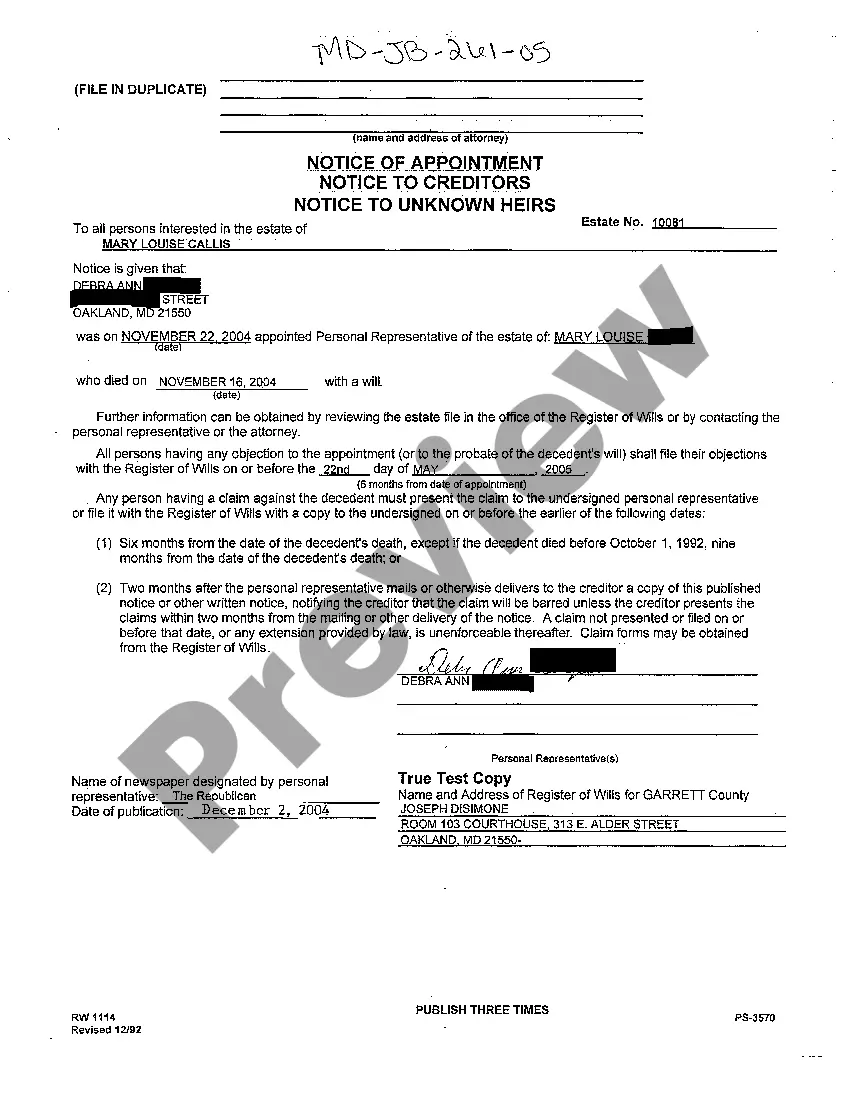

Maryland Notice of Appointment, Notice to Creditors, Notice to Unknown Heirs

Description

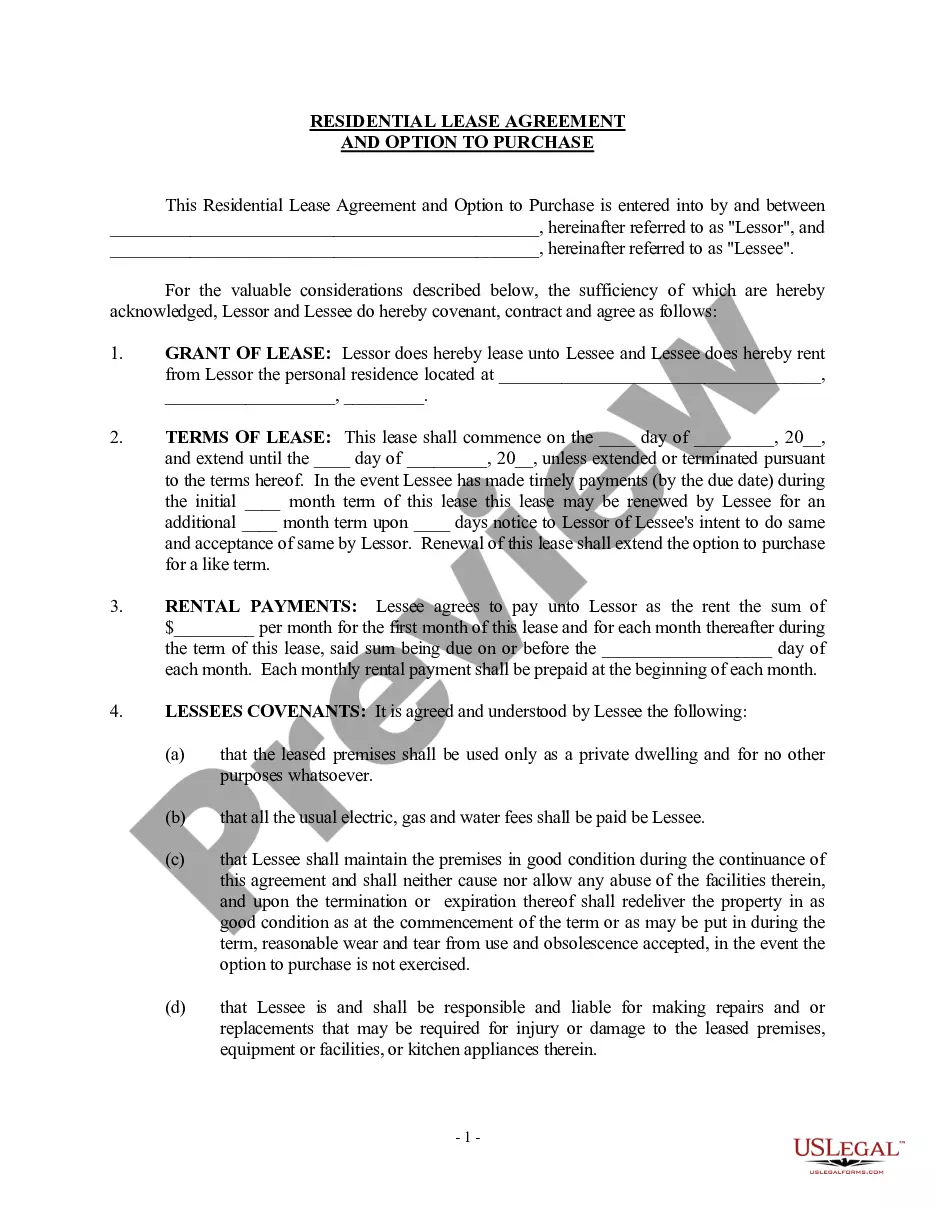

How to fill out Maryland Notice Of Appointment, Notice To Creditors, Notice To Unknown Heirs?

Welcome to the greatest legal documents library, US Legal Forms. Here you can find any template such as Maryland Notice of Appointment, Notice to Creditors, Notice to Unknown Heirs forms and download them (as many of them as you wish/need to have). Prepare official papers in a couple of hours, instead of days or even weeks, without spending an arm and a leg on an lawyer or attorney. Get your state-specific example in clicks and be confident with the knowledge that it was drafted by our accredited lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maryland Notice of Appointment, Notice to Creditors, Notice to Unknown Heirs you want. Because US Legal Forms is web-based, you’ll always get access to your downloaded forms, no matter what device you’re using. See them in the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check our instructions below to get started:

- If this is a state-specific sample, check out its validity in your state.

- Look at the description (if offered) to understand if it’s the correct example.

- See far more content with the Preview option.

- If the document fulfills all of your requirements, click Buy Now.

- To create an account, select a pricing plan.

- Use a card or PayPal account to join.

- Save the template in the format you require (Word or PDF).

- Print out the file and fill it with your/your business’s information.

As soon as you’ve completed the Maryland Notice of Appointment, Notice to Creditors, Notice to Unknown Heirs, send it to your attorney for confirmation. It’s an additional step but an essential one for making certain you’re completely covered. Sign up for US Legal Forms now and access a mass amount of reusable examples.

Form popularity

FAQ

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

A notice to creditors is a public statement noting the death of an individual in order to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

If a person owns assets in his or her individual name and dies without a Will, assets remaining after payment of administration expenses, debts and taxes (if any) are distributed to the person's heirs as provided under Maryland Intestacy Laws (the person is said to have died intestate).

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.