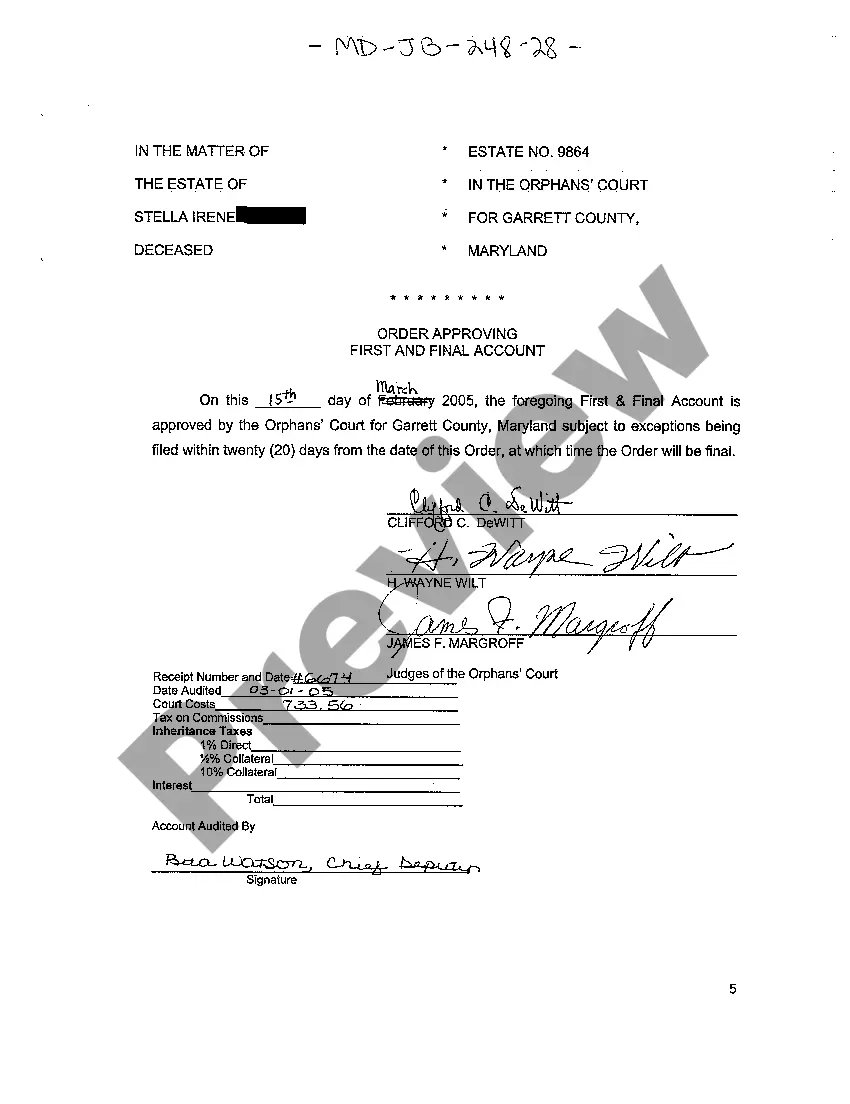

Maryland Order Approving First and Final Account

Description

How to fill out Maryland Order Approving First And Final Account?

Welcome to the largest legal documents library, US Legal Forms. Here you will find any template including Maryland Order Approving First and Final Account templates and download them (as many of them as you wish/need to have). Get ready official documents in just a few hours, instead of days or even weeks, without having to spend an arm and a leg with an lawyer. Get your state-specific example in a couple of clicks and be assured knowing that it was drafted by our qualified legal professionals.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Maryland Order Approving First and Final Account you want. Because US Legal Forms is online solution, you’ll generally have access to your saved forms, no matter the device you’re using. Find them inside the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check our guidelines listed below to begin:

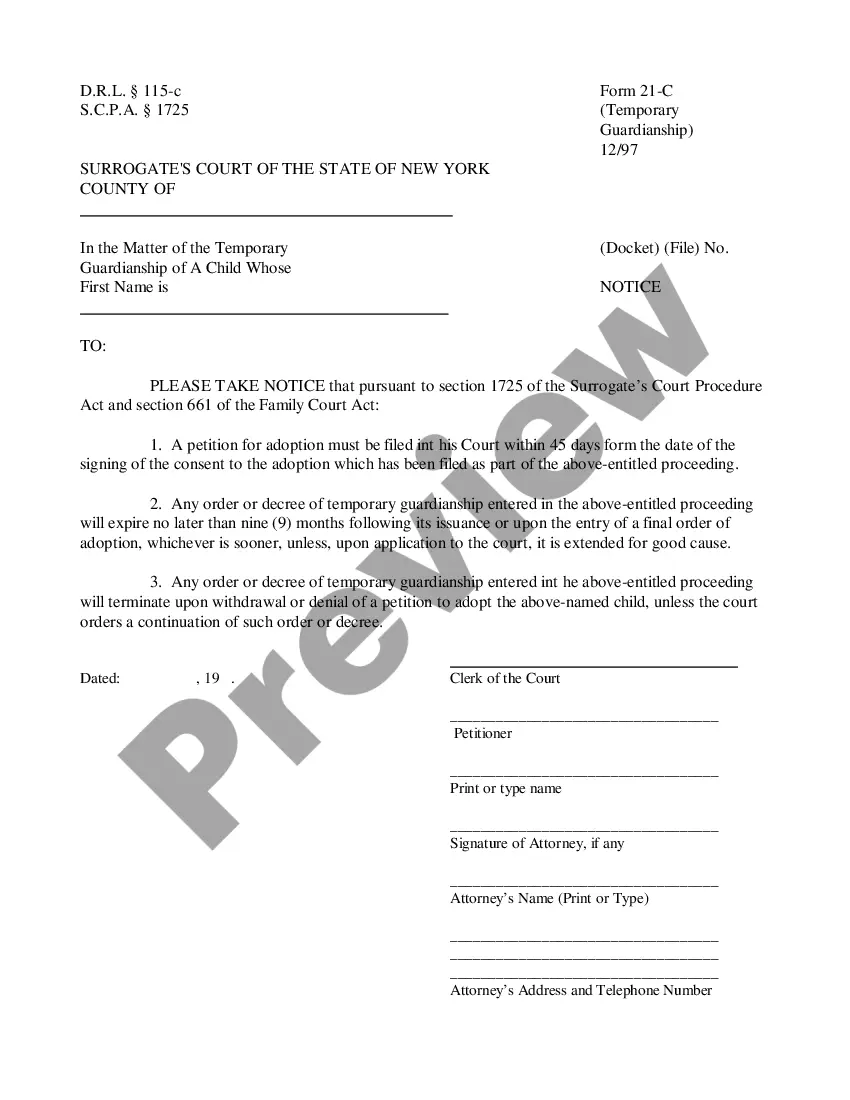

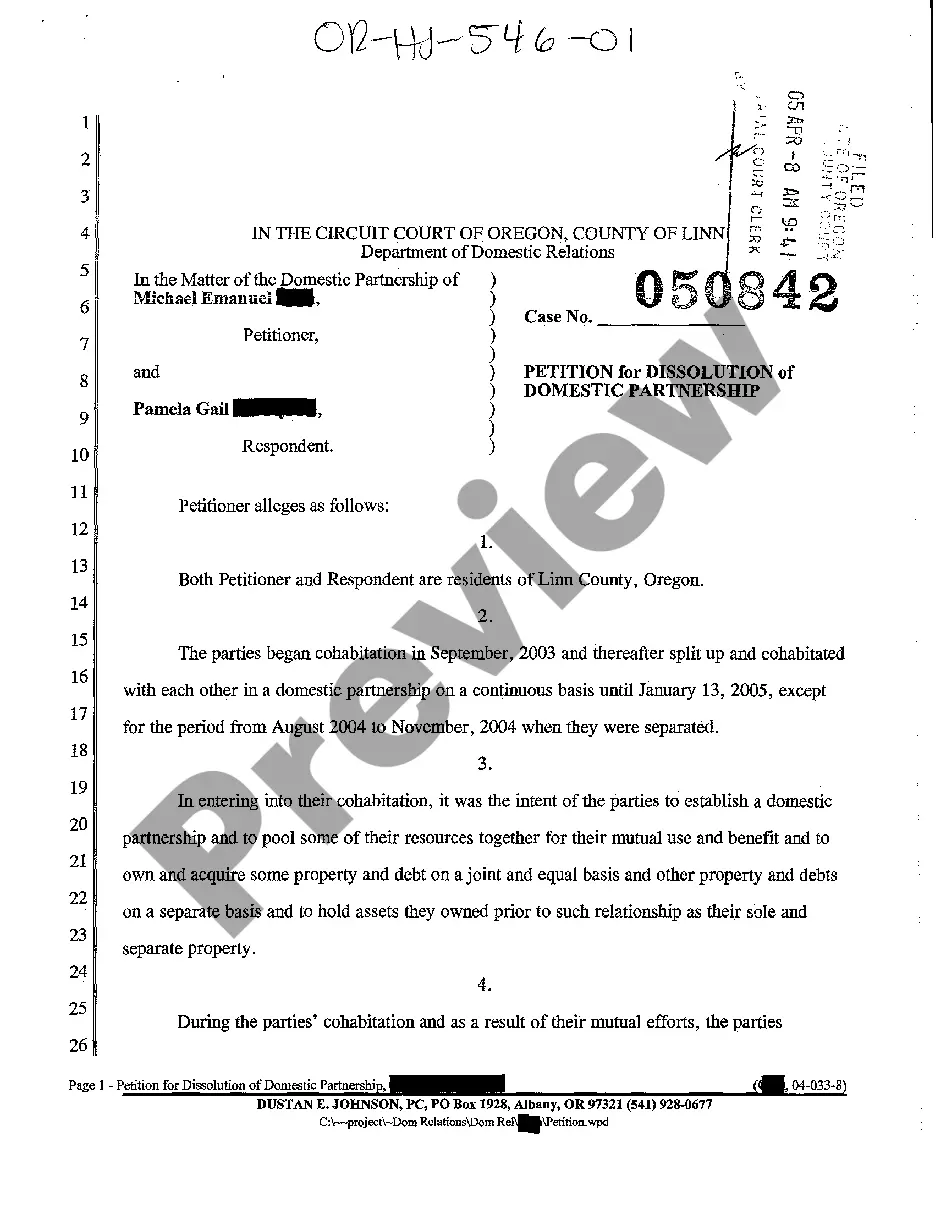

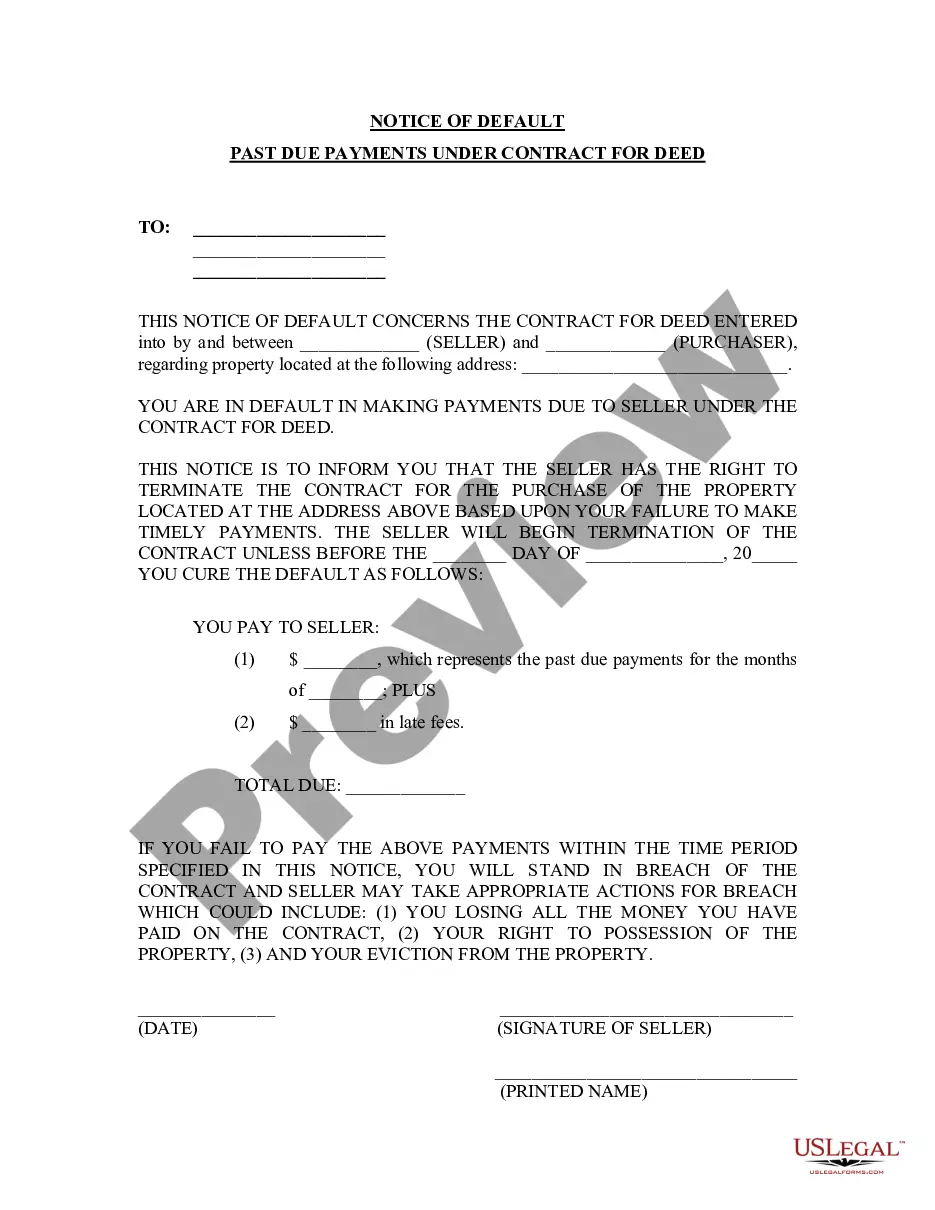

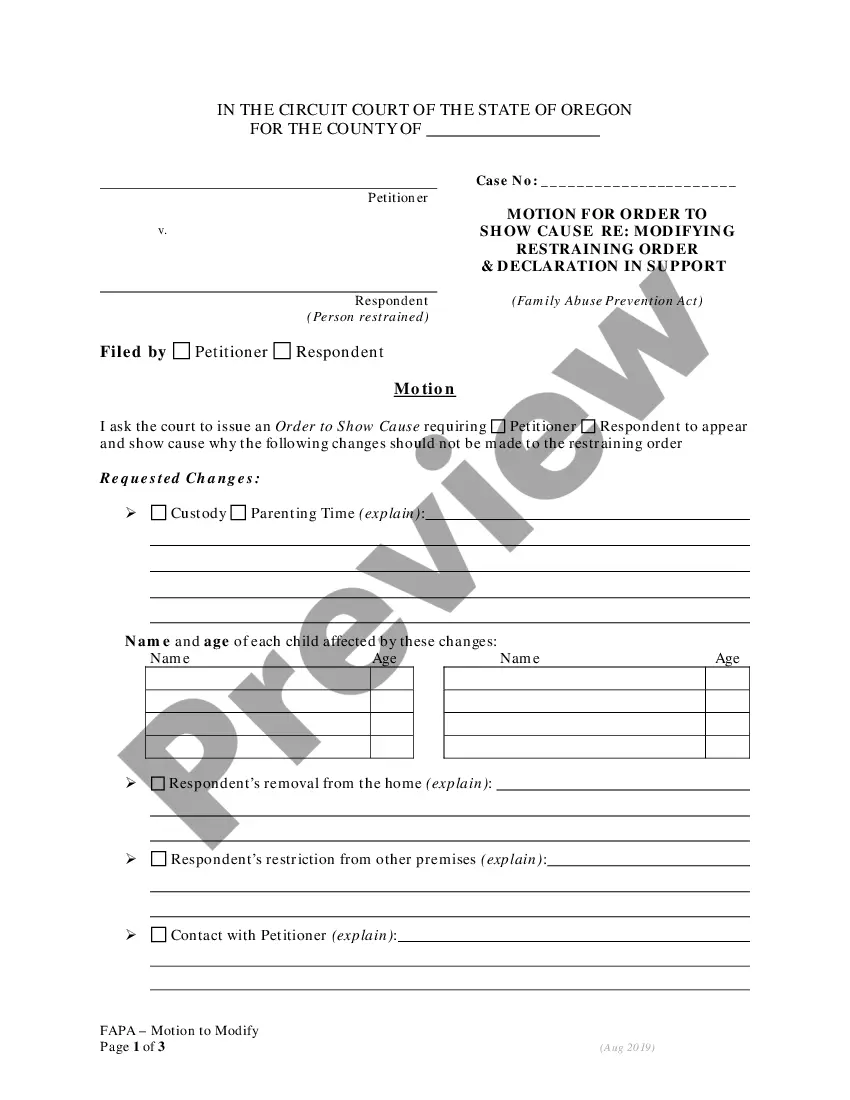

- If this is a state-specific sample, check out its validity in your state.

- Look at the description (if readily available) to understand if it’s the proper template.

- See a lot more content with the Preview option.

- If the document matches all your requirements, just click Buy Now.

- To make your account, pick a pricing plan.

- Use a card or PayPal account to sign up.

- Download the template in the format you want (Word or PDF).

- Print out the document and complete it with your/your business’s info.

As soon as you’ve filled out the Maryland Order Approving First and Final Account, send it to your attorney for confirmation. It’s an extra step but a necessary one for making sure you’re entirely covered. Sign up for US Legal Forms now and get a large number of reusable samples.

Form popularity

FAQ

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

The Personal Representative is responsible for identifying probate assets (assets in the sole name of the decedent), filing the necessary forms and tax returns required by Law, paying from the estate assets administration expenses, valid creditor claims (including funeral expenses) and taxes (if there are any), and

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

Maryland Law requires that any one holding an original Will and/or Codicil(s) must file that document with the Register of Wills promptly after a decedent's death even if there are no assets. However, although the Will and/or Codicil are kept on file, no probate proceedings are required to be opened.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

The Maryland statutes say that the maximum personal representative fee is 9 percent of the estate's value if the estate is worth $20,000 or less. That would equal $900 on a $10,000 estate. The fee is $1,800 for estates greater than $20,000, plus 3.6 percent of the estate's value over $20,000.

If the estate is small and has a reasonable amount of debt, six to eight months is a fair expectation. With a larger estate, it will likely be more than a year before everything settles. This is especially true if there's a lot of debt or real estate in multiple states.