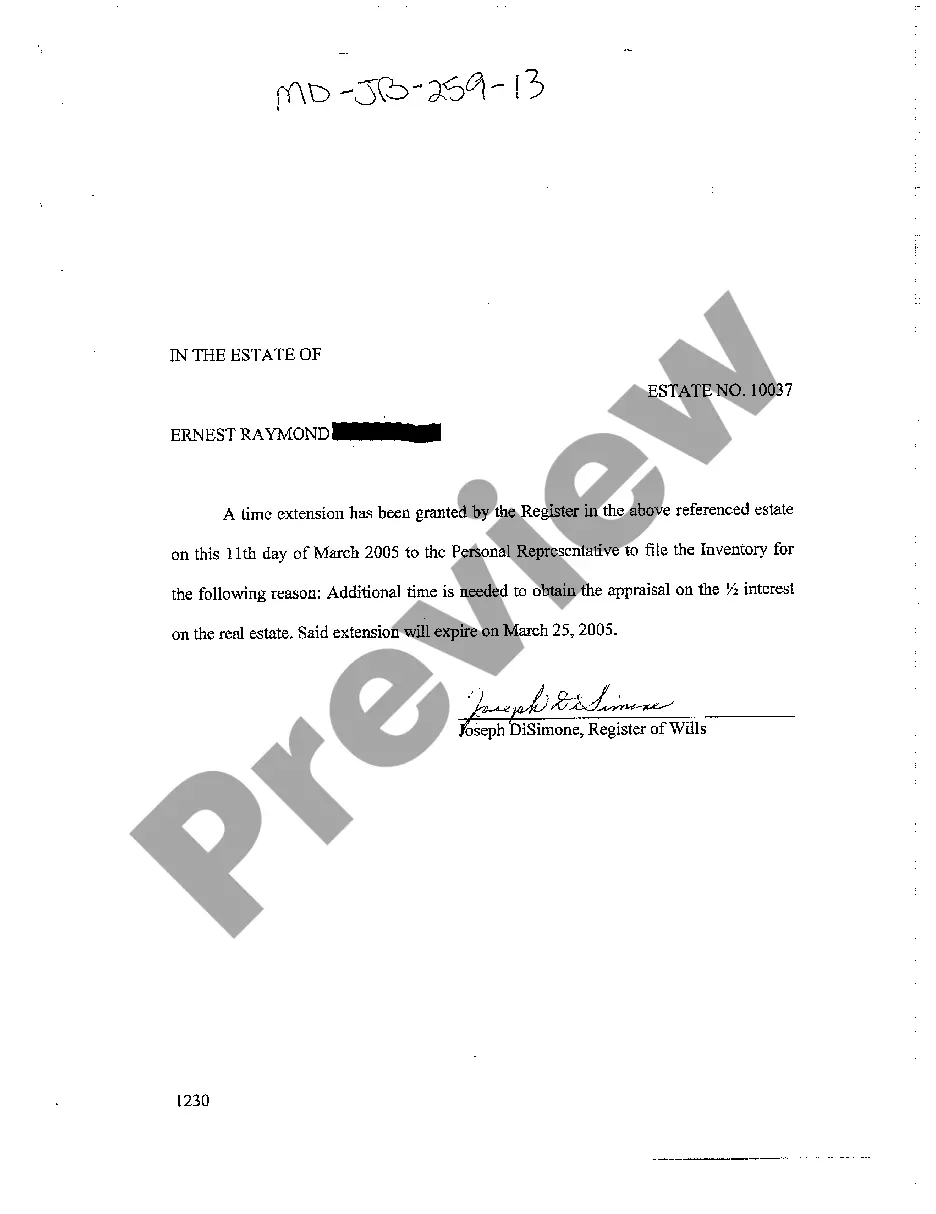

Maryland Notice of Time Extension

Description

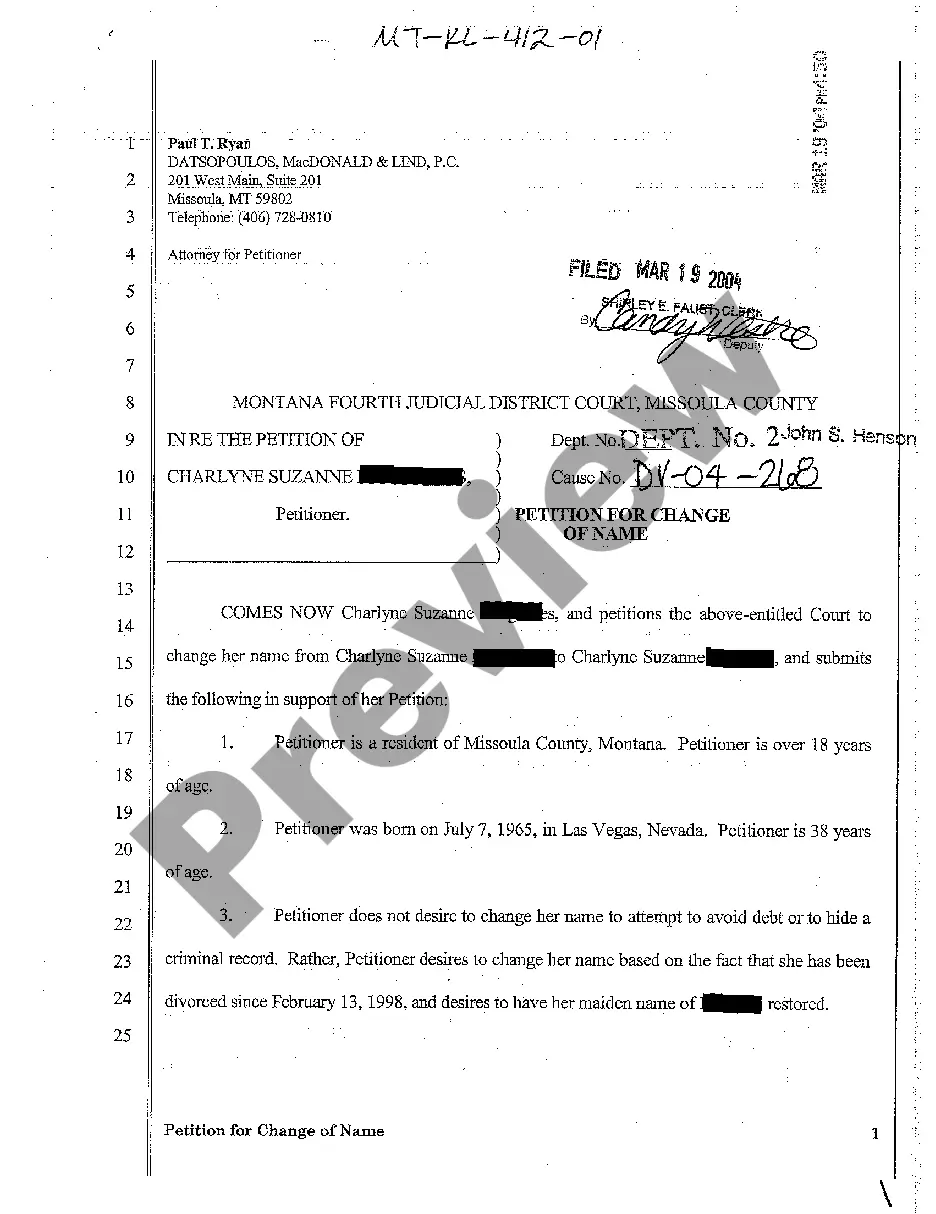

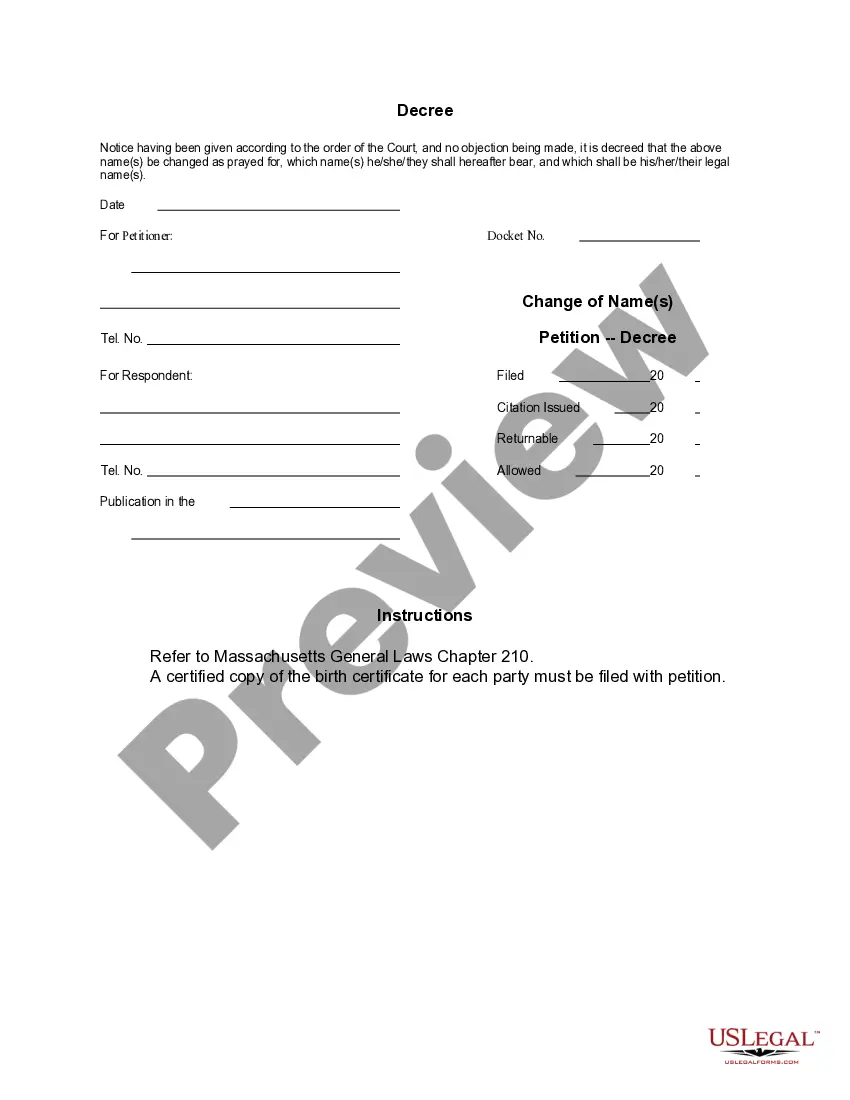

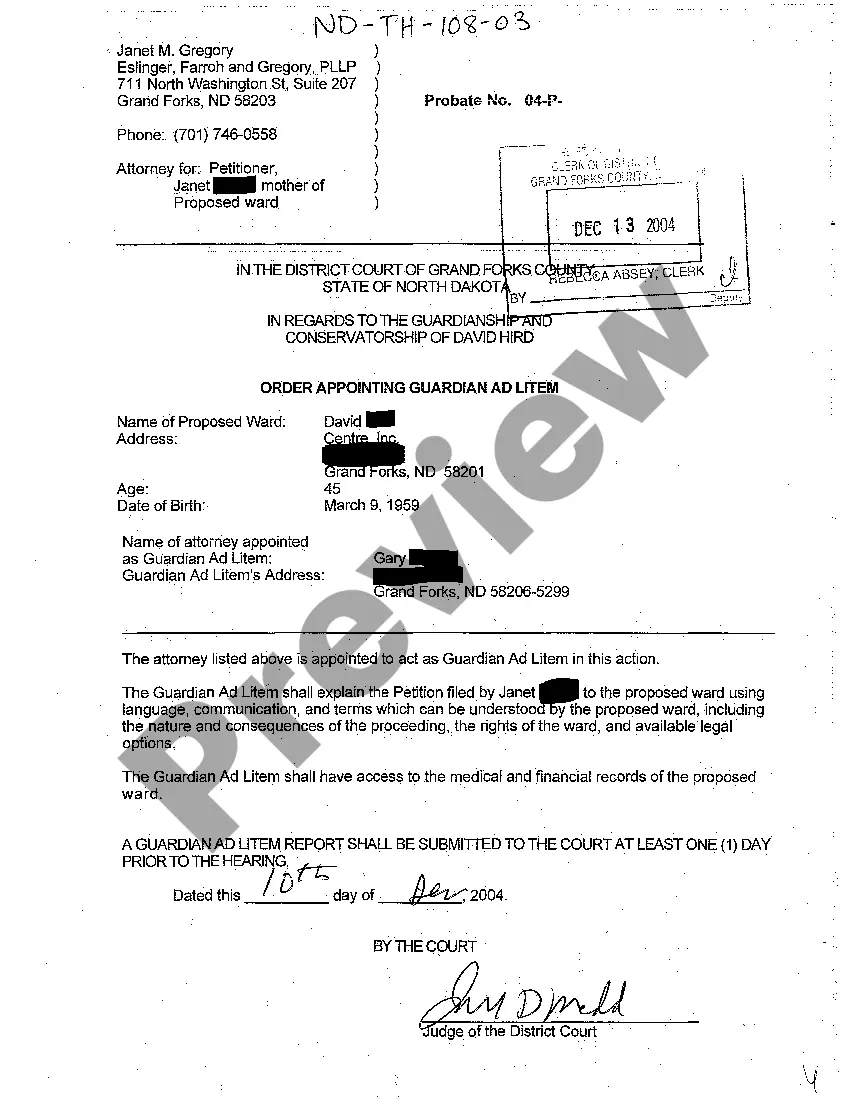

How to fill out Maryland Notice Of Time Extension?

Welcome to the greatest legal documents library, US Legal Forms. Here you will find any sample such as Maryland Notice of Time Extension forms and save them (as many of them as you want/need to have). Prepare official files in a several hours, instead of days or even weeks, without spending an arm and a leg on an attorney. Get the state-specific form in a couple of clicks and feel confident with the knowledge that it was drafted by our state-certified legal professionals.

If you’re already a subscribed consumer, just log in to your account and click Download next to the Maryland Notice of Time Extension you require. Because US Legal Forms is online solution, you’ll always get access to your downloaded files, no matter what device you’re utilizing. Find them in the My Forms tab.

If you don't have an account yet, what exactly are you waiting for? Check our guidelines below to start:

- If this is a state-specific form, check its validity in the state where you live.

- See the description (if available) to learn if it’s the correct example.

- See a lot more content with the Preview function.

- If the sample meets all of your needs, just click Buy Now.

- To make an account, pick a pricing plan.

- Use a credit card or PayPal account to join.

- Save the document in the format you need (Word or PDF).

- Print out the file and complete it with your/your business’s information.

When you’ve completed the Maryland Notice of Time Extension, send away it to your lawyer for verification. It’s an extra step but a necessary one for making confident you’re entirely covered. Become a member of US Legal Forms now and access a mass amount of reusable samples.

Form popularity

FAQ

So if you owe taxes for 2020, you have until May 17, 2021, to pay them without interest or penalties. If you need more time, though, you can file for an extension to Oct. 15 with Form 4868.

Individual taxpayers who need additional time to file beyond the May 17 deadline can request a filing extension until Oct. 15 by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov.

A tax extension gives you an additional 6 months to file your tax return, making your new deadline October 15. It is not an extension of time to pay your tax bill. e-File or file IRS Form 4868 by May 17, 2021 for Tax Year 2020 here on eFile.com for free.

You may still need to pay by April 15. Tax filing is a little more complicated this year. The deadline to file a 2020 individual federal return and pay any tax owed has been extended to May 17, about a month later than the typical April deadline.This year, the first estimated tax deadline remains April 15.

The deadlines for individuals to file and pay most federal income taxes are extended to May 17, 2021.An extension of time to file your return does not grant you any extension of time to pay your taxes. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

Extended Deadline with Maryland Tax Extension: Maryland offers a 6-month extension, which moves the filing deadline from April 15 to October 15 (for calendar year filers). Maryland Tax Extension Form: If you have an approved Federal tax extension (IRS Form 4868), you will automatically receive a Maryland tax extension.

For tax year 2017 Federal income tax returns, the normal April 15 deadline to claim a refund has also been extended to May 17, 2021.

On March 17th, the Treasury Department and Internal Revenue Service announced that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021 to May 17, 2021. This is to help taxpayers navigate the unusual circumstances related to the pandemic.

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15, 2020, are automatically extended until July 15, 2020.This relief is automatic, taxpayers do not need to file any additional forms or call the IRS to qualify.