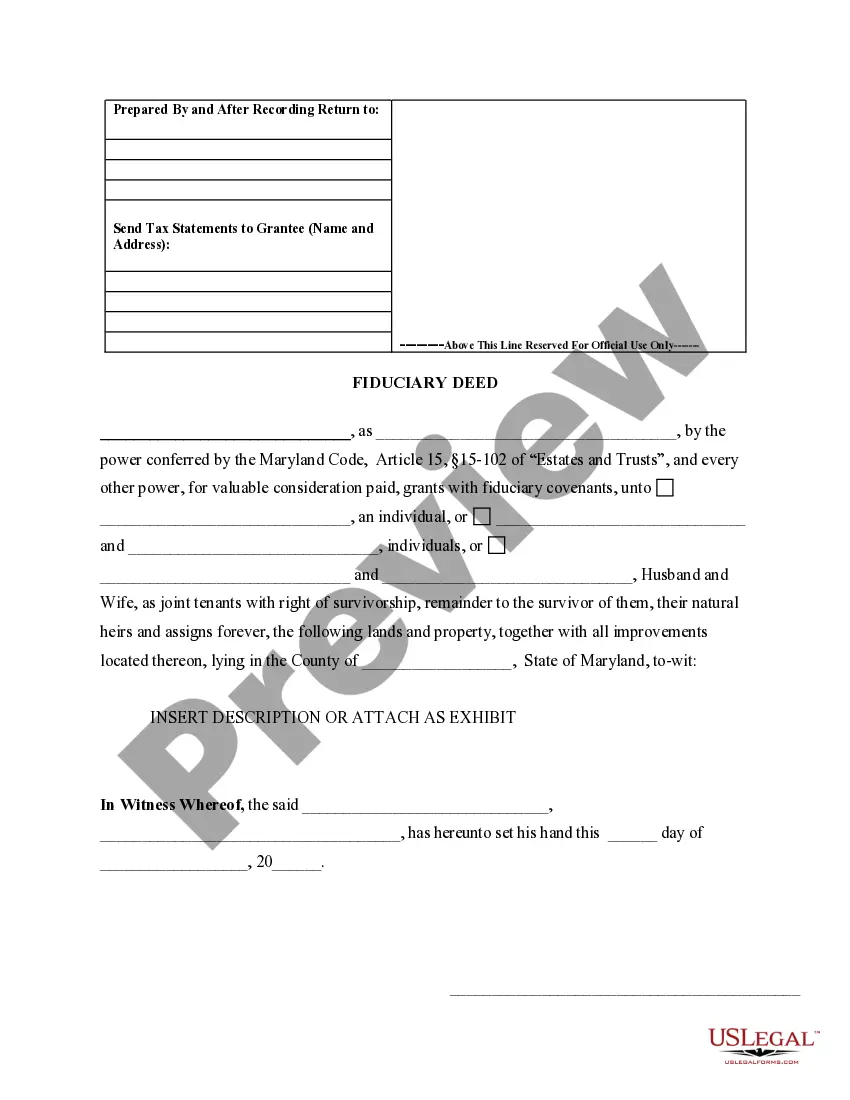

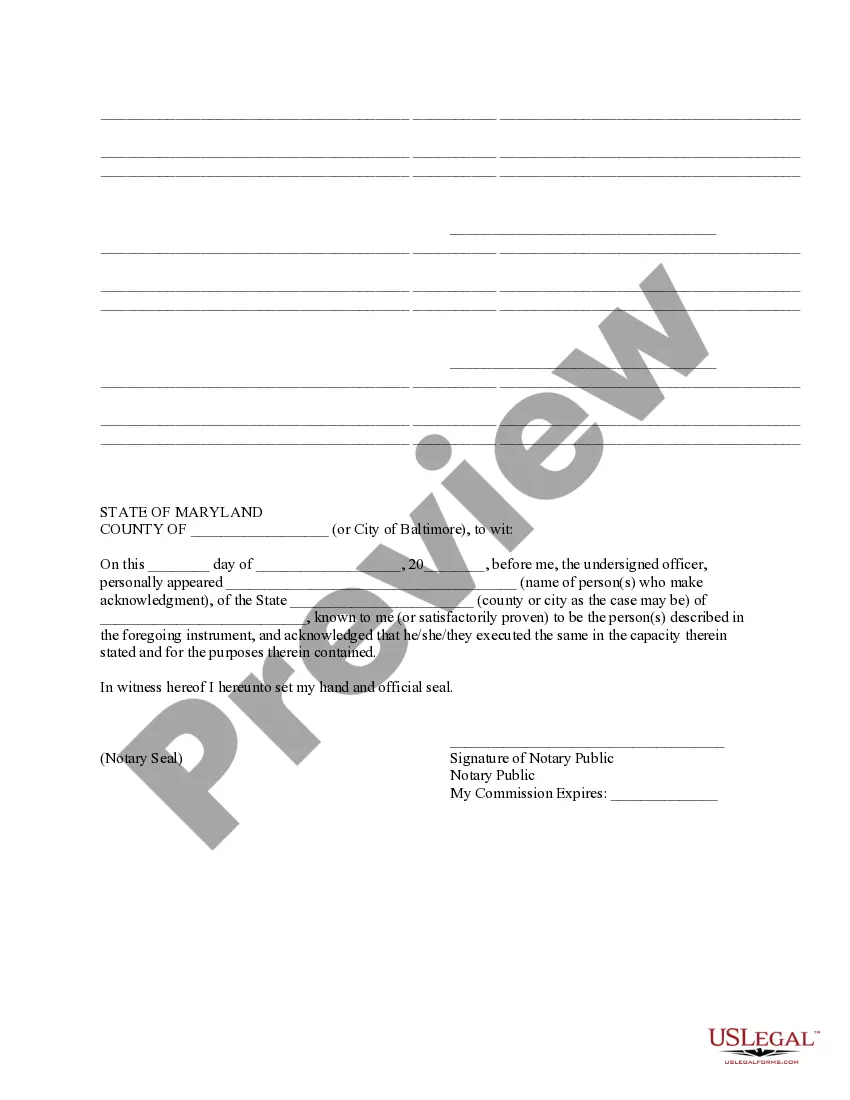

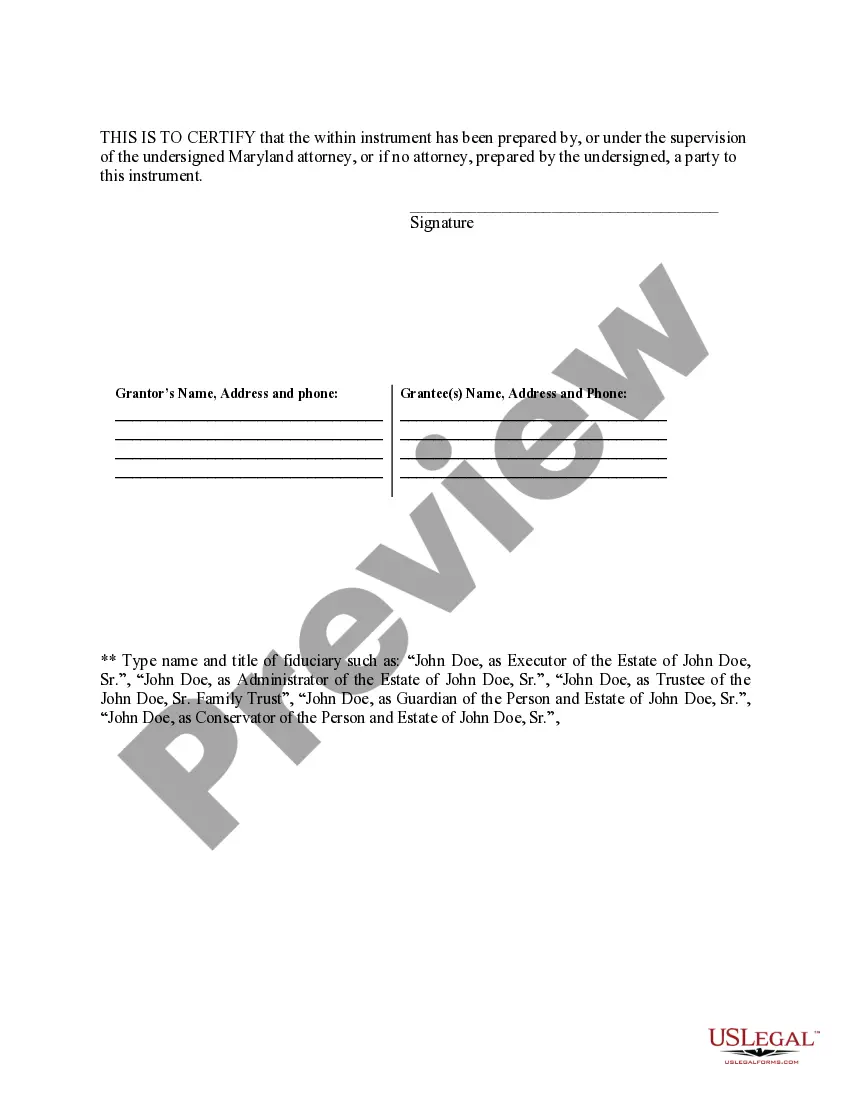

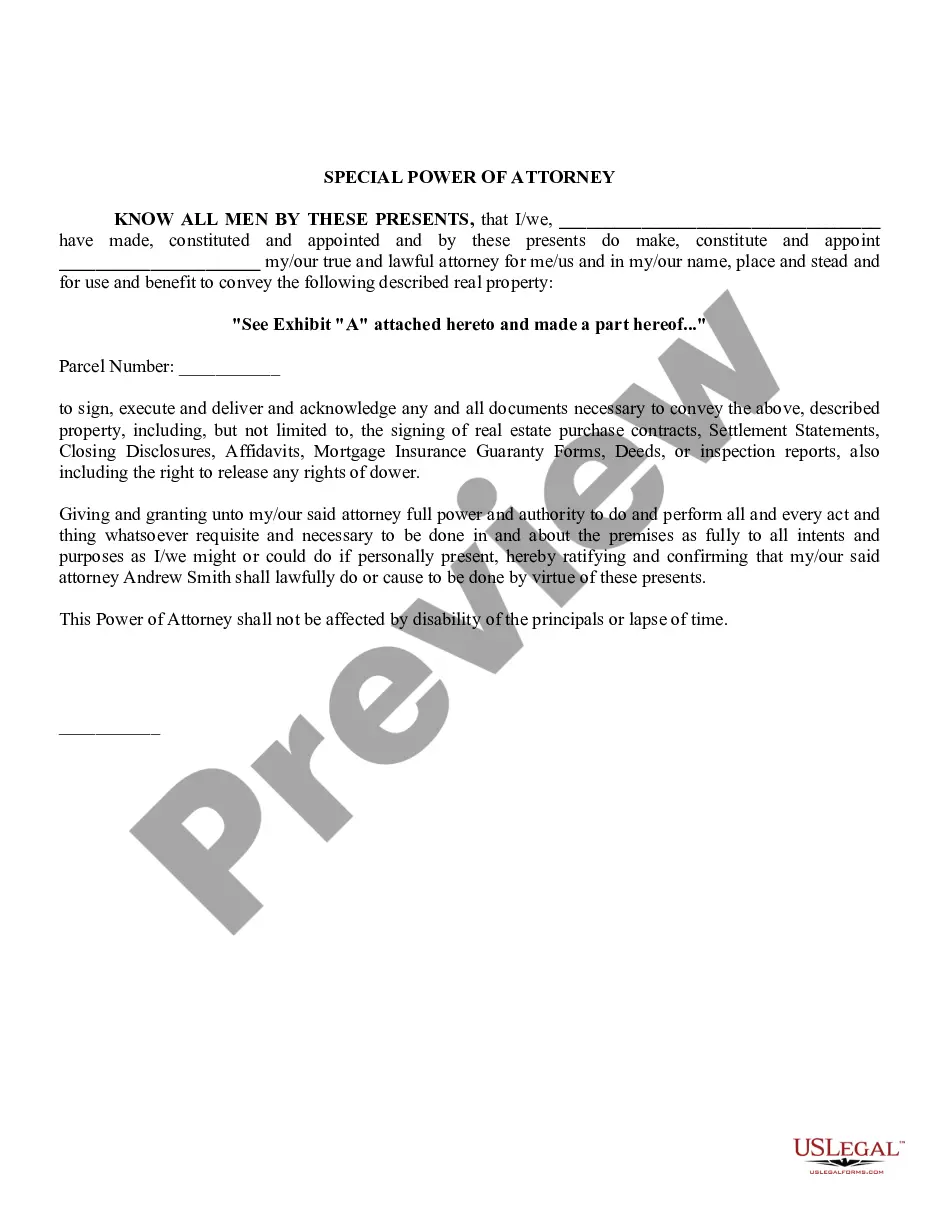

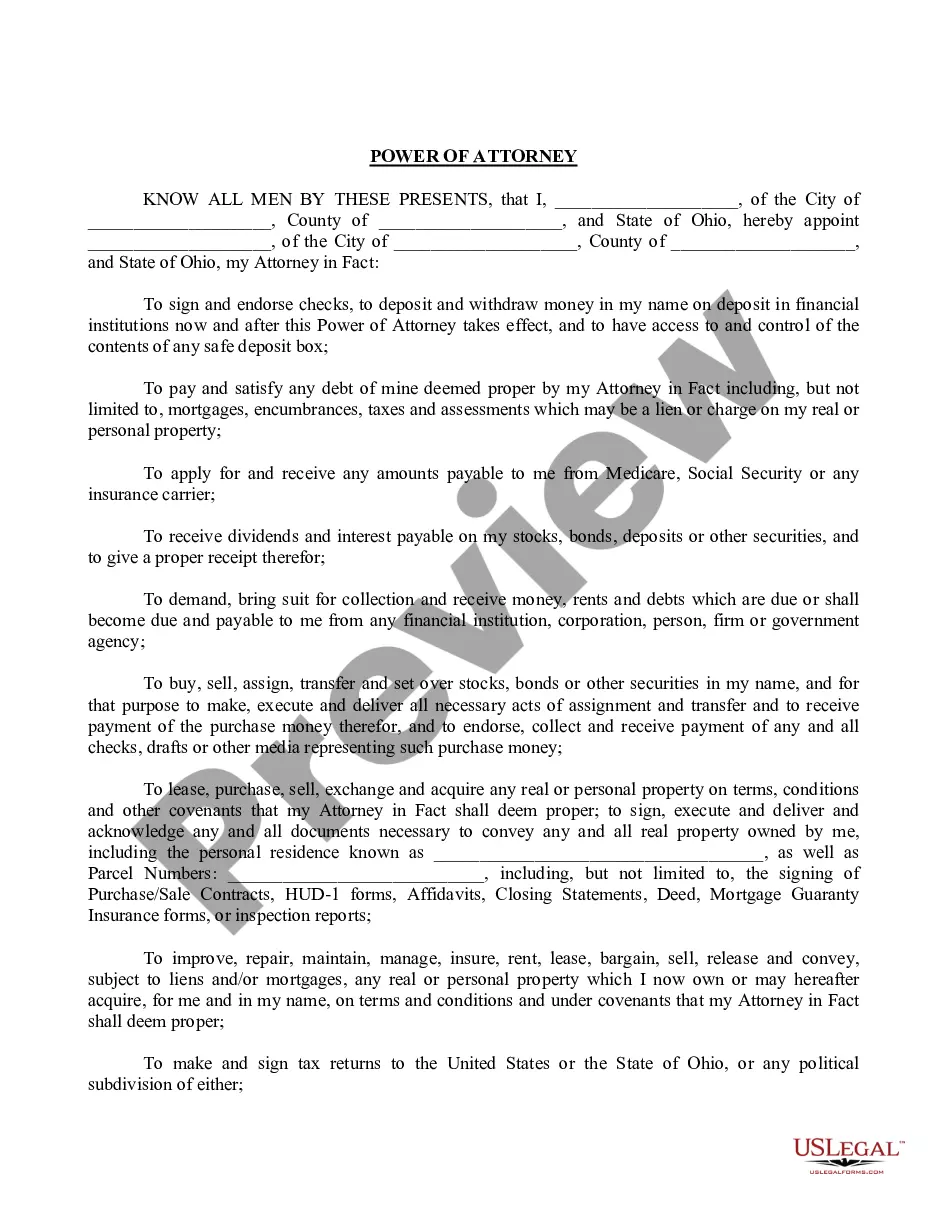

Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description Executor's Deed

How to fill out Maryland Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among countless paid and free examples which you get on the net, you can't be certain about their accuracy. For example, who made them or if they are skilled enough to take care of what you need these to. Keep calm and use US Legal Forms! Find Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries samples developed by professional lawyers and avoid the expensive and time-consuming process of looking for an lawyer or attorney and after that paying them to write a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you’re seeking. You'll also be able to access all of your previously acquired samples in the My Forms menu.

If you are making use of our website for the first time, follow the guidelines listed below to get your Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries quickly:

- Ensure that the document you see is valid in your state.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or look for another example utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

Once you have signed up and purchased your subscription, you can use your Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as many times as you need or for as long as it continues to be valid where you live. Revise it in your favorite online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Realty trusts are a method of owning real estate used primarily in Massachusetts.The owner can make the gifts without having to record new deeds at the registry of deeds. Typically, a realty trust will refer to a schedule of beneficiaries which lists the true owners of the property.

Trusts have many varied uses and benefits, primary among them: 1) ongoing professional management of assets; 2) reduction of tax liabilities and probate costs; 3) keeping assets out of a surviving spouse's estate while providing income for life; 4) care for special needs individuals; 4) protecting individuals from poor

Typically, a realty trust will refer to a schedule of beneficiaries which lists the true owners of the property. The trustees simply act on behalf of the beneficiary or beneficiaries listed on the schedule, which is not recorded at the registry of deeds.

Only the trustee not the beneficiaries can access the trust checking account. They can write checks or make electronic transfers to a beneficiary, and even withdraw cash, though that could make it more difficult to keep track of the trust's finances. (The trustee must keep a record of all the trust's finances.)

A trust account is used exclusively for money received or held by a real estate agent for or on behalf of another person in relation to a real estate transaction and is not to be used to hold moneys for any other purpose.

The purpose of a trust account in real estateTrust accounts exist to protect everyone involved in the real estate transaction. They are heavily governed by legislation and failure to comply can result in hefty penalties and even loss of licence.

Trusts allow for assets to be split between family members and are an efficient way to house complex assets. They also offer protection from creditors. Assets that belong to a trust are also not subject to executors' fees, which can amount to up to 3.5% plus VAT on the gross value of your estate.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.