Maryland Order for Small Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

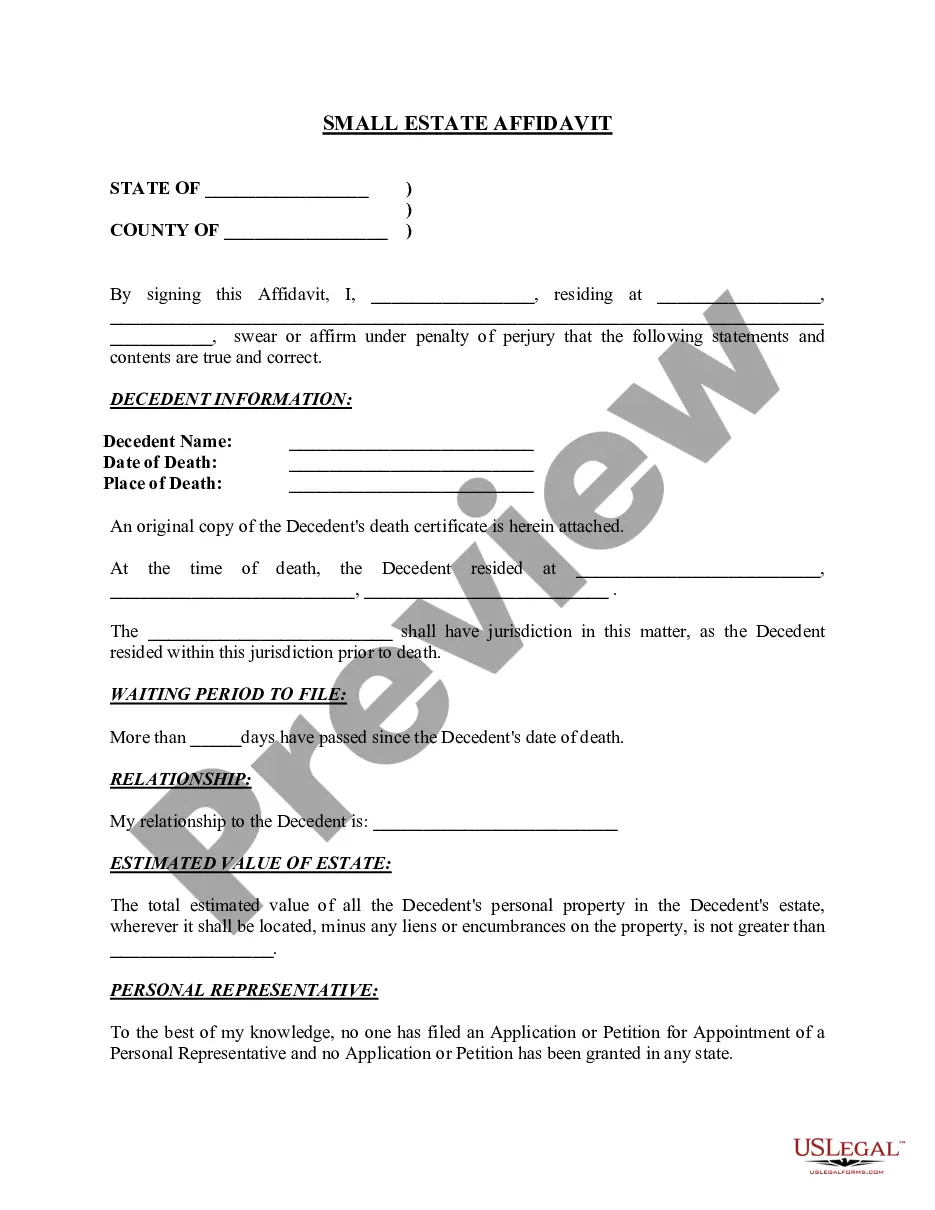

How to fill out Maryland Order For Small Estate?

Utilize US Legal Forms to obtain a printable Maryland Order for Small Estate.

Our court-acceptable forms are composed and frequently revised by experienced attorneys.

Ours is the most comprehensive Forms repository on the internet and provides economical and precise templates for clients, lawyers, and small to medium-sized businesses.

Click Buy Now if it’s the template you desire. Create your account and pay via PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search engine if you want to obtain another document template. US Legal Forms offers a vast array of legal and tax samples and packages for both business and personal requirements, including the Maryland Order for Small Estate. Over three million users have successfully utilized our platform. Select your subscription plan and acquire high-quality forms within just a few clicks.

- The documents are organized into state-specific categories, and many can be previewed prior to download.

- To access templates, users need an active subscription and must Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For individuals without a subscription, follow the guidelines below to easily locate and download the Maryland Order for Small Estate.

- Ensure you have the correct template for the required state.

- Examine the document by reviewing the description and utilizing the Preview option.

Form popularity

FAQ

Maryland Law requires that any one holding an original Will and/or Codicil(s) must file that document with the Register of Wills promptly after a decedent's death even if there are no assets. However, although the Will and/or Codicil are kept on file, no probate proceedings are required to be opened.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

Petition for Administration. List of Assets and Debts. Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs. Bond of Personal Representative Form. List of Interested Persons. Paid Funeral Bill. Copy of Death Certificate - available from Division of Vital Records.