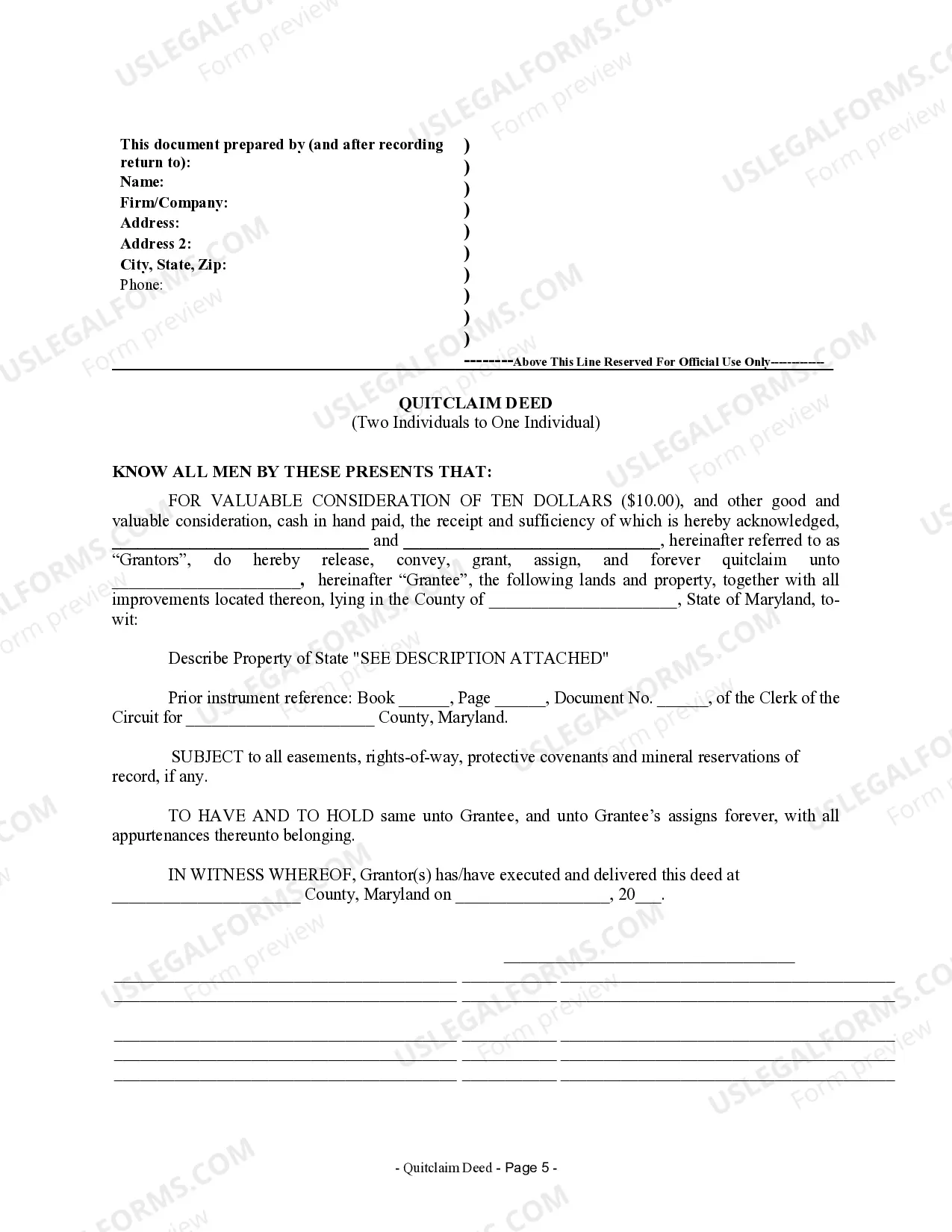

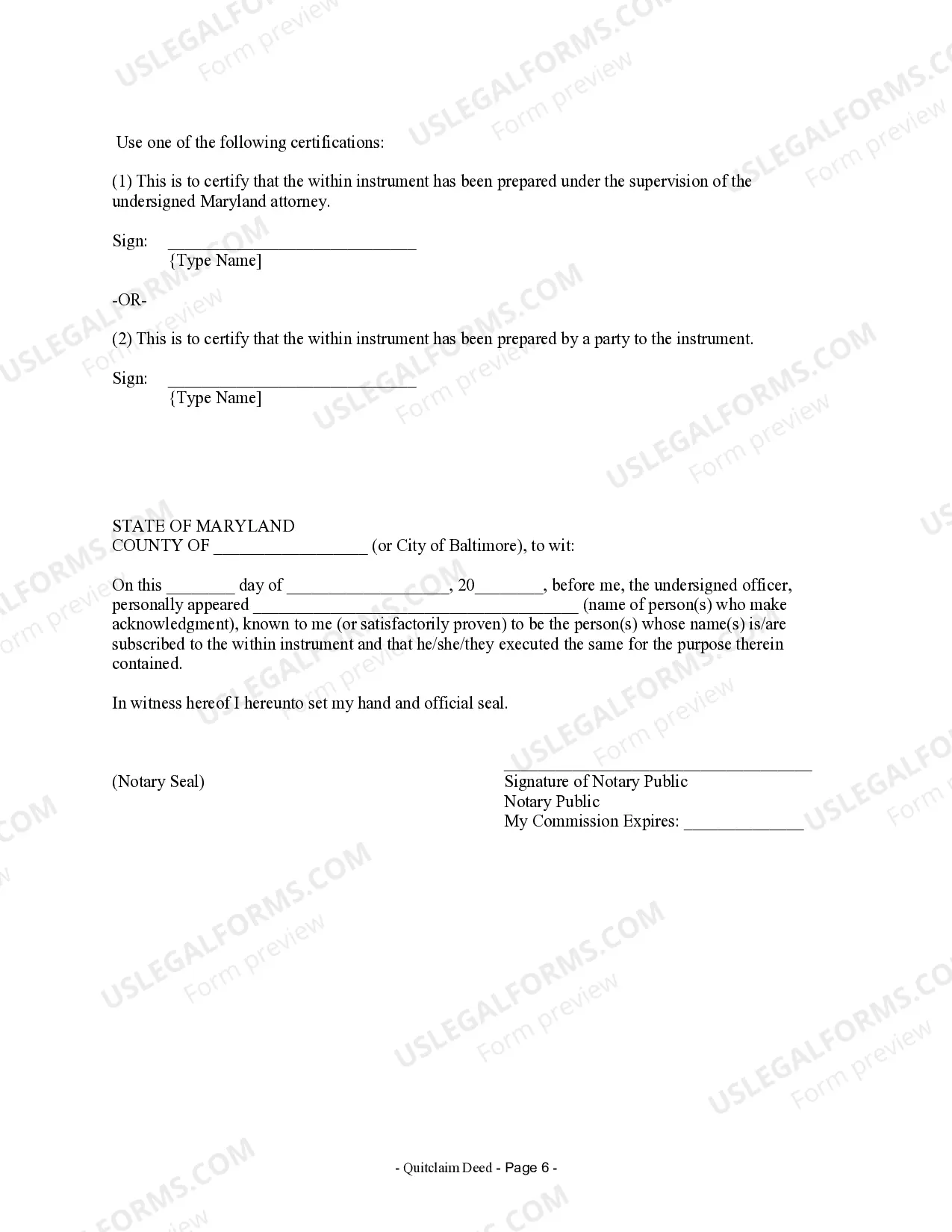

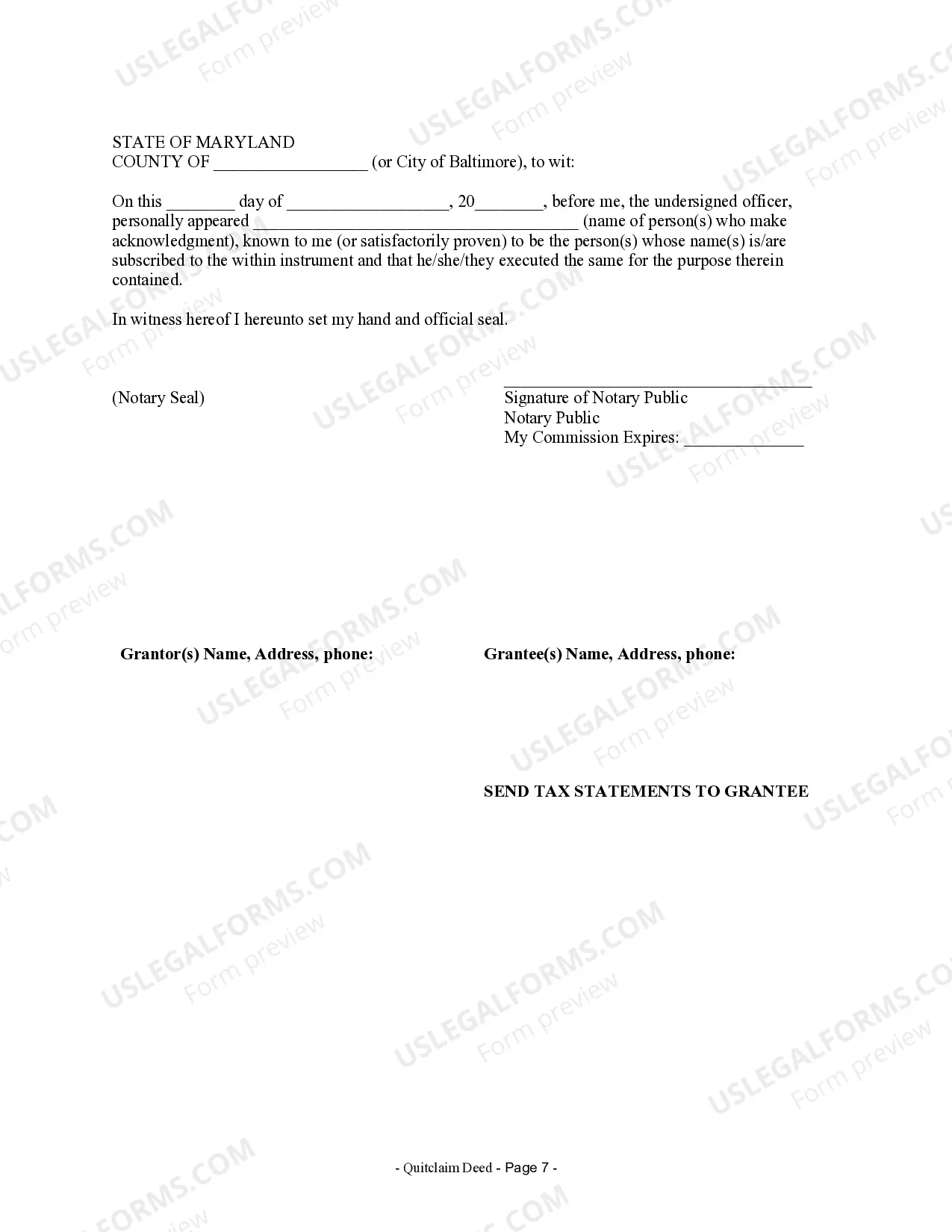

Maryland Quitclaim Deed from two Individuals to One Individual

Description

How to fill out Maryland Quitclaim Deed From Two Individuals To One Individual?

Among lots of free and paid samples which you get on the internet, you can't be certain about their accuracy and reliability. For example, who created them or if they’re competent enough to take care of what you need these people to. Keep calm and make use of US Legal Forms! Discover Maryland Quitclaim Deed from two Individuals to One Individual samples created by skilled attorneys and get away from the expensive and time-consuming process of looking for an lawyer and after that having to pay them to draft a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all your earlier saved documents in the My Forms menu.

If you’re utilizing our service for the first time, follow the instructions below to get your Maryland Quitclaim Deed from two Individuals to One Individual quick:

- Make certain that the file you discover is valid in the state where you live.

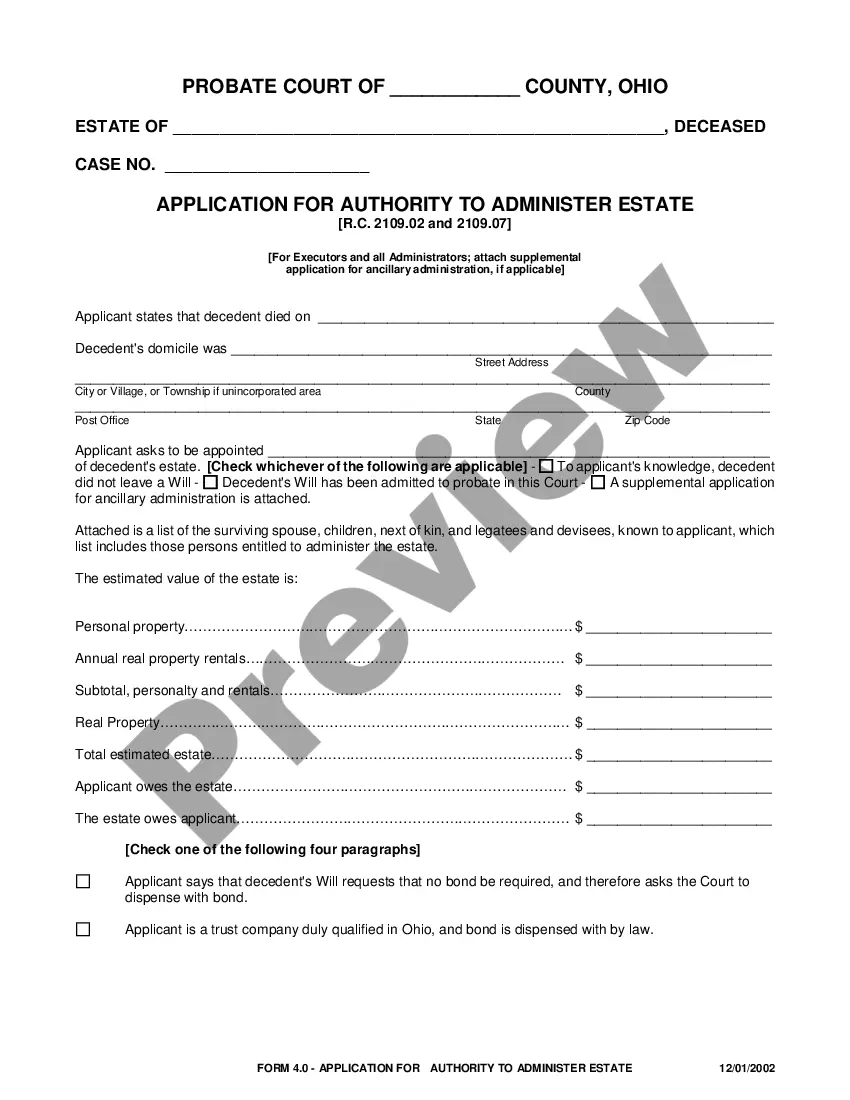

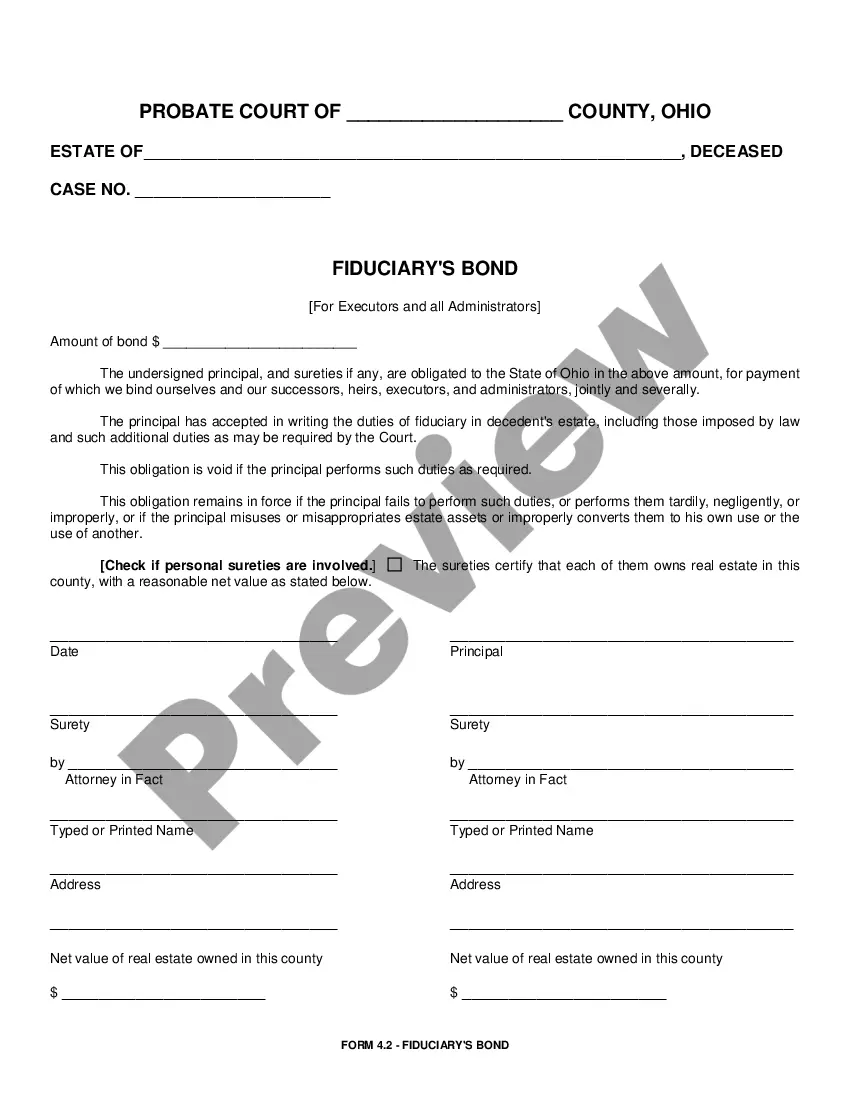

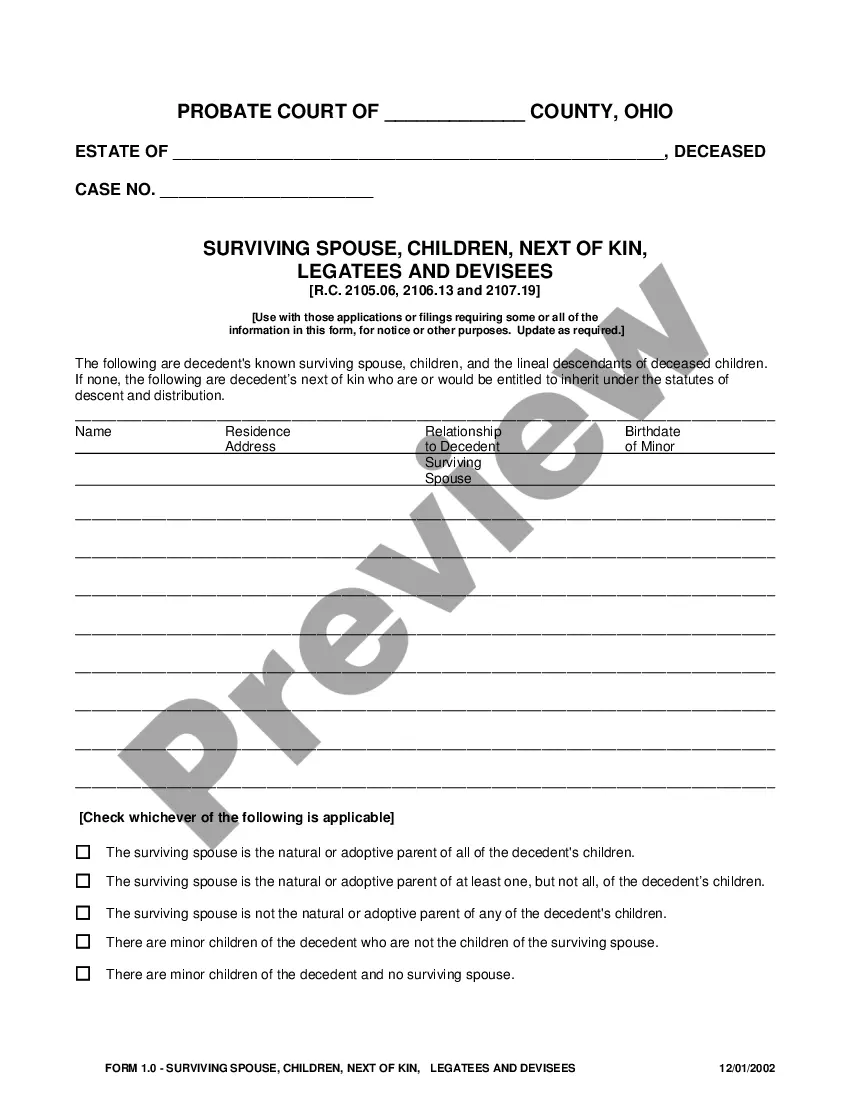

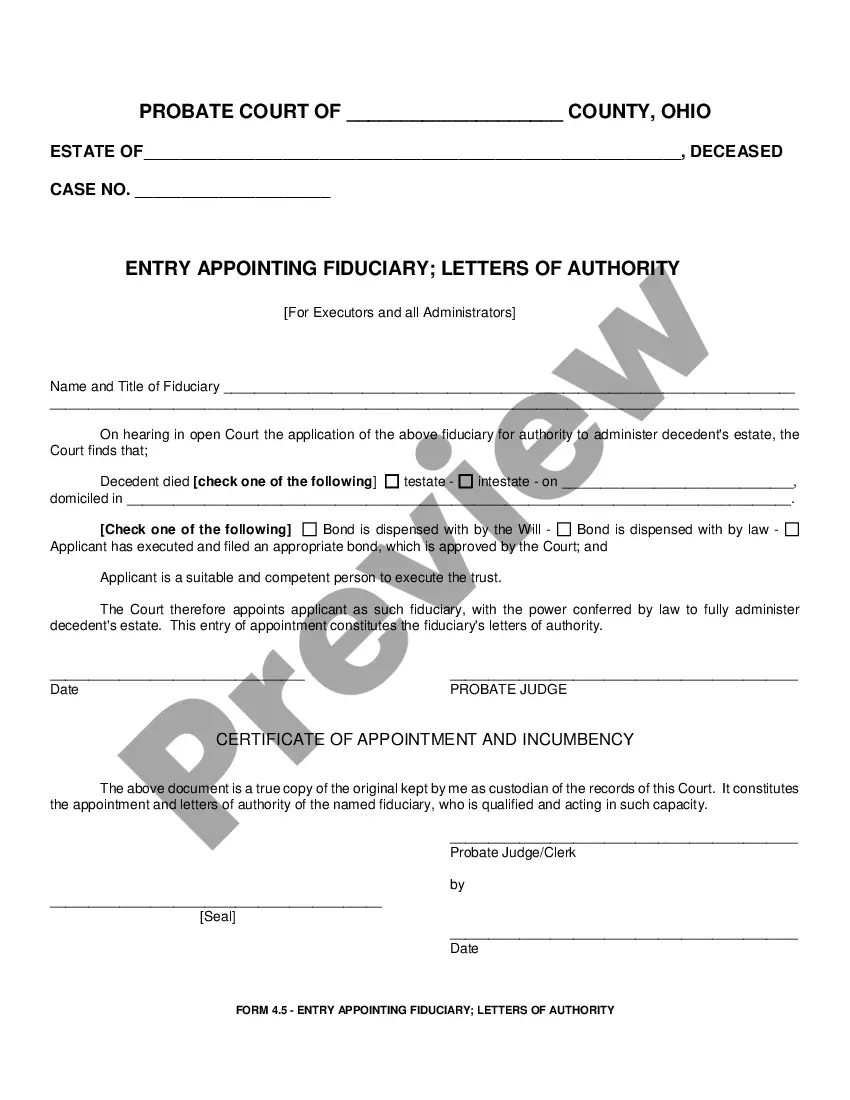

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another sample utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you’ve signed up and paid for your subscription, you may use your Maryland Quitclaim Deed from two Individuals to One Individual as often as you need or for as long as it stays valid where you live. Change it with your favored online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

For a flat fee of $240 - $250 in most cases (plus governmental recording fees) the firm can in most circumstances have an attorney prepared deed ready for signature in 2-4 business days. In most cases a true " Quit Claim Deed" is rarely the best choice.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.