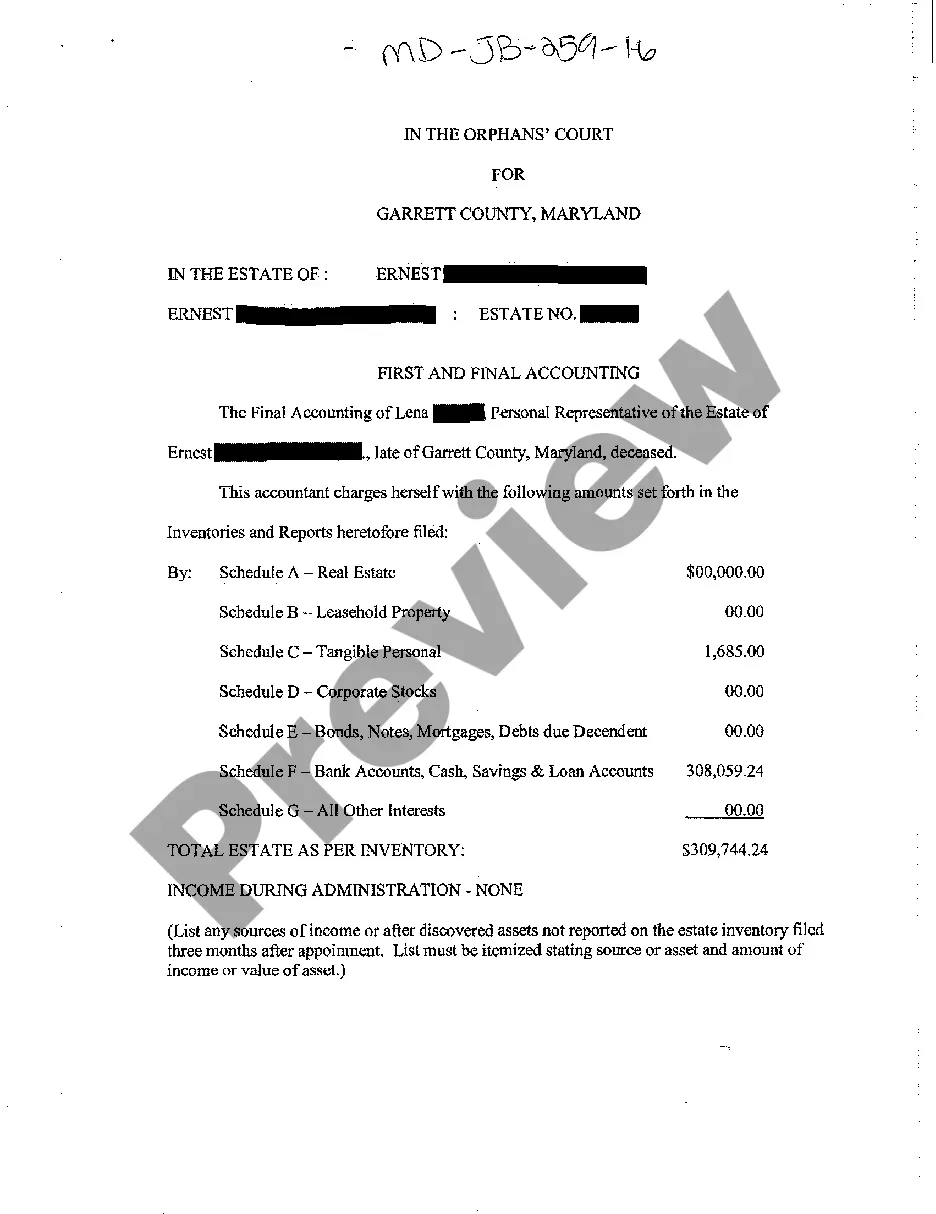

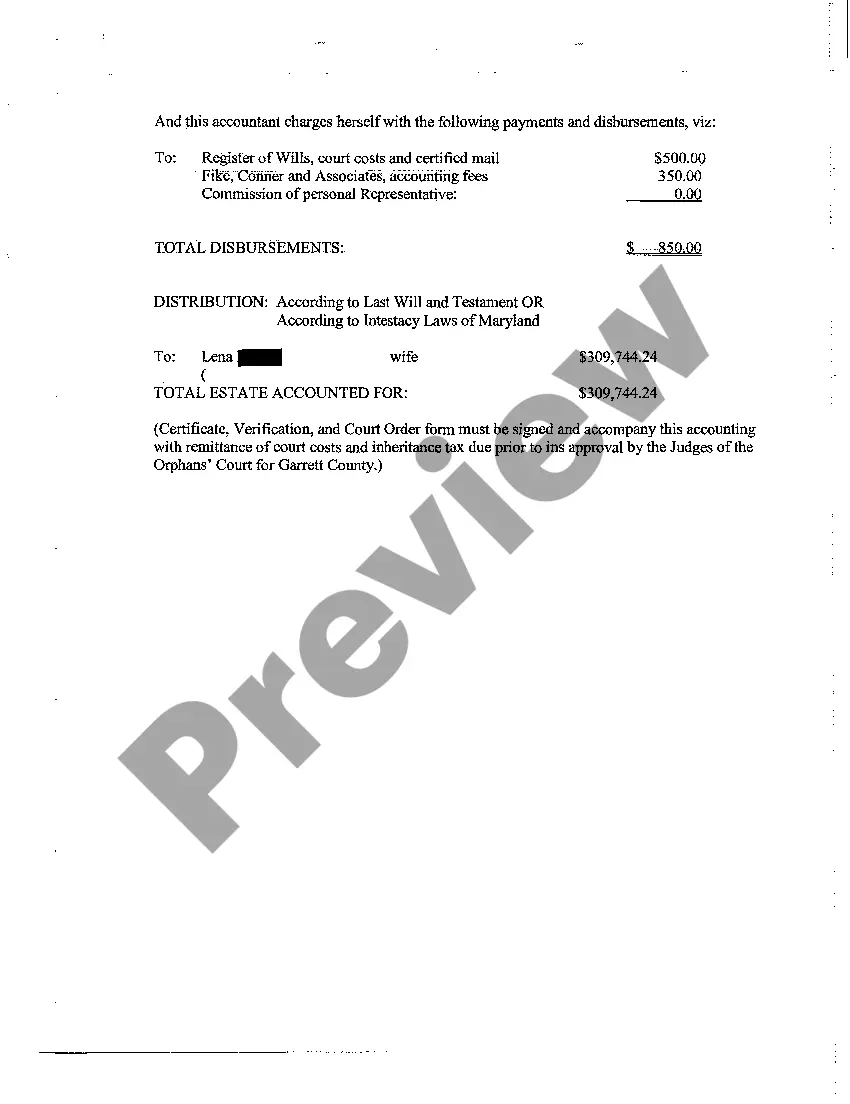

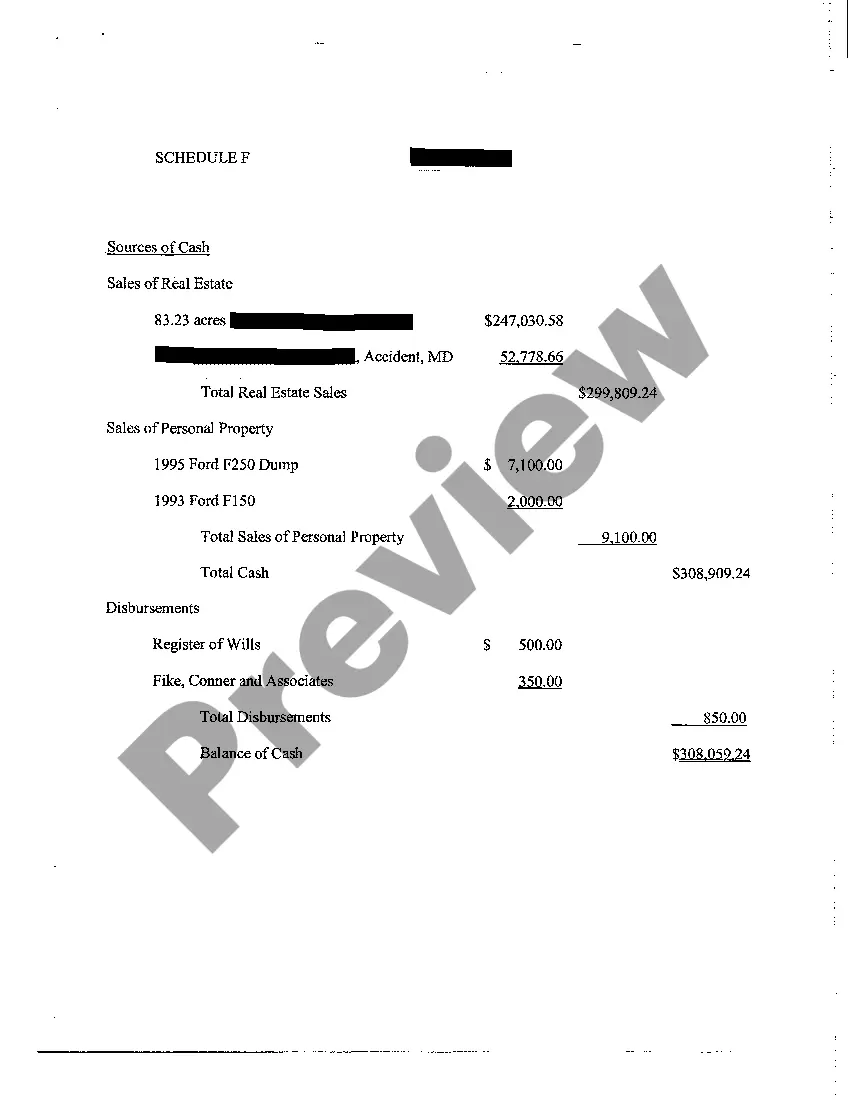

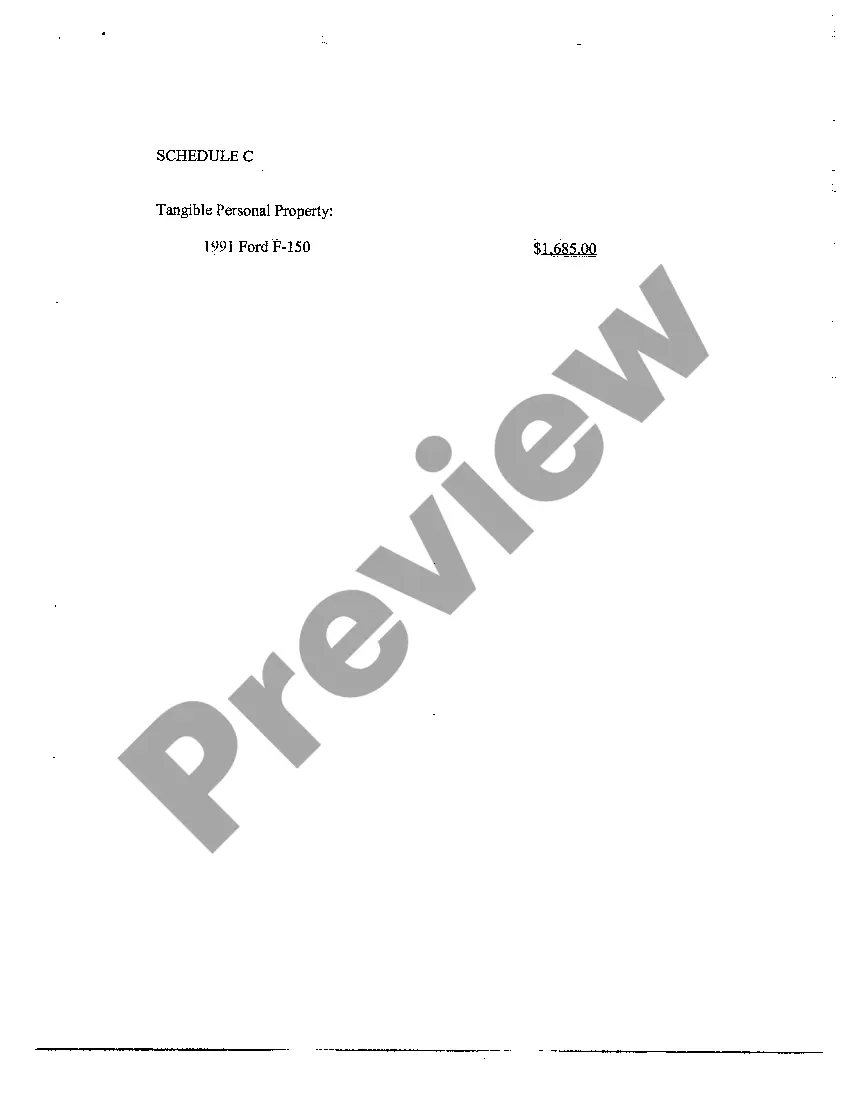

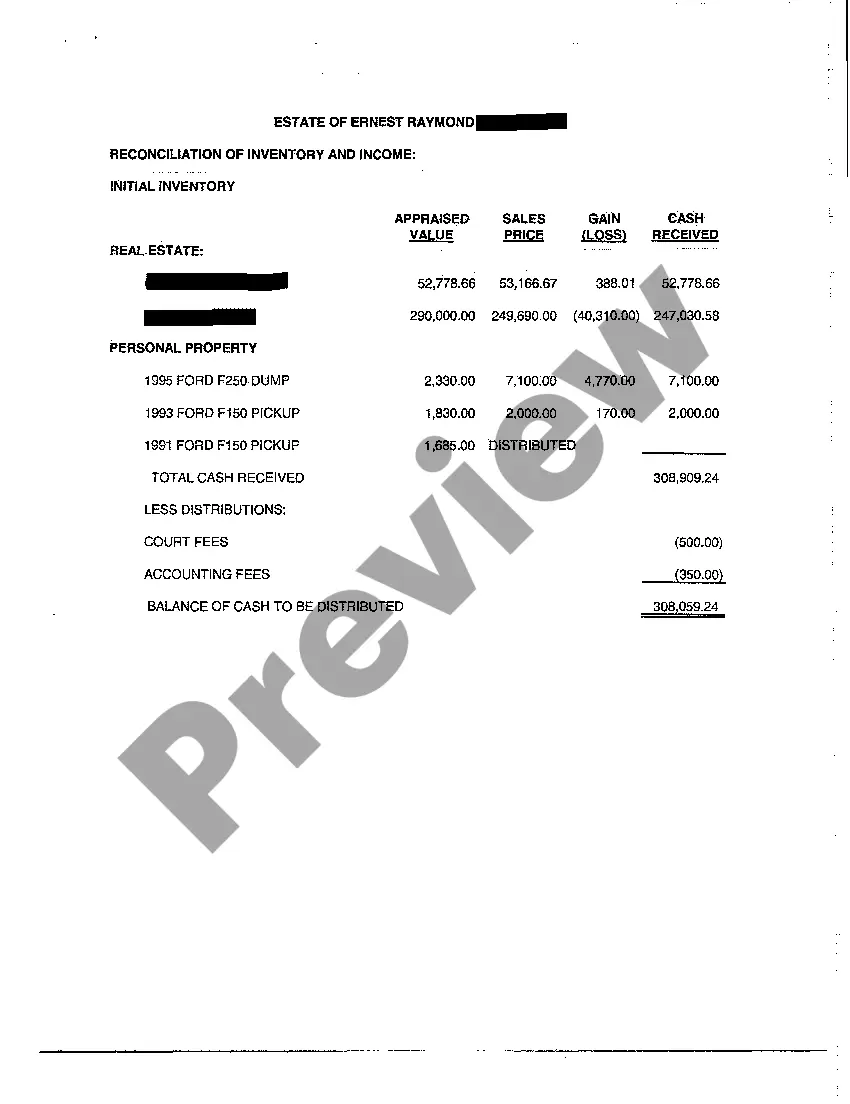

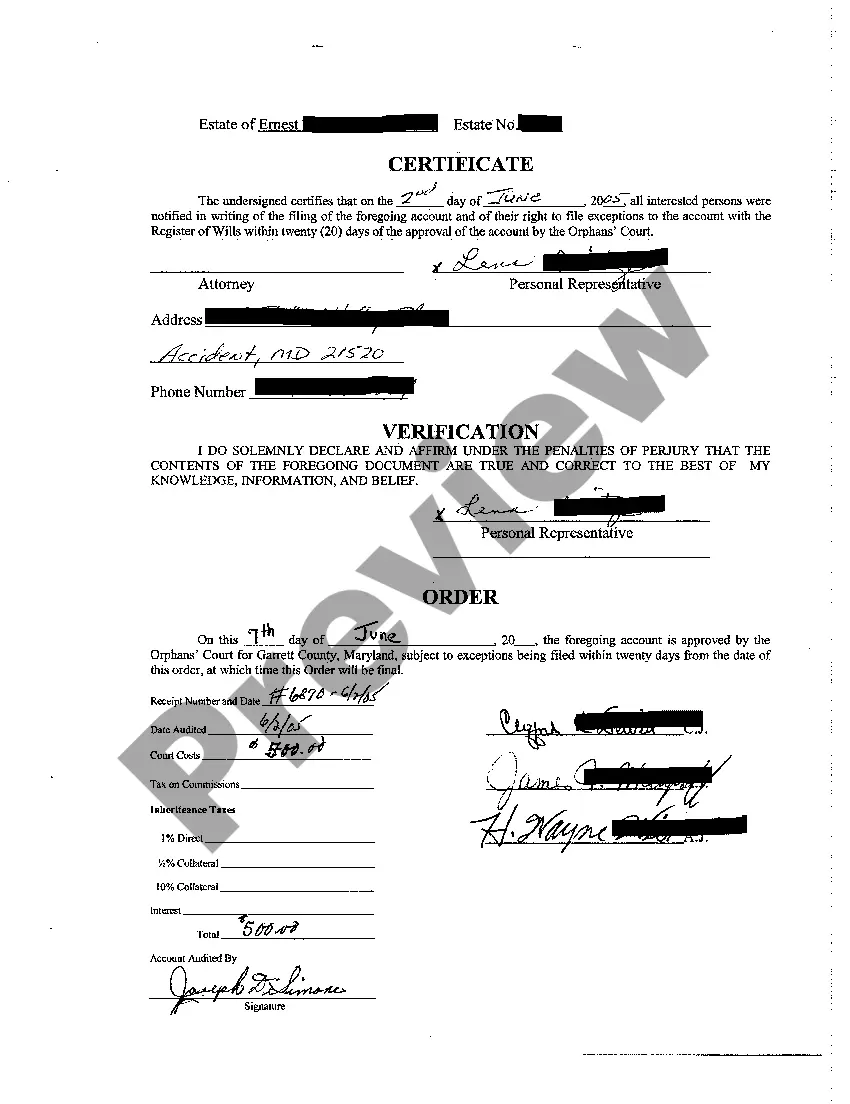

Maryland First and Final Accounting

Description Estate Accounting Sample

How to fill out What Is A Final Accounting In Probate?

Welcome to the largest legal files library, US Legal Forms. Here you can get any sample such as Maryland First and Final Accounting forms and download them (as many of them as you want/need). Make official documents in just a couple of hours, rather than days or even weeks, without having to spend an arm and a leg with an lawyer or attorney. Get your state-specific sample in a few clicks and be assured with the knowledge that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maryland First and Final Accounting you need. Due to the fact US Legal Forms is web-based, you’ll always have access to your saved templates, no matter what device you’re using. See them in the My Forms tab.

If you don't have an account yet, what are you awaiting? Check our guidelines below to begin:

- If this is a state-specific form, check out its validity in the state where you live.

- See the description (if accessible) to learn if it’s the proper template.

- See more content with the Preview option.

- If the sample fulfills all your needs, just click Buy Now.

- To create your account, select a pricing plan.

- Use a card or PayPal account to subscribe.

- Download the file in the format you need (Word or PDF).

- Print out the document and fill it with your/your business’s details.

When you’ve completed the Maryland First and Final Accounting, send out it to your legal professional for verification. It’s an extra step but an essential one for being confident you’re completely covered. Become a member of US Legal Forms now and access a large number of reusable samples.

Estate Accounting Template Form popularity

Estate Accounts Example Other Form Names

First And Final Accounting Estate Maryland FAQ

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.

If a person owns assets in his or her individual name and dies without a Will, assets remaining after payment of administration expenses, debts and taxes (if any) are distributed to the person's heirs as provided under Maryland Intestacy Laws (the person is said to have died intestate).

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

How to Close an Estate in Maryland Probate. Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.

The Maryland statutes say that the maximum personal representative fee is 9 percent of the estate's value if the estate is worth $20,000 or less. That would equal $900 on a $10,000 estate. The fee is $1,800 for estates greater than $20,000, plus 3.6 percent of the estate's value over $20,000.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

Step 1, Determine whether You are the Personal Representative. Step 2, Petition to Probate the Estate. Step 3, Make an Inventory of the Estate. Step 4, Assess any projected Inheritance Taxes. Step 5, Consolidate the Estate and Manage Expenses.