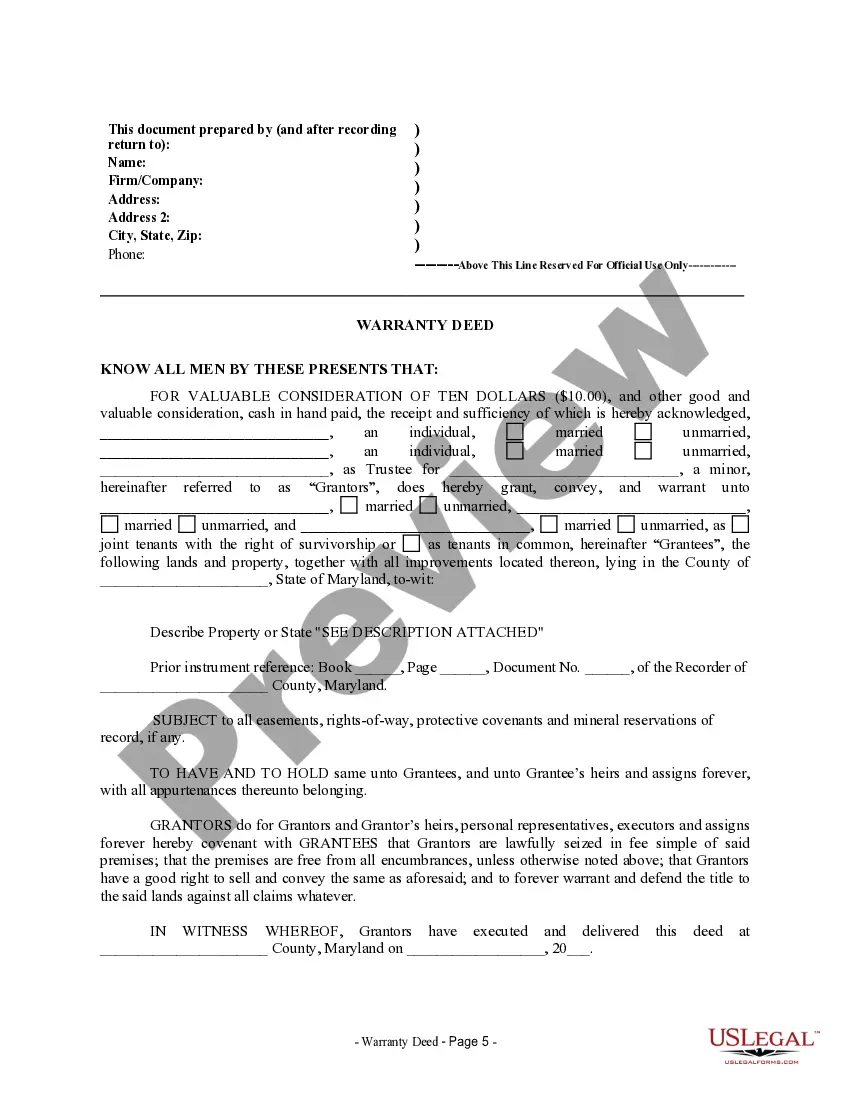

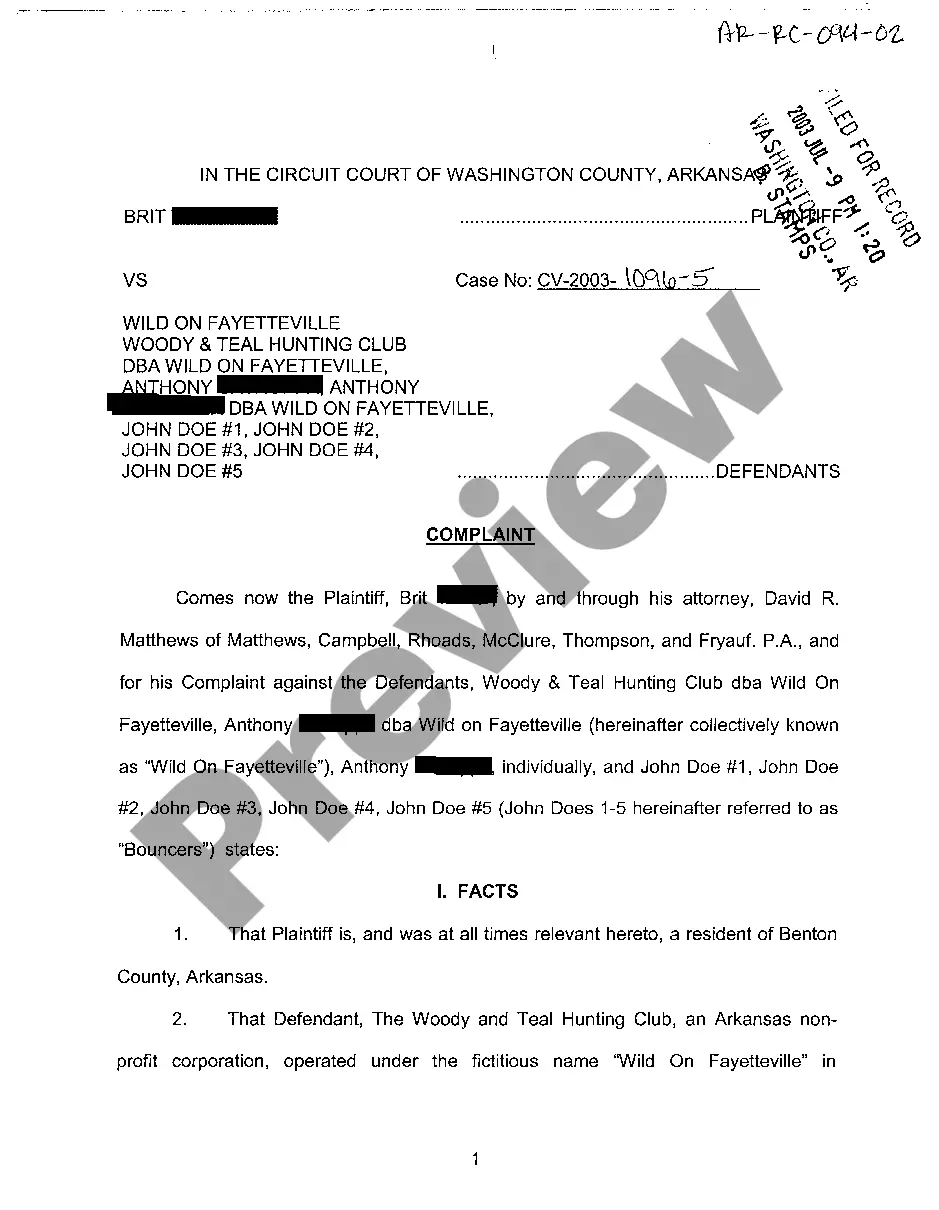

Maryland Warranty Deed from two Individuals and Trustee to Three Individuals

Description Maryland Warranty

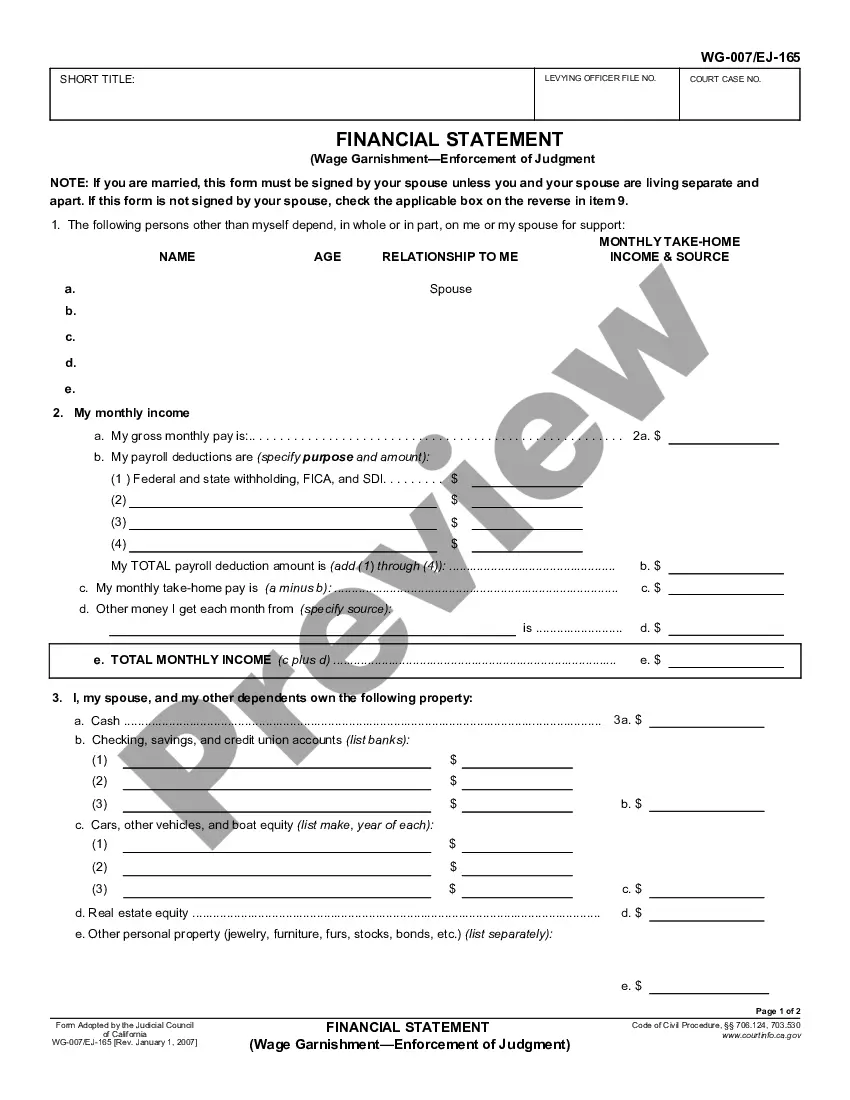

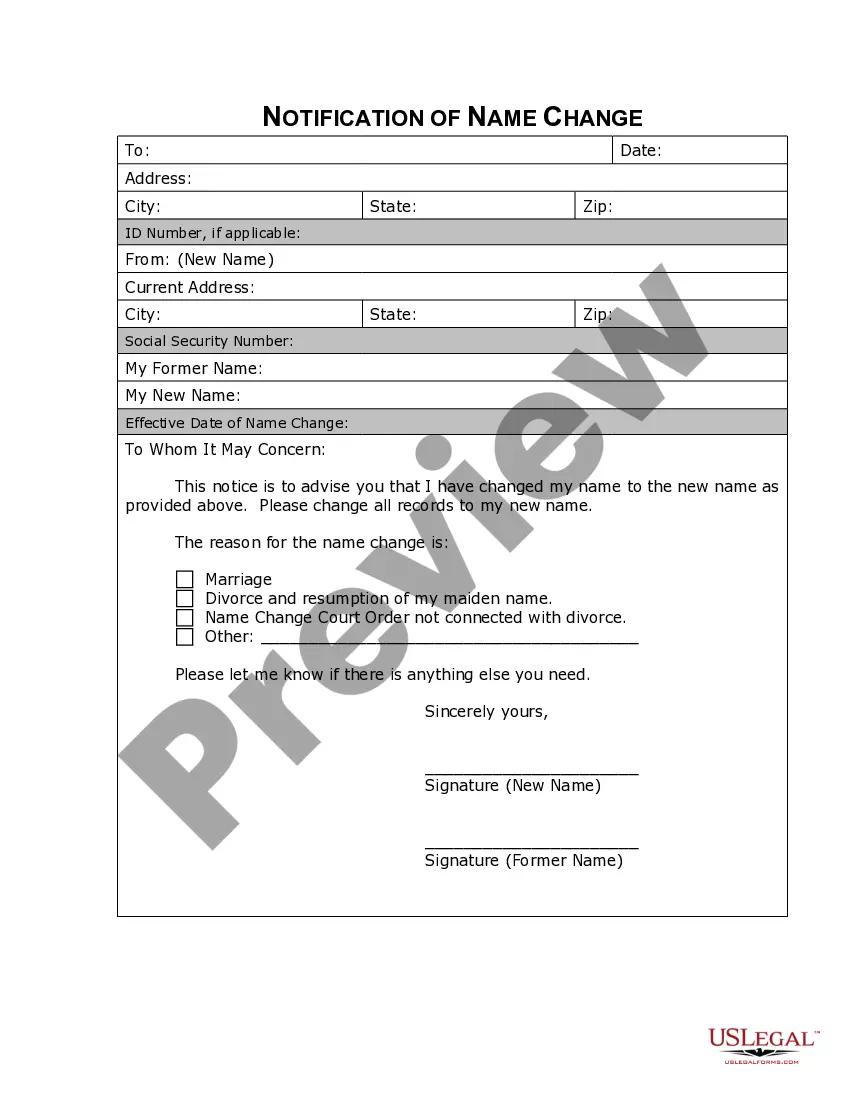

How to fill out Maryland Trustee Sample?

Among hundreds of free and paid samples that you can get online, you can't be sure about their reliability. For example, who created them or if they’re qualified enough to take care of the thing you need these people to. Keep relaxed and utilize US Legal Forms! Discover Maryland Warranty Deed from two Individuals and Trustee to Three Individuals samples made by professional attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access all of your earlier acquired files in the My Forms menu.

If you’re using our platform for the first time, follow the instructions listed below to get your Maryland Warranty Deed from two Individuals and Trustee to Three Individuals easily:

- Ensure that the document you find applies in the state where you live.

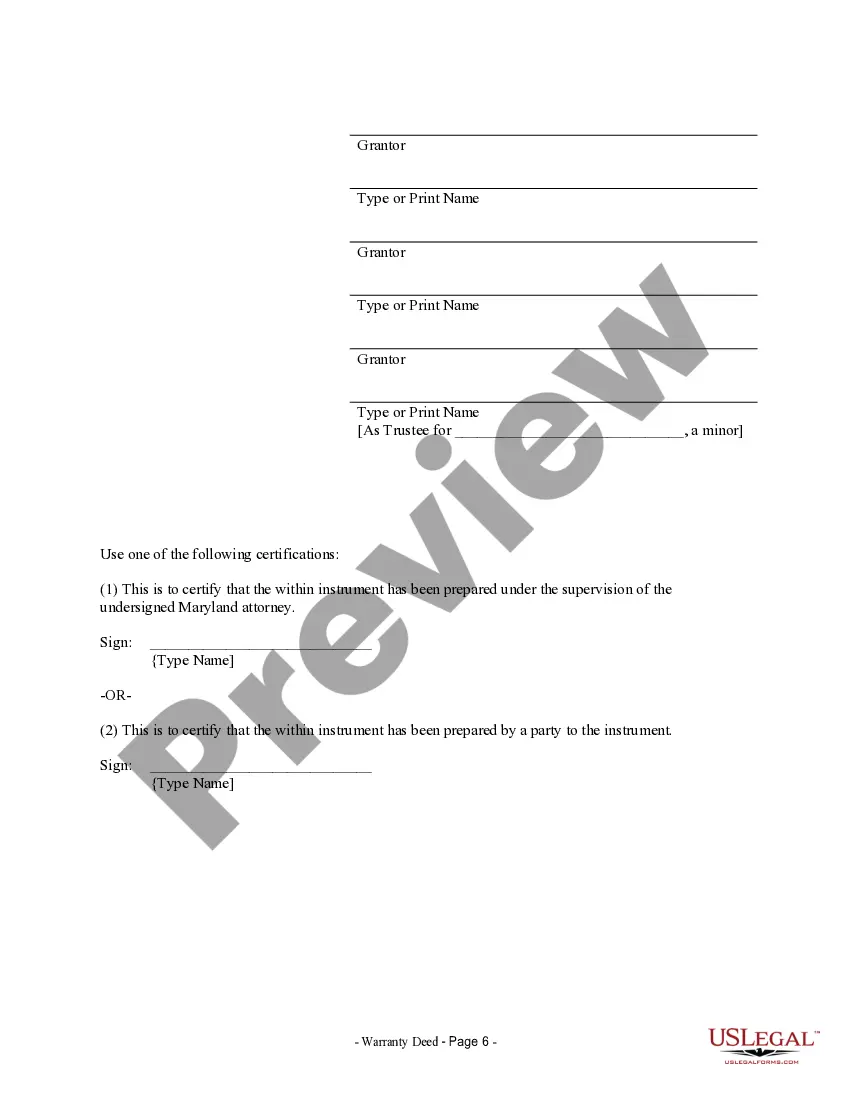

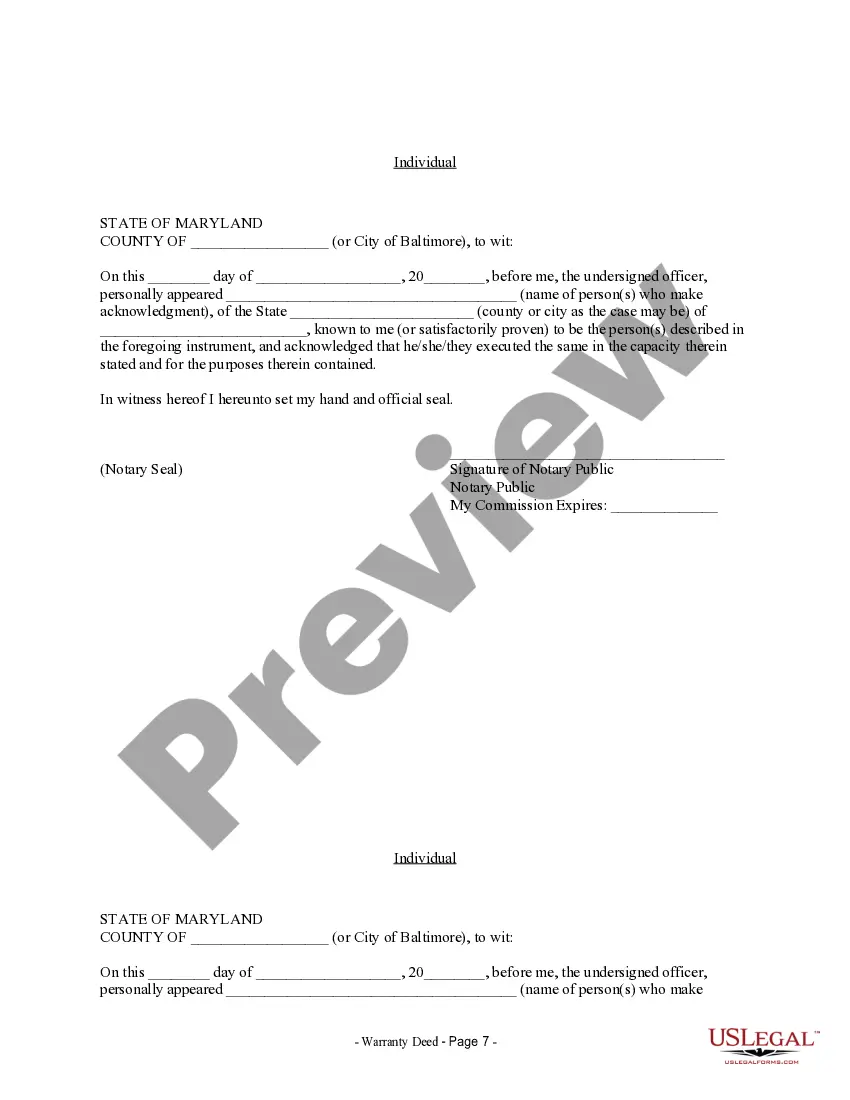

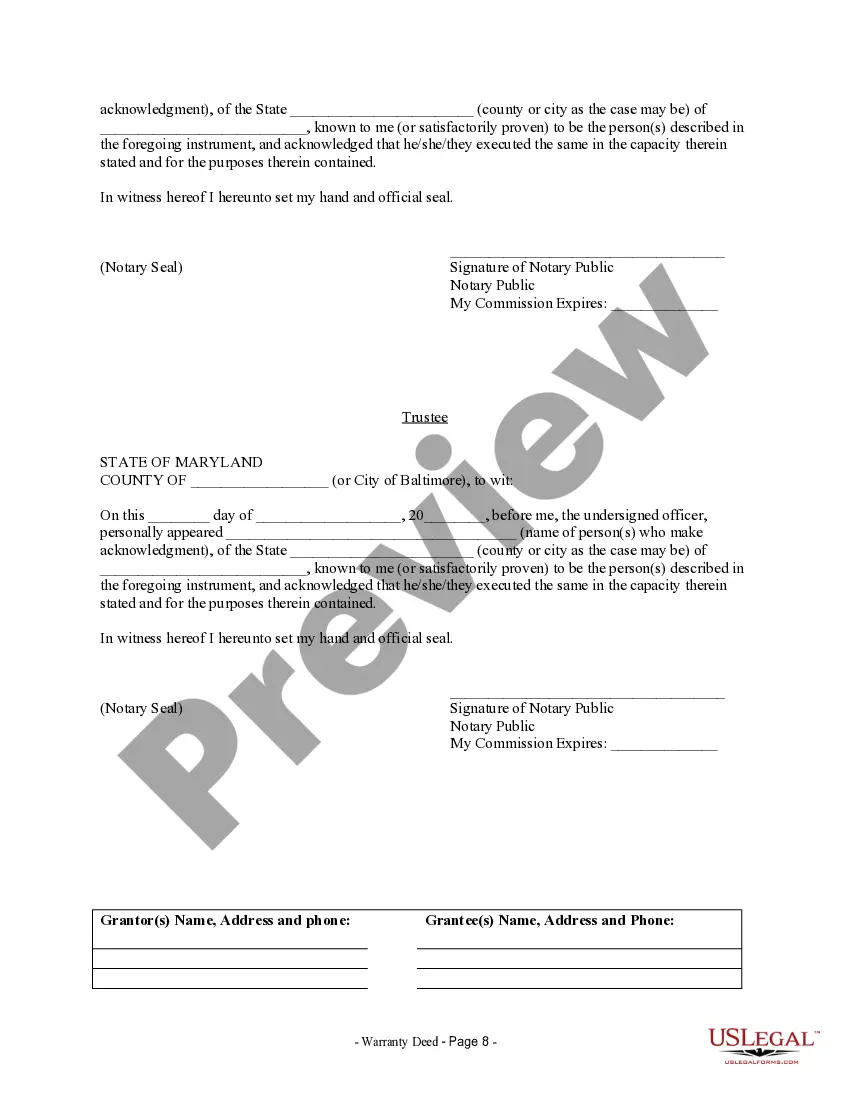

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another sample using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

When you’ve signed up and paid for your subscription, you can use your Maryland Warranty Deed from two Individuals and Trustee to Three Individuals as often as you need or for as long as it continues to be active in your state. Revise it in your preferred editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Deed 2 Individuals Form popularity

Warranty Two Individuals Other Form Names

Md Trustee Form FAQ

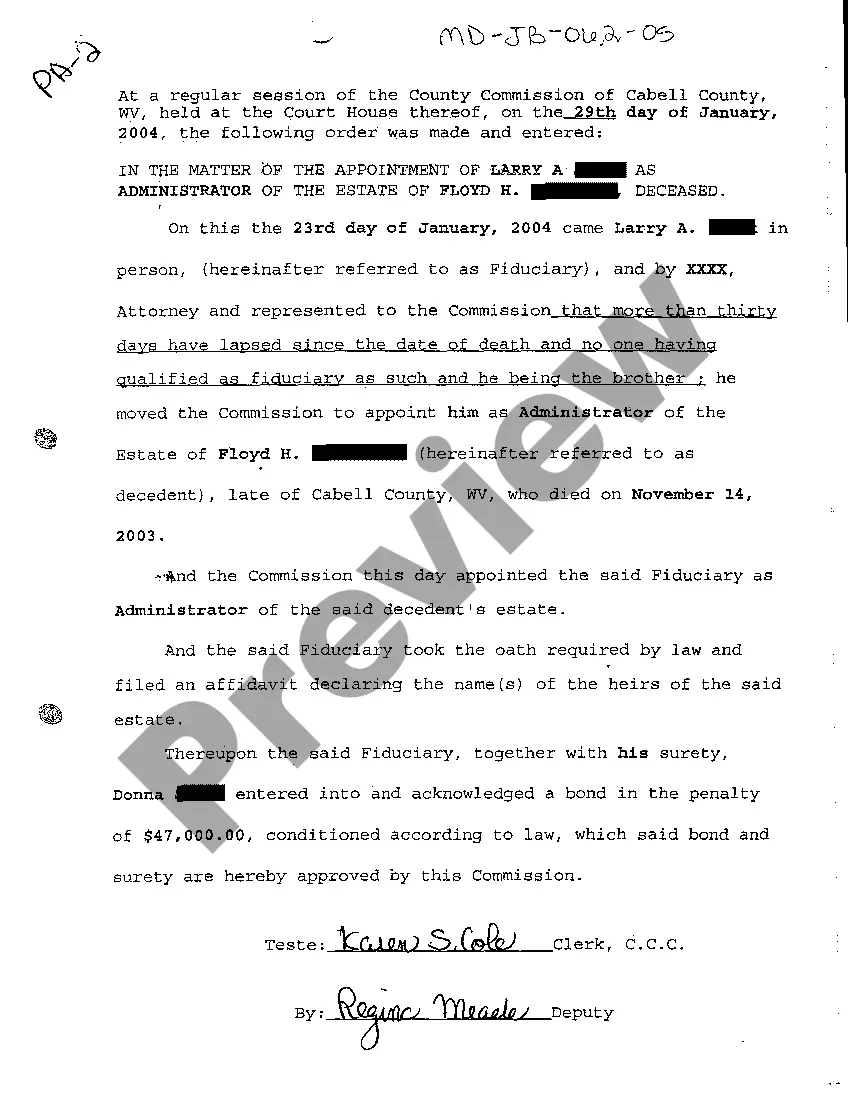

Your executor and successor trustee can usually be the same person, and it's actually a quite common arrangement.It helps to understand the roles of the executor and the successor trustee in your estate plan as you make a decision because some of the factors can be personal.

Trustee: a person or persons designated by a trust document to hold and manage the property in the trust. Beneficiary: a person or entity for whom the trust was established, most often the trustor, a child or other relative of the trustor, or a charitable organization.

When you are creating a will and a trust as part of your estate planning, you need to name an executor as well as a trustee, which can both be the same person, if you wish.

Generally, the individual that develops the trust appoints the trustees. You can have up to four trustees. Many grantors appoint their executors to also act as trustees. Similar to an executor, you can request professionals to act as trustees, such as an accountant or lawyer.

Executor v. If you have a trust and funded it with most of your assets during your lifetime, your successor Trustee will have comparatively more power than your Executor.

The role of a trustee is different than the role of an estate executor. An executor manages a deceased person's estate to distribute his or her assets according to the will. A trustee, on the other hand, is responsible for administering a trust.The beneficiaries are the recipients of the trust's assets.

An all-in fee will start between 1% and 2%, and usually covers the trust's investment manager, fiduciary and trust administration, and record-keeping and disbursements, but typically not asset-management fees. So, you might pay $30,000 to $50,000 a year on a $3 million trust.

The role of Executor is to administer the deceased's Estate, but the Trustees are there to manage any ongoing Trusts which arise from the Will.

Most corporate Trustees will receive between 1% to 2%of the Trust assets. For example, a Trust that is valued at $10 million, will pay $100,000 to $200,000 annually as Trustee fees. This is routine in the industry and accepted practice in the view of most California courts.