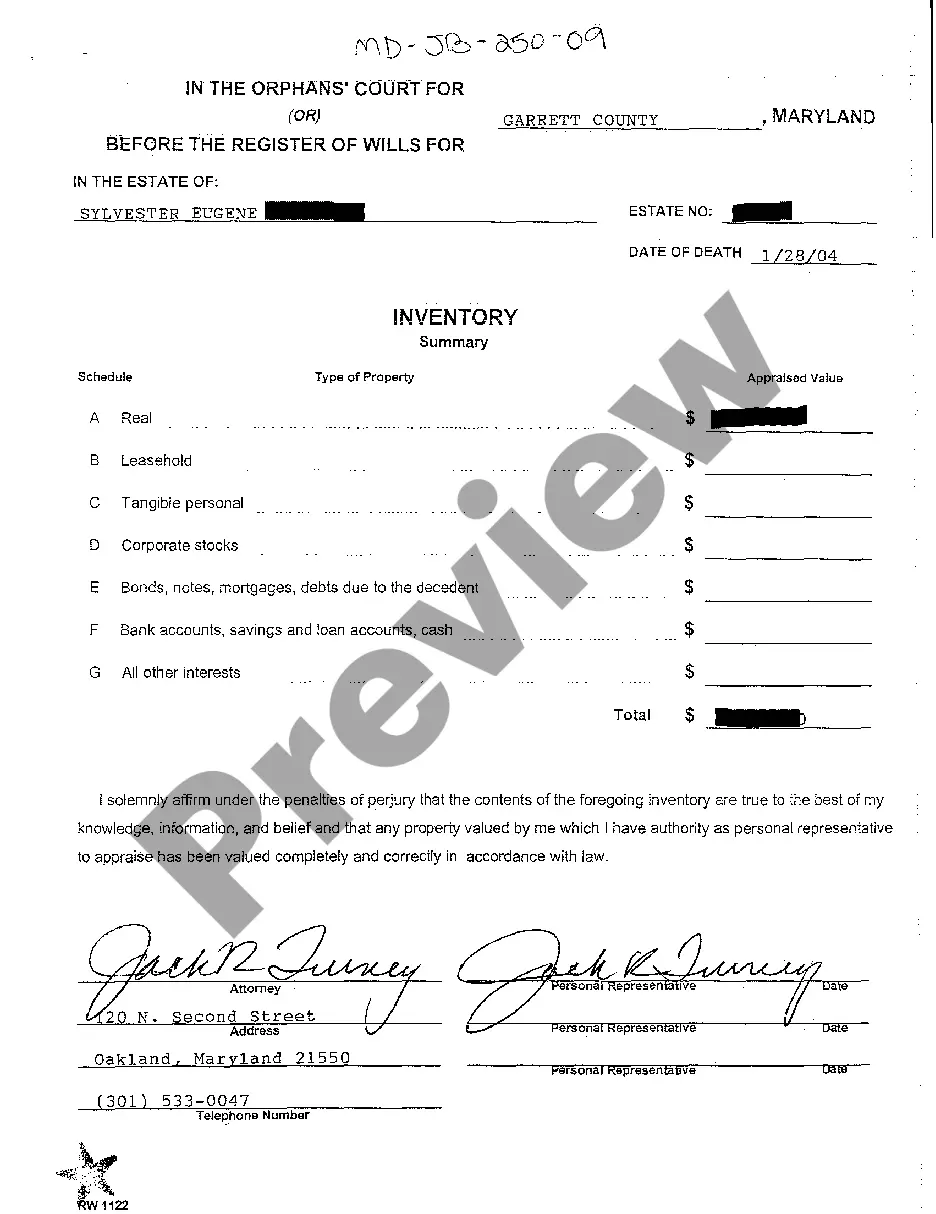

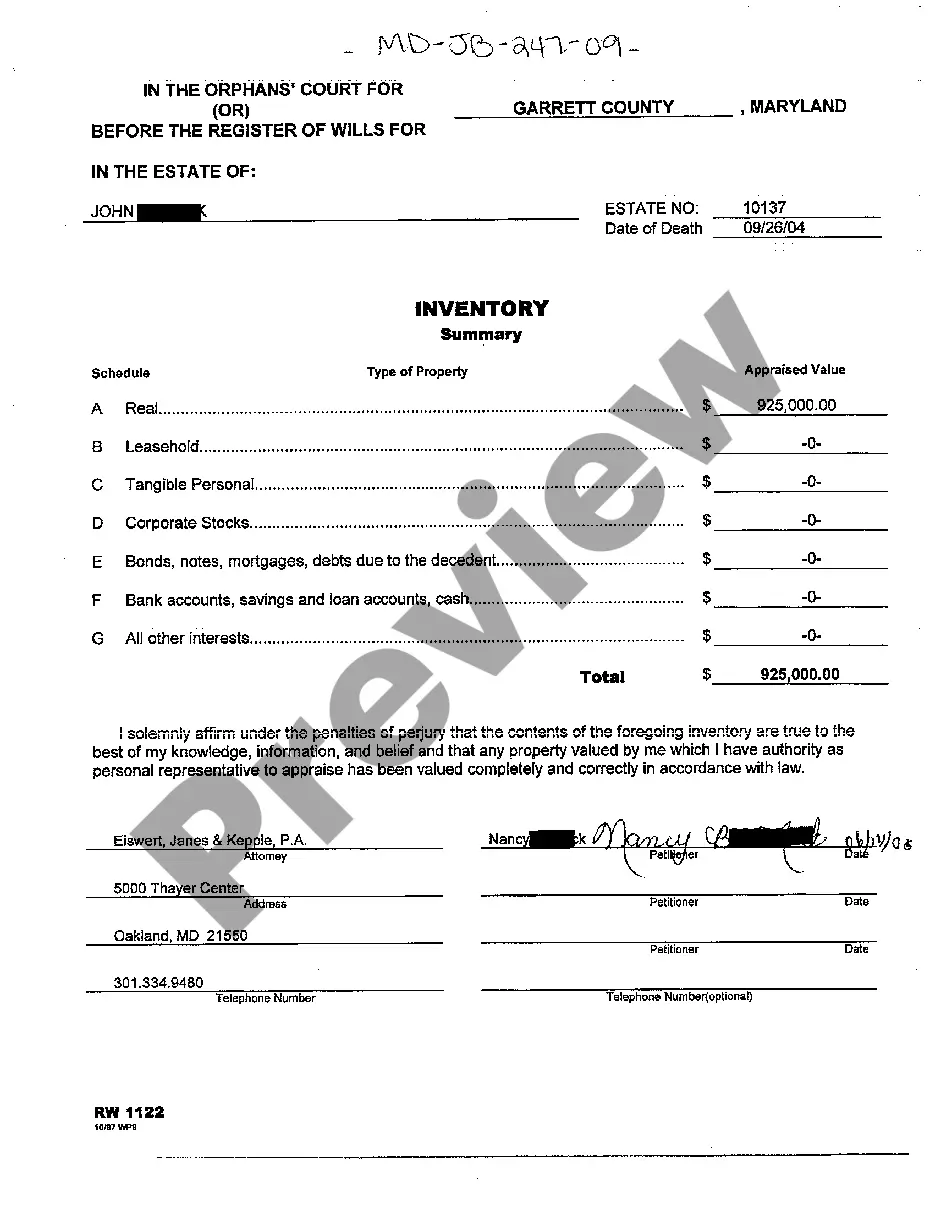

Maryland Inventory Summary and Appraisal of Property

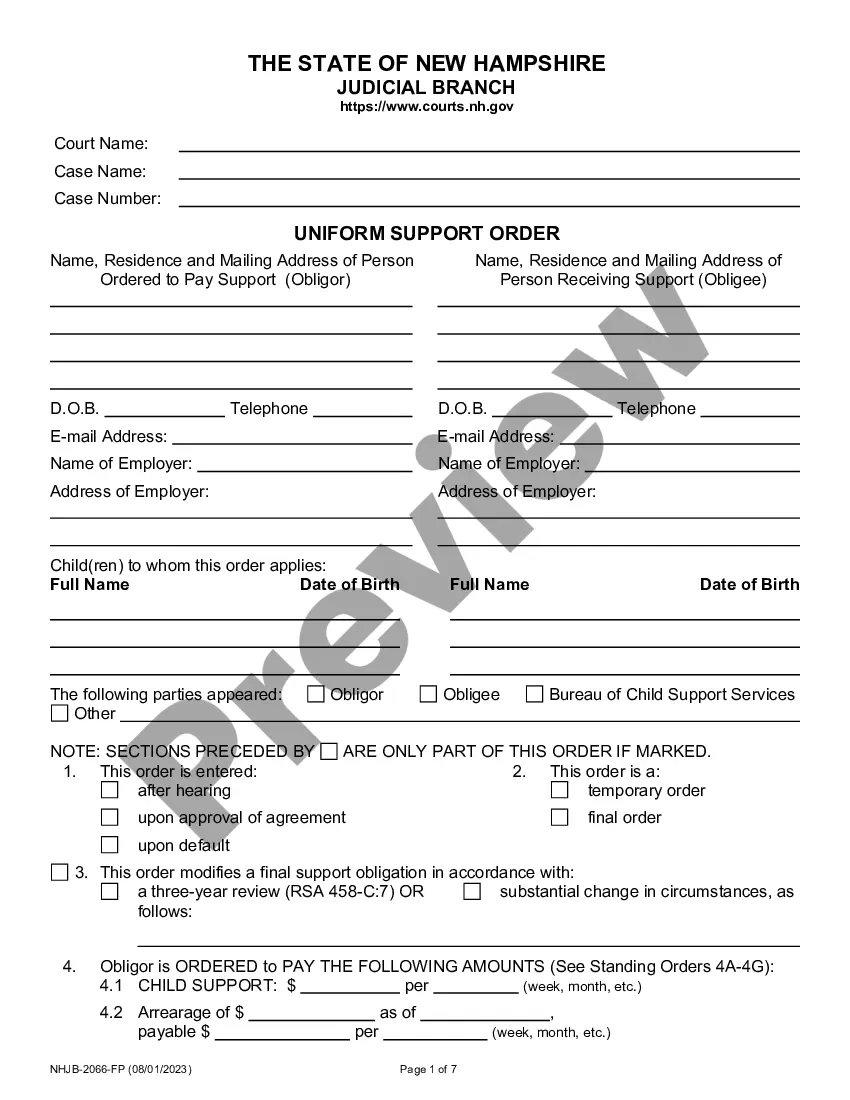

Description

How to fill out Maryland Inventory Summary And Appraisal Of Property?

You are invited to the most important legal documents library, US Legal Forms. Here you can obtain any sample including Maryland Inventory Summary and Valuation of Property forms and keep them (as many as you wish or require). Prepare formal papers in just a few hours, rather than days or even weeks, without spending a fortune on an attorney. Acquire your state-specific form in moments and feel confident knowing it was crafted by our experienced lawyers.

If you’re already a subscribed client, just Log In to your account and click Download next to the Maryland Inventory Summary and Valuation of Property you need. Because US Legal Forms is internet-based, you’ll constantly have access to your saved forms, regardless of the device you're using. Find them in the My documents section.

If you don't possess an account yet, what are you waiting for? Check our guidelines listed below to start.

After you’ve filled out the Maryland Inventory Summary and Valuation of Property, send it to your attorney for approval. It’s an added step but a crucial one to ensure you’re completely covered. Join US Legal Forms today and access thousands of reusable examples.

- If this is a state-specific form, verify its relevance in the state where you reside.

- View the details (if available) to ensure it’s the right template.

- See additional content using the Preview feature.

- If the document fulfills your needs, just click Buy Now.

- To create your account, select a pricing option.

- Use a card or PayPal account to sign up.

- Download the template in the format you require (Word or PDF).

- Print the document and complete it with your or your business’s details.

Form popularity

FAQ

The first account of an estate in Maryland is a detailed report of all financial transactions related to the estate, including income, expenses, and distributions to beneficiaries. This account must be submitted to the probate court to ensure transparency and compliance with Maryland law. Utilizing the US Legal Forms platform can help you prepare the necessary documents, including the Maryland Inventory Summary and Appraisal of Property, for this important step.

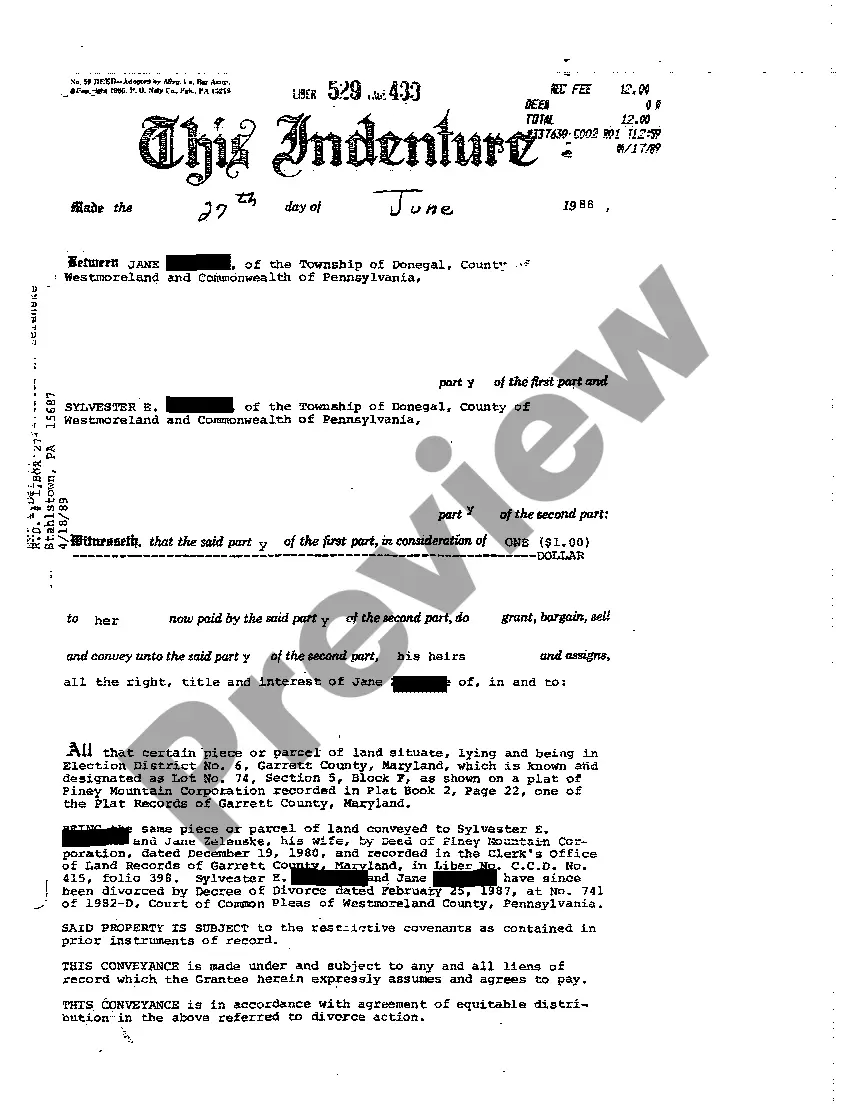

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

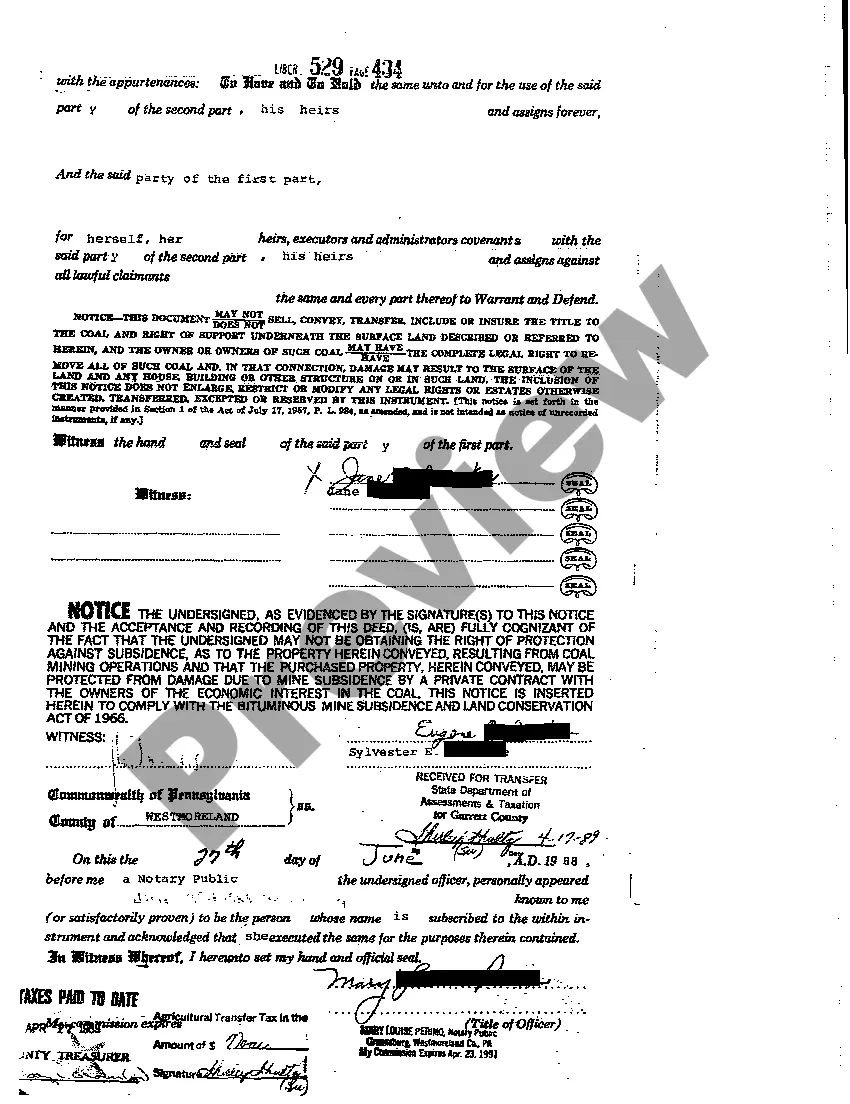

Real Estate, Bank Accounts, and Vehicles. With regard to real estate owned by the decedent, you will want to provide the address and a description of the property. Stocks and Bonds. Life Insurance and Retirement Plans. Wages and Business Interests. Intellectual Property. Debts and Judgments.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

Step 1, Determine whether You are the Personal Representative. Step 2, Petition to Probate the Estate. Step 3, Make an Inventory of the Estate. Step 4, Assess any projected Inheritance Taxes. Step 5, Consolidate the Estate and Manage Expenses.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Common Assets That Go Through Probate owned solely in the name of the deceased personfor example, real estate or a car titled in that person's name alone, or. a share of property owned as tenants in commonfor example, the deceased person's interest in a warehouse owned with his brother as an investment.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.