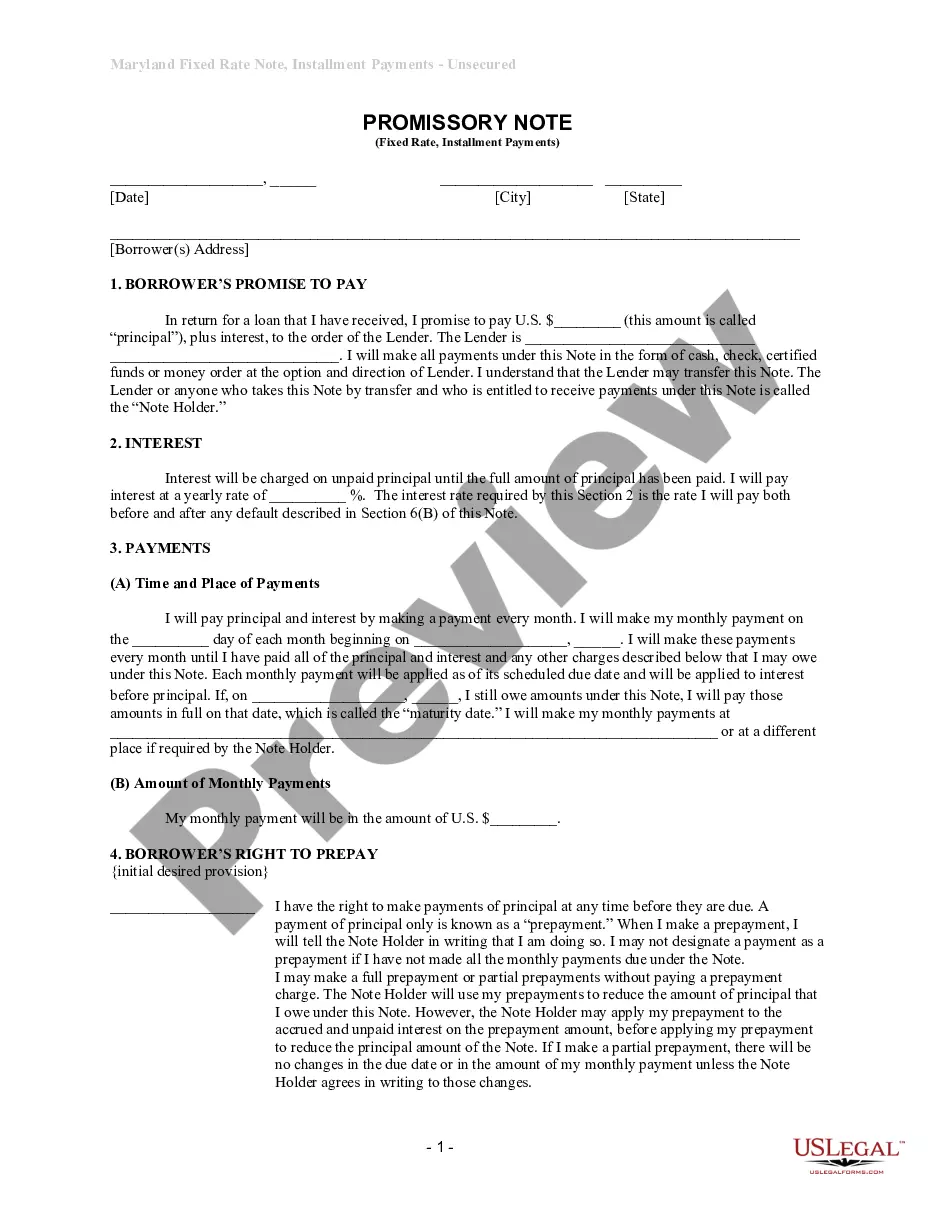

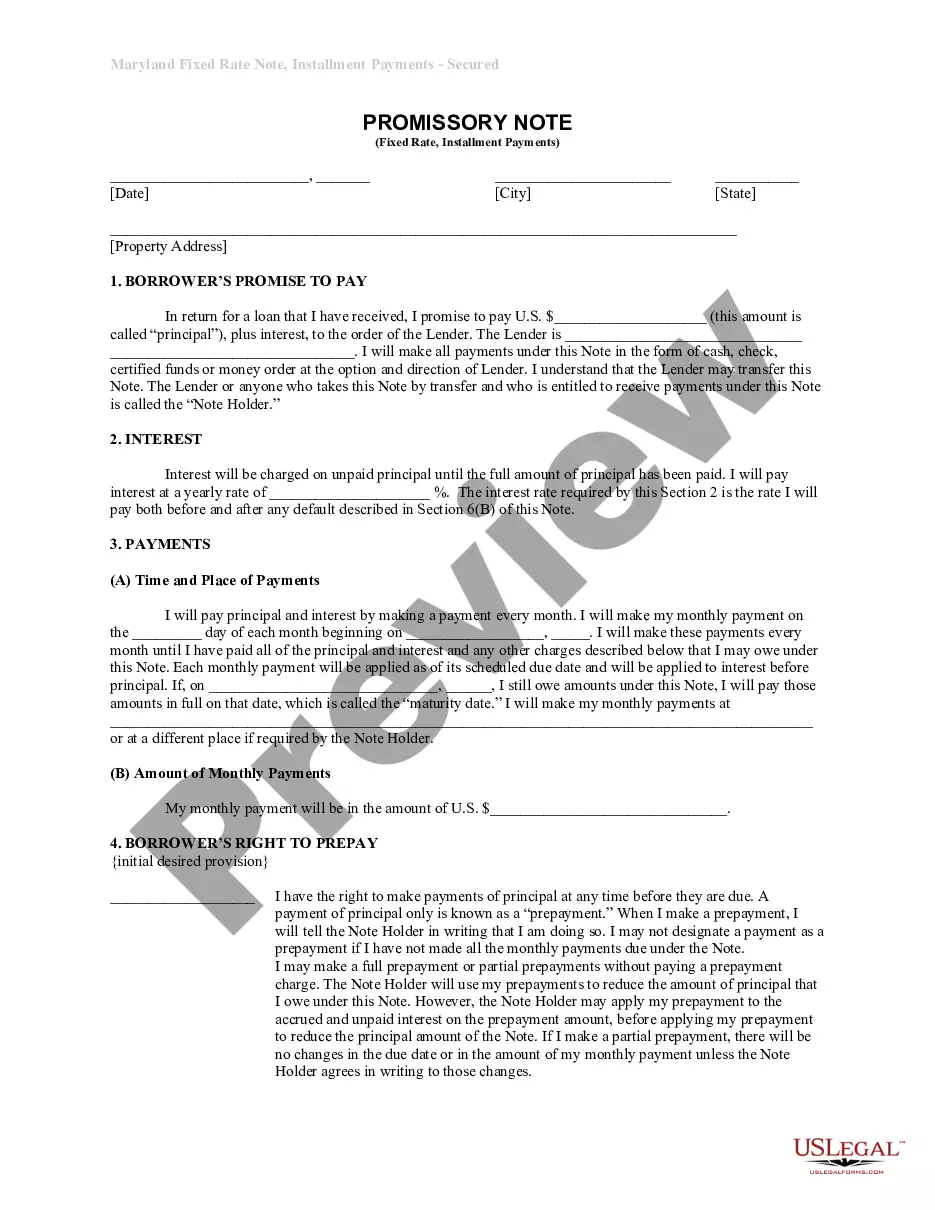

Maryland Unsecured Installment Payment Promissory Note for Fixed Rate

Description Maryland Promissory Note Example

How to fill out Maryland Unsecured Installment Payment Promissory Note For Fixed Rate?

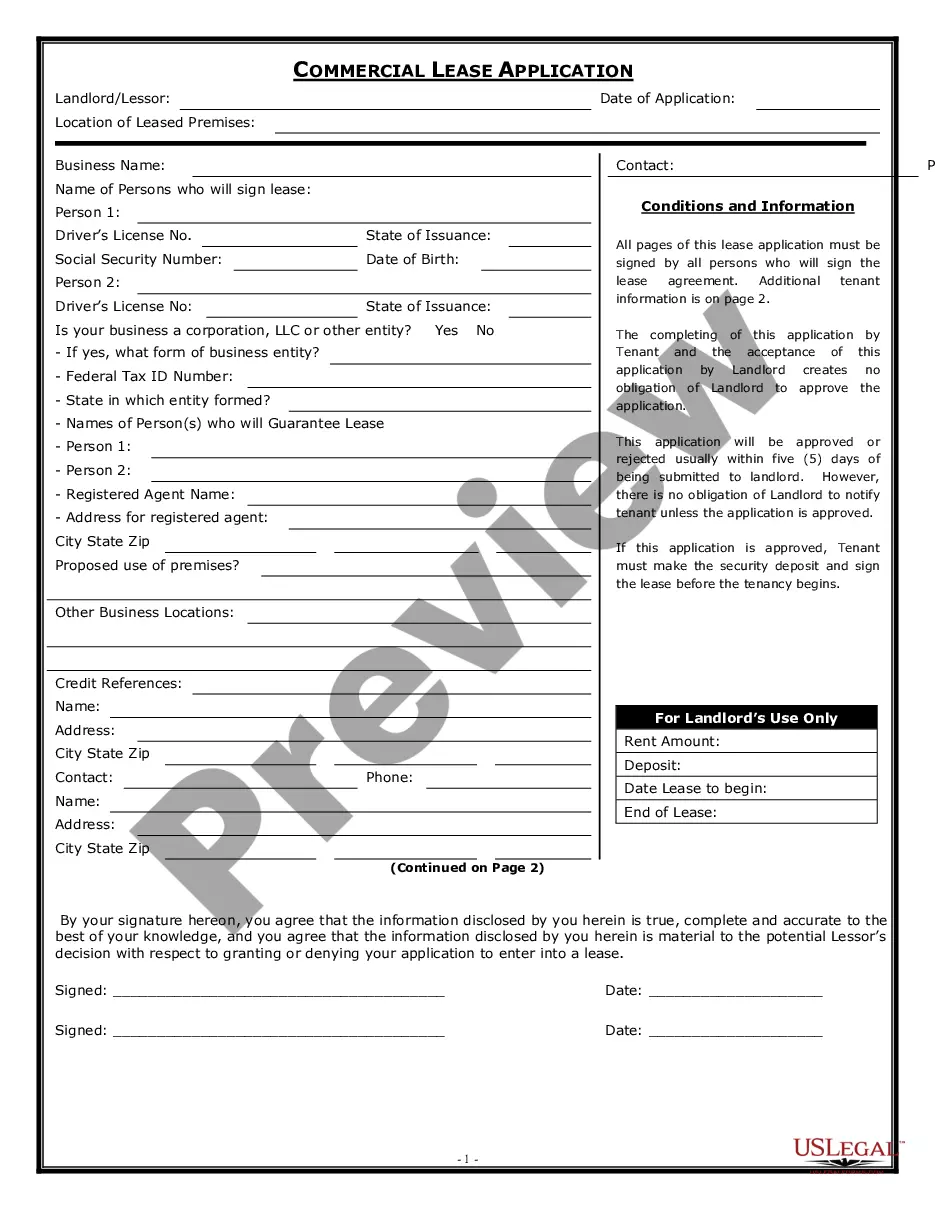

Welcome to the largest legal documents library, US Legal Forms. Right here you will find any example such as Maryland Unsecured Installment Payment Promissory Note for Fixed Rate forms and save them (as many of them as you want/need). Make official papers in a several hours, instead of days or weeks, without having to spend an arm and a leg on an attorney. Get your state-specific example in a few clicks and be confident understanding that it was drafted by our accredited attorneys.

If you’re already a subscribed user, just log in to your account and click Download near the Maryland Unsecured Installment Payment Promissory Note for Fixed Rate you want. Due to the fact US Legal Forms is online solution, you’ll always have access to your downloaded templates, regardless of the device you’re using. Locate them in the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check out our guidelines below to get started:

- If this is a state-specific sample, check its applicability in your state.

- Look at the description (if readily available) to learn if it’s the right example.

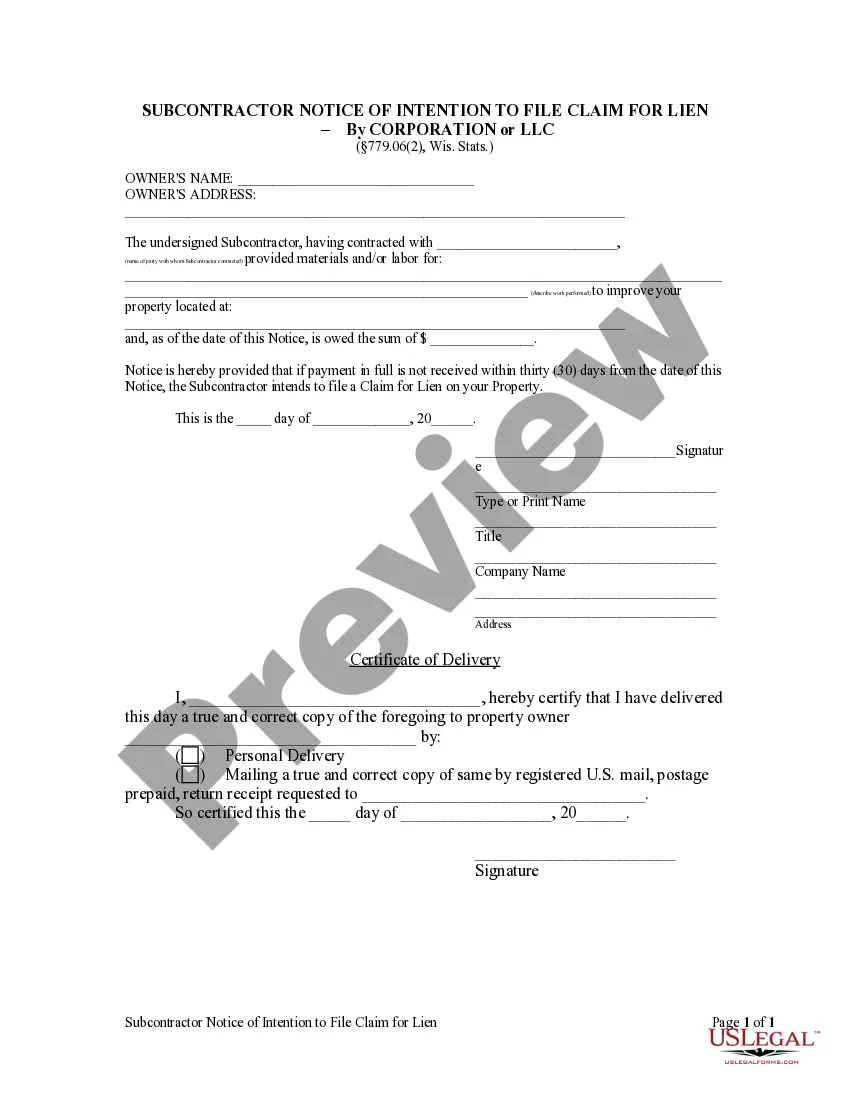

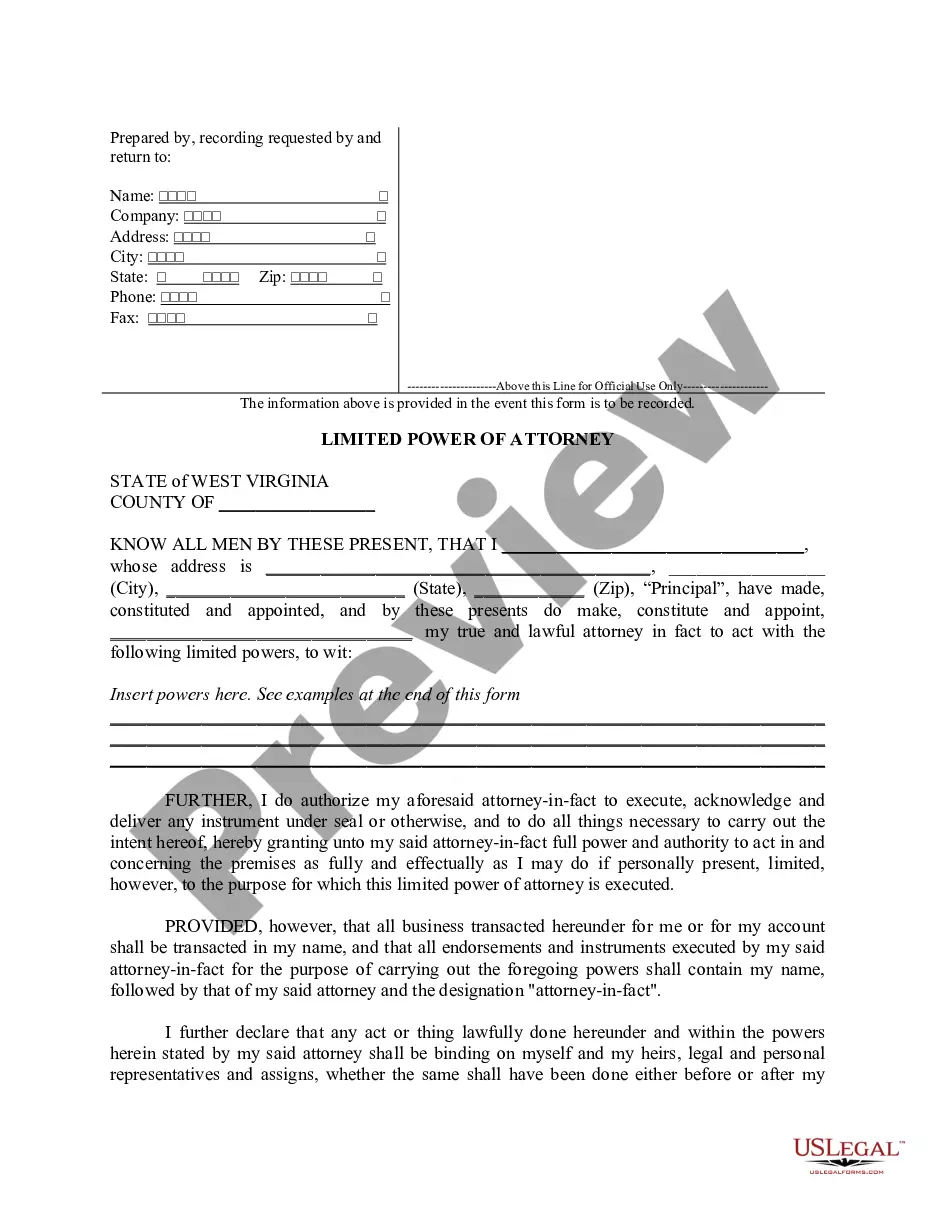

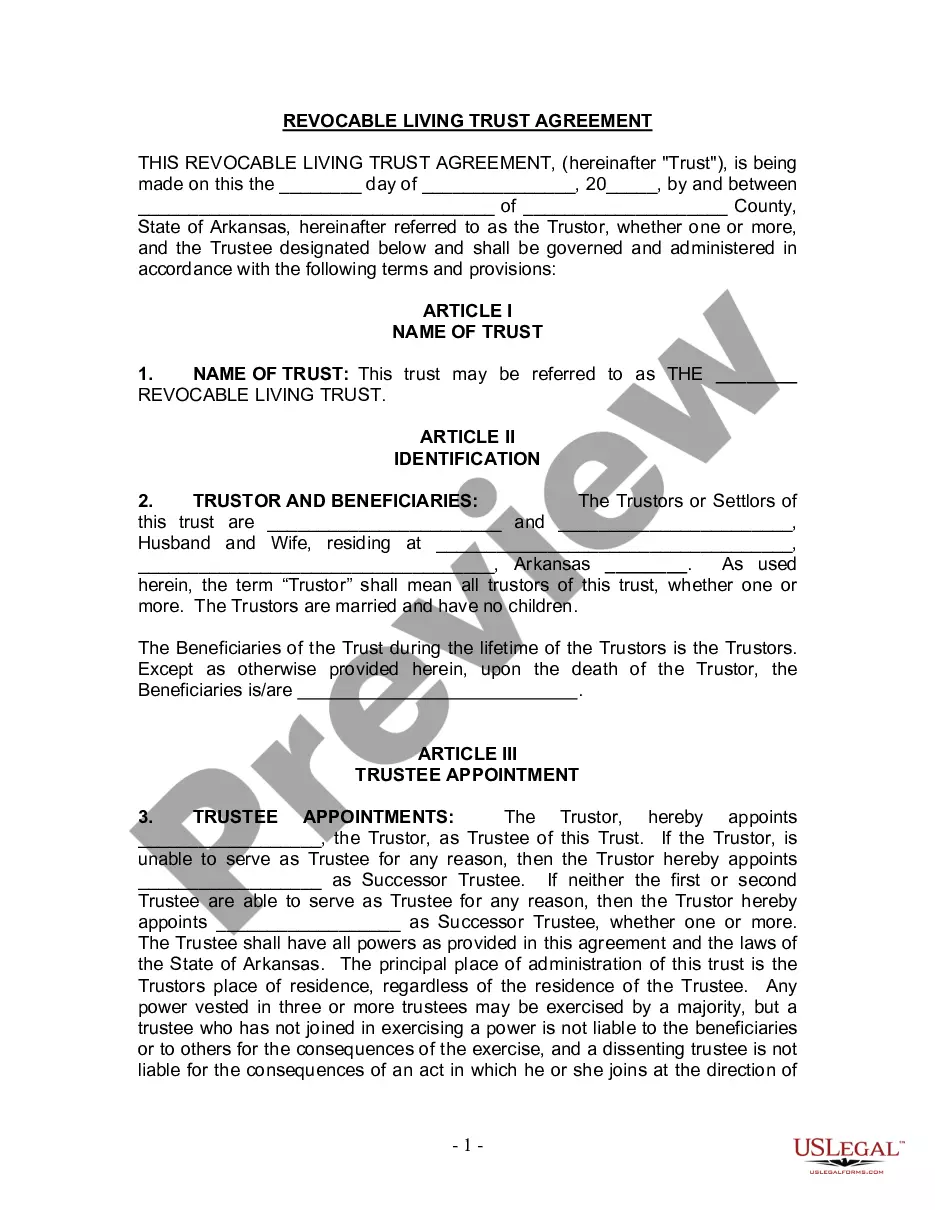

- See far more content with the Preview feature.

- If the example fulfills all of your requirements, click Buy Now.

- To make an account, choose a pricing plan.

- Use a credit card or PayPal account to register.

- Save the file in the format you require (Word or PDF).

- Print the file and complete it with your/your business’s info.

After you’ve completed the Maryland Unsecured Installment Payment Promissory Note for Fixed Rate, give it to your legal professional for confirmation. It’s an additional step but an essential one for being sure you’re completely covered. Join US Legal Forms now and get thousands of reusable examples.

Form popularity

FAQ

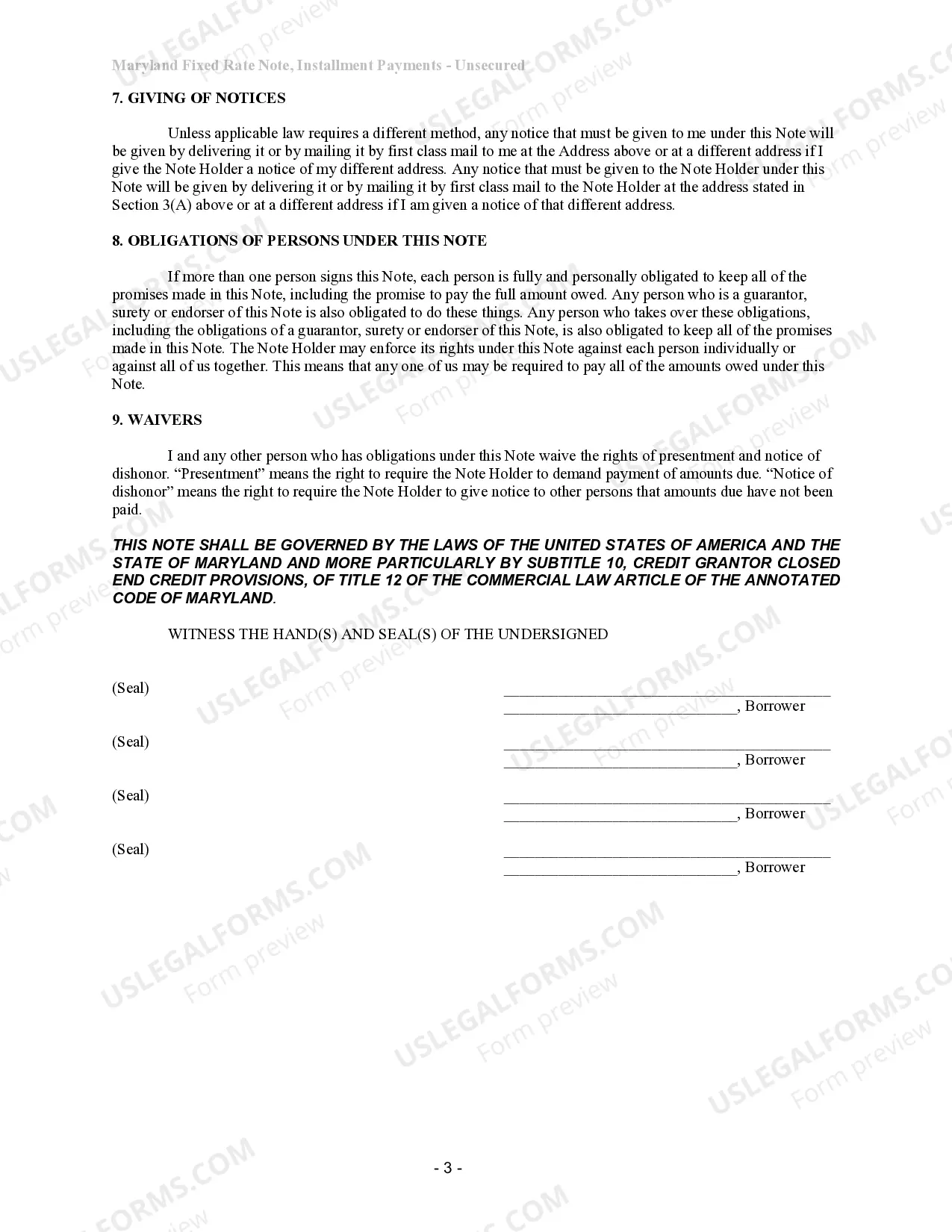

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

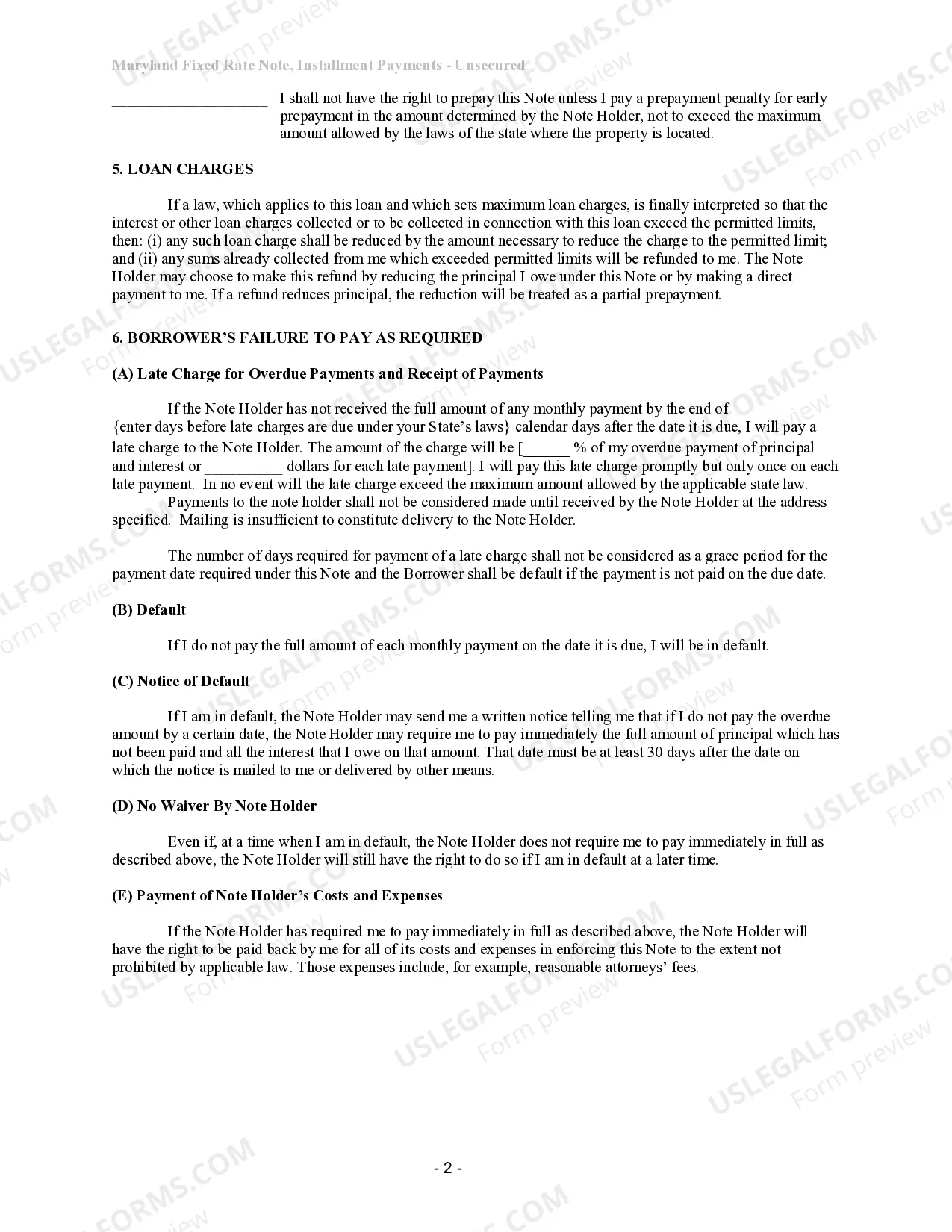

A party seeking to enforce an unsigned agreement may also have a claim for unjust enrichment or promissory estoppel.A claim of promissory estoppel requires a clear and unambiguous promise, reasonable and foreseeable reliance on that promise, and injury to the relying party as a result of the reliance.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

An unsecured note is a loan that is not secured by the issuer's assets. Unsecured notes are similar to debentures but offer a higher rate of return. Unsecured notes provide less security than a debenture. Such notes are also often uninsured and subordinated.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.