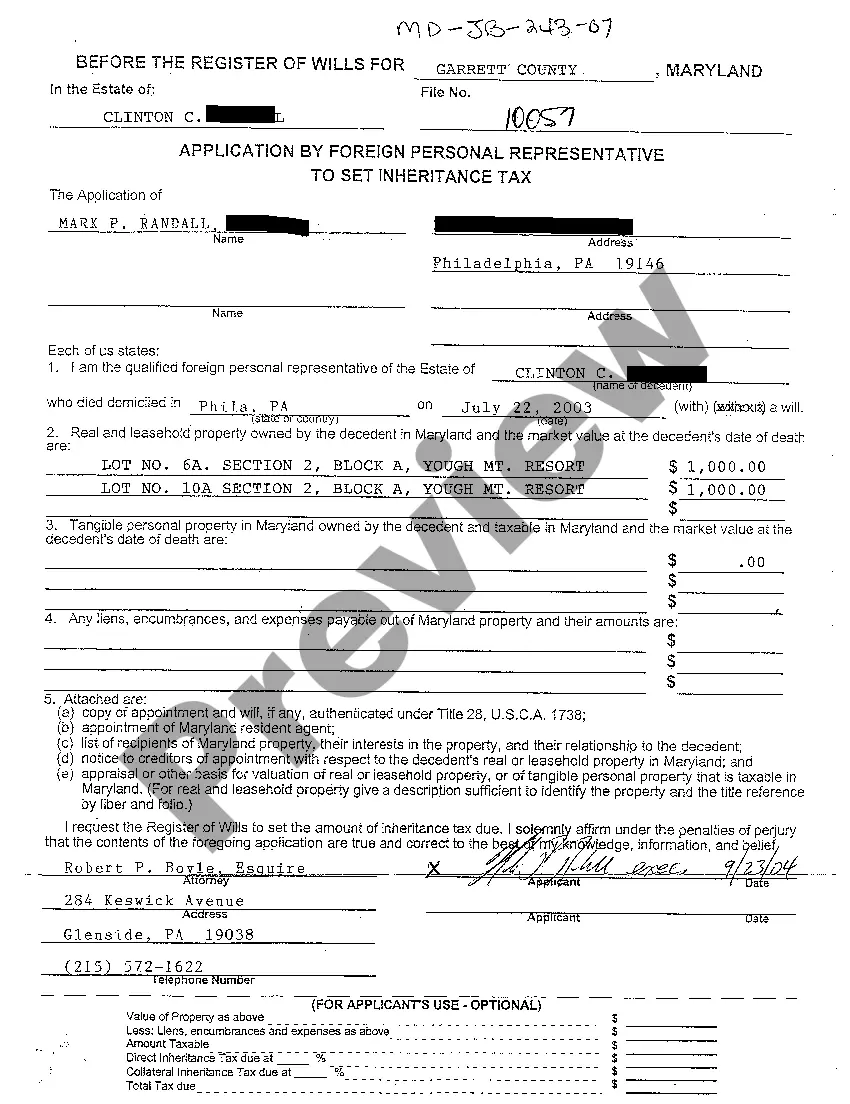

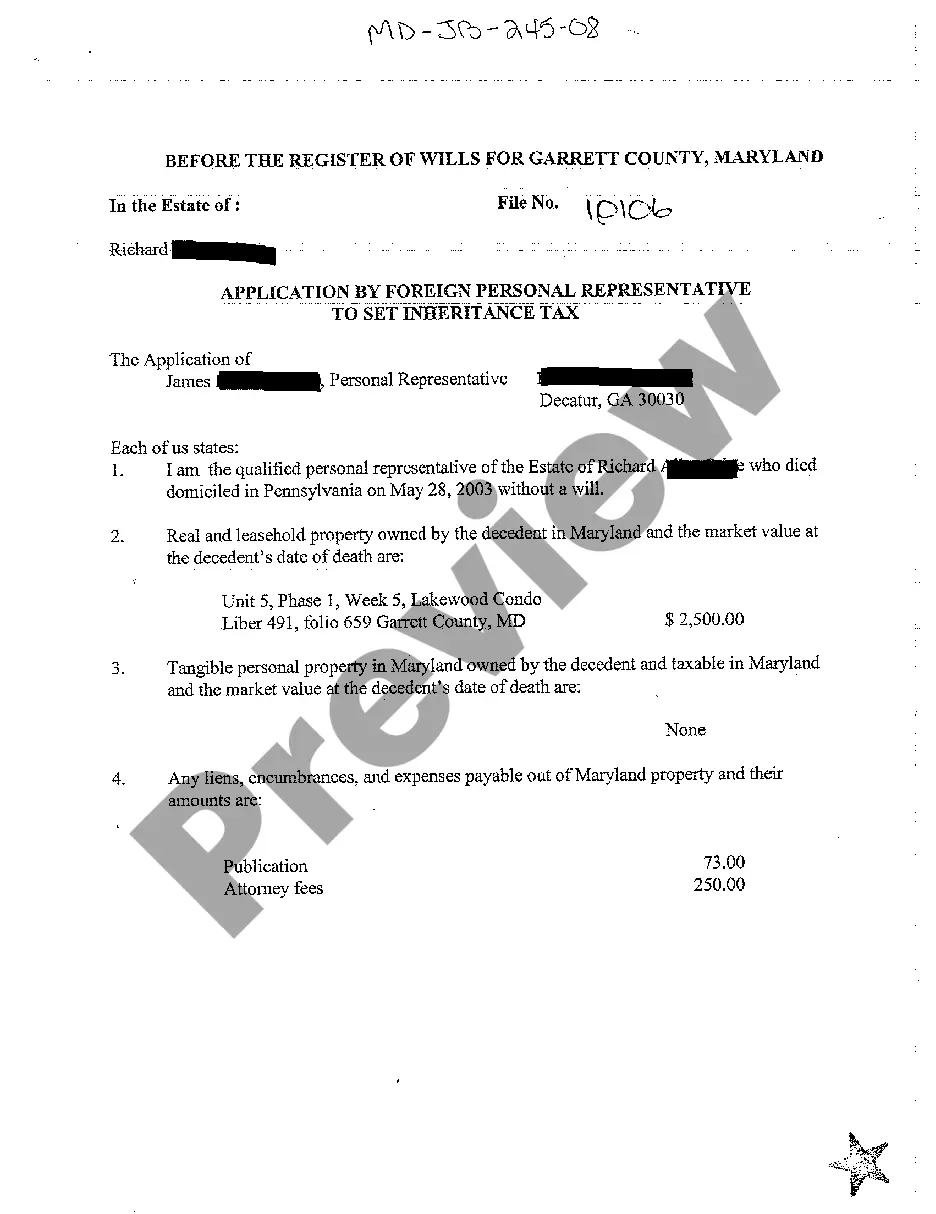

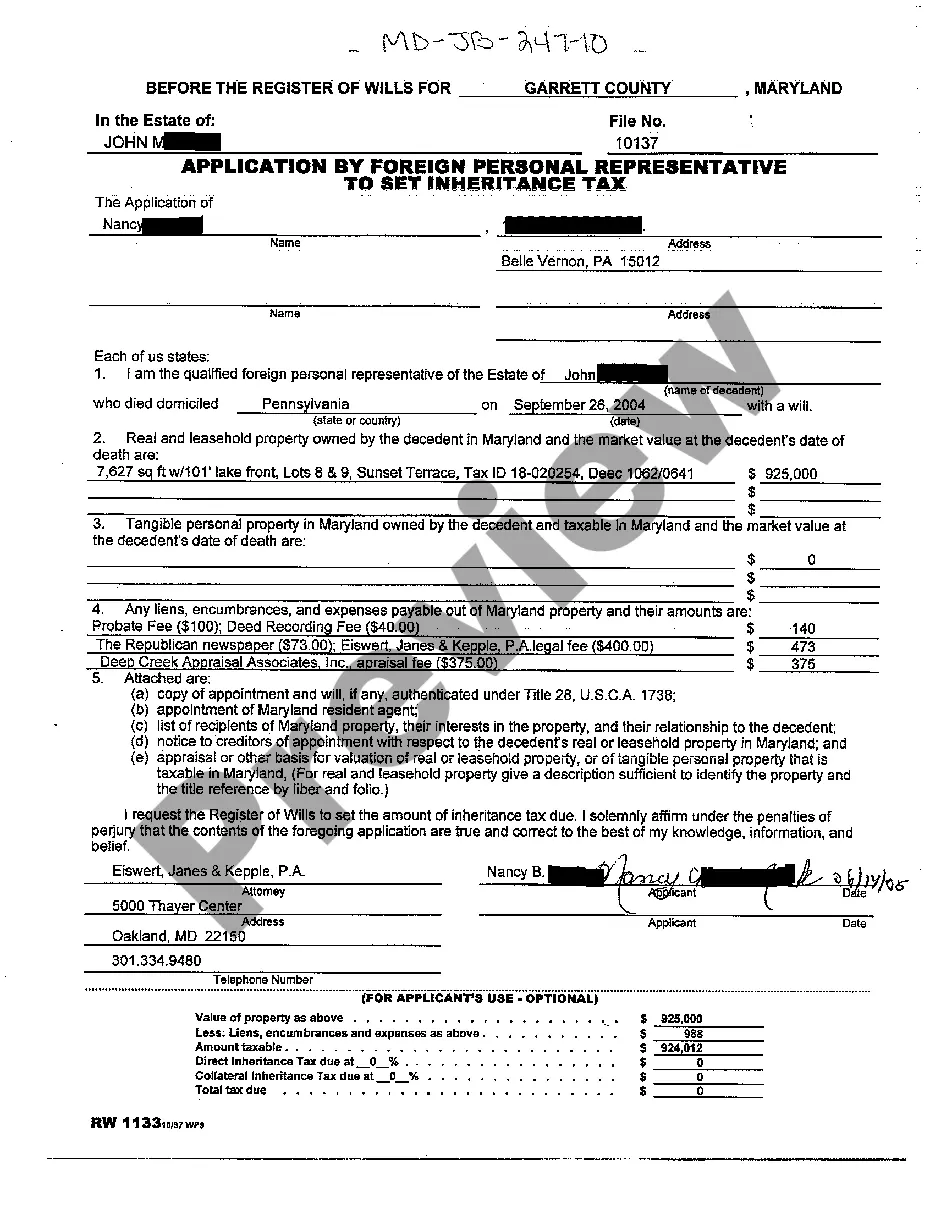

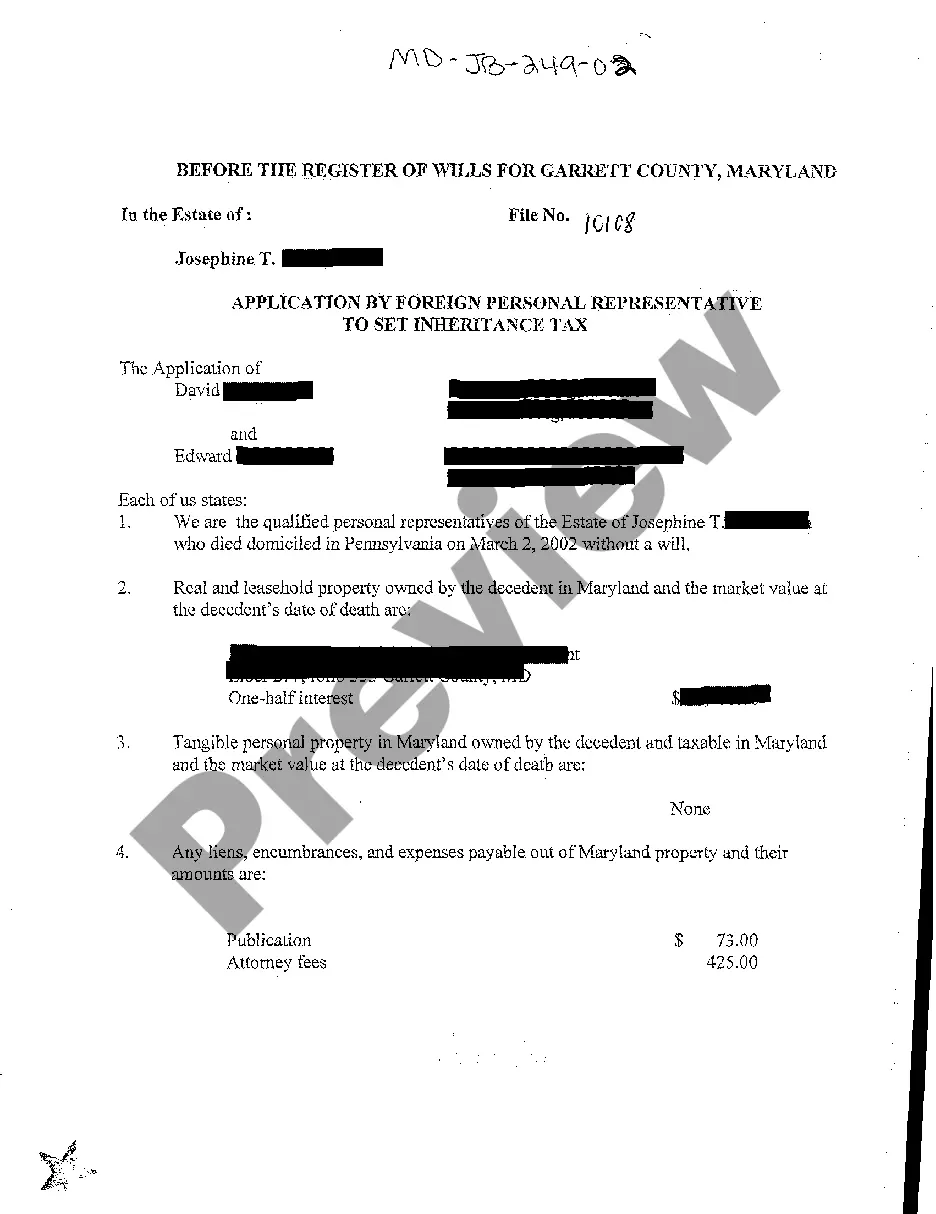

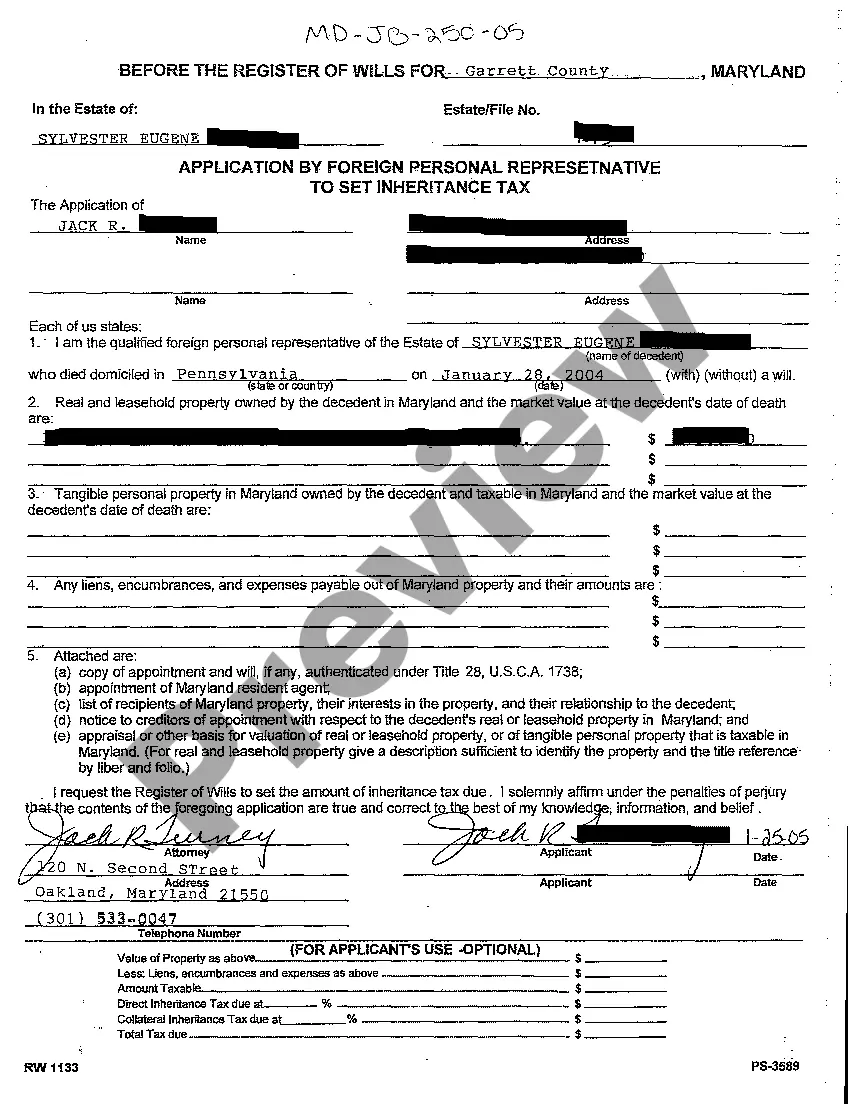

Maryland Application by Foreign Personal Representative to Set Inheritance Tax

Description

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

Greetings to the largest repository of legal documents, US Legal Forms. Here, you can discover any template including Maryland Application by Foreign Personal Representative to Establish Inheritance Tax forms and store them (as many as you desire). Prepare formal documents in just a few hours, rather than days or weeks, without needing to spend a fortune on a lawyer or attorney.

Obtain your state-specific form in a few clicks and feel confident knowing that it was created by our state-certified legal experts.

If you’re already a subscribed client, simply sign in to your account and then click Download next to the Maryland Application by Foreign Personal Representative to Establish Inheritance Tax you require. Since US Legal Forms is online-based, you'll always have access to your saved documents, no matter the device you are using. Find them under the My documents section.

Print the document and fill it out with your/your company’s information. Once you’ve completed the Maryland Application by Foreign Personal Representative to Establish Inheritance Tax, send it to your attorney for validation. This extra step is necessary to ensure you're fully protected. Register for US Legal Forms now and gain access to a vast collection of reusable templates.

- If you haven't set up an account yet, what are you waiting for? Check out our instructions below to get started.

- Verify the applicability of this state-specific form in the state where you reside.

- Review the description (if available) to determine if it’s the correct example.

- View additional content with the Preview option.

- If the template fulfills all your needs, click Buy Now.

- To create your account, select a pricing tier.

- Register using a credit card or PayPal account.

- Download the document in the desired format (Word or PDF).

Form popularity

FAQ

Yes, US inheritance tax can apply to non-US citizens in certain situations. If a non-citizen inherits property located in the United States, they may need to file a Maryland Application by Foreign Personal Representative to Set Inheritance Tax. The amount of tax can depend on various factors, including the value of the inheritance and the relationship to the deceased. It’s essential to consult with a knowledgeable professional to understand your specific situation.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

Petition for Administration. List of Assets and Debts. Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs. Bond of Personal Representative Form. List of Interested Persons. Paid Funeral Bill. Copy of Death Certificate - available from Division of Vital Records.