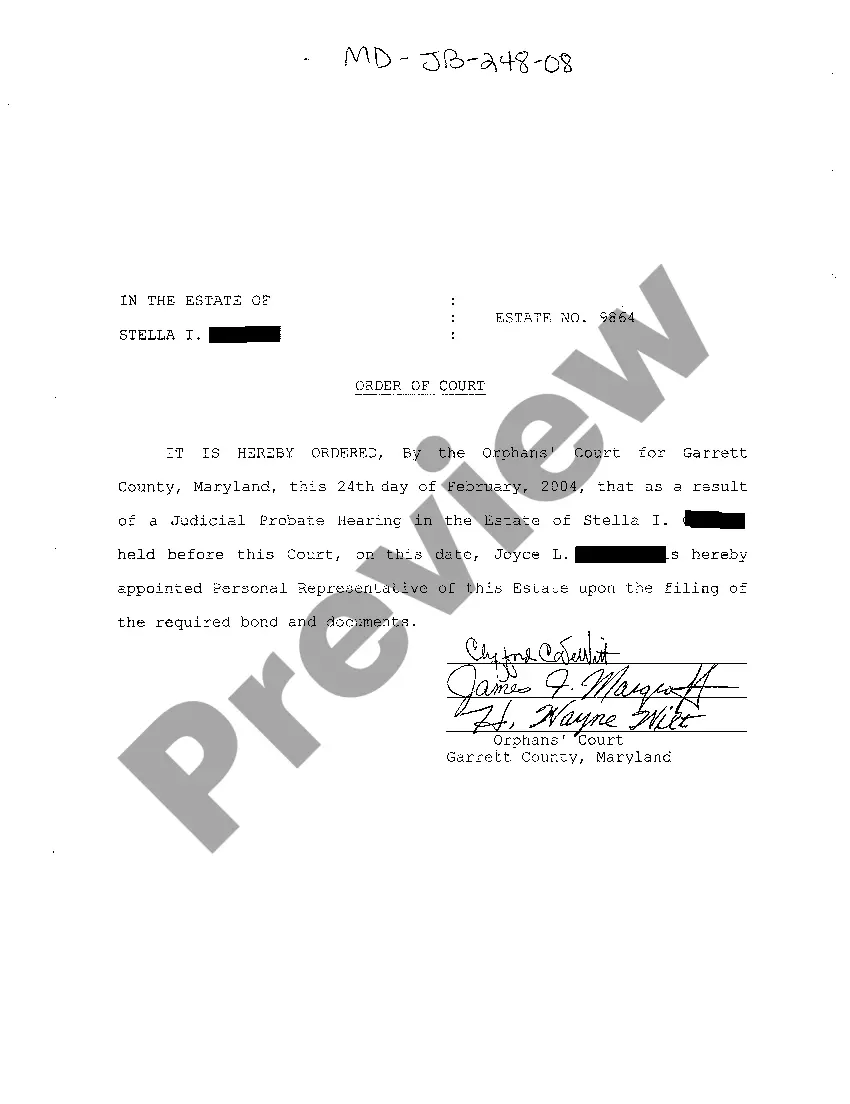

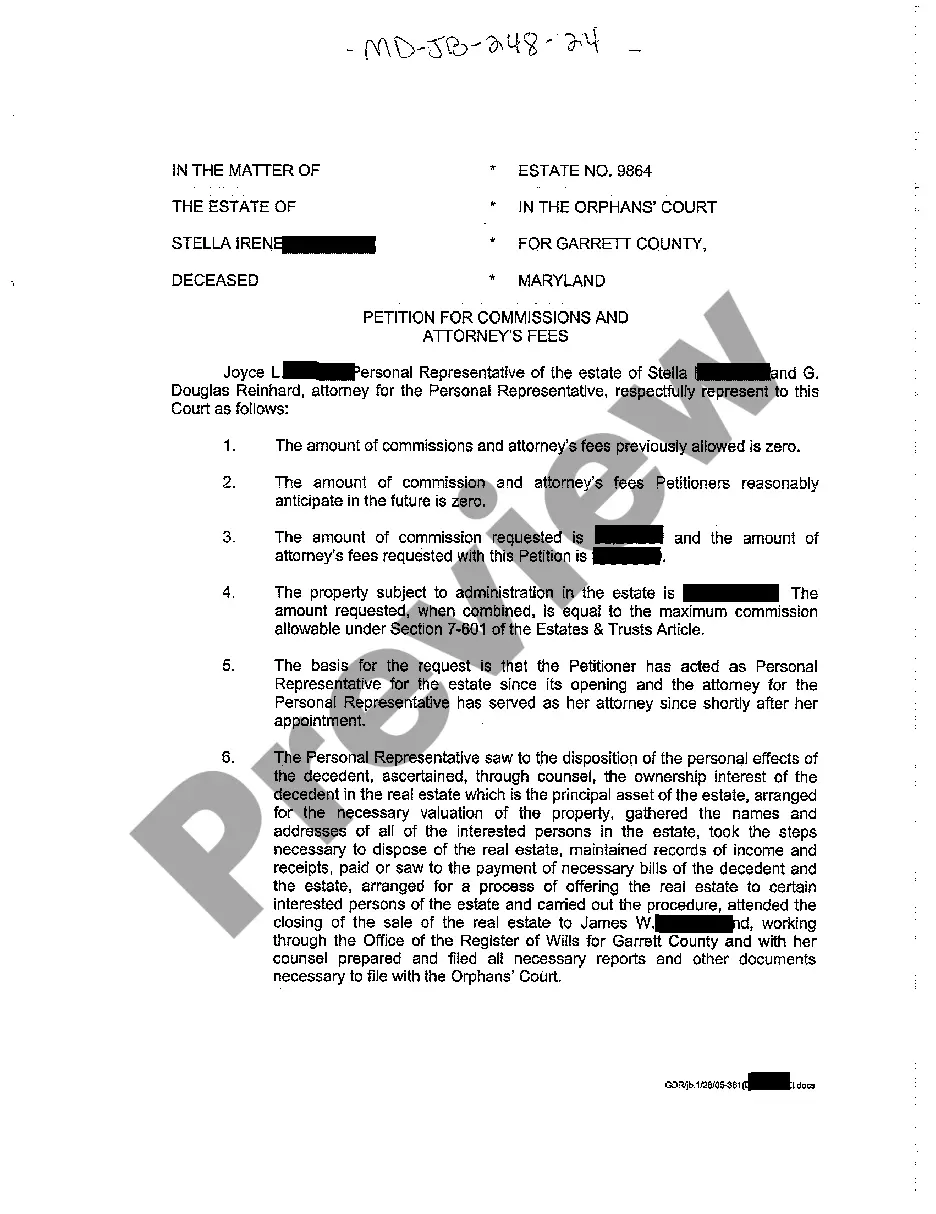

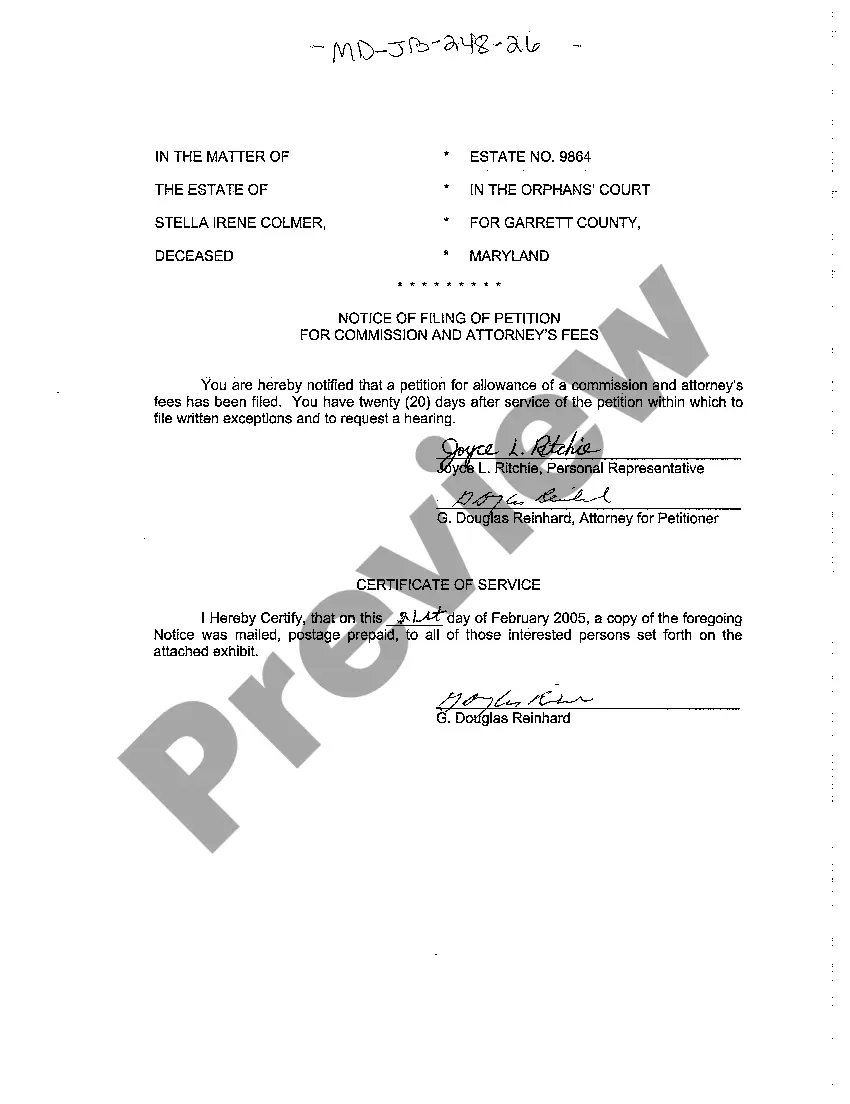

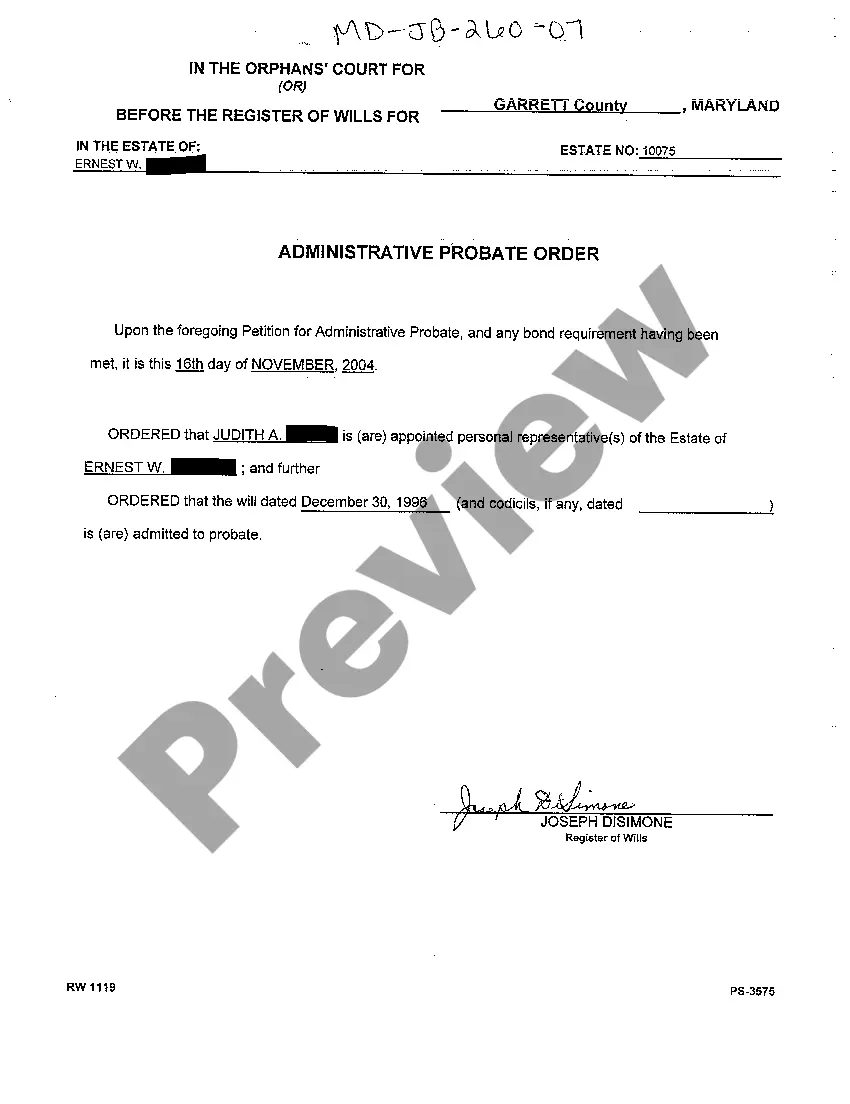

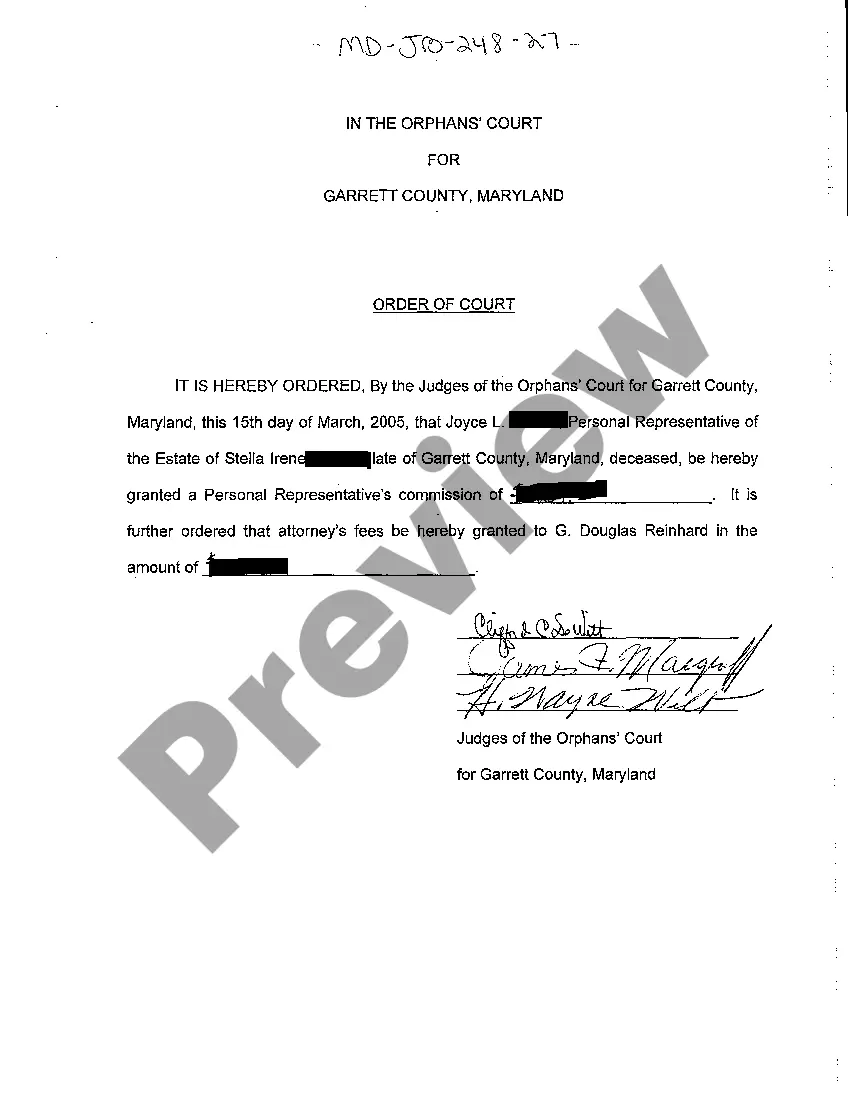

Maryland Order of Court Granting Personal Representative's Commission Fees

Description

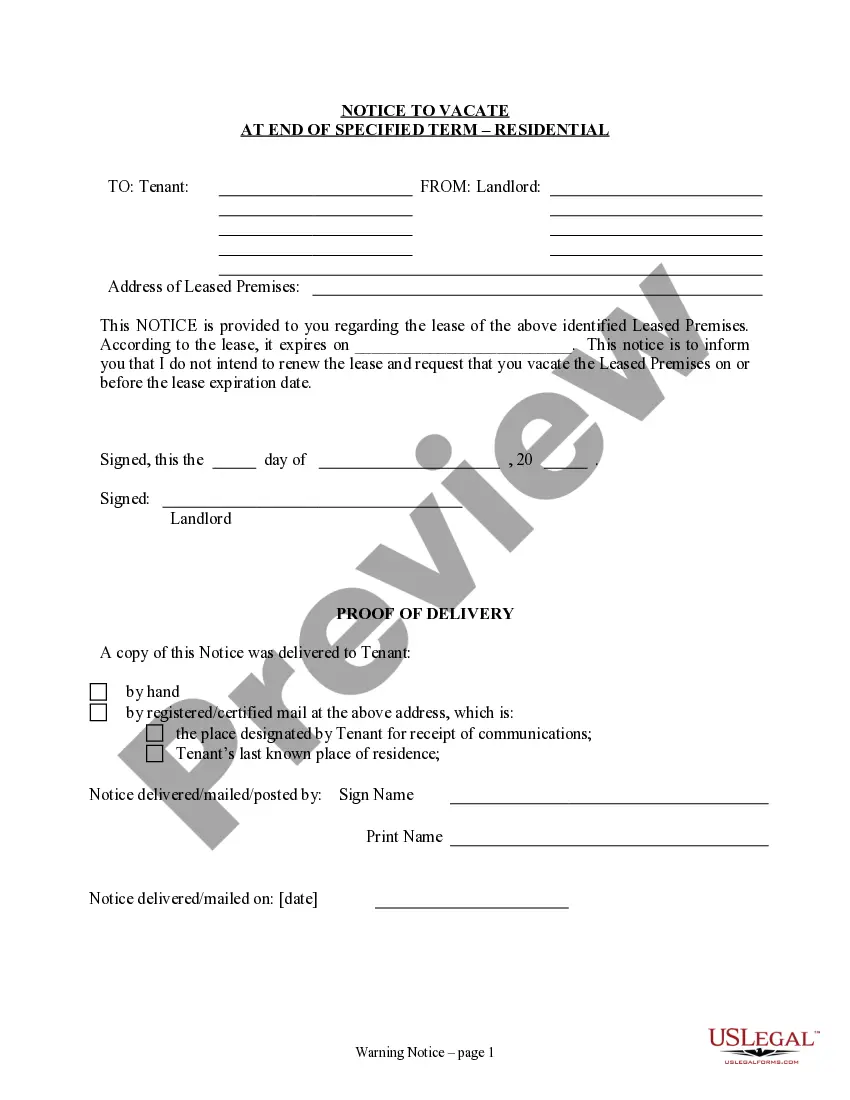

How to fill out Maryland Order Of Court Granting Personal Representative's Commission Fees?

Greetings to the most extensive legal documents repository, US Legal Forms. Here, you can discover any sample such as Maryland Order of Court Granting Personal Representative's Commission Fees templates and download them (as numerous as you wish/require). Create legal documents in a matter of hours, instead of days or weeks, without having to pay exorbitant fees to a legal expert.

Obtain your state-specific template in just a few clicks and feel assured knowing that it was crafted by our licensed attorneys.

If you’re already a subscribed customer, simply Log In to your account and then click Download next to the Maryland Order of Court Granting Personal Representative's Commission Fees you need. Because US Legal Forms is an online service, you’ll consistently have access to your saved forms, no matter which device you’re utilizing. View them within the My documents section.

Print the document and fill it out with your or your business’s particulars. After completing the Maryland Order of Court Granting Personal Representative's Commission Fees, send it to your attorney for validation. It’s an additional step but an essential one for ensuring you’re thoroughly protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If you do not possess an account yet, what are you waiting for.

- Review our instructions below to begin.

- If this is a state-specific form, verify its relevance in your state.

- Examine the description (if provided) to determine if it’s the correct sample.

- Access additional information with the Preview feature.

- If the sample satisfies your requirements, simply click Buy Now.

- To create your account, select a pricing plan.

- Utilize a card or PayPal account for registration.

- Download the document in your preferred format (Word or PDF).

Form popularity

FAQ

Paying any debts and liabilities of the estate, owing prior to death; defending the Will of the deceased if litigation is started against the deceased's estate; attending to tax returns for the deceased and their estate; distributing the estate in accordance with the deceased's Will.

Professional executors, such as solicitors or banks, are of course able to charge for their time, but there is no financial incentive for lay executors.The only exception is if a clause has been included in the will which specifically allows an executor to charge for their time.

The Maryland statutes say that the maximum personal representative fee is 9 percent of the estate's value if the estate is worth $20,000 or less. That would equal $900 on a $10,000 estate. The fee is $1,800 for estates greater than $20,000, plus 3.6 percent of the estate's value over $20,000.

Under California law, an executor or administrator of the estate can receive compensation for working on the estate.If an estate is valued at under $100,000, the executor may be paid an amount that is four percent of the value.

If the deceased person appointed a professional Executor in their Will, it's common for the professional to charge a fee for this service. The professional Executor will want to ensure that the Will contains a specific fee clause, which will entitle them to charge for their services.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

If the estate is valued at an amount greater than $25 million, the California Probate Code does not establish a percentage for the executor to receive. Instead, the court sets a reasonable fee for the executor.