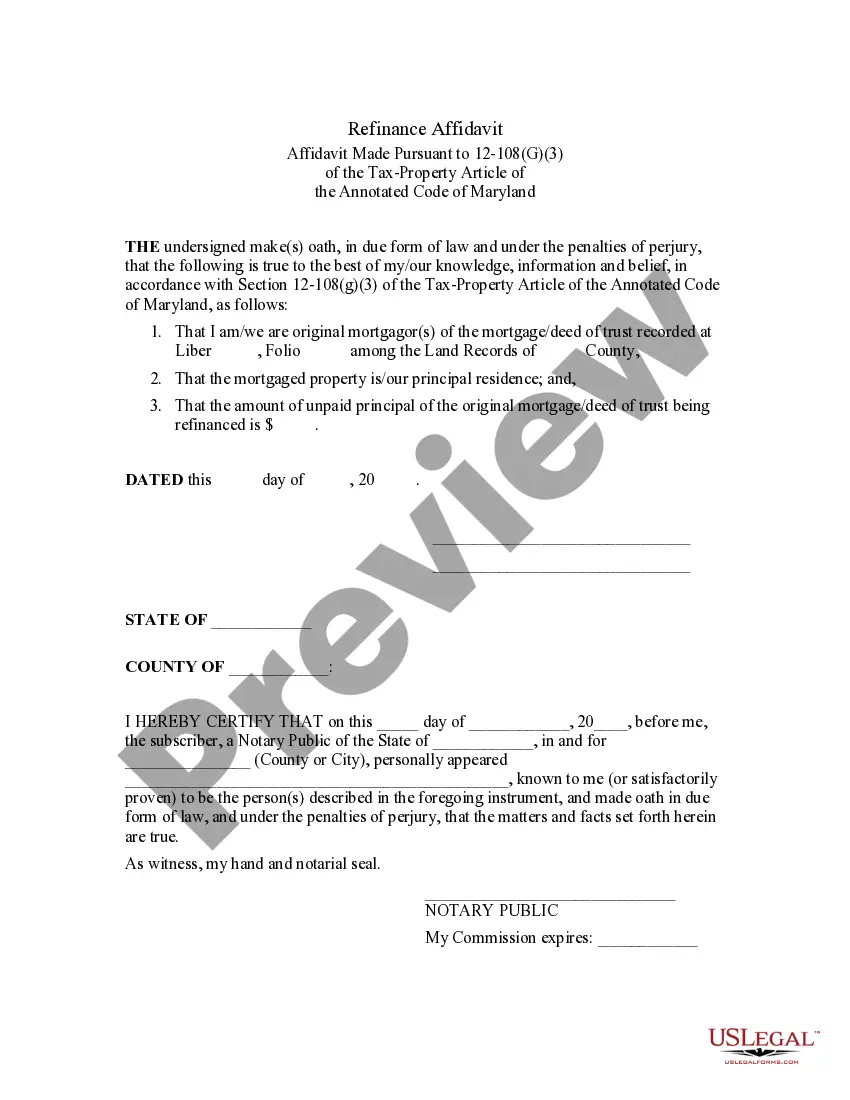

The Maryland Refinance Affidavit is a document used in residential real estate transactions to make sure that all parties involved are aware of the terms of the refinancing loan. The document is used to inform the lender of the current loan amount, current interest rate, and other important information. It also serves as a form of acknowledgement that all parties involved in the transaction are aware of the terms of the loan and agree to them. There are two types of Maryland Refinance Affidavits: a refinancing affidavit for a purchase money mortgage and a refinancing affidavit for a non-purchase money mortgage. The purchase money mortgage refinance affidavit requires the name of the parties involved in the transaction, the loan amount, the interest rate, the loan terms, and the name of the title company. The non-purchase money mortgage refinance affidavit requires the name of the parties involved in the transaction, the loan amount, the interest rate, the loan term, and the name of the lender. Both types of affidavits must be signed and dated by the parties involved in the transaction.

Maryland Refinance Affidavit

Description

How to fill out Maryland Refinance Affidavit?

How much duration and resources do you usually utilize for creating formal documentation.

There’s a better alternative to obtaining such forms than engaging legal professionals or investing hours searching the internet for a suitable template.

Another advantage of our service is that you can access previously acquired documents that are securely stored in your profile under the My documents section. Retrieve them at any time and redo your paperwork as often as you require.

Conserve time and effort preparing official documentation with US Legal Forms, one of the most trustworthy online solutions. Join us today!

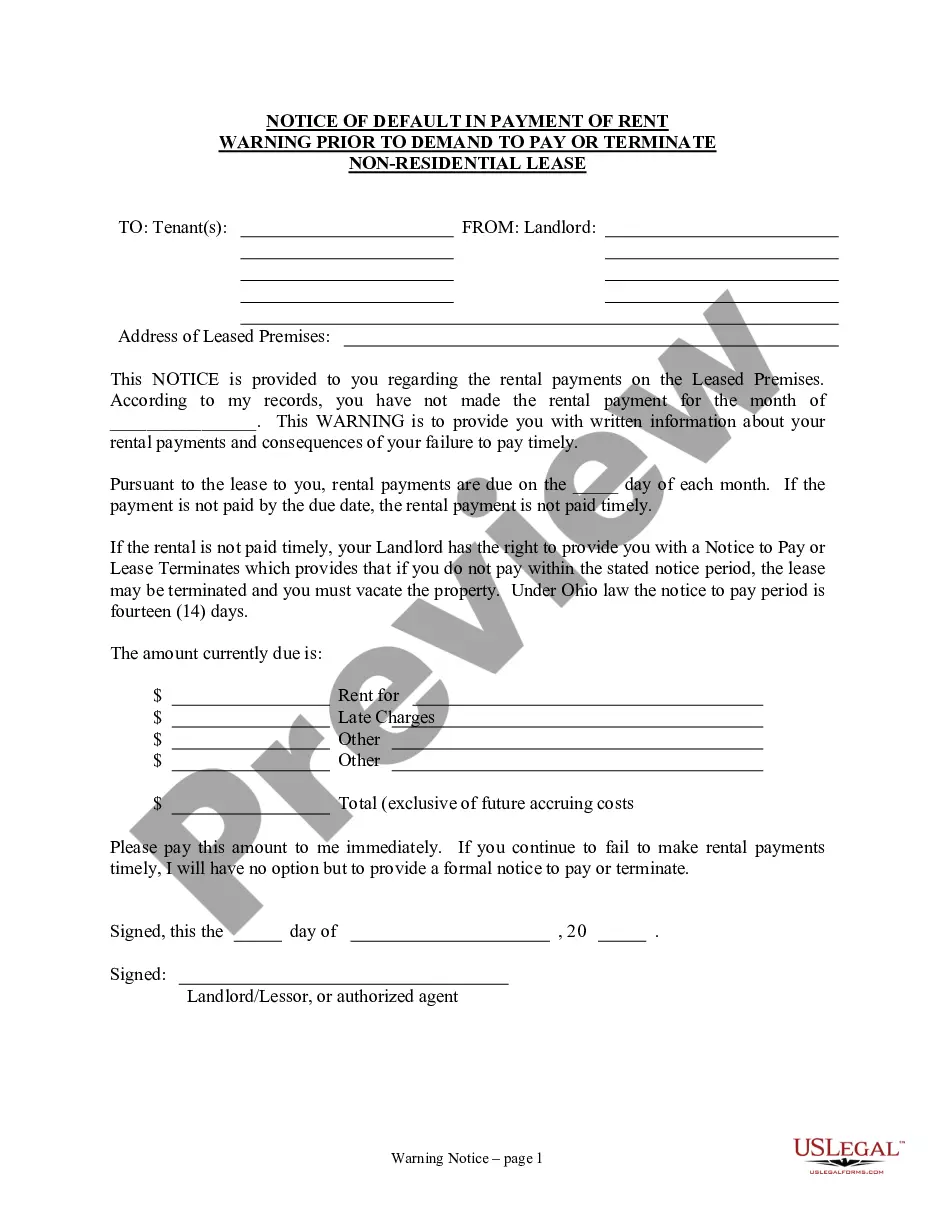

- Browse the form details to confirm it adheres to your state's regulations. To achieve this, review the form description or use the Preview option.

- If your legal template does not satisfy your requirements, locate another one via the search bar at the top of the screen.

- If you are already registered with our service, Log In and download the Maryland Refinance Affidavit. If you are not, proceed to the subsequent steps.

- Click Buy now once you identify the appropriate document. Select the subscription plan that best fits your needs to gain access to our library's full functionalities.

- Create an account and pay for your subscription. You can complete your payment using your credit card or via PayPal - our service is completely secure for that.

- Download your Maryland Refinance Affidavit onto your device and complete it on a printed copy or digitally.

Form popularity

FAQ

How to Fill Out General Affidavit PDFRun - YouTube YouTube Start of suggested clip End of suggested clip Online. Button this will redirect you to pdf runs online editor first enter your state and countyMoreOnline. Button this will redirect you to pdf runs online editor first enter your state and county under statement of the affiliate. Provide the following information your state date of signing.

The Finance Affidavit is used in Prince George's County to claim exemptions from County Transfer and/or State Recordation taxes. All instruments of writing are. taxable for both County Transfer.

How to Fill Out an Affidavit The name and address of the person making the statement (affiant) The name of the court where the affidavit will be filed. The case number, if known. A brief description of the case. The facts or evidence being sworn to or affirmed. The date of the affidavit. The signature of the affiant.

6 steps to writing an affidavit Title the affidavit. First, you'll need to title your affidavit.Craft a statement of identity. The very next section of your affidavit is what's known as a statement of identity.Write a statement of truth.State the facts.Reiterate your statement of truth.Sign and notarize.

I Mr/Ms S/o Daughter of , aged around years, resident of , do hereby solemnly affirm and declare as under: That my name as per the records in my educational institution is (XYZ)

The affidavit must be signed by you, and swear (or affirm) under the penalties of perjury that what you are saying is true. For example: ?I solemnly affirm under the penalties of perjury and upon personal knowledge that the contents of the foregoing paper are true.?

Yes, in addition to being correctly signed and witnessed, an affidavit must be notarized in order to be legally binding.