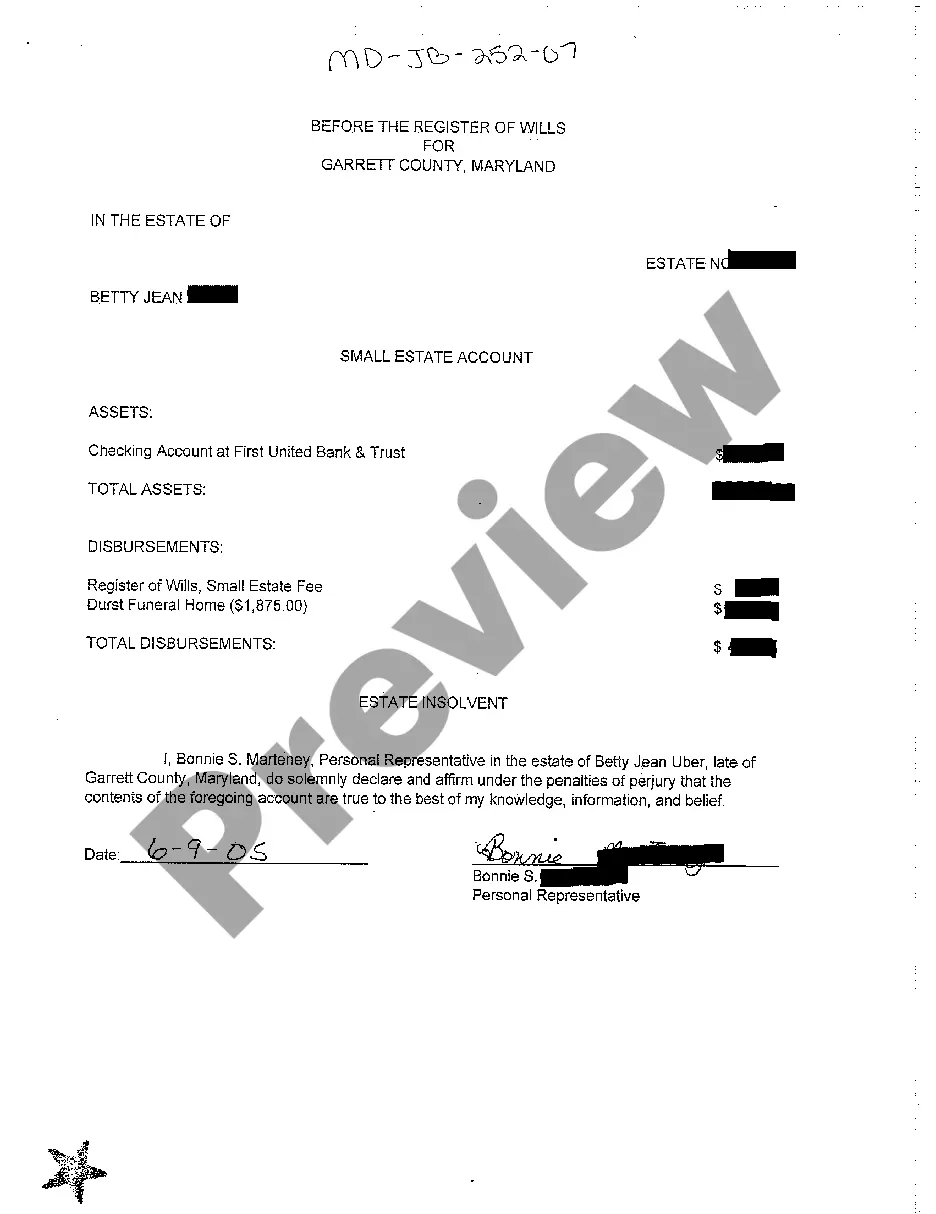

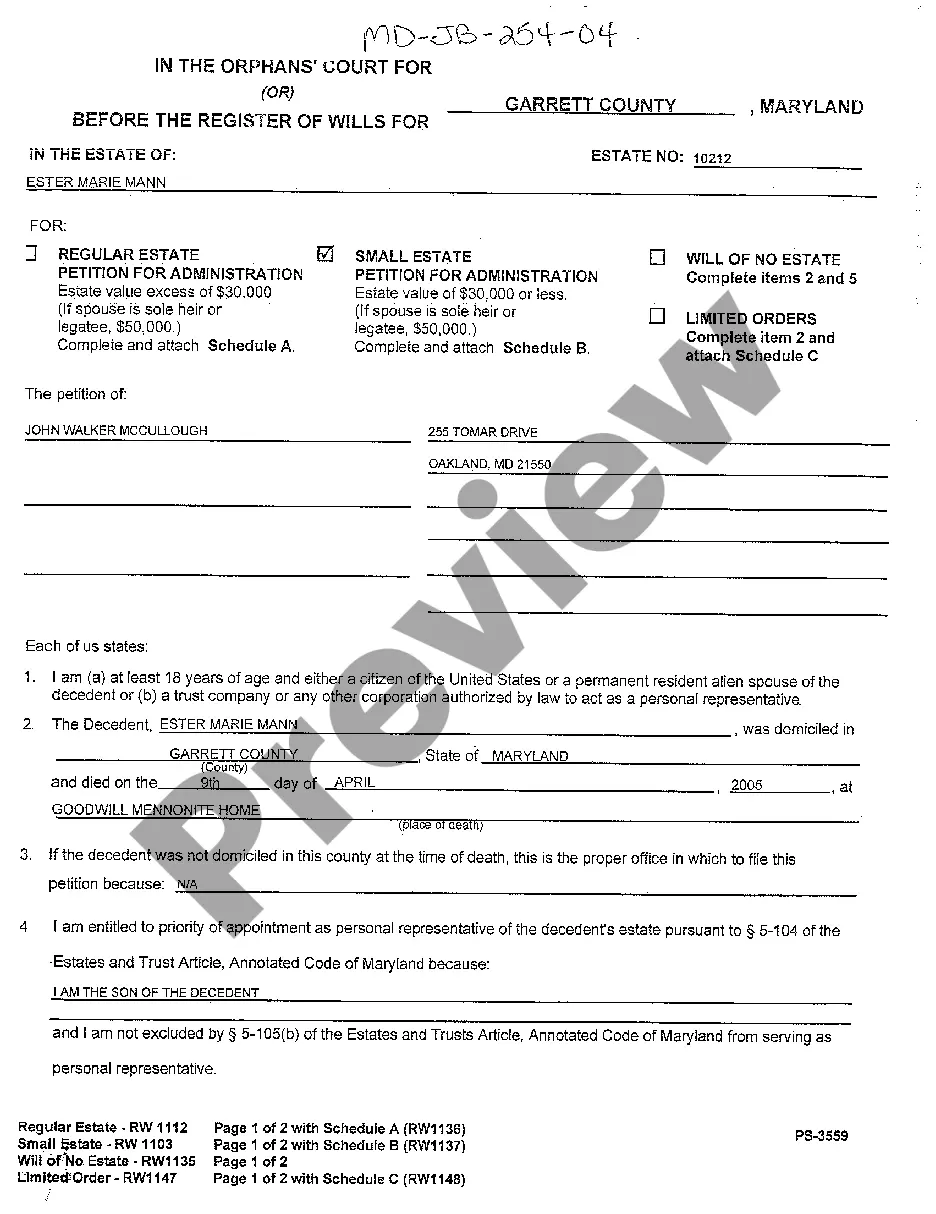

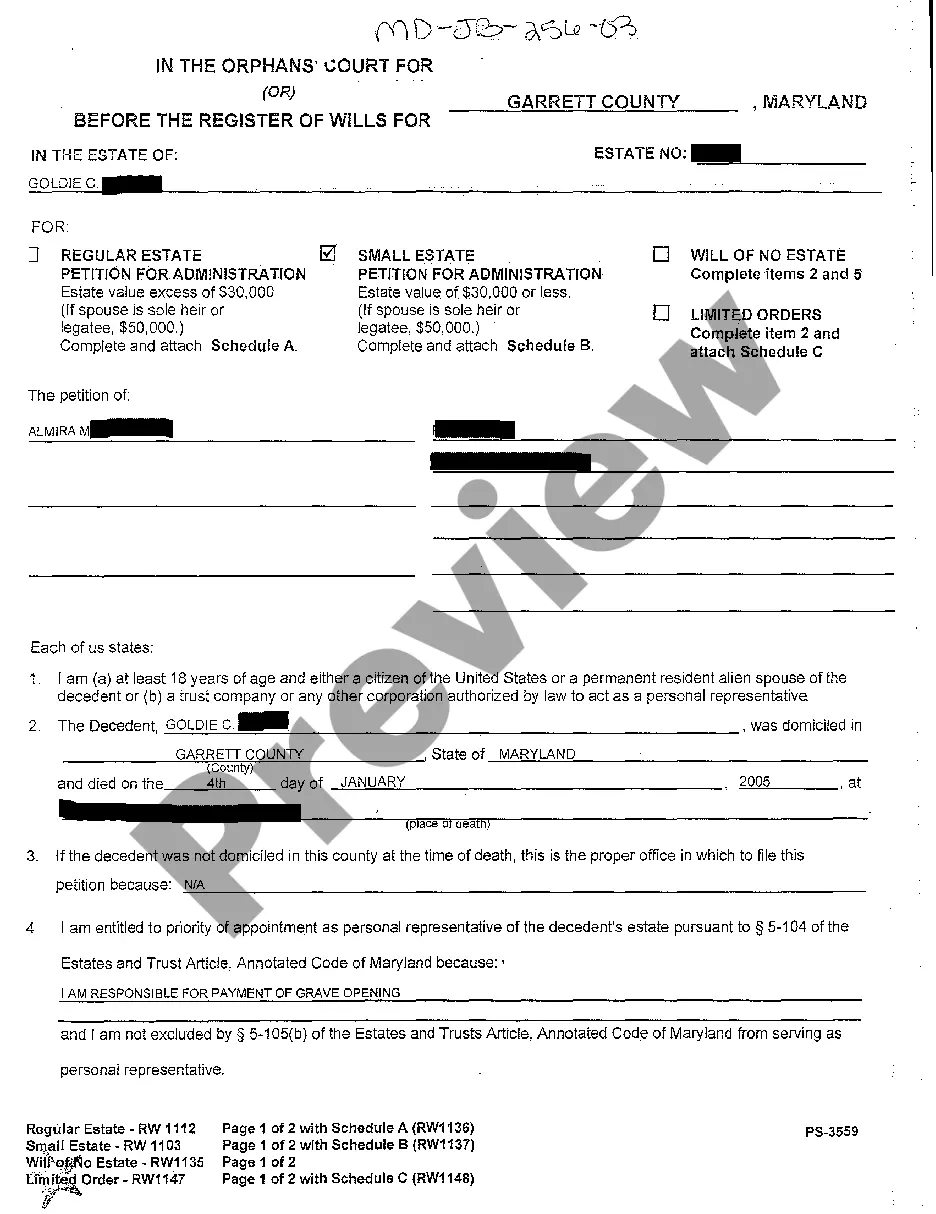

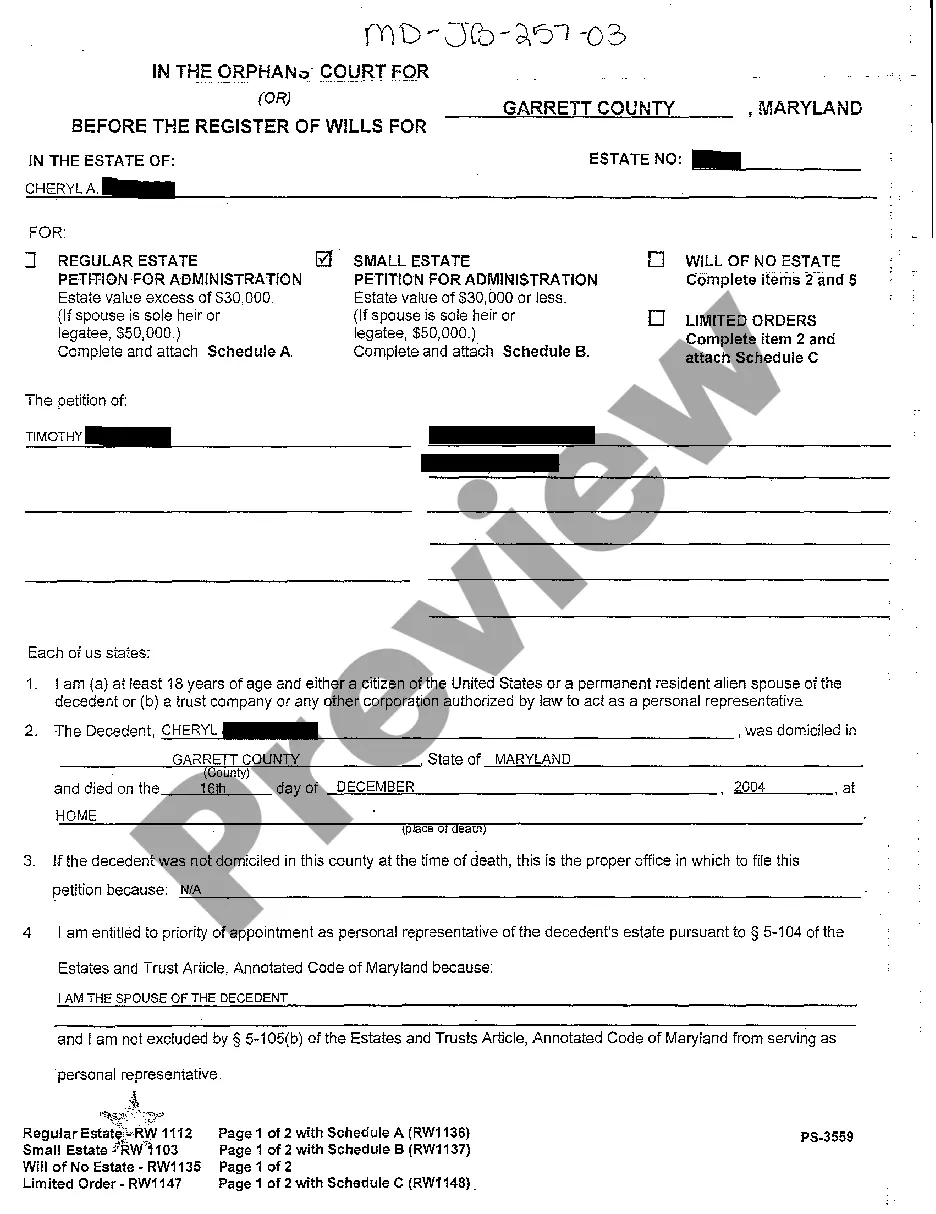

Maryland Small Estate Account

Description

How to fill out Maryland Small Estate Account?

We extend a warm welcome to the largest repository of legal documents, US Legal Forms. Here, you will discover any template, including Maryland Small Estate Account forms, and download them as many as you wish or require.

Prepare official documents within a few hours, instead of days or even weeks, without having to spend a fortune with a legal expert. Obtain your state-specific template with just a few clicks, assured that it has been crafted by our experienced attorneys.

If you are already a registered customer, simply Log In to your account and then click Download next to the Maryland Small Estate Account that you need. Since US Legal Forms offers an online service, you will routinely gain access to your stored documents, regardless of the device you are using. Find them under the My documents section.

Print the document and fill it out with your or your business's details. Once you've completed the Maryland Small Estate Account, forward it to your attorney for verification. This extra step is essential to ensure you are fully protected. Join US Legal Forms today and gain access to a plethora of reusable templates.

- If you don't have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific template, verify its relevance in your state.

- Review the description (if available) to determine if it is the right document.

- Look at additional content with the Preview function.

- If the template satisfies all your requirements, just click Buy Now.

- To set up your account, select a pricing plan.

- Register using a credit card or PayPal account.

- Download the document in the format you need (Word or PDF).

Form popularity

FAQ

Is a holographic (handwritten) Will legal in Maryland ? Yes, if it complies with Maryland Law.

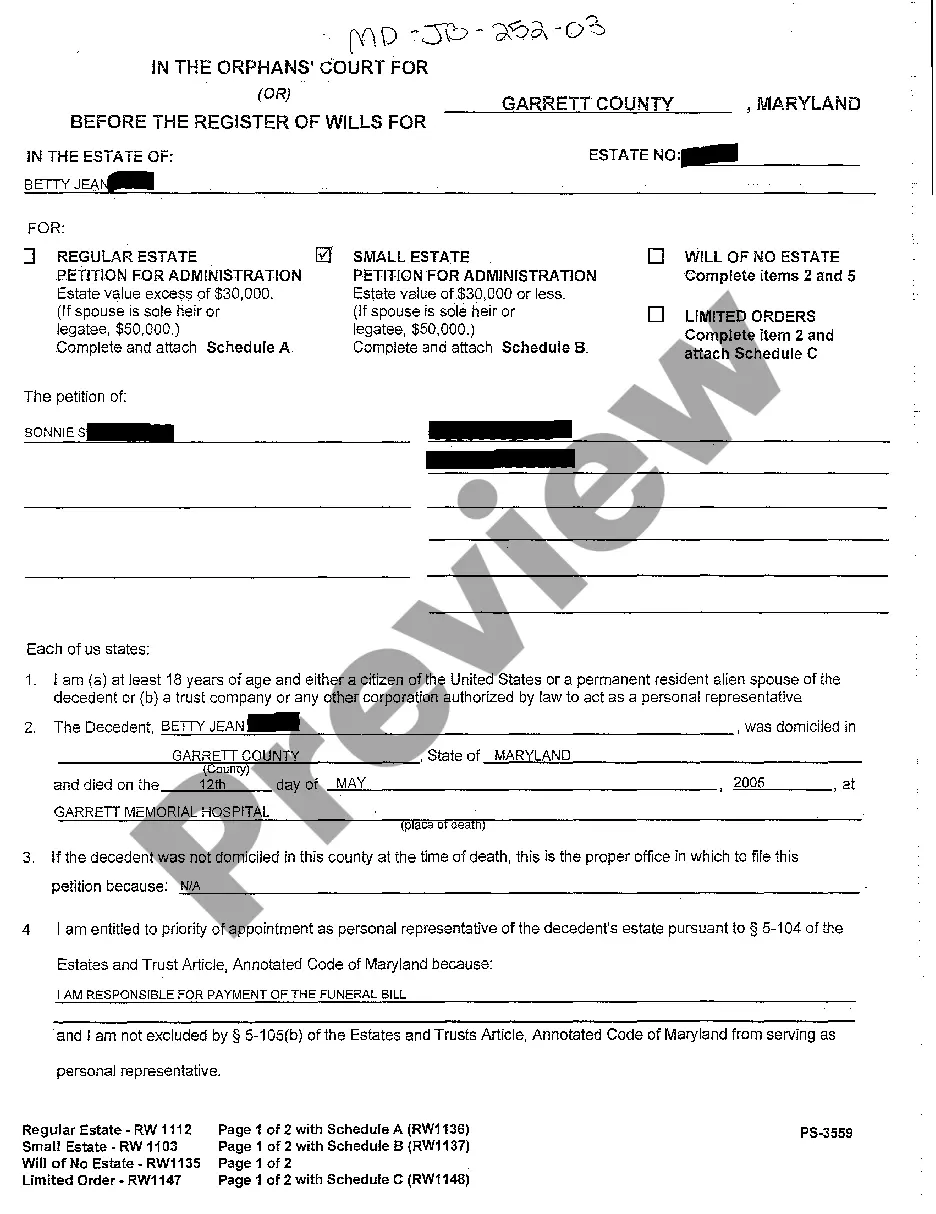

Step 1, Determine whether You are the Personal Representative. Step 2, Petition to Probate the Estate. Step 3, Make an Inventory of the Estate. Step 4, Assess any projected Inheritance Taxes. Step 5, Consolidate the Estate and Manage Expenses.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Obtain and complete the California small estate affidavit. You must obtain the form used by the probate court in the county where the deceased was a resident. Include attachments. Obtain other signatures. Get the documents notarized. Transfer the property.

Holographic wills are wills that have been written entirely in the hand of the testator. Although Maryland does recognize holographic wills, they must comply with Maryland law. Unless holographic wills are written properly, there is a chance the courts may not recognize the document as a valid last will and testament.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.