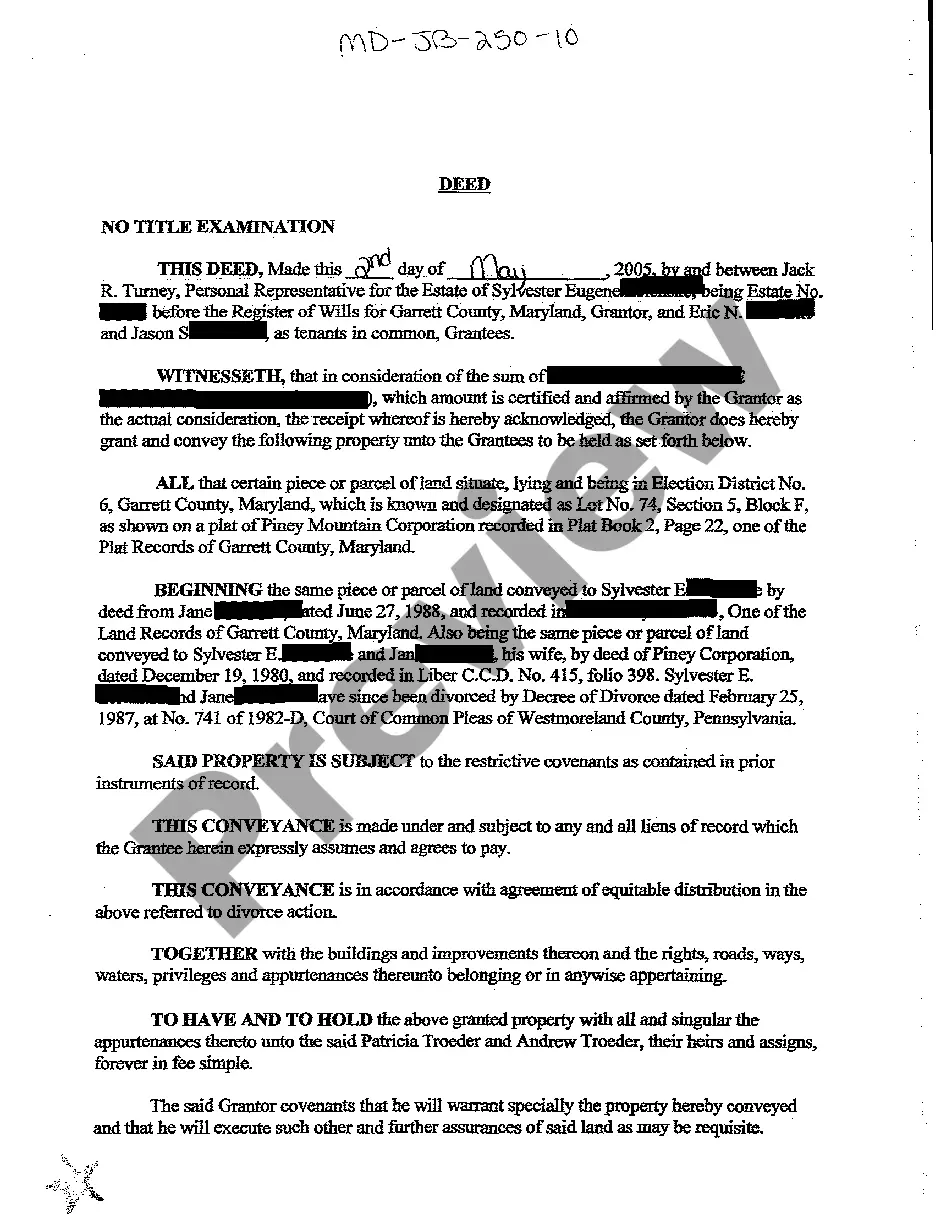

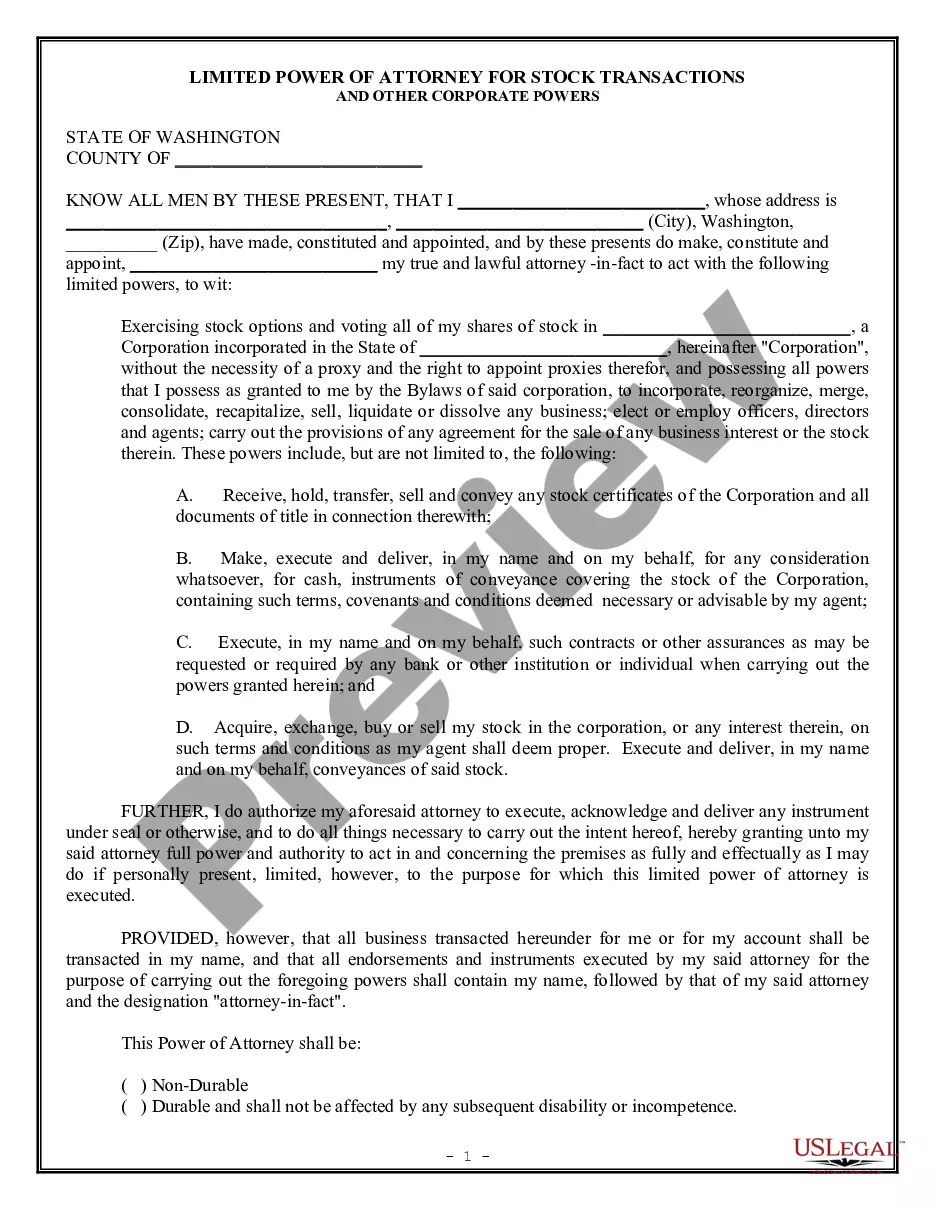

Maryland Deed Conveying Decedent's Property to Grantees

Description

How to fill out Maryland Deed Conveying Decedent's Property To Grantees?

You are welcome to the greatest legal documents library, US Legal Forms. Right here you can get any template including Maryland Deed Conveying Decedent's Property to Grantees forms and download them (as many of them as you want/need). Get ready official files within a few hours, instead of days or even weeks, without having to spend an arm and a leg with an lawyer. Get the state-specific sample in clicks and be confident with the knowledge that it was drafted by our qualified attorneys.

If you’re already a subscribed user, just log in to your account and click Download near the Maryland Deed Conveying Decedent's Property to Grantees you require. Due to the fact US Legal Forms is online solution, you’ll always have access to your downloaded forms, no matter what device you’re using. Find them in the My Forms tab.

If you don't have an account yet, what exactly are you awaiting? Check out our guidelines listed below to get started:

- If this is a state-specific sample, check its applicability in your state.

- See the description (if available) to learn if it’s the proper example.

- See far more content with the Preview feature.

- If the example matches your needs, click Buy Now.

- To make an account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the document in the format you require (Word or PDF).

- Print the file and fill it out with your/your business’s info.

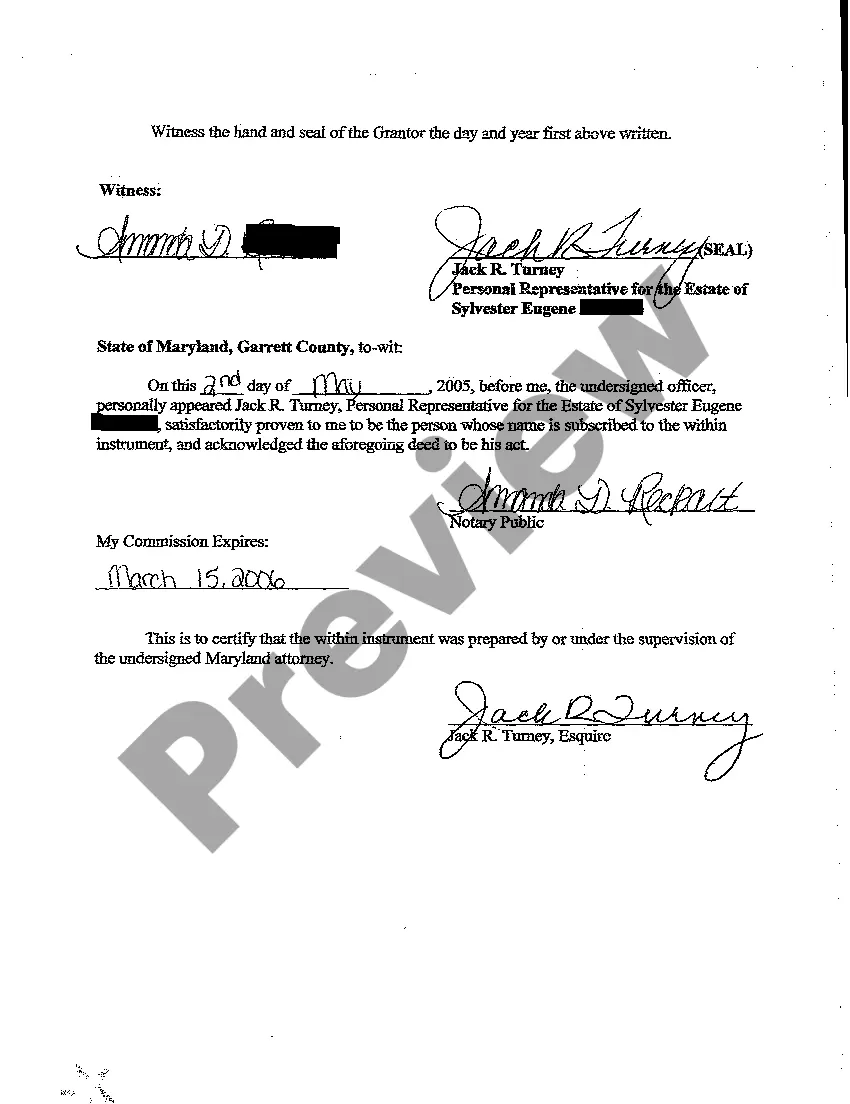

When you’ve filled out the Maryland Deed Conveying Decedent's Property to Grantees, give it to your attorney for verification. It’s an extra step but an essential one for making sure you’re completely covered. Become a member of US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

While nothing needs to be done, the best practice is for a surviving owner to formally record the transfer of the interest. File an affidavit of survivorship with the recorder's office to remove the deceased person's name from the title.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

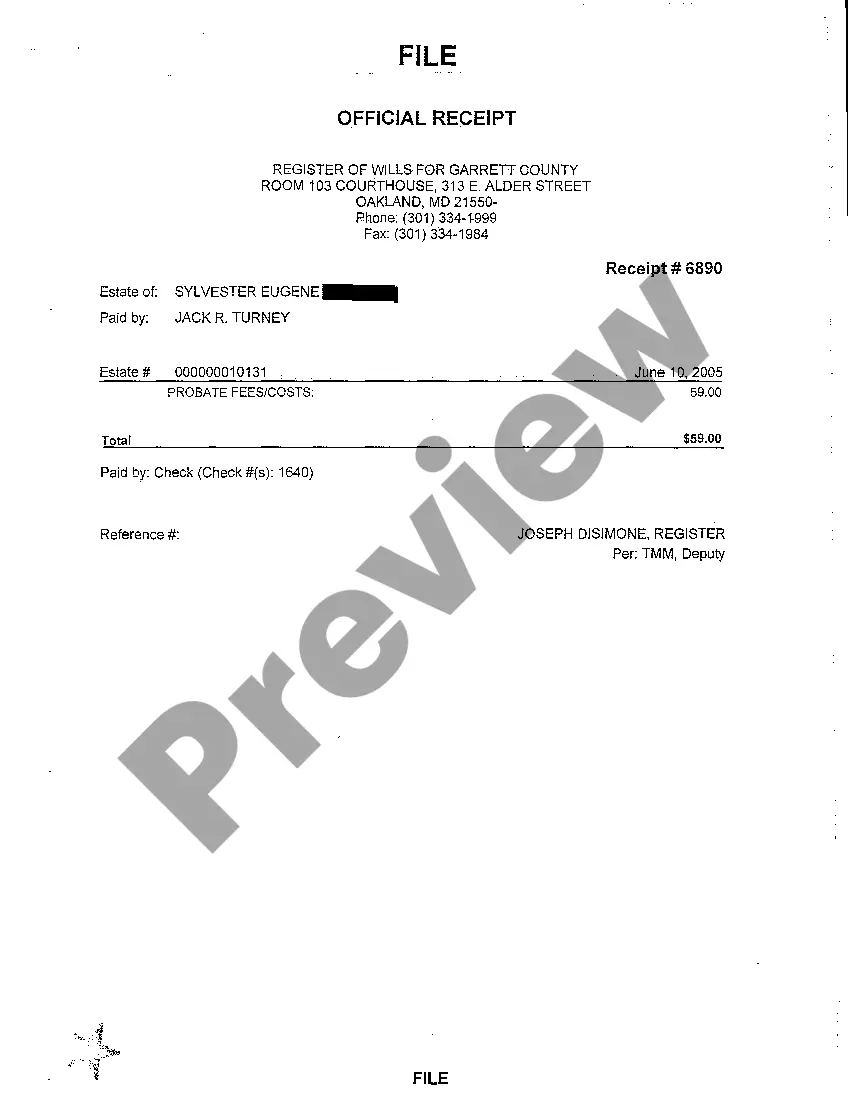

Typically, the only cost is between $25 and $55 to record the new deed and obtain a certificate from the city/county to show that all taxes are current. The deed should be notarized and must be prepared by one of the parties or under the supervision of a Maryland attorney.

200bAlaska. Arizona. Arkansas. California. Colorado. District of Columbia. Hawaii. Illinois.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

In order to change any information in a Deed, a new Deed has to be prepared. One of the questions this office is most frequently asked is how to remove the name of a deceased person from the deed to property. Unfortunately, this is not a process that can be accomplished by merely providing a death certificate.