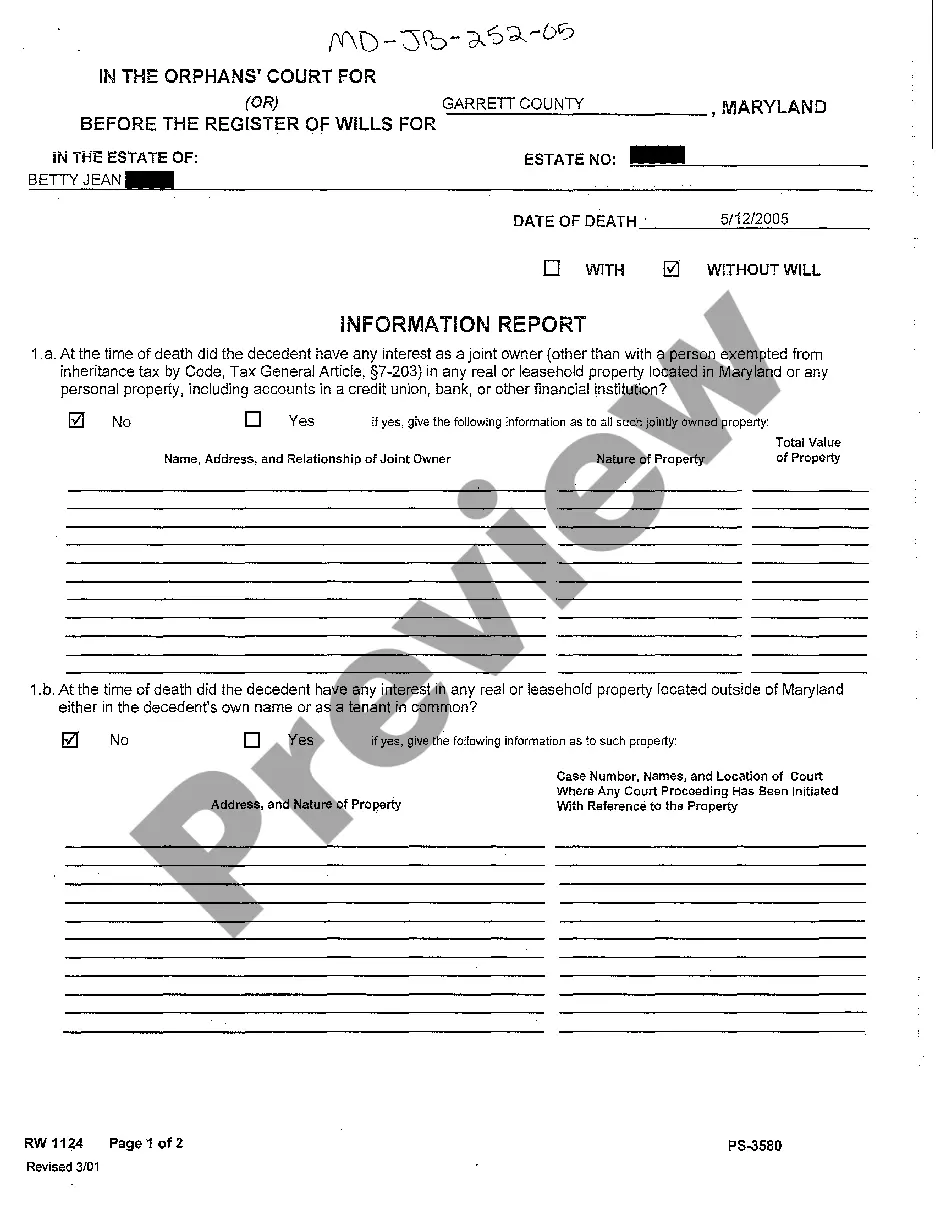

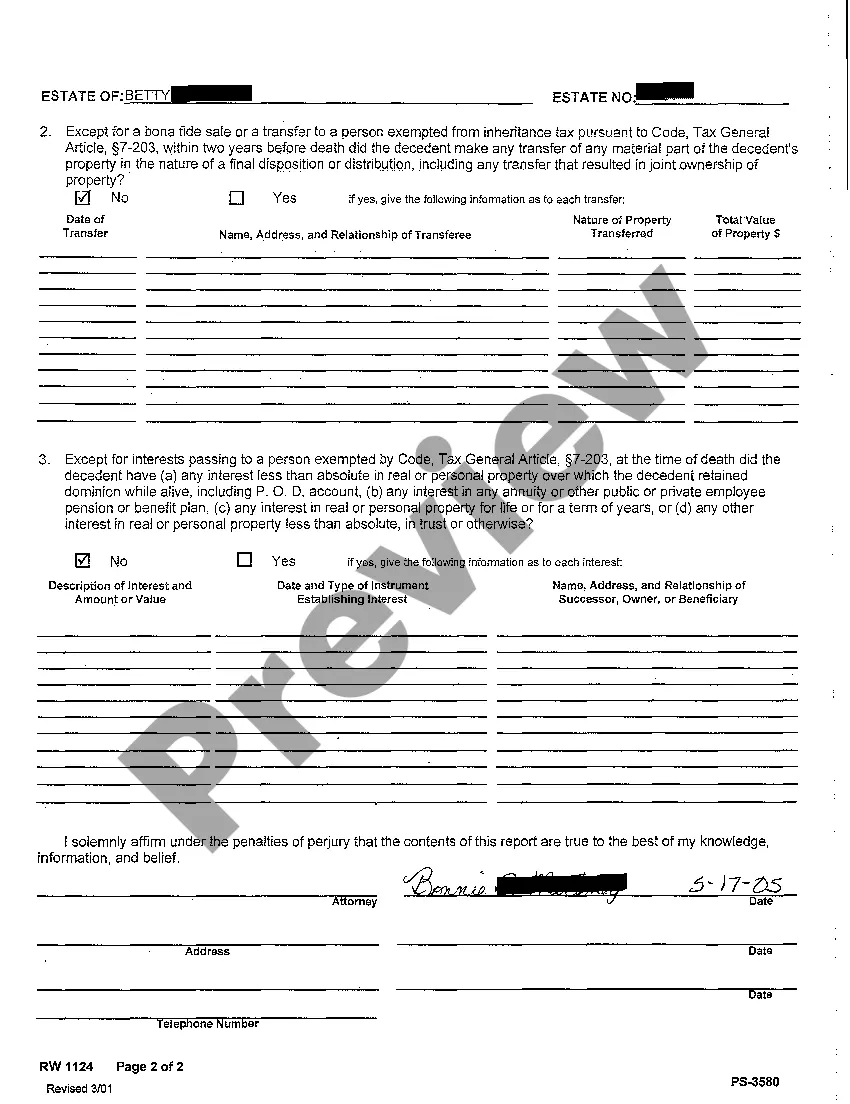

Maryland Information Report

Description Mdcasesesrch

How to fill out Maryland Information Report?

Welcome to the largest legal files library, US Legal Forms. Here you will find any example including Maryland Information Report templates and download them (as many of them as you wish/need to have). Get ready official files within a several hours, rather than days or weeks, without having to spend an arm and a leg with an legal professional. Get your state-specific form in a few clicks and be assured with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed user, just log in to your account and then click Download next to the Maryland Information Report you need. Due to the fact US Legal Forms is online solution, you’ll always have access to your saved templates, no matter the device you’re utilizing. Find them within the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our instructions listed below to start:

- If this is a state-specific sample, check out its validity in your state.

- View the description (if accessible) to learn if it’s the correct example.

- See more content with the Preview function.

- If the sample meets all your needs, just click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the file in the format you want (Word or PDF).

- Print out the document and fill it out with your/your business’s info.

When you’ve filled out the Maryland Information Report, send it to your legal professional for verification. It’s an additional step but a necessary one for being sure you’re completely covered. Join US Legal Forms now and access a large number of reusable samples.

Md Judiciary Case Search Form popularity

Bank Form In Case Of Death Other Form Names

FAQ

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

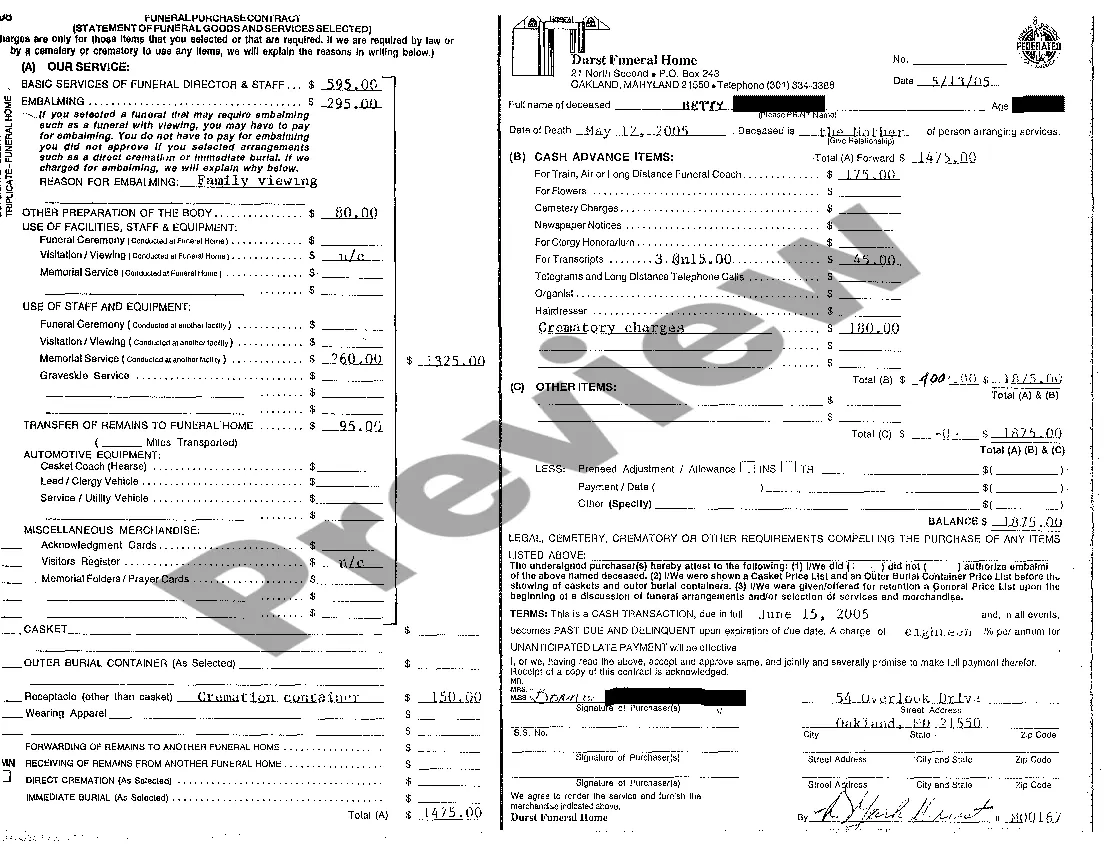

Create an inventory of the deceased person's property and determine the estate size according to Maryland Law. Petition the Maryland Register of Wills to begin the probate process. Prove the will in court. Pay the deceased person's debts and expenses.

If a person owns assets in his or her individual name and dies without a Will, assets remaining after payment of administration expenses, debts and taxes (if any) are distributed to the person's heirs as provided under Maryland Intestacy Laws (the person is said to have died intestate).