Maryland Warranty Deed for Parents to Child with Reservation of Life Estate

Description

How to fill out Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate?

Among numerous paid and complimentary examples available online, you cannot guarantee their precision.

For instance, who made them or if they possess the qualifications necessary to address the matter you require them for.

Stay composed and make use of US Legal Forms! Find Maryland Warranty Deed for Parents to Child with Reservation of Life Estate formats crafted by skilled attorneys and avoid the costly and time-intensive process of searching for a lawyer and subsequently paying them to compose a document for you that you could easily obtain.

Select a pricing plan and establish an account. Complete the subscription payment using your credit/debit card or PayPal. Download the document in the necessary format. Once you have registered and paid for your subscription, you can use your Maryland Warranty Deed for Parents to Child with Reservation of Life Estate as frequently as you wish or as long as it remains valid in your area. Edit it with your preferred editor, complete it, sign it, and print it. Accomplish more for less with US Legal Forms!

- If you already possess a subscription, Log In to your account and locate the Download button next to the form you are seeking.

- You will also have access to all of your previously stored templates in the My documents section.

- If this is your first time using our service, follow the instructions below to obtain your Maryland Warranty Deed for Parents to Child with Reservation of Life Estate effortlessly.

- Ensure that the document you find is valid in your jurisdiction.

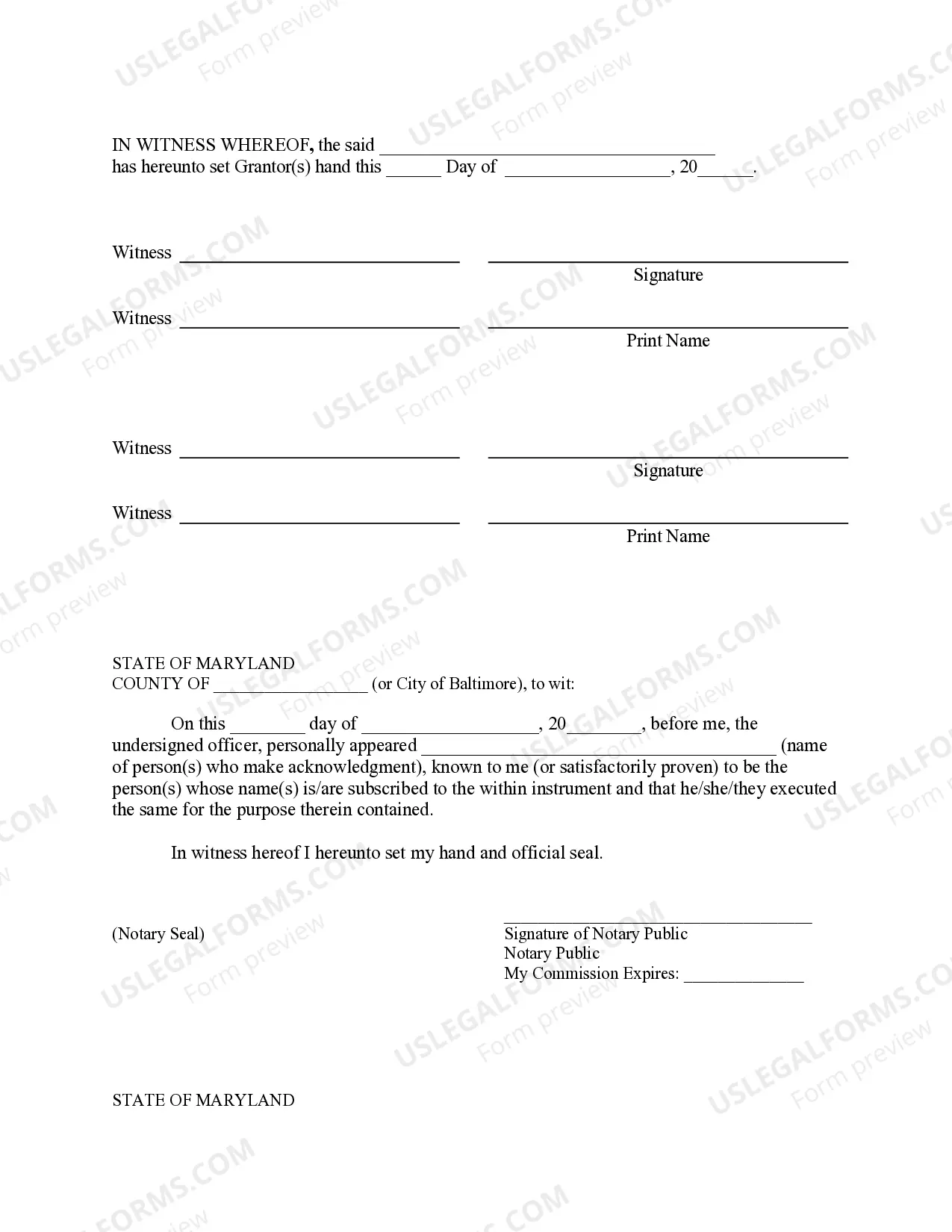

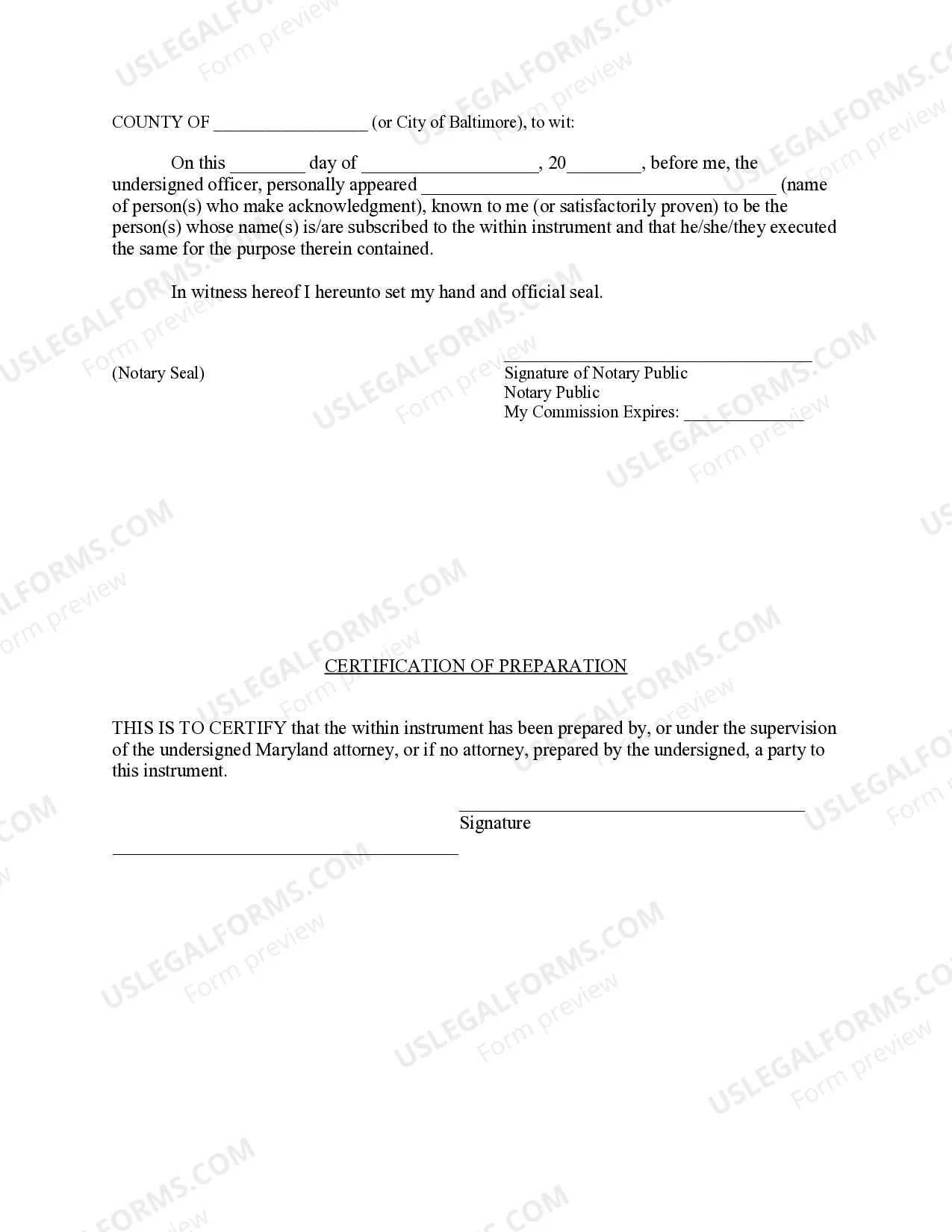

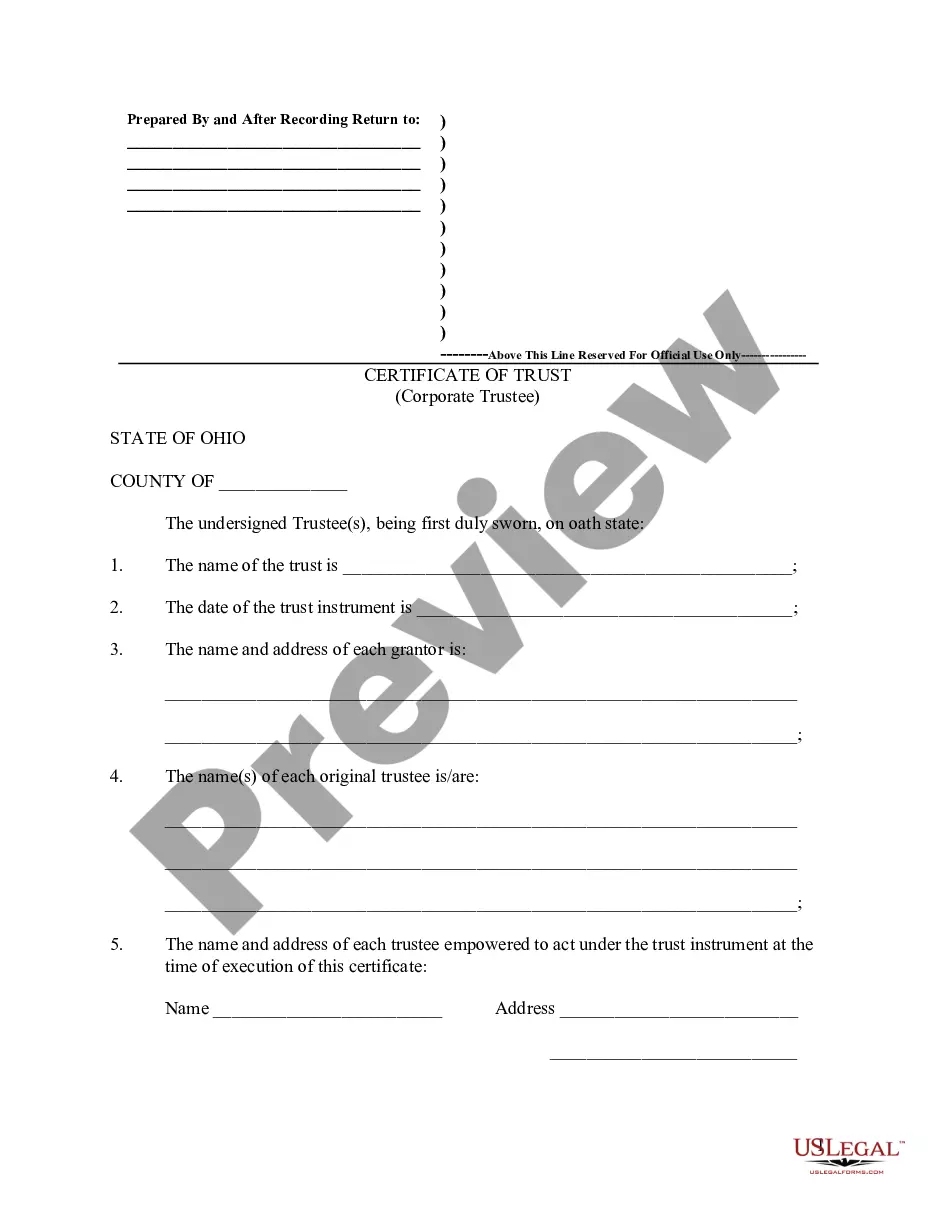

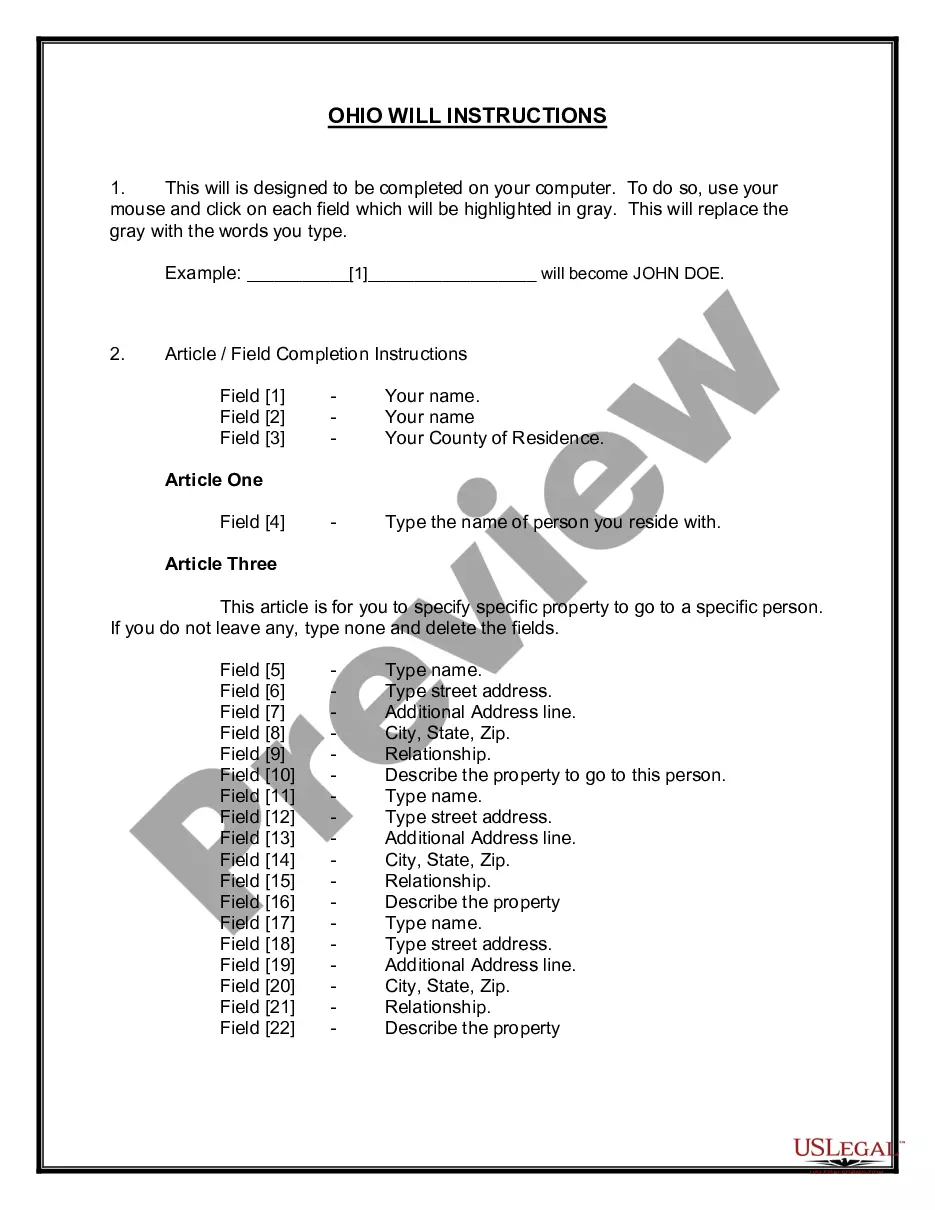

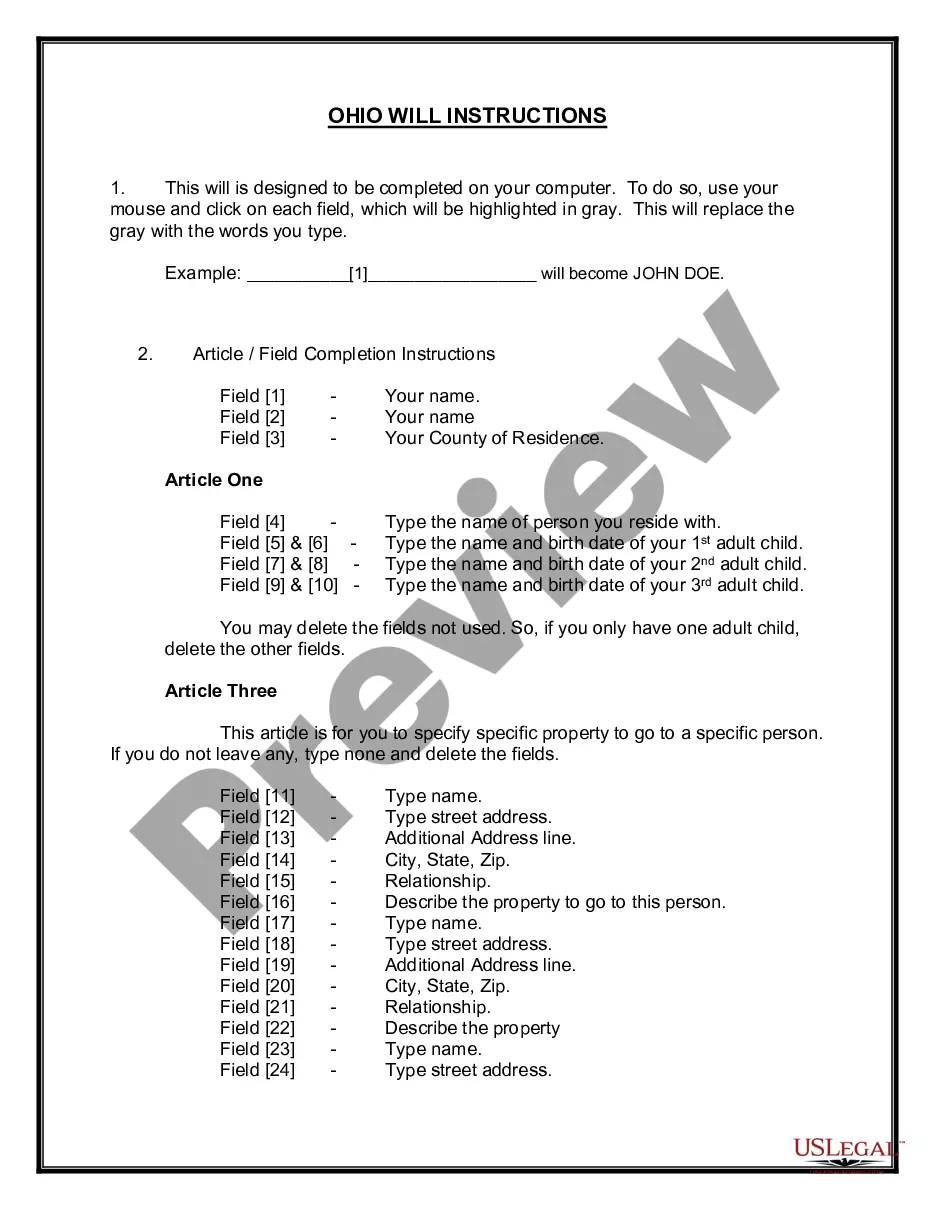

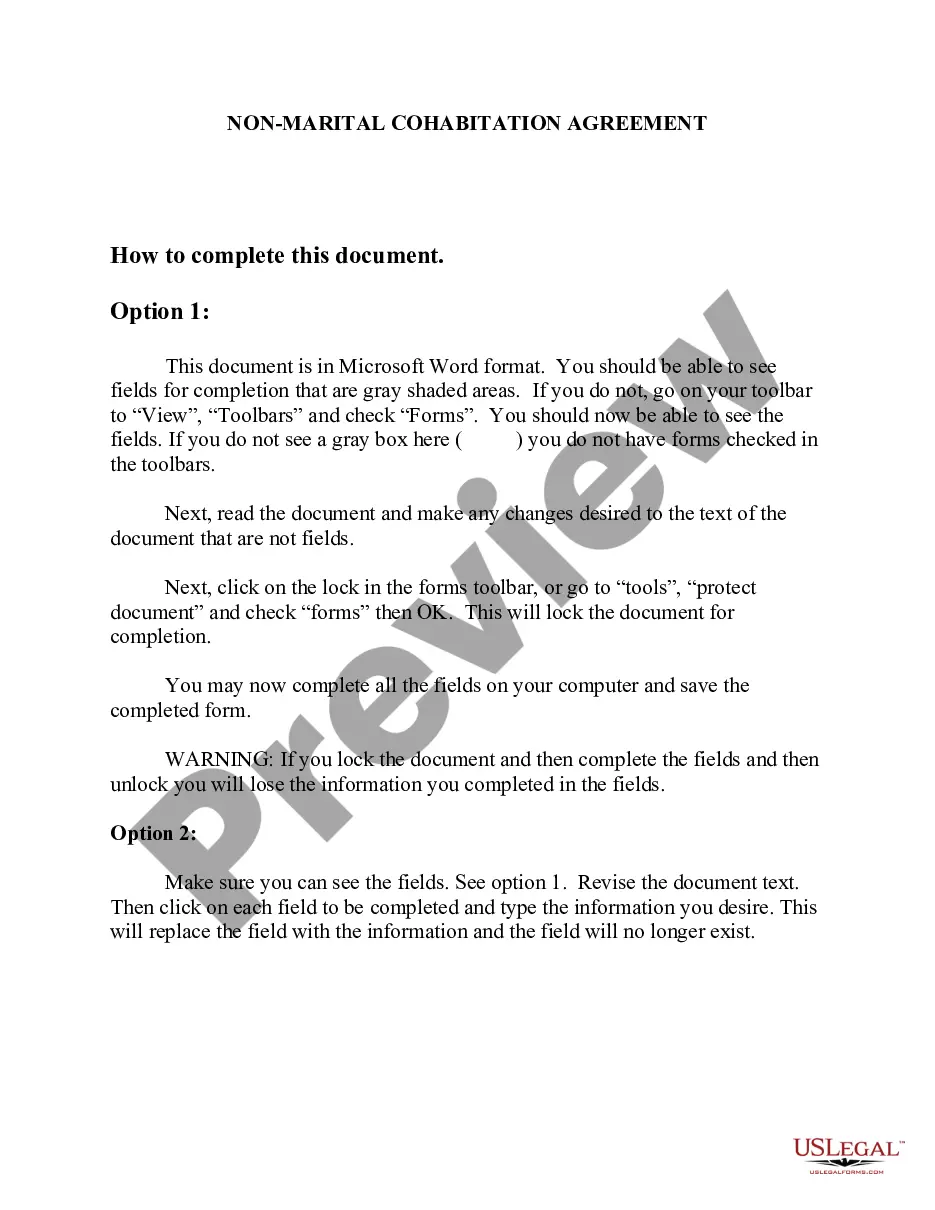

- Examine the template by reviewing the details using the Preview function.

- Click Buy Now to initiate the purchasing process or search for another example using the Search field located in the header.

Form popularity

FAQ

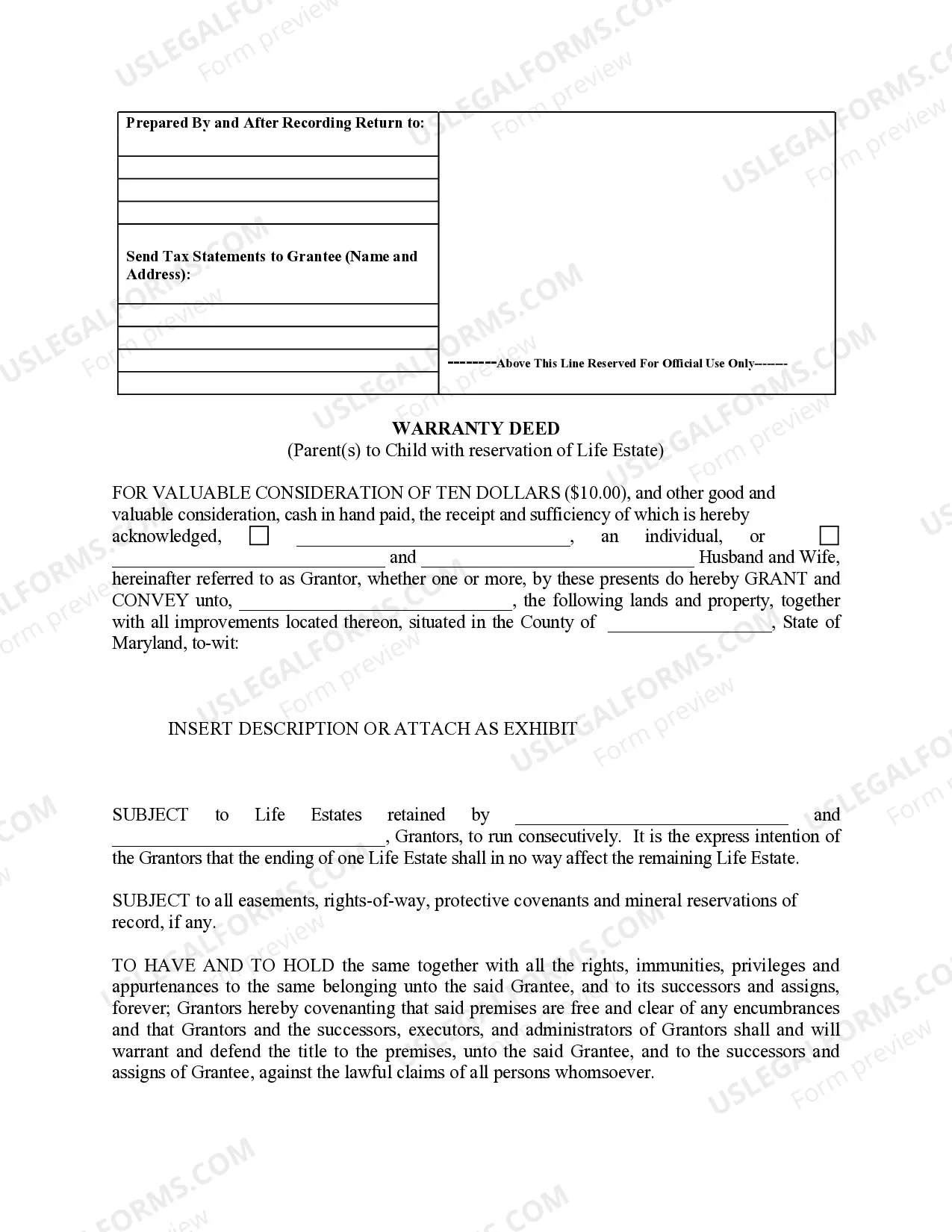

A life estate deed is a type of deed. You give yourself a life estate interest in your home 1 and retain the right to live in, use, and enjoy the property during your lifetime.There are two different types of life estate deeds used in Maryland. The first is called a life estate deed with full powers.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

When the life tenant dies, the house will not go through probate, since at the life tenant's death the ownership will pass automatically to the holders of the remainder interest.The life tenant cannot sell or mortgage the property without the agreement of the remaindermen.

The IRS treats the life estate transfer as a sale, and the fair market value of the house is included in your estate. If your estate exceeds the exclusion amount, you could owe estates taxes on the difference.If your estate is $100,000 to $150,000 over the exclusion maximum, the amount is taxed at 30 percent.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner.Remainder Owners have no right to use the property or collect income generated by the property, and are not responsible for taxes, insurance or maintenance, as long as the Life Tenant is still alive.

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.